COVID-19 Bulletin: December 22

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices rose about 3.5% Tuesday, nearly regaining Monday’s steep losses. Futures were higher in late morning trading, with WTI up 0.9% at $71.76/bbl and Brent up 0.73% at $74.49/bbl. U.S. natural gas was 2.9% higher at $3.98/MMBtu.

- The American Petroleum Institute reported a larger-than-expected draw in U.S. crude inventories last week, bringing total draws since January to 65 million barrels.

- European gas prices hit a record Tuesday for the second consecutive day, rising 16% after Russia began reversing flows on a major pipeline to Germany.

- Spain is extending energy tax cuts until May to keep skyrocketing consumer bills down through winter.

- China’s largest LNG importer signed a deal with U.S. firm Venture Global to buy LNG from a new export facility in Louisiana.

- Indian crude refiners processed 5.25 million bpd in November, up from 4.96 million bpd in October to the highest level since February 2020.

- Norwegian exploration company Aker BP inked a deal to purchase the oil and gas unit of Sweden’s Lundin Energy for $14 billion, creating the second-largest petroleum firm on the Norwegian continental shelf.

- The Hornsea 2 wind farm offshore the eastern U.K. has generated its first power, a milestone, as it aims to become the world’s highest-producing wind power project by next year.

- The U.K. will subject all future North Sea oil and gas licenses to a “net-zero test” to align potential projects with the nation’s long-term climate goals.

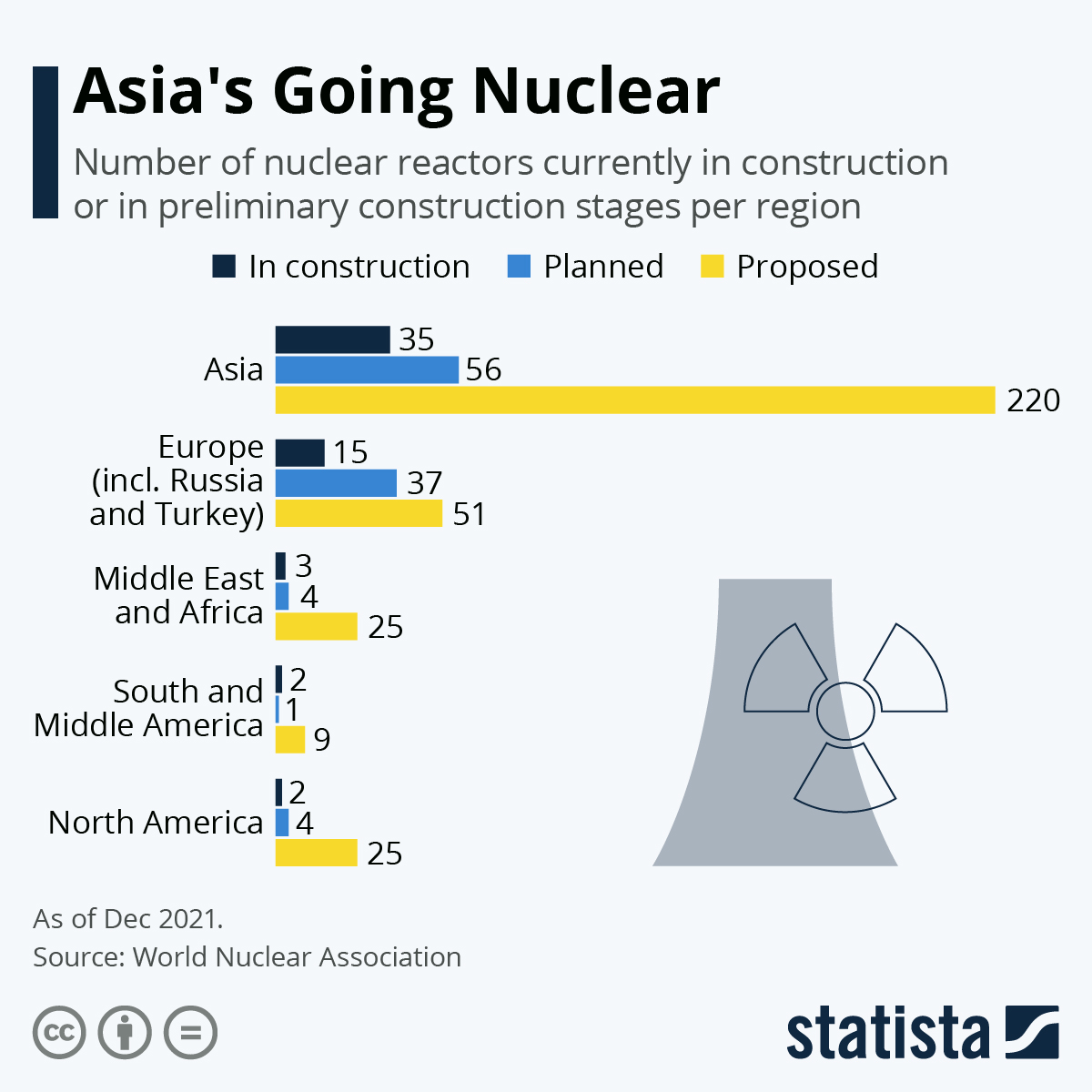

- Asian nations will be the primary source of new global nuclear capacity in the coming years, new data shows:

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Maersk is canceling some trans-Atlantic port calls due to severe winter weather across the North Atlantic.

- Lucrative Asia-to-U.S. container ship routes have attracted vessels from normal operations in Africa, punishing African manufacturers and exporters.

- Shipping industry experts forecast global supply chain logjams could last another two years.

- Toyota is partially suspending operations at five Japanese factories next month due to chip shortages, with the automaker estimating a production loss of up to 20,000 vehicles.

- Efforts to train new commercial truck drivers in the U.S. are putting added strain on driver schools.

- UPS announced an order for 19 Boeing 767 freighters Tuesday, pushing the plane-maker’s 2021 freighter sales well past a previous record.

- The Suez Canal will lower rebates on canal tolls for LNG carriers the first six months of next year, authorities said Tuesday.

- Shipping lines flush with pandemic cash have sought further integration by snapping up land-based services, exemplified by Maersk’s reported deal to acquire LF Logistics’ 223 distribution centers across Asia and MSC’s $6.4 billion offer for the African logistics assets of French operator Bollore.

- The U.S.’s first all-electric tugboat will operate out of the Port of San Diego starting in mid-2023, its builders said.

- Tesla secured an order for 10 all-electric semi-trucks from foodservice distributor Karat Packaging.

- World-leading Turkish hazelnut production is sharply declining due to effects of the nation’s currency crisis, posing supply chain problems for big consumer brands such as Nutella.

- Striking Kellogg workers reached a deal with management Tuesday, ending an 11-week standoff that disrupted the cereal-maker’s production.

- General Mills missed profit estimates on rising raw material, freight and labor costs in the latest quarter, prompting the retail foods giant to forecast more price increases on products next quarter.

- U.S. retailer Big Lots is adding two more forward distribution centers handling bulk products and furniture to its network next year to accommodate rising e-commerce activity.

- Supermarket pet food sales grew 6.9% for the year ending in late November, spurred by a sharp rise in adoptions during the pandemic, as supply chain issues challenge the industry.

- Levi Strauss has applied artificial intelligence to pricing and shipping decisions to great effect, allowing the apparel-maker to spot trends and instantly adjust volumes in some 50,000 retail locations in more than 110 countries.

Domestic Markets

- The U.S. reported 172,072 new COVID-19 infections and 2,093 virus fatalities Tuesday. Just 61.6% of Americans are fully vaccinated.

- The U.S. has the highest number of new COVID-19 cases of any country, the World Health Organization said. Cases could peak in January, according to the CDC.

- To help blunt the Omicron wave, the White House announced new plans to send out 500 million free at-home COVID-19 tests, deploy 1,000 military personnel to hospitals and promptly add to the nation’s 20,000 federal testing sites.

- Chicago will require proof of COVID-19 vaccination for entry into most indoor public venues starting Jan. 3, including restaurants and bars.

- Ohio reported 12,502 new COVID-19 cases Tuesday, a pandemic record. Six hospital systems in Cleveland ran a full-page newspaper ad imploring residents to get vaccinated as they grapple with overwhelming COVID-19 infections.

- New York reported 22,258 new COVID-19 cases Tuesday, a decrease of 1,000 from Monday, with 61% of cases concentrated in New York City.

- Massachusetts deployed 500 National Guard troops to state hospitals to help with non-medical tasks such as food service and transportation, while nonessential procedures could be postponed as soon as Monday due to rising COVID-19 patients.

- COVID-19 hospitalizations in California are up 10% over the last two weeks. The state will require all healthcare workers to get a booster dose.

- Florida could average 40,000 new COVID-19 cases per day by February, new models predict, a 75% increase over case counts in previous waves of Delta.

- COVID-19 hospitalizations at Texas Children’s Hospital have tripled in the past week, officials say.

- Atlanta is the latest large U.S. city to reimpose an indoor mask mandate.

- The governors of Minnesota and Maryland tested positive for COVID-19.

- The National Hockey League reversed course and will not let players participate in the upcoming Winter Olympics in China due to soaring COVID-19 infections.

- Wells Fargo has indefinitely delayed its return-to-office plans.

- Major U.S. pharmacies will start limiting the number of at-home COVID-19 tests customers can buy, as surging demand depletes inventories.

- New Yorkers will receive $100 for getting a COVID-19 booster dose at any city-run vaccination site before the end of the year.

- Many employers are adding booster shots to their vaccine mandates.

- Fully vaccinated people with a COVID-19 booster dose are unlikely to suffer serious illness with a breakthrough infection, top medical experts say, lending support to the U.S.’s expected decision to shorten quarantine requirements for breakthrough cases.

- U.S. regulators are expected to approve the nation’s first at-home COVID-19 antiviral pills later this week.

- Tremors and vibrations are two symptoms commonly associated with long-term COVID-19, new research shows.

- More than 39 million Americans resigned from their jobs in the first 10 months of 2021, the highest number in data going back two decades.

- Over one-fifth of nurses surveyed said they plan to resign within the next six months, while two-thirds say the pandemic has made them consider resigning.

- The U.S. population grew by just 0.1% in the year ending July 1, the lowest rate on record, continuing a string of declining growth rates since 2008.

- American life expectancy fell 1.8 years to 77 in 2020, a larger decline than initially expected, with COVID-19 confirmed as the third-leading cause of death behind heart disease and cancer.

- Federal grants to U.S. states rose 37% in the 2020 fiscal year, the largest increase since 2009, largely due to the distribution of emergency pandemic funds.

- The Conference Board’s index of U.S. leading economic indicators rose by 1.1% in November, bolstering views that the nation’s economy will continue to expand in the first half of 2022.

- Foot traffic to U.S. stores and shopping centers rose 19% last week from a year ago, signaling little impact from the COVID-19 Omicron variant on brick-and-mortar retail.

- U.S. electric vehicle startup Canoo will build its vehicles at plants in Arkansas and Oklahoma, with plans to produce up to 6,000 units next year.

International Markets

- The COVID-19 Omicron variant is now present in 106 countries.

- The U.K. reported 90,629 new COVID-19 cases Tuesday, near recent all-time highs. Infections rose 45% the past week.

- New COVID-19 measures were announced by countries across the globe Tuesday:

- France banned spontaneous parties, outdoor fireworks and other celebrations on New Year’s Eve.

- Germany shortened the recommended amount of time before getting a COVID-19 booster shot and imposed tighter capacity limits on personal gatherings.

- Scotland canceled public New Year’s celebrations in Edinburgh and reimposed capacity limits on large venues.

- Sweden reimposed social distancing guidelines and is asking everyone who can to work from home.

- Canada’s British Columbia banned indoor social events and temporarily closed gyms, bars and nightclubs.

- Portugal will temporarily close schools, bars and clubs starting the day after Christmas.

- China locked down 13 million people after an outbreak in the city of Xi’an.

- Spain posted 49,823 new COVID-19 cases the past 24 hours, a record.

- Denmark reported 13,558 new COVID-19 infections Tuesday, a record.

- Montreal entered a state of emergency Tuesday after the wider Quebec province saw a record 5,043 new COVID-19 cases.

- Cases of the COVID-19 Omicron variant have doubled in more than a dozen Indian states in recent weeks.

- New single-day COVID-19 cases in Israel surpassed 1,300, the most since October, including 170 Omicron cases. Healthcare workers and Israelis over the age of 60 will begin receiving fourth vaccine doses.

- In February, only Europeans who have gotten a COVID-19 booster dose will be considered fully vaccinated for purposes of travel and health passes.

- The U.S. administration is considering lifting a travel ban on several south African nations that were the first to report the COVID-19 Omicron variant.

- Economists expect the COVID-19 Omicron variant to slow global economic growth to just 0.7% in the fourth quarter, half the pace of the third quarter and well below a pre-pandemic pace of 1%.

- The U.K. is allocating $1.3 billion in grants to support businesses suffering serious financial hits caused by the COVID-19 Omicron variant.

- The U.S. will donate $580 million more to the World Health Organization, the United Nations Children’s Fund and five other global aid groups to boost pandemic efforts in low-income nations.

- Toyota will start a new service next year to improve vehicle software, refresh interiors and update safety systems in response to more people holding onto cars longer.

At M. Holland

- M. Holland will be closed Friday, Dec. 24, in observance of Christmas. We wish all a wonderful holiday!

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.