COVID-19 Bulletin: April 4

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices dropped Friday to close the week about 13% lower, the steepest weekly fall in two years, after members of the International Energy Agency agreed to join in the largest-ever release of emergency oil reserves. Details of the agreement, which includes Canada, Mexico, Japan, South Korea and most of Europe, will be released early this week.

- In late-morning trading today, WTI futures were up 2.3% at $101.60/bbl, Brent was up 1.8% at $106.20/bbl, and U.S. natural gas was up 0.3% at $5.74/MMBtu.

- OPEC raised production by just 90,000 bpd in March, well short of a planned 253,000-bpd increase. Separately, the oil-producing cartel will stop using International Energy Agency data to assess compliance with production quotas.

- U.S. energy firms added three oil and gas rigs last week, the second week of gains, although growth remains slow as drillers continue returning cash to shareholders rather than boosting production.

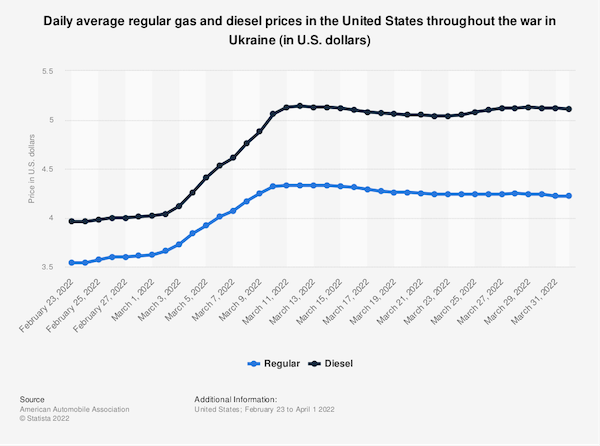

- The average U.S. gasoline price dropped to $4.19 a gallon Sunday, a decline of 14 cents since hitting an all-time high of $4.33 three weeks ago.

- The U.S. administration unveiled new fuel economy rules late last week, including a stepping scale that will require automakers to raise their average fleet miles per gallon to 49 by 2026.

- Wounded by commercial customer closures during the pandemic, natural gas and electricity retailer Volunteer Energy Services filed for bankruptcy and intends to wind down its business. Based in Ohio, the company provides natural gas and electricity to 212,000 homes and businesses in Ohio, Michigan, Kentucky and Pennsylvania.

- Hundreds of climate activists blocked oil terminals across Britain Friday, forcing Exxon Mobil to temporarily suspend operations at four locations.

- Mexico excluded the U.S. border region from its gasoline subsidies after a flood of Americans began driving south to fill up their tanks.

- Asia-Pacific LNG imports fell 10% in the first quarter as more cargoes were redirected to the high-paying European market, causing LNG prices in Asia to rise sharply in response to the lower supply.

- More oil news related to the war in Europe:

- The Baltic states — Estonia, Latvia, Lithuania — became the first European nations to completely halt Russian gas imports, with domestic reserves now covering the lost supplies, according to officials.

- Russia’s Friday threat to cut off gas supplies to Europe unless buyers paid with rubles was averted, with Moscow saying it will not halt supplies until new payments are due later in April.

- Slovakia announced that it will stand with Europe against Russia’s demands for foreign countries to pay for gas in rubles.

- U.S. diesel exports are at the highest level since August 2019 as buyers in Europe and Latin America look to replace Russian supplies.

- Ukrainian forces struck a Russian oil depot in a cross-border raid on Friday, while Russian forces struck back on Sunday in the southern port city of Odessa, hitting an oil refinery and fuel storage facilities.

- Chinese LNG importers are reportedly looking to purchase additional Russian fuel shipments to take advantage of steep discounts resulting from a boycott from Western nations.

- India reaffirmed plans to buy more Russian crude at a steep discount, despite opposition from the U.S. and U.K.

- Representatives from U.S. oil companies with the most production on federal lands and waters declined invitations to attend a congressional hearing this week on the surging cost of energy prices.

- Vietnamese utilities warned of electricity shortages starting next month due to tight coal supplies with officials looking to raise imports from Australia.

- Beijing aims to completely halt coal usage, which accounts for 1.5% of the city’s energy mix, by 2035.

- A new report from the Global Wind Energy Council shows the sector is behind in its efforts to curb greenhouse gas emissions and meet net zero targets, after supply chain issues caused by the pandemic limited new installations in 2021.

Supply Chain

- More than 6,000 U.S. flights were delayed and 1,900 were canceled Saturday as thunderstorms ripped across Florida, while another 1,400 were canceled on Sunday.

- American Airlines canceled nearly 300 flights over the weekend due to staffing shortages.

- Service disruptions are plaguing some American Express customers, who are struggling to access products and services on both web and mobile apps as the firm works to get its systems back online.

- The U.S. trucking industry lost 4,900 jobs in February, the first decline in 21 months.

- The industrial real estate market will likely see low vacancies and high rents for at least another two years as companies take on larger inventory positions to avoid future supply shocks.

- Airfreight prices from China to the U.S. hit $8.54/kilogram for the week ended March 28, up 22% over the previous three weeks after more than 1,800 flights at Shanghai’s two airports were canceled due to lockdowns.

- Sanctions are crippling China’s ambitions to send more exports to Europe on a 7,500-mile rail corridor through Russia, a key part of the nation’s years-long Belt and Road program.

- Mexico is gaining ground as firms reset their supply chains from China, with procurement bids from large American manufacturers rising sixfold in the nation in 2020, compared to a 9% decline in bids to suppliers based in China.

- The U.S. Senate passed a law Thursday that would strengthen the power of the Federal Maritime Commission to impose greater transparency on ocean carriers and expedite exports. Lawmakers from each chamber will now work on merging two versions of the bill to send to the White House.

- The White House is set to unveil new details later today about plans to help solve challenges in the trucking industry, including hiring more women and veterans, as part of an ongoing effort to bolster U.S. supply chains against climate and geopolitical issues.

- The ports of Long Beach and Los Angeles will add a fee of $10 per 20-foot container to fund a clean-trucks initiative.

- A state budget proposal would shut down the faltering bulk handling operations at South Carolina’s Port of Georgetown.

- Expanded lockdowns in Shanghai are set to halt more factories, including Volkswagen’s joint venture with SAIC and a plant owned by Tesla.

- The London Metal Exchange is suspending deliveries of some Russian-made metals into its British warehouses, citing sanctions.

- DHL signed a new deal to add freighter capacity from Cargojet, which includes the potential for DHL to buy a stake in the Canadian carrier.

- A second P&O ferry ship in London failed safety inspections and was detained, just weeks after the firm abruptly replaced hundreds of staff with agency workers paid less than minimum wage.

- Over 17 million birds have died or been destroyed as the worst bird flu epidemic in seven years spreads across the nation, driving up egg and poultry prices.

- Wedding planners are struggling with supply chain shortages of key event materials, including meals.

- Hershey has begun limiting product variety on store shelves in a bid to boost efficiency.

Domestic Markets

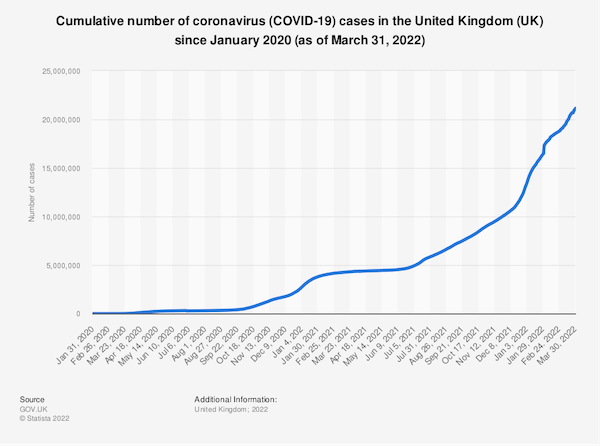

- The U.S. reported 4,586 new COVID-19 infections and 32 virus fatalities Sunday.

- Total COVID-19 hospitalizations in the U.S. dropped 90% over the past two months to the lowest level since the start of the pandemic.

- New COVID-19 cases rose 16% in Florida and 77% in Massachusetts last week.

- Cases of the BA.2 “stealth” subvariant of Omicron doubled in Los Angeles County last month, raising fears that overall infections could soon plateau and start rising again.

- The percentage of Los Angeles children who are chronically absent from school, defined as missing at least 9% of the school year, is nearing 50%, more than twice as high as it was before the pandemic.

- More U.S. companies are relaxing vaccine and other COVID-19-related requirements in response to updated guidance from health authorities and declining case counts.

- The share of U.S. employees telecommuting dropped to 10% in March, down from 22% last year and 35% two years ago.

- Average U.S. hourly earnings were up 0.4% in March, a level slightly below the half-year average in a sign that employers are feeling less pressure to offer pay increases to keep up with inflation. Compensation for chief executives has risen sharply.

- College enrollment nationwide is down 5% since 2019 as schools grapple to overcome pandemic disruption and the lure of a robust job market for prospective students.

- The average nightly hotel rate in the U.S. hit $149.38 last week, the third highest ever recorded, as hoteliers seize on a rise in travel after two years of pandemic restrictions.

- Mortgage delinquencies rose for the first time in nine months in February as pandemic relief programs began expiring. The delinquency rate is now near its pre-pandemic levels.

- GM’s U.S. sales slid over 20% in the first quarter, one of the largest drops amid an industry-wide slump, even as sales of electric vehicles surged.

- While 68% higher than last year, Tesla delivered a lower-than-expected 310,000 vehicles across the globe last quarter due to supply disruptions and COVID-induced lockdowns in China.

- Washington is the first state to strike a deal on the budding question of ride-hailing worker status, with a new law imposing minimum per-mile pay and other worker benefits while decisively stating that drivers are not employees.

- Amazon warehouse workers in Staten Island, New York, became the company’s first employees to successfully unionize.

International Markets

- About 1 in 13 people in England were infected with COVID-19 last week, the highest prevalence rate of the pandemic, with the figures released on the same day that officials scrapped the nation’s free testing program.

- The “XE” strain of COVID-19 — a hybrid of Omicron and its BA.2 subvariant — could be the most transmissible yet, officials say. The strain was first discovered in the U.K. in January and has been detected 600 times since.

- China reported over 13,000 COVID-19 cases Monday, including a record of over 9,000 in Shanghai as the city’s lockdown expanded to cover nearly all 26 million residents. Dissent is rising over the nation’s strict pandemic controls, as over 2,000 military medics and 10,000 medical workers were sent to curb the outbreak in Shanghai, which began testing all residents.

- Seoul, South Korea, is scrambling to build crematoriums to meet soaring demand for cremations from COVID-19 fatalities.

- Brazil eased its restrictions for entering the country, no longer requiring COVID-19 tests for vaccinated travelers.

- Sweden recommended a fourth COVID-19 vaccine dose for people aged 65 and older.

- Recent British research suggests the transmissibility of COVID-19 is not connected to whether a person displays symptoms.

- Economists predict housing prices in Hong Kong could fall by 10% this year as more residents leave the island’s tight pandemic controls.

- More news related to the war in Europe:

- Auto transport company Gefco, part owned by Stellantis, will buy back 75% of its shares held by a sanctioned Russian railroad ahead of an expected acquisition by CMA CGM, reports say.

- A record number of British firms expect to increase wages between 2%-5% next year as the war in Ukraine accelerates a rise in the cost of living.

- Several companies are donating profits derived from Russia to humanitarian-relief efforts in Ukraine, while others continue to book those profits in their global earnings.

- The U.S. will provide an additional $300 million in security assistance to Ukrainian forces fighting Russian troops, officials said Friday.

- Currencies in export-heavy Latin American nations are defying broader trends and gaining strength against the dollar, boosted by some of the world’s quickest efforts to raise interest rates and curb inflation.

- China’s administration has largely scrapped the once-ubiquitous catchphrase “common prosperity” over concerns that its economic agenda could further dent the nation’s slowing growth.

- Powered by a 7,500 KWh marine battery made by China’s CATL, the world’s largest electric cruise ship completed its maiden voyage last week with some 1,300 passengers on board.

At M. Holland

- In case you missed it, watch M. Holland’s Plastics Reflections webinar about the current and future state of the North American plastics industry. Click here to access the recording.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.