COVID-19 Bulletin: December 14

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices fell slightly Monday but were under pressure in late morning trading on news that the global oil market has returned to a surplus. WTI was down 1.3% at $70.34/bbl, while Brent was off 1.4% at $73.33/bbl. U.S. natural gas was 1.5% lower at $3.74/MMBtu.

- OPEC downplayed the COVID-19 Omicron variant and boosted demand forecasts by 1.1 million bpd in the first quarter of 2022, a figure about equal to pre-pandemic levels of yearly consumption growth. The group also stuck to its timeline for a return to pre-pandemic levels of oil use by Q3.

- Oil and gas supply is expected to surpass growth in energy demand sometime next year, a result of higher production from non-OPEC nations and from the U.S. shale patch.

- OPEC+ was half a million bpd short of its overall production quota last month, undermining the cartel’s pledges to steadily boost monthly output from pandemic lows.

- European gas prices closed at a record high Monday. EU member nations are proposing a new system to jointly buy gas to form strategic reserves, a bid to mitigate shortages caused by colder weather and lower imports from Russia.

- New-well oil production per rig in the U.S. has increased 81% since the start of 2019 as drillers focus on the most prolific shale basins.

- Geopolitical tensions are lengthening delays for German regulators to approve the already constructed Nord Stream 2 gas pipeline from Russia, which would double the capacity of the existing Russia-Germany line.

- Alberta-based energy firm Suncor updated guidance for 2022 on forecasts of a 5% increase in daily upstream production to between 750,000 and 790,000 barrels of oil equivalent per day.

- India’s Bharat Petroleum is partnering with the nation’s nuclear research institute to begin using electrolyser technology to produce green hydrogen, part of the refiner’s plan to reach net-zero emissions by 2040.

Supply Chain

- The confirmed death toll from last weekend’s devastating Midwest tornadoes rose to 88, with dozens more expected. Businesses in hard-hit Mayfield, Kentucky, including retail suppliers, are reporting extensive damage and impacts on operations.

- Businesses in China’s Zhejiang manufacturing hub are shut down and tens of thousands of people are in quarantine following a recent COVID-19 outbreak that saw 74 new cases Sunday.

- The Port of Houston moved $16.9 billion worth of goods in October, a 51% rise from a year ago, while the combined value for the first ten months of the year is up 31%.

- While recent measures have worked to clear empty containers from Southern California ports, operators report more of the boxes piling up across logistics networks, a mere shift in congestion from one place to another.

- U.S. freight rail traffic fell 4.5% in November from the same time last year, primarily due to lower intermodal volume.

- Container volumes at Dublin ports are sharply rising as more exporters bypass the U.K. to ship directly to Europe.

- Shareholders unanimously approved Canadian Pacific’s $31 billion acquisition of Kansas City Southern, with public hearings on the deal expected later this month.

- California intermodal trucker Orange Avenue Express is suing Hapag-Lloyd to collect $258,000 in refrigerated container detention fees, the first lawsuit of its kind filed by a trucking company for overcharges related to storage and late fees.

- Global air cargo demand was up 9.4% in October from the same period in 2019, while capacity constraints slightly eased, new data shows.

- Chinese air freight rates are expected to remain high following a new rule barring the shipment of cargo in the upper decks of passenger aircraft.

- Security concerns have the U.S. administration looking to block American funding for Chinese artificial-intelligence development and bar China’s largest chip maker from buying U.S. manufacturing tools.

- Construction distributor GMS is boosting orders of steel due to lead times of up to 12 weeks, five times longer than normal.

- Prices for lithium, a key component of electric-vehicle batteries, have surged 240% this year.

- The White House detailed plans to build 500,000 electric charging stations across the U.S. with $5 billion in funding from the recent $1 trillion infrastructure bill.

- With availability at historic lows, nearly 87% of all new vehicles in the U.S. sold at or above the sticker price in November.

- Norwegian investment firm Clarksons Platou predicts up to 200 more car carriers will be needed by 2030 to meet rising demand for passenger vehicles.

Domestic Markets

- The U.S. reported 198,017 new COVID-19 infections and 1,364 virus fatalities Monday. Cases are trending upward in 28 states, while the COVID-19 Omicron variant has been found in 30 states.

- Thirteen percent of new COVID-19 infections sampled in Washington state last week were likely Omicron cases, researchers say.

- New Jersey’s seven-day average for new COVID-19 cases is up nearly 200% from a month ago, led by a surge of infections contracted during Thanksgiving. Hospitalizations in the state rose 25% last week.

- Facing a likely winter surge of COVID-19, California reimposed a blanket mask mandate for indoor venues to last for a month.

- A large hospital system in Arizona is halting elective surgeries due to a rapid influx of COVID-19 patients.

- COVID-19 hospitalizations in Massachusetts have more than doubled over the past month, while the state’s daily case average has climbed to its highest level in almost a year. The state administration distributed more than 2 million free tests to local officials, hoping to curb transmission from holiday gatherings.

- COVID-19 infections in Florida rose for the third straight week to the highest level in over a month.

- New COVID-19 cases in Chicago public schools hit a pandemic record, as case numbers rise broadly across the city. The NBA is postponing the next two Chicago Bulls games due to a COVID-19 outbreak among many players and staff.

- Philadelphia will begin requiring proof of a COVID-19 vaccine for indoor dining.

- Today marks the one-year anniversary since the first COVID-19 vaccine was administered in the U.S.

- The U.S. Supreme Court upheld New York’s COVID-19 vaccine mandate for healthcare workers.

- Tennessee was temporarily blocked from preventing schools and local governments from imposing mask mandates and setting quarantine policy following a federal judge’s ruling last Friday.

- Two doses of the Pfizer and Moderna COVID-19 vaccines were 70% effective in protecting against hospitalizations for those infected with the Omicron strain, according to a South African study.

- The U.S. has recorded over 50 million confirmed COVID-19 cases since the start of the pandemic.

- The percentage of Americans worrying they or a family member will contract COVID-19 is sharply rising, new survey results show.

- Three-quarters of the U.S.’s 800,000 COVID-19 fatalities have been among people over age 65, with 1 virus death per 100 in the elderly population.

- Pfizer today announced that its experimental COVID-19 antiviral pill was 89% effective in preventing deaths and hospitalizations among high-risk people exhibiting symptoms, in a study of 2,250 patients.

- The FDA has not yet issued a decision on approving Merck’s COVID-19 antiviral pill over concerns of potential harmful side effects to pregnant women.

- Fidelity and Morgan Stanley are two of the latest large financial firms reconsidering return-to-office plans due to the COVID-19 Omicron variant.

- Kroger, one of the largest U.S. employers, is eliminating some COVID-19 benefits for unvaccinated employees and will charge $50 more per month for some of their health plans.

- Twenty-seven Air Force members were discharged over refusal to get vaccinated against COVID-19, the branch’s first such removals under the policy.

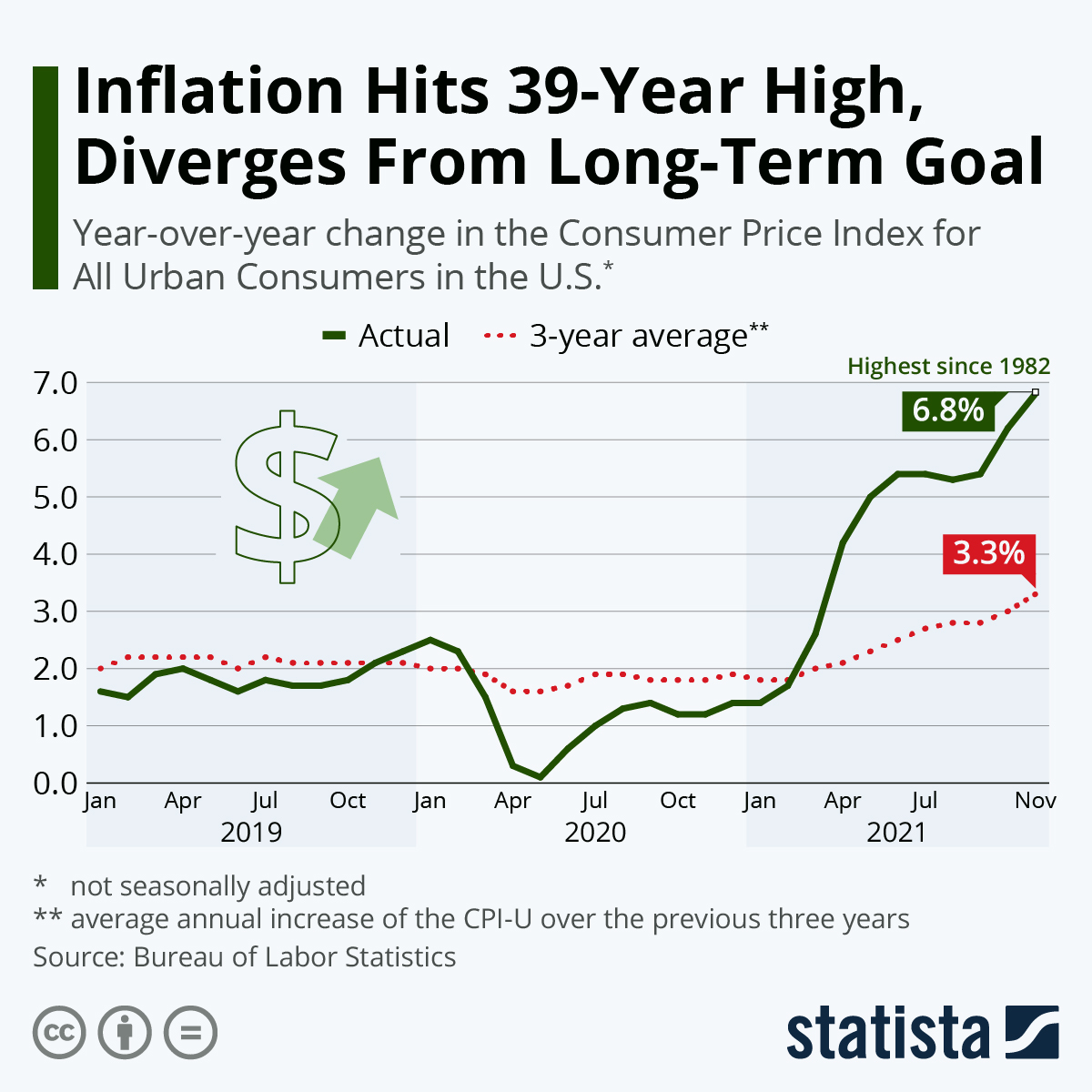

- The Federal Reserve will meet today for the first time since signaling the need for quicker policy shifts against inflation last month. Any announcements would come at the close of business tomorrow, as the central bank grapples with four-decade-high inflation…

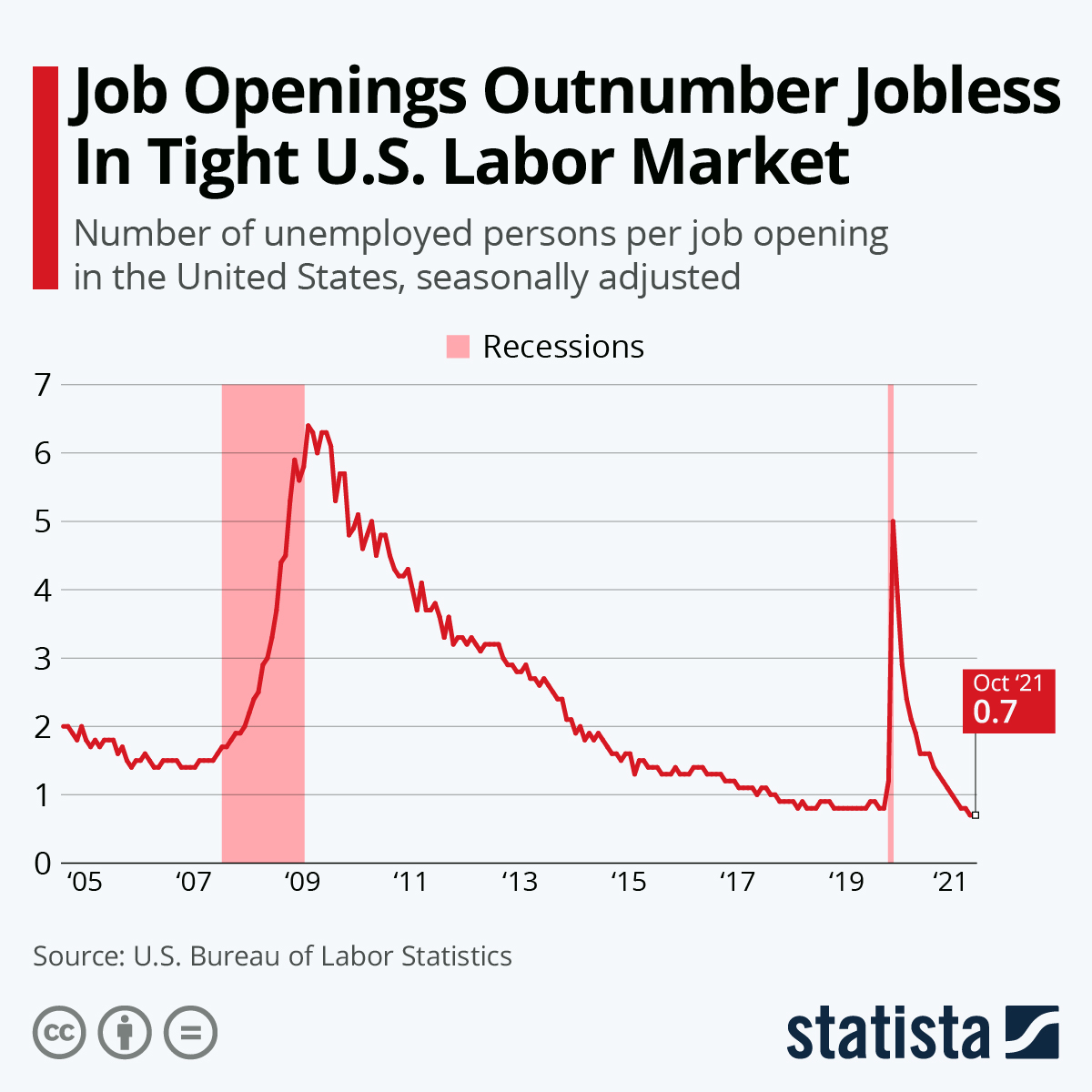

…and the tightest labor market in recent memory:

International Markets

- The COVID-19 Omicron variant has spread to 60 nations, most recently mainland China and Taiwan.

- All of Europe’s 766 cases of the COVID-19 Omicron variant have been mild or asymptomatic, officials said.

- Norway is tightening pandemic restrictions, including temporarily banning alcohol sales, over forecasts of tens of thousands of new daily COVID-19 cases by January.

- Facing a public backlash, Russia dropped plans to tighten travel restrictions after reporting under 30,000 new COVID-19 cases Monday, a decline from recent highs.

- Austria ended a strict three-week lockdown on vaccinated people, while tight restrictions for those who have not received shots will continue.

- The U.K. will soon require people to have three COVID-19 shots to be considered fully vaccinated, as officials indicate more restrictions could come amid a new wave partly fueled by Omicron. The nation reported 54,055 new cases Monday, including more than 1,500 with the Omicron variant.

- Hong Kong will require passengers from the U.K. to quarantine for three weeks upon arrival due to concerns over the COVID-19 Omicron variant.

- Australia will ease travel restrictions for many vaccinated travelers this Wednesday, while some individual states continue to keep borders closed.

- New Zealand’s largest city will drop most pandemic restrictions for vaccinated people by the end of December amid broad inoculation rates surpassing 80%.

- Severe COVID-19 hospitalizations and fatalities in South Korea have risen to record highs.

- India had just 91,456 active COVID-19 cases Monday, the lowest in 18 months.

- Daily COVID-19 cases in Nigeria, Africa’s largest nation, have risen fivefold over the past week.

- Ghana’s main international airport will begin fining airlines $3,500 for every arriving passenger who is not vaccinated against COVID-19 or tests positive on touching down.

- Brazil will require all incoming passengers to show proof of COVID-19 vaccination upon entering the country.

- The standard two-dose COVID-19 vaccine regimen provided less protection against Omicron than Delta, new research from the U.K. found. South African researchers say the Pfizer vaccine’s effectiveness in stopping Omicron hospitalizations is about 70%.

- Merck, a loser in the race to develop a COVID-19 vaccine, is now producing more than 500,000 daily doses of Johnson & Johnson’s vaccine for countries with low supplies.

- Israel will break its pandemic-induced ban barring foreigners from entering the country to import tech workers as the nation confronts a labor shortage.

- Wholesale prices in Germany rose 16.6% year over year in November, the largest annual rise in nearly 60 years.

- Toyota announced plans to accelerate its electric vehicles (EVs) program, aiming to introduce 30 models by 2030 and moving its luxury Lexus brand to 100% EVs by 2035.

- Walmart created a new supply chain finance program to help small and mid-size companies operate sustainably, as the retailer aims to eliminate 1 billion metric tons of emissions from its global suppliers by 2030.

- The U.K. launched its largest ever round of financial support for renewable energy projects, pledging to distribute $377 million over three bidding periods.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.