COVID-19 Bulletin: August 24

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices snapped a seven-day losing streak Monday, jumping more than 5% on news of a weaker U.S. dollar and robust global equities. Crude futures continued their rise in mid-day trading, with WTI up 2.5% at $67.29/bbl and Brent up 2.8% at $70.69/bbl. Natural gas fell 0.6% to $3.92/MMBtu.

- Five workers are dead and six injured after a fire on Sunday at an offshore oil platform operated by Pemex, cutting Mexico’s oil production by about a quarter, or 444,000 bpd. It is the second major fire at a Pemex offshore rig in two months.

- Hess Corporation joined Chevron in mandating COVID-19 vaccines for some of its employees, requiring those working in the Gulf to be fully vaccinated by Nov. 1.

- South Africa has begun geological mapping at its first carbon capture and storage site, with plans to bring the project online in 2023.

- As global supply shortages ease, thermoplastic prices also are softening from the record highs of recent months.

- India’s central government is tightening bans and restrictions on single-use plastic products to address plastics pollution.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Tropical Storm Henri remained stationary over the U.S. Northeast Monday, drenching the region and knocking out power to more than 100,000 structures. Damage from the storm could total $8 billion, forecasters predict.

- High pressure weather systems in the U.S. West — the source of record-breaking heat waves and drought in recent months — have had an opposite effect on the East Coast, which saw the sixth wettest month in more than a century in July.

- Some 63% of the U.S. spring wheat crop is in poor or very poor condition compared to 6% the same time last year, a result of persistent heat waves baking the U.S. West and pushing up prices for staple crops.

- Texas’ power grid operator expects demand to reach record highs today as the state sees yet another heat wave, with temperatures in Houston rising into the high 90s.

- Wildfires are continuing to rip through California, prompting the closure of nine of the state’s national forests.

- Roughly 153,000 acres of California forest designated as carbon-offset areas have been burned this year.

- The state’s Caldor Fire grew to more than 106,000 acres with just 5% containment Monday, destroying more than 400 homes in its path.

- Aided by widespread drought, the Dixie Fire grew to 725,822 acres with just 40% containment.

- Bulk carrier rates crossed $50,000 per day Monday, pushing the Baltic Dry Index up 55 points to 4,147, its highest level in more than 11 years.

- The number of container ships leaving Chinese ports fell by 6% from July to August, with regional congestion growing over outbreaks of COVID-19 and a terminal closure at the world’s third-busiest port of Ningbo.

- A terminal at China’s Shanghai airport will remain closed after five new COVID-19 cases were reported Friday, halting cargo deliveries for the foreseeable future due to the nation’s “zero tolerance” virus policy.

- While imports continue to soar, exports from the top 10 U.S. container ports fell 8.3% in July compared to the same time last year. Exports from the Port of Los Angeles fell 27.6% to the lowest level since February 2005, with empty container exports outnumbering full containers by 3 to 1. Analysts point to equipment shortages and higher tariffs on exports for the slide.

- A planned widening and deepening of the Houston Ship Channel is expected to accommodate an additional 1,400 vessels per year through the Port of Houston by 2025.

- Prices for iron ore, the world’s second-most-traded commodity, have fallen 40% since July after China announced a desire to keep steel output at 2020 levels this year.

- New orders for robots and other factory equipment to build electric vehicles has accelerated the U.S. manufacturing sector’s rebound, with automakers planning to invest more than $37 billion into SUV and electric vehicle production by 2025.

- Samsung announced plans to boost capital investments by $205 billion over the next three years, as the South Korean tech giant seeks greater market share in the global semiconductor industry.

- Volvo will halt production at a Swedish plant next week over the ongoing global semiconductor chip shortage.

- Maersk announced the order of eight new methanol-powered vessels that the company says will be carbon neutral when put into operation in 2024.

- India is looking to sell $81 billion in state-owned assets to boost public finances over the next four years, including gas pipelines, roads, railway assets and warehousing facilities.

- Target will expand its sortation-center model to four new U.S. cities this fall, a move to free up space at retail stores while quickening deliveries.

- Walmart has opened its last-mile delivery service to other U.S. merchants as it seeks to capitalize on shipping delays at traditional carriers ahead of the peak holiday season.

Domestic Markets

- Average daily COVID-19 infections in the U.S. have climbed past 137,000, a 230% surge over the last month, while the country’s seven-day average for virus deaths topped 1,000 for two straight days for the first time since March. The country reported 229,831 new cases and 908 virus fatalities Monday.

- Full FDA approval of Pfizer’s COVID-19 vaccine has prompted several major new vaccination mandates, including for all U.S. military personnel; public school employees in New York City and New Jersey; city workers in Sacramento; unionized Disney employees; corporate staff and customer-facing employees at CVS; and all colleges and universities in Nevada.

- More than 20 hospitals in Kentucky are facing severe staffing and equipment shortages amid a flood of COVID-19 patients, with the state reporting a record-high 1,890 virus hospitalizations.

- Tennessee’s seven-day average for new COVID-19 cases among children is approaching 1,400, accounting for roughly a third of all new cases in the state.

- In Florida, children currently have the highest virus positivity rate of any demographic. Some 75 doctors at hospitals in South Florida staged a walkout to protest surging infections among the unvaccinated in the state.

- COVID-19 hospitalizations in Maine rose 66% over the past week to their highest level since May.

- Hawaii reported 893 new COVID-19 cases Sunday, a record, as the state mulls reimposing broad testing requirements on travelers. The state’s governor is discouraging tourists from visiting the state.

- New COVID-19 cases in California are on the rise, with the state reporting a 10% increase in infections over the past two weeks.

- Arizona reported 2,632 new COVID-19 cases Monday, the first time in five days that daily infections dropped below 3,000, while hospitalizations in the state rose to 1,901, the most since February.

- Indiana saw 20,416 new COVID-19 cases last week, a surge of 32.5% from the previous week.

- Pennsylvania has reported 7,652 new COVID-19 infections since Friday, despite more than 80% of the state’s population having received at least one dose of a COVID-19 vaccine.

- COVID-19 hospitalizations in Virginia have returned to levels not seen since last year’s peaks.

- U.S. home sales rose 2% in July as the median home price dropped to $359,500 from a record $362,800 in June.

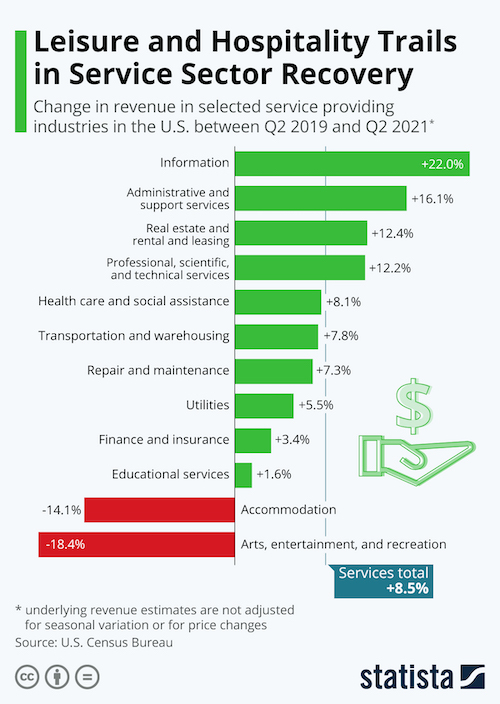

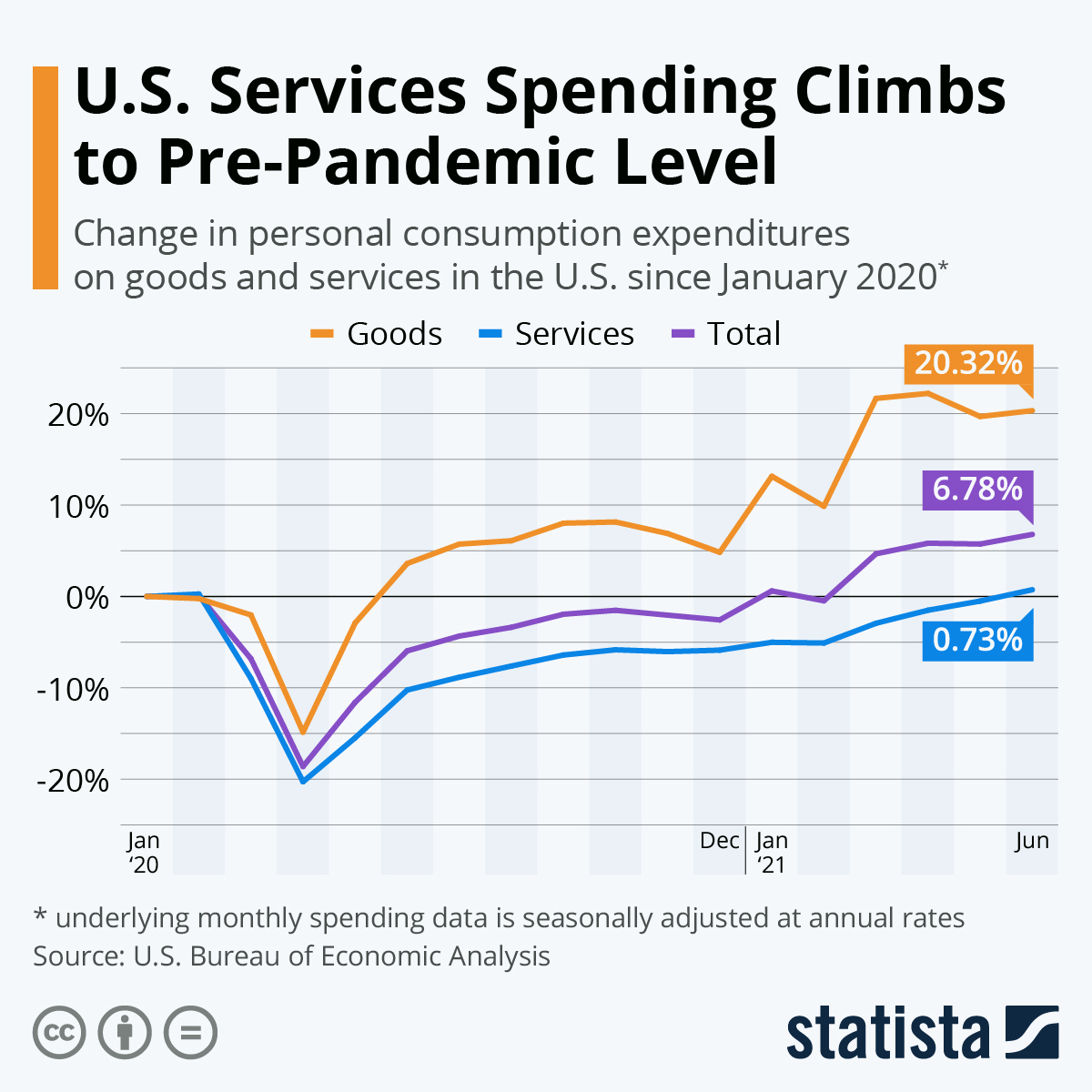

- U.S. service providers have reported sharply slower growth in August due to the recent surge in COVID-19, with a key index of sector activity falling to an eight-month low of 55.2 compared to 59.9 in July. Leisure and hospitality led the sector’s drop…

…despite overall service-sector spending rebounding to pre-pandemic levels:

- Air travelers are canceling bookings and buying fewer tickets amid the resurgence of COVID-19, prompting several U.S. and international airlines to forecast quarterly losses.

- Twenty-six crew members and a passenger suffered COVID-19 infections on a recent Carnival Cruise voyage, with the passenger later passing away from the illness.

- Wind turbine manufacturers are reducing profit forecasts for the rest of 2021, reflecting rising raw material and transport costs despite growing demand for renewable energy.

- Pepsi is setting targets to become “net water positive” by 2030, which would see the company replenish more water than it uses in production.

International Markets

- Tokyo’s 4,392 new daily COVID-19 infections remained near record levels, as Japanese officials urged city hospitals to accept more virus patients.

- Australia’s largest state of New South Wales reported 818 new COVID-19 cases Monday, down only slightly from Sunday’s record of 830, as strict pandemic lockdowns will likely remain for the foreseeable future.

- The Philippines reported 18,332 new COVID-19 infections Monday, a record.

- New Zealand recorded 41 new COVID-19 cases Tuesday, the most since April 2020.

- South Korea reported 1,509 new COVID-19 cases, the 49th day of daily case counts above 1,000 led by a concentration of outbreaks in metropolitan Seoul.

- Thailand is drawing up plans to relax certain COVID-19 restrictions despite averaging around 20,000 new infections per day.

- Indonesia will relax some capacity restrictions on places of worship and retail stores amid a drop in the nation’s COVID-19 infections.

- The U.K. ordered an additional 35 million doses of Pfizer’s COVID-19 vaccine as it prepares for the broad administration of booster shots. The country reported 31,914 new infections and 40 virus deaths Monday.

- Germany will begin using COVID-19 hospitalizations to gauge the need for pandemic restrictions, shifting away from infection rates amid a rise in the country’s vaccination rate.

- Sao Paulo, Brazil, the most populous city in the western hemisphere, will require at least one dose of a COVID-19 vaccine for indoor dining, retail and public events.

- The World Health Organization is calling for a two-month halt to administering COVID-19 booster shots to reduce global vaccine inequality and prevent new virus variants from emerging.

- New data from Israel shows that a booster dose of the Pfizer COVID-19 vaccine significantly improved protection for those over age 60.

- Egypt will require COVID-19 vaccinations for its 4.5 million state employees by the end of September.

- An increase in COVID-19 vaccinations continues to spur euro zone business activity, with a key index dipping just slightly in August to 59.5, compared to 60.2 in July.

- Germany’s GDP grew 1.6% in the second quarter, slightly beating analyst estimates on the tail of a first-quarter contraction of 2%.

- Japan’s factory activity slowed in August, while its services sector shrank at its fastest pace since May 2020, with a key purchasing manager’s index dropping to 52.4 for the month, down from 53 in July.

At M. Holland

- Thursday: What’s the outlook for plastics supply and the global supply chain? Join us for our Plastics Reflections Web Series featuring panelists from Business Publishing International, MTS Logistics, LyondellBasell and M. Holland. Register here for this webinar on Thursday, Aug. 26 at 1:00 pm CT/2:00 pm ET.

- Matt Zessin, our Automotive Market Manager, was interviewed about materials trends for electric vehicles on the Automotive News Daily Drive podcast, accessible here.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.