COVID-19 Bulletin: February 4

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices surged nearly 2% Thursday on signs that supply could remain tight in the coming months. WTI shot past $90/bbl for the first time since 2014 over concerns that cold weather in Texas would limit production from the U.S. Permian Basin.

- Futures are set for their seventh weekly rise in a row today, with WTI up 2.0% in mid-morning trading to $92.23/bbl and Brent up 2.0% to $92.97/bbl. U.S. natural gas was 1.6% lower at $4.81/MMBtu.

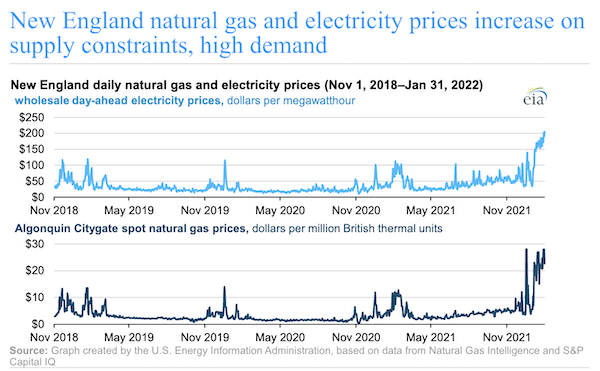

- Spot natural gas prices in New England shot up to an eight-year high the past few days in anticipation of this week’s severe winter storm:

- The U.S. shale boom may be ending as inventories shrink in known reserves amid a slowdown in exploration activity.

- British households will see a 54% jump in energy bills due to a policy change in April, prompting lawmakers to shell out $12 billion in subsidies to residents.

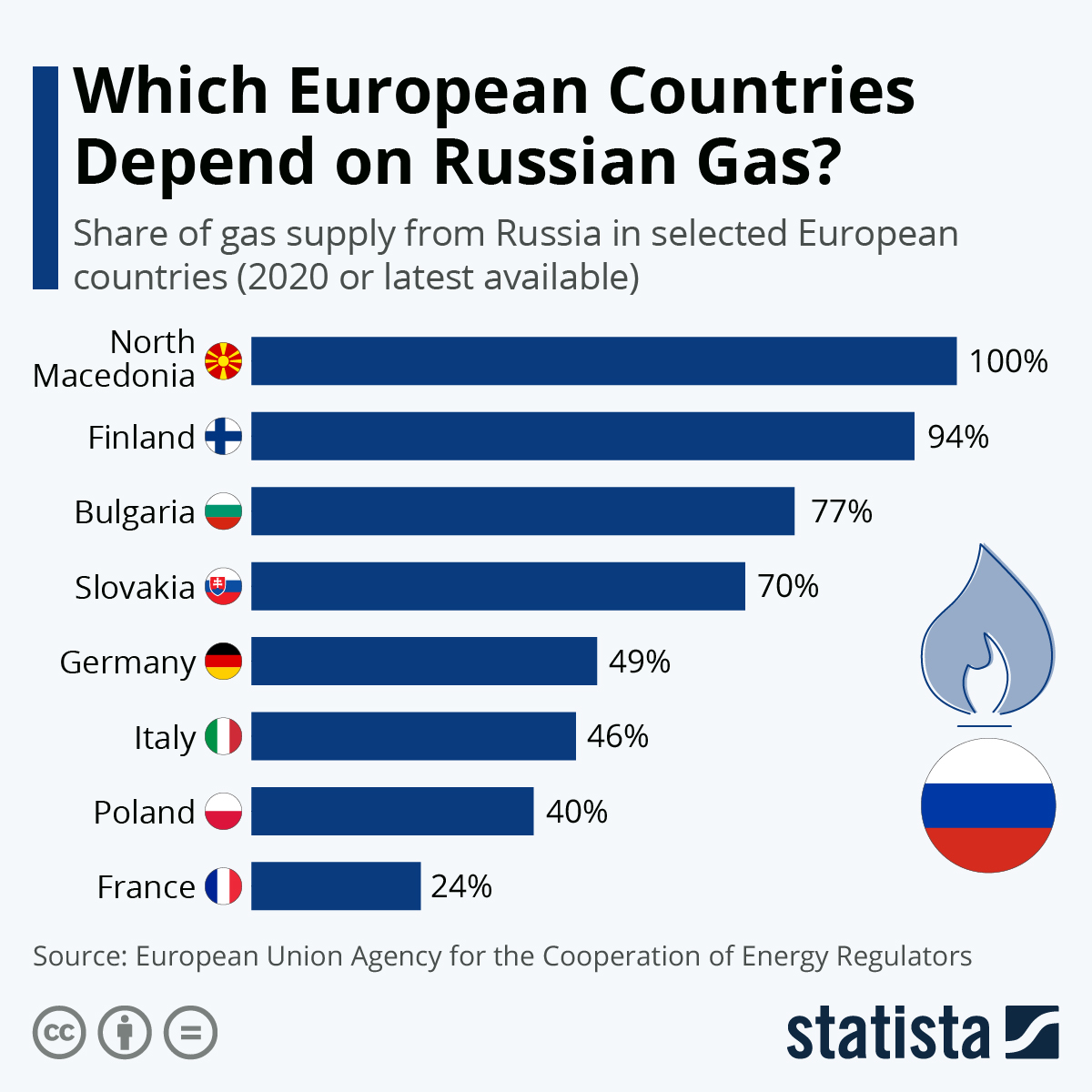

- LNG carriers are sailing to Europe in large numbers as a growing crisis in Eastern Europe threatens to cut off Russian supplies. In its most recent announcement, Russia said it would attempt to resume oil output to 90% of pre-pandemic levels at 1.8 million bpd beginning in March.

- A 2-million-barrel oil tanker exploded off the coast of Nigeria Thursday, killing 10 crewmembers on board.

- Peru is experiencing a fuel shortage after the government suspended unloading operations of Spanish energy firm Repsol at its La Pampilla refinery due to a 10,000-barrel spill.

- Sri Lanka signed a $500 million credit line with India to import fuel as the nation tries to stave off power cuts caused by an ongoing financial and energy crisis.

- China National Nuclear Corp. is investing $8 billion to build a new nuclear plant in Argentina, reviving a deal between the two nations that had been stalled since 2015.

- The UAE’s state-owned oil firm discovered between 1.5 to 2 trillion standard cubic feet of raw gas in an offshore area, its first discovery from the emirate’s offshore exploration efforts.

- ConocoPhillips saw quarterly profits rise to $2.6 billion, topping estimates and prompting the company to forecast a rise in output by 18% to 1.8 million barrels of oil equivalent per day in 2022.

- Tanker owner Euronav saw fourth-quarter net losses of $72.6 million as spreading COVID-19 cases dragged on the recovery of the crude tanker market.

- Brazil announced plans to invest $117 million to build seven wind farms in the northern state of Bahia.

Supply Chain

- U.S. airlines canceled almost 5,000 flights Thursday as a severe winter storm blanketed states from North Texas to upstate New York, dropping freezing rain and over a foot of snow in some areas. Texas’ power grid appears to be holding steady, helped in part by significant new wind power capacity taking strain off the grid, erasing initial fears of a repeat of last February’s “Texas Freeze.”

- The 50-day rate for a 2,756-teu boxship has hit $175,000 per day, a record.

- Freight rates for large bulk carriers have fallen more than 90% from last year’s October peak, in large part caused by slowdowns in Chinese steel production.

- North American rail volume reached 330,983 intermodal units for the first three weeks of this year, down 15% from last year.

- U.S. supplies of 53-foot chassis are dwindling amid growing demand for domestic container transport, while international supplies are more plentiful.

- Germany’s Port of Hamburg has completed an expansion project that will allow larger vessels to sail along the Elbe River into the North Sea.

- A record 572 container ships were sold in 2021 with the capacity for 1.94 million TEUs. Mediterranean Shipping Company purchased 132 of them, the most of any shipper.

- Chinese and South Korean shipbuilders won 36 orders for container ships worth about $7.6 billion in January.

- One of Maersk’s ultra large container ships ran aground near a German island in the North Sea on Wednesday.

- Order backlogs at Caterpillar rose 60% last quarter from a year ago as supply constraints offset strong demand for construction equipment.

- Chinese furniture maker Loctek purchased a new container ship to help take back control of its supply chain.

- Ninety-seven percent of shippers plan to increase their freight procurement budgets in 2022, while over half will increase those budgets by 25% or more, survey results show.

- Tanker owners Cargill, Mitsui and Maersk are pooling resources for research and development into lowering shipping emissions.

- Rystad Energy predicts near-term difficulties in building super large offshore wind turbines due to a lack of vessels capable of installation.

- A coalition of Swiss, German and Dutch firms are partnering to begin producing green ammonia for use as marine fuel, to be centered at a location in southwest Norway.

- The Netherlands’ Port of Rotterdam has been ranked as Europe’s top carbon-polluting port, with emissions topping 14 million tonnes of CO2 each year.

- Italy’s d’Amico International Shipping is looking to expand the use of biofuel across its entire tanker and carrier fleet in a bid to speed up maritime decarbonization.

Domestic Markets

- The U.S. reported 282,262 new COVID-19 infections and 2,241 virus fatalities Thursday, one of the biggest one-day fatality declines after weeks of rising numbers.

- Average COVID-19 cases in the U.S. have fallen to under 425,000 per day, down from 750,000 two weeks ago. Virus hospitalizations have also dropped 16% from a Jan. 20 high.

- New COVID-19 cases in New Jersey are down 43% week over week and 83% compared to a month ago.

- Alaska’s statehouse canceled yesterday’s floor session due to a potential COVID-19 outbreak among lawmakers.

- Utah lawmakers approved a new bill yesterday that makes it harder for schools to switch to remote learning options amid COVID-19 outbreaks.

- The CDC Director said the BA.2 “Stealth” variant, which so far accounts for just 1.5% of U.S. cases, is slightly more infectious than the original Omicron and should not reverse the recent surge decline.

- New survey results suggest just 30% of parents of children younger than age 5 plan to have their children inoculated against COVID-19 once a shot is approved.

- Medicare will begin offering free at-home COVID-19 testing kits from select pharmacies this spring.

- Merck and Eli Lilly reported strong fourth-quarter earnings after their at-home COVID-19 treatments were approved and began selling.

- The U.S. Labor Department reported a 467,000 increase in employment in January, over three times analyst expectations.

- The U.S. administration authorized an unusually high number of green cards for foreign professionals this year, primarily to reduce hospital staffing shortages.

- U.S. work productivity jumped 6.6% in the fourth quarter, the largest advance since the beginning of the pandemic.

- Average 30-year U.S. mortgage rates held at 3.55% for the third straight week, up from 2.73% one year ago.

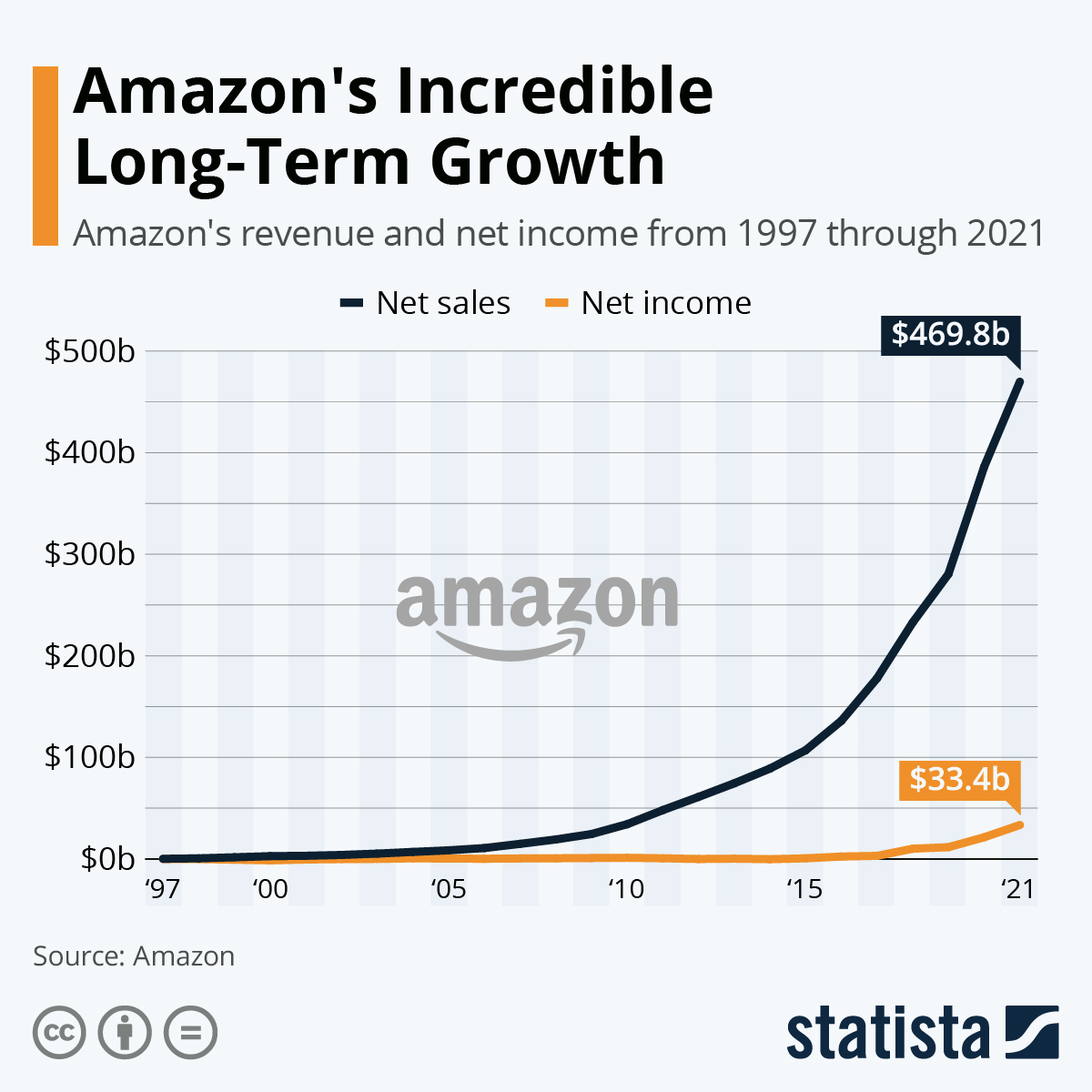

- Amazon saw revenue jump 9% in the fourth quarter to $14.3 billion, as the firm was able to stave off the worst effects of supply chain disruption and staffing shortages.

- Ford reported $17.9 billion in net income last year, led primarily by a gain in its investment into electric vehicle maker Rivian and a revaluation of its pensions. The automaker expects to deliver 10-15% more vehicles across the globe this year.

- The used furniture market is expected to grow nearly 40% by 2025 as designers and consumers turn to second-hand items because of long waits for new furniture.

- MIT researchers claim to have developed a two-dimensional ultra-thin polymer that is as light as plastic and stronger than steel, with hopes that the material could be used to manufacture parts for vehicles and electronics.

International Markets

- The U.K. reported 303 COVID-19 fatalities yesterday, the most in a year.

- Germany reported more than 238,000 new COVID-19 cases Thursday, a record. The nation began recommending fourth COVID-19 vaccine doses for some people.

- Russia reported a record 155,768 new COVID-19 infections Thursday, up from 141,883 Wednesday.

- Japan reported a record 94,908 new COVID-19 infections Thursday. The nation hopes to grant approval for Pfizer’s COVID-19 antiviral pill by mid-February.

- COVID-19 cases in Indonesia are at six-month highs.

- South Korea reported 22,907 new COVID-19 cases Thursday, a 500% increase from just two weeks ago.

- The Beijing Olympic Committee reported 55 more COVID-19 cases among personnel in its “closed loop” system on Thursday.

- India’s official COVID-19 death toll during the pandemic topped 500,000 Friday, though most analysts believe the number is vastly understated.

- The COVID-19 Omicron subvariant BA.2 accounted for one-fifth of new cases in South Africa in January, up from just 4% of new cases the month before.

- The World Health Organization is warning the international community about extremely low COVID-19 vaccination rates in some densely populated Latin American and Caribbean nations.

- New Zealand will wait until October to fully reopen its borders, officials said.

- The U.K. approved U.S.-based Novavax’s COVID-19 vaccine, the fifth authorized for use.

- The Euro strengthened against the U.S. dollar yesterday after the European Central Bank signaled it could raise interest rates to combat stubborn inflation.

- German factory orders rose 2.8% in December, a surprise gain after disappointing GDP growth put the nation on the brink of another pandemic recession.

- Grupo Aeroméxico was approved to exit chapter 11 bankruptcy protection last week after a 19-month bankruptcy spurred by the pandemic.

At M. Holland

- Plastics News reported that M. Holland earned a Bronze rating from EcoVadis, a trusted provider of business sustainability ratings. The article reports that our improved annual score for 2021 is due to progress in our diversity and inclusion program, wellness benefits, career development and more.

- Our Healthcare team has published a revised Medical Resin Selection Booklet containing additional resins, new focus grades and new 3D printing resins.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.