COVID-19 Bulletin: April 22

Hello,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices fell roughly 2% Wednesday to their lowest levels in a week amid news of higher-than-expected crude inventories and concern about lower fuel demand in India, the world’s third-largest importer.

- Crude futures were higher in mid-day trading today, with the WTI up 0.4% at $61.57/bbl and Brent 0.2% higher at $65.54/bbl. Natural gas was 0.8% higher at $2.77/MMBtu.

- The White House is aiming to end a legal battle with California over the state’s authority to regulate vehicle emissions, a move that could allow for stricter regulations on the auto industry in the coming months and years.

- The U.S. is suspending all oil and gas lease sales on public lands through the end of June as it reviews the fairness of the leasing process.

- The U.S. administration unveiled new ambitious plans for cutting the nation’s greenhouse-gas emissions roughly in half by 2030.

- An Icelandic startup is looking to become Europe’s repository for carbon pollution, promoting a new technique to turn the gas into underground rock by mineralizing carbon, similar to natural processes.

- Angola, once Africa’s largest oil producer, is hoping a privatization effort for its state-owned oil company will revive the industry.

- Halliburton’s revenues were down 31% in the first quarter, but the company beat analyst estimates for sales and earnings. Baker Hughes reported a 12% revenue decline, with Oilfield Services revenues down 30%, while also beating earnings estimates.

- New technology developed at the University of California, Berkeley and Lawrence Berkeley National Laboratory breaks down enzyme-laced plastic films without creating microplastics, opening the possibility for true compostability at home.

- New pyrolysis technology developed at the University of Delaware requires less heat than traditional methods for converting non-recyclable polyolefin waste into oil and gas.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Ford is extending shutdowns at five North American factories for two weeks over continued effects from the global semiconductor chip shortage, mainly affecting production of its popular F-150 pickup truck.

- Whirlpool, enjoying continued strong demand for appliances, has been forced to juggle production schedules and search for cost savings as it confronts rising costs and shortages of semiconductors and plastics.

- An import surge of intermodal ocean containers is causing significant backlogs at central Kansas City rail terminals. Higher intermodal volumes are prompting carrier BNSF and other major carriers to shift operations to ease congestion at key terminals.

- Profit at railroad CSX fell 8% to $706 million in the first quarter as lower commodity volumes offset an 11% gain in intermodal revenue.

- Walmart is phasing out its automated pickup towers that are used to distribute online orders in its stores, focusing on its curbside pickup services that gained popularity during the pandemic.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports due in part to operating challenges related to the pandemic. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- There were 62,857 new COVID-19 cases and 842 deaths in the U.S. yesterday, with 24.4% of the population now fully vaccinated.

- More than 200 million COVID-19 vaccine shots have been administered in the U.S. as of yesterday, meeting the White House’s 100-day goal. With half the population having received at least one shot, the national vaccination rate slowed this week due to the suspension of use of Johnson & Johnson’s vaccine, healthcare constraints and vaccine hesitancy among many citizens.

- The U.S. vaccination pace has held above 3 million shots per day for two weeks straight. A study in 14 states suggests the nation’s vaccination campaign is working, with infections falling faster among older people who have been vaccinated than younger populations where vaccination rates are lower.

- Michigan’s seven-day average of new COVID-19 cases has topped 7,000 for nearly two weeks, matching the state’s previous record of new cases in late November. Still, the state’s inoculation campaign is stalling with many residents avoiding or skipping vaccination appointments, particularly in rural areas.

- Nearly half of counties in Iowa have declined deliveries of more COVID-19 vaccines, citing reduced demand amid skepticism about the shots.

- Oregon suffered 989 new COVID-19 infections yesterday, the highest since January, marking a fourth straight week of rising infections and hospitalizations in the state.

- California now has the lowest COVID-19 case rate in the nation, an average of 40.3 per 100,000 residents for the past seven days, versus a national average of 135.3 and an average of 483 in Michigan, which has the highest infection rate.

- New York has registered its lowest COVID-19 positivity rate since early November at 2.35%. New York City plans to spend $30 million on a tourism campaign in June, hoping to revive an industry vital to the city’s economy.

- Texas is seeing an influx of vaccine tourists from Latin America, wealthy travelers visiting the state to receive shots, which are scarce in their home countries.

- The White House will offer a tax credit to businesses with fewer than 500 employees that give paid leave to get COVID-19 vaccines or recover from the shots’ side effects.

- Cigna Corporation has introduced new incentives to encourage its workers to get a COVID-19 vaccine, including offering paid time off to get the shot and adding $200 to the health-spending accounts for those who are fully vaccinated.

- Pfizer has found the first confirmed instances of counterfeit versions of its COVID-19 vaccine in Mexico and Poland.

- Johnson & Johnson will assume oversight of a contract manufacturing plant for its COVID-19 vaccine in Baltimore after the FDA closed the facility when an inspection revealed unsanitary conditions and potential cross-contamination of the shots with AstraZeneca’s vaccine. Separately, Johnson & Johnson said it would add 10 new manufacturing sites to its vaccine supply network.

- Big tech quickly stepped in to fill a void in cloud-based platforms for the U.S.’s massive inoculation campaign, with Microsoft, Amazon and Alphabet all releasing applications to schedule vaccines in recent months.

- There were 547,000 first-time unemployment claims last week, the lowest weekly count of the pandemic.

- The current U.S. labor force has lost 5 million workers during the pandemic, one reason that the labor market appears to be tightening amid a shortage of workers while other data indicates high unemployment levels.

- Luxury U.S. home sales spiked 41.6% year over year in the first quarter, a further sign of the pandemic’s aggravation of economic inequality.

- Home sales overall fell 3.7% in March due to tight supply, while the median price was up 17.2% year over year.

- The U.S. State Department has declared about 80% of the world’s nations as no-go zones due to rising COVID-19 cases, dampening airline industry hopes for a summer tourism rebound. The industry upped its estimate for expected losses this year by about 25% to $48 billion.

- American Airlines reported a $1.25 billion loss in the first quarter, with a cash burn of $27 million a day, but sees signs of an industry recovery. The company plans to hire 300 pilots this year in anticipation of renewed air travel this summer.

- General Motors is bumping up by a year the planned rollout of its new Lyriq electric vehicle, hoping the SUV will rejuvenate the company’s luxury Cadillac brand.

- Mars, PepsiCo and McCormick have teamed up to create the Supplier Leadership on Climate Transition coalition, with a goal of guiding emissions cuts in global supply chains.

International

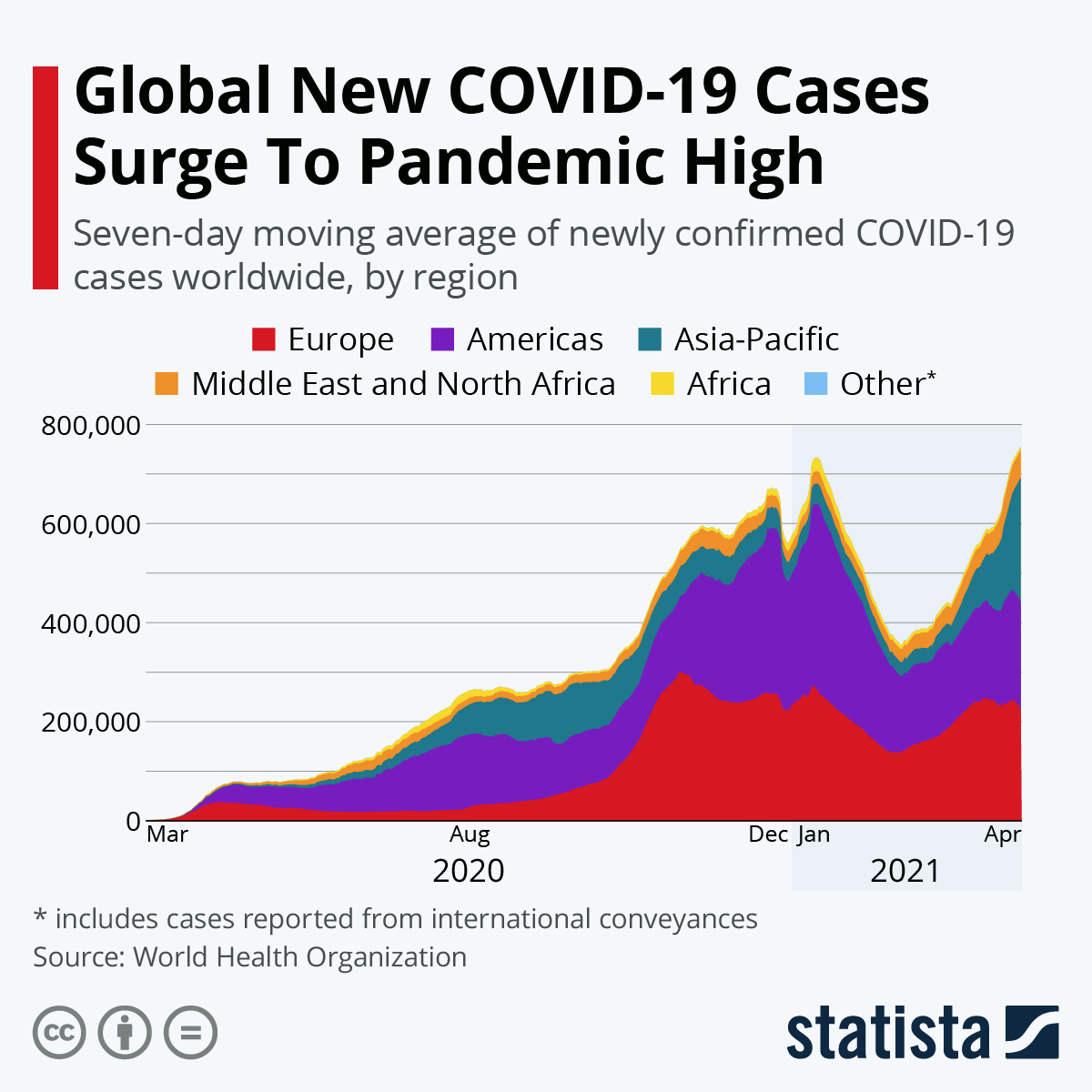

- Global COVID-19 infections are at an all-time high:

- India today posted the highest single-day infection rate on record globally — 314,835 — topping the previous record set by the U.S. in December. India remains the world’s hotspot for resurgent COVID-19, posting a record daily death toll of 2,023 on Wednesday. The nation’s hospitals are rapidly running out of critical medical supplies for the most severe patients with at least 24 virus patients passing away in a single incident when their oxygen supplies suddenly ran out.

- Singapore is tightening border restrictions with India in response to that country’s historic COVID-19 outbreak.

- Brazil, only weeks ago suffering the world’s worst COVID-19 outbreak, has registered a drop in infections in recent days, but officials warn that relaxing lockdown restrictions will reverse the improvement.

- A sharp second wave of COVID-19 in Argentina has pushed total virus deaths above 60,000, as the country begins reimposing some lockdown measures.

- The EU’s health agency eased social distancing rules and mask requirements for those who get vaccinated against COVID-19.

- France saw its lowest weekly increase of new COVID-19 cases since mid-March.

- Italy’s government has approved a new reopening decree, allowing lower-risk areas to relax certain COVID-19 restrictions beginning April 26.

- Poland announced plans to ease some of its pandemic restrictions on April 26, starting with hair salons and allowing children to return to in-person learning in 11 of its 16 regions.

- Denmark eased restrictions on cafes, restaurants, bars and museums for the first time in months.

- With 35% of its population vaccinated, Hungary plans to partially open restaurants and ease a curfew this weekend.

- Citing a rising surge in infections throughout the country, Sweden will postpone a planned easing of some of its COVID-19 restrictions, hoping to combat a third wave.

- Rather than relying on the country’s 16 states to set their own rules, lawmakers in Germany approved a new amendment allowing the chancellor’s federal government to set lockdown restrictions in areas where COVID-19 is spreading.

- Russia has agreed to provide Thailand with its Sputnik V COVID-19 vaccine, as the country tries to curb a recent surge in infections, reporting 1,470 new cases on Thursday along with seven deaths, the country’s highest single-day death toll since the start of the pandemic.

- COVID-19 vaccine supply shortages and a slow rollout threaten to derail Australia’s economic recovery, with the timeline for vaccinating all its 25 million people likely stretching into 2022.

- Deliveries to Europe of Johnson & Johnson’s COVID-19 vaccine have resumed, a week after the shots were temporarily halted due to concerns over extremely rare side effects.

- The European Central Bank will maintain negative interest rates and other stimulus programs to encourage economic recovery.

- The World Bank is warning that developing nations will likely lose growth momentum as COVID-19 infections increase worldwide.

- The Canadian dollar notched its biggest gain in 10 months on news that the Bank of Canada will dial back emergency support for the nation’s economy.

- The EU put forth new rules that would make companies report standardized information about their environmental impact for the first time, a move that could affect up to 50,000 entities.

Our Operations

- This week’s recent Plastics Reflections webinar on Driving Sustainability Action in the Plastics Industry can be viewed here.

- M. Holland is the headline sponsor for AMI’s Thermoplastic Concentrates & Masterbatch Virtual Summit on April 26-29. Christopher Thelen, Regulatory Specialist for M. Holland, will be speaking on Monday, April 26 at 8:00 am CT.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.