COVID-19 Bulletin: August 31

More news relevant to the plastics industry:

Some sources linked are subscription services.

Hurricane Ida

- Hurricane Ida weakened into a tropical depression Monday as it moved northeast from New Orleans into Mississippi, Alabama and Tennessee. Severe storms from the system are expected to reach Maryland by Wednesday.

- Thousands of emergency personnel and National Guard troops were deployed across Louisiana Monday to help search and rescue efforts and to deliver critical supplies.

- The storm’s fatality count in Louisiana rose to two on Monday, with a third man missing after being attacked by an alligator in flood waters. Louisiana’s governor expects many more fatalities to be reported in the coming days and weeks.

- Two people were killed and 10 injured in Mississippi Monday night when heavy rain washed out a road.

- Officials warned it could be weeks before clean water is available in some areas and power is restored with more than 2,000 miles of high-voltage lines down in Louisiana and Mississippi.

- Oil prices continued last week’s rally Monday as closed platforms, refineries and pipelines assessed Ida’s damage and began forming plans to restart operations. Roughly 95% of Gulf Coast production, totaling about 1.74 million bpd, was shut down by the storm, while roughly 8% of the nation’s refinery capacity was halted. Already high U.S. gas prices could rise 10 cents or more due to a supply crunch, analysts predict.

- The Federal Motor Carrier Safety Administration issued hours of service waivers for truck drivers in six southern states, expanding driver availability for transporting emergency supplies and support relief in Ida’s wake.

- The Port of New Orleans and associated operations remain closed, with officials reporting that initial assessments show no major damage to facilities.

- Kansas City Southern suspended traffic on its main rail line in Louisiana as well as rail transfer operations in the state until floodwaters recede so it can assess potential damage, further disrupting the nation’s freight outlook.

- Our product managers report the following:

- Our petrochemicals partners are assessing conditions following the storm, with some reporting minimal disruption to their production.

- The outlook for feedstock and additive availability remains uncertain.

- A greater disruption to resin supply could be the recovery of the transportation infrastructure in the region.

- Pinnacle declared force majeure on polypropylene products due to the hurricane’s impact on its Garyville, Louisiana, facility.

Supply

- Energy prices rose only modestly yesterday on cautious expectations of a quick recovery from Hurricane Ida. Crude futures were lower in late morning trading, with WTI down 0.4% at $68.91/bbl and Brent down 0.5% at $73.08/bbl. Natural gas was flat at $4.31/MMBtu.

- Early indications suggest OPEC will continue its modest production increases when the group convenes Wednesday, despite calls from the U.S. to increase production to lower gas prices.

- In 2020, the 50 largest publicly listed exploration and production companies booked $66.6 billion in impairment charges, $84.1 billion in after-tax losses and the lowest revenues since 2016, a new report shows.

- The Federal Trade Commission is looking to crack down on mergers in the oil and gas industry to help lower U.S. gas prices, which have risen above $3/gallon to their highest levels since 2014.

- Libya’s debt-ladened, state-owned Arabian Gulf Oil Company has suspended all activities due to a lack of government spending allocations for both 2020 and 2021, quashing the nation’s hopes of boosting production to help fund the national budget and economic reforms.

- Oil field services provider Basic Energy Services announced it will cut around 500 Texas jobs as the company restructures through a bankruptcy filing, its second in the past six years.

- Royal Dutch Shell finalized subsidiary plans for a renewable-powered offshore well in Malaysia, capable of producing up to 50,000 bpd per day during peak operations.

- Norway began production from a North Sea project expected to release just 0.1 kg of emissions per barrel oil equivalent, a record low.

- Algeria has shut down the world’s last refinery for leaded gasoline after halting sales of the extremely toxic fuel last month.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Wildfires continue to rage in the U.S.:

- More than 22,000 people were ordered to evacuate South Lake Tahoe, California, as the region’s Caldor Fire rapidly grew to 126,182 acres while containment dropped from 19% to 14%.

- California’s Dixie Fire grew to a five-county span of 759,218 acres Monday and is 48% contained.

- California’s Chaparral Fire emerged on Monday afternoon, growing to more than 1,500 acres by 8:45 p.m. with just 13% containment.

- Rain is helping firefighters battle Minnesota’s 26,000-acre Greenwood Fire, now 37% contained.

- The White House has appointed a port envoy to the recently formed taskforce assigned to address ongoing congestion at U.S. ports.

- C.H. Robinson will impose a $175 drayage levy on every inbound and outbound container starting Sept. 1., citing increased backlogs at U.S. ports.

- The global semiconductor shortage has forced Stellantis to suspend more manufacturing in the U.S. and Canada, impacting production of its Ram 1500 trucks and Pacifica and Voyager minivans.

- Several Asian producers of ceramic capacitors, essential components in smartphones, PlayStations and other electronic devices, have shut down production in recent weeks due to COVID-19 outbreaks.

- Auto and farm equipment manufacturers have taken to producing as much of a vehicle as possible and letting incomplete vehicles stack up on factory floors and airport parking lots, awaiting backlogged parts and components.

- Southeast Asian supply-chain disruption has pushed aluminum prices up roughly 33% this year to $2,560 per metric ton, the highest in a decade.

- Train drivers in Germany announced a week-long strike beginning Sept. 1 over wage disputes, threatening both freight and passenger rail services.

Domestic Markets

- The U.S. reported 258,532 new COVID-19 infections and 1,172 virus fatalities Monday.

- Roughly 204,000 new COVID-19 cases were reported in children last week, the second-highest week on record and a fivefold increase from the month prior.

- Texas reported 14,033 schoolchildren infected with COVID-19 for the week ending Aug. 22, a 182% surge from the previous week and the most since the start of the pandemic.

- Florida has 224 children hospitalized with COVID-19, the most in more than a year, while schools in Tampa Bay reported 10,000 infections in just three weeks. The state saw more than 31,100 new infections Monday, a record, as roughly 95% of its ICU beds are currently occupied.

- Kentucky reported more than 25,000 new COVID-19 cases last week, a record, while more than half of the state’s 96 hospitals reported critical staffing shortages.

- Georgia’s 5,600 hospitalized COVID-19 patients are the most since January, as the state reported 8,403 new infections Friday.

- Oklahoma’s seven-day COVID-19 average grew to 2,806, the highest since January.

- Oregon followed Florida in requesting portable refrigerated trucks to serve as temporary morgues for escalating COVID-19 fatalities.

- Parts of Hawaii are mandating proof of COVID-19 vaccination to enter indoor venues, a response to the state’s worst COVID-19 surge of the pandemic.

- Wisconsin’s COVID-19 hospitalizations increased 365% since last month to a total of 865 patients.

- New Jersey will reopen some COVID-19 vaccine mega-sites this fall ahead of expected high demand for booster shots.

- The CDC elevated its travel warning to Level 4, “Very High” risk for seven destinations, including Puerto Rico and Switzerland.

- The White House plans to maintain restrictions on travelers from the U.K., Europe’s Schengen area and other countries due to high COVID-19 infection rates.

- Nearly 1 million COVID-19 booster shots have been administered to Americans in the two weeks following regulatory approval.

- The U.S. Education Department is investigating five states — Iowa, Oklahoma, South Carolina, Tennessee and Utah — about whether their bans on mask mandates in public schools may violate civil rights laws for students with disabilities.

- Prescriptions for Ivermectin, used to treat parasites in horses, have risen to more than 88,000 per week from a baseline average of 3,600 per week, fueled by people seeking unauthorized and unproven ways to treat COVID-19 infections.

- New research suggests Moderna’s COVID-19 vaccine could provide up to twice as many virus antibodies as Pfizer’s shot.

- A growing number of American fast-food chains are reimposing restrictions on indoor seating and hours due to surging COVID-19 cases.

- Labor Day flight bookings are down 15% compared to 2019, while early holiday spending for the same period is down 16%, a result of rising COVID-19 cases and reimposed restrictions.

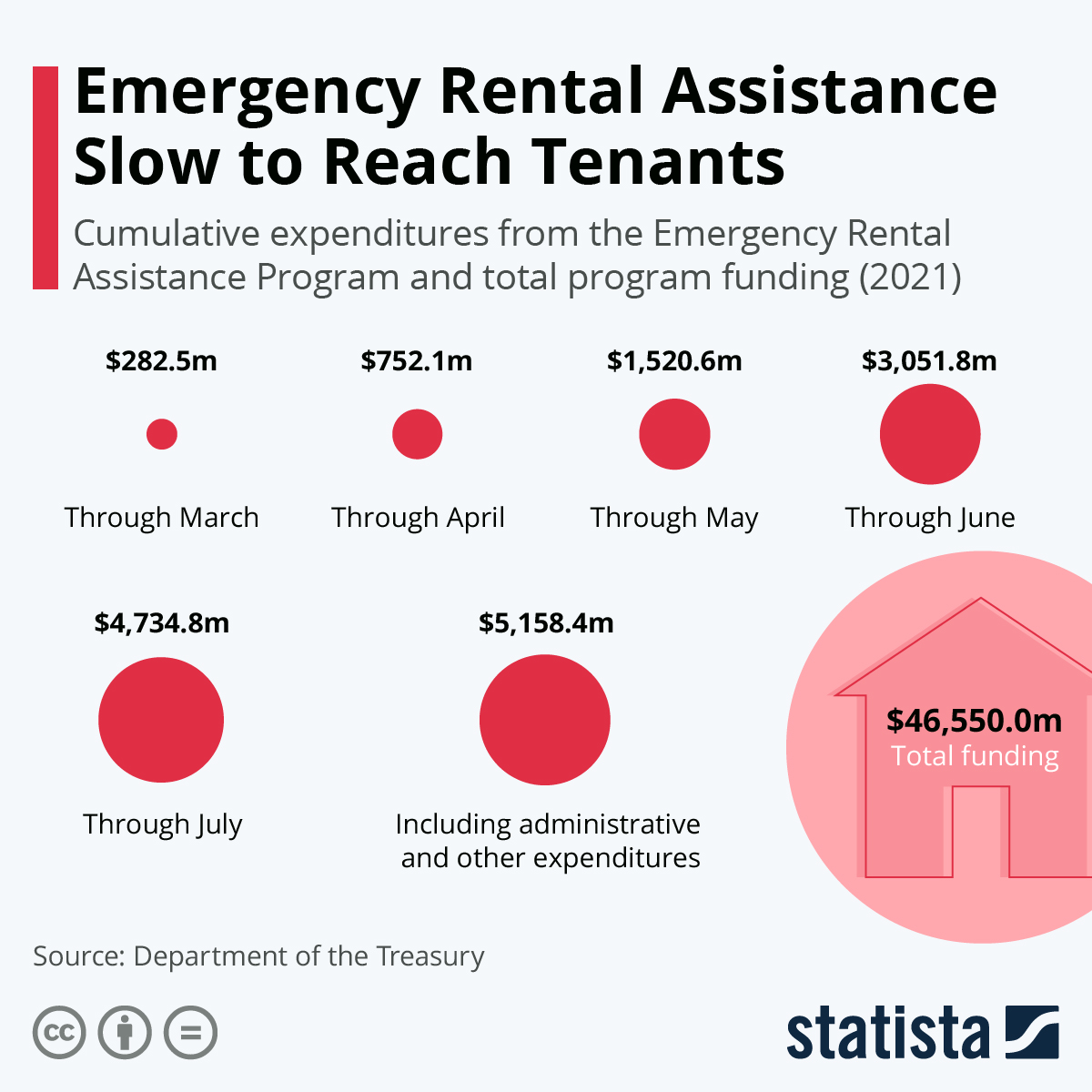

- Having so far distributed just a fraction of allocated dollars, House lawmakers are pushing a measure that would accelerate disbursement of pandemic rental aid as the program expires.

- The U.S. Department of Health and Human Services is working on plans to launch a new federal office that will address climate change as a public health issue, a bid to tackle ongoing health risks and spur new initiatives to help limit the effects of extreme weather.

International Markets

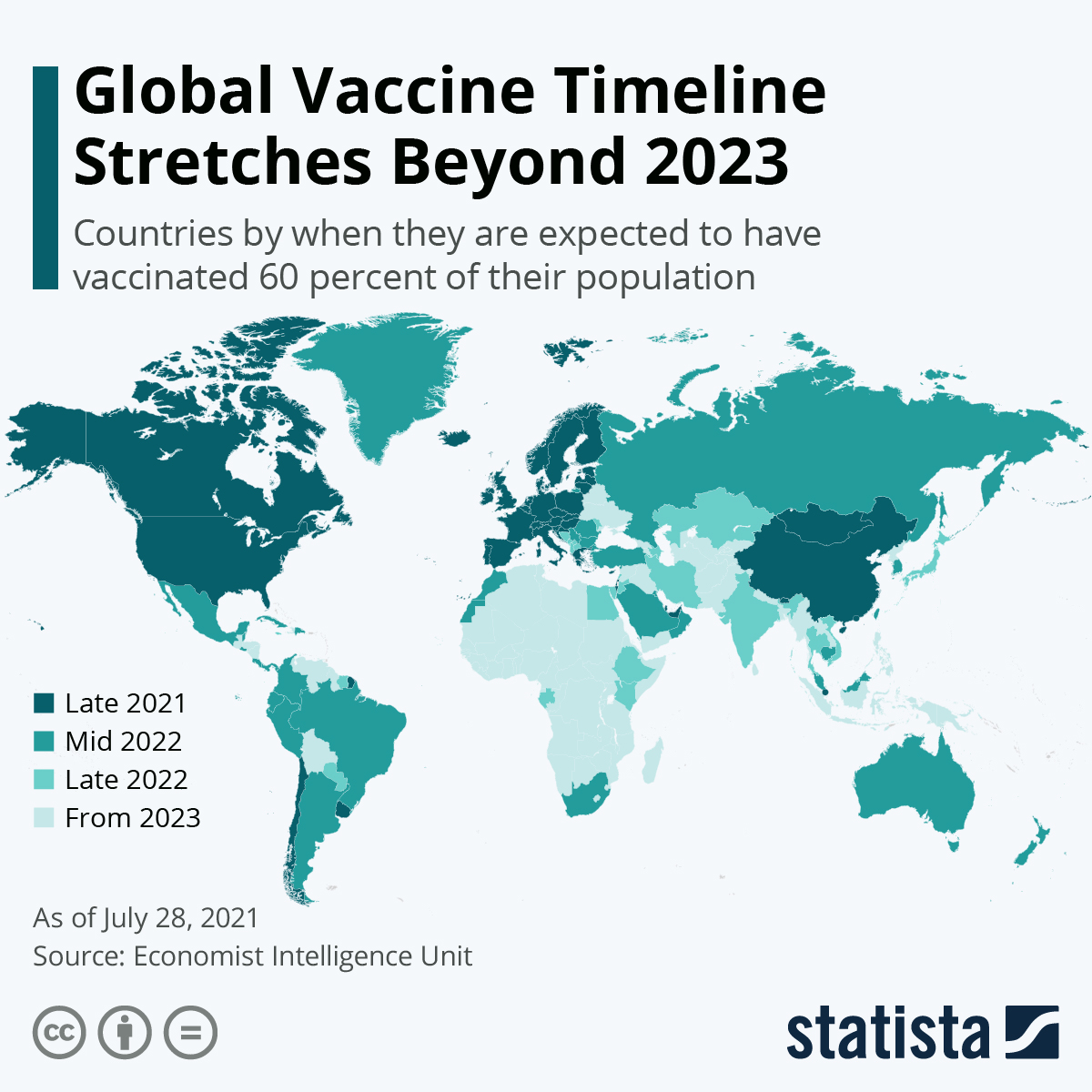

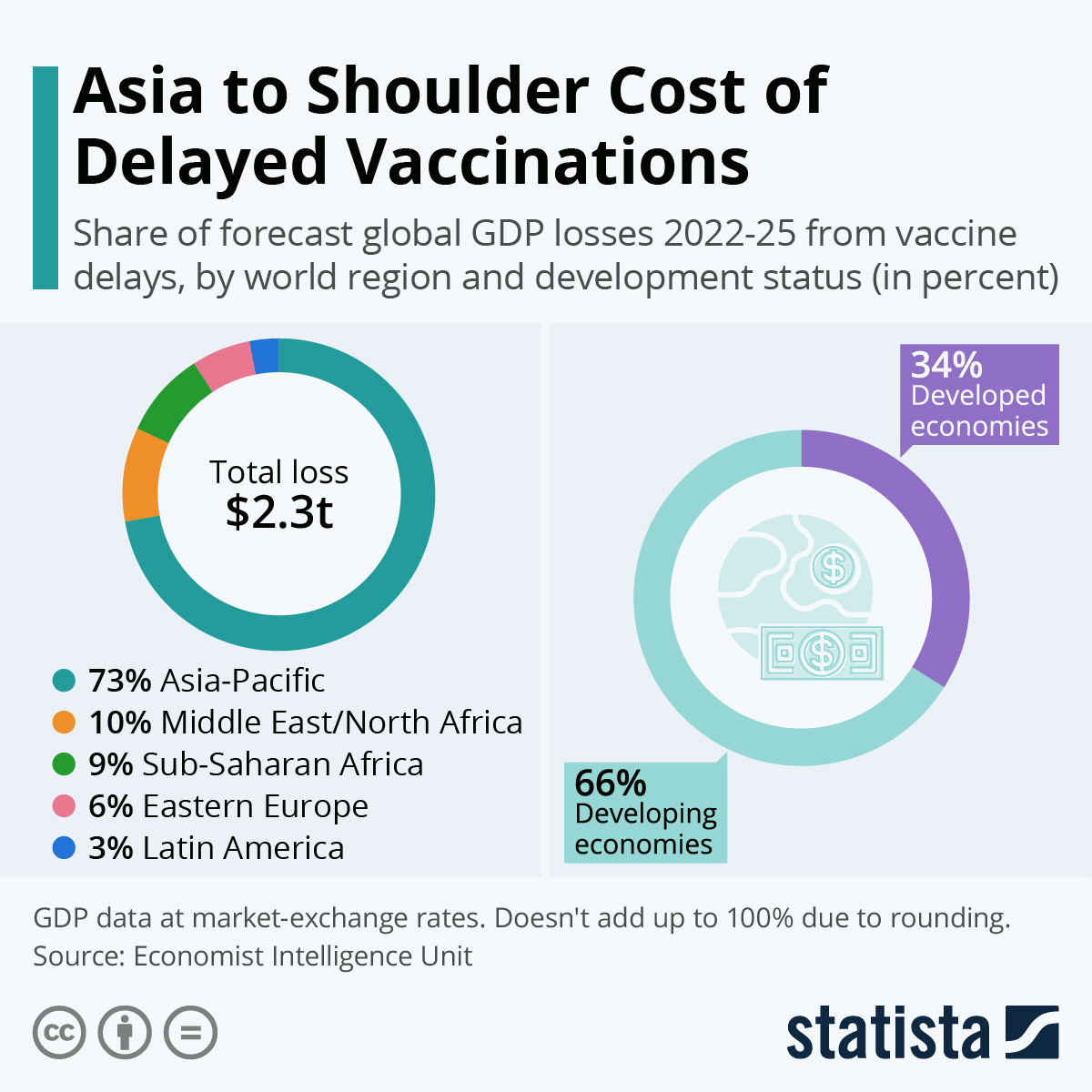

- The spreading Delta variant and slow vaccination rollouts are extending projections on when the pandemic will end…

…with vaccine delays expected to cost roughly $2.3 trillion in lost GDP by 2025:

- COVID-19 infections in the U.K. rose 5.8% last week from the week before, while fatalities rose 16%.

- New South Wales reported 1,290 new COVID-19 cases Monday, a record, as Australian officials predict the nation’s current surge to last through October.

- Singapore has now fully vaccinated more than 80% of its population against COVID-19, as the city-state makes plans to gradually reopen its economy.

- Japan’s retail sales rose for the fifth consecutive month in July, increasing 1.1% from June and 2.4% compared to the same time last year, fueled largely by ripple effects from the Tokyo Olympics. The nation’s factory activity slipped 1.5% on a slowdown in auto production.

- A Purchasing Manager’s Index of Chinese factory activity fell to 50.1 in August from 50.4 in July, bolstering predictions of a second-half slowdown in the world’s second-largest economy.

- Germany’s inflation rate reached a 13-year high in August, with consumer prices rising 3.4% for the month following a 3.1% rise in July.

- An index of euro-zone consumer sentiment fell for the first time this year to 117.5 in August, down from an all-time high of 119 in July, while inflation in the 19-member union surged to a 10-year high of 3% this month.

- England is readying to ban the use of single-use plastic cutlery, plates and polystyrene cups starting this fall as part of an effort to reduce litter throughout the country.

At M. Holland

- During last week’s Plastics Reflections Web Series event, panelists from M. Holland, BPI, LyondellBasell and MTS Logistics discussed how global supply chain complexities are impacting the plastics industry. Click here to access the recording.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.