MH Daily Bulletin: March 31

News relevant to the plastics industry:

At M. Holland

- Todd Waddle, Director of M. Holland’s Wire & Cable and Sustainability groups, joined a recent Art of the Possible podcast episode hosted by IPC. Click here to access the episode, which focuses on the growth in electrification, sustainability efforts across the manufacturing industry and the Electrical Wire Processing Technology Expo (EWPTE) 2023.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil rose more than 1% Thursday, supported by news of lower U.S. crude stocks.

- In mid-morning trading today, WTI futures were up 1.0% at $75.13/bbl, Brent was up 0.4% at $79.61/bbl, and U.S. natural gas was up 4.0% at $2.19/MMBtu.

- Beginning in June, S&P Global will factor the WTI price into calculating the Brent benchmark price due to a decline in the amount of traded oil currently in the Brent price.

- Freeport LNG’s fire-damaged export terminal in Texas is back at full capacity, data shows.

- Valero, the U.S.’s second-largest oil refiner, is seeking government permission to import Venezuelan crude, according to reports.

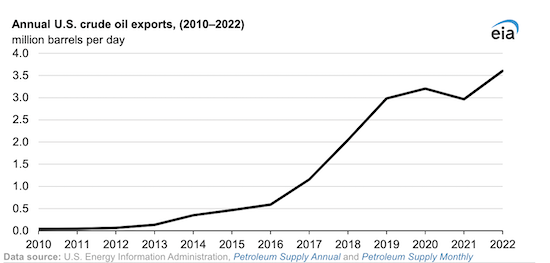

- U.S. crude exports averaged a record 3.6 million bpd last year:

- Kurdistan’s oil exports could be shut down for another week after Iraq closed a pipeline in a dispute with Turkey, halting more than 400,000 barrels of daily shipments. The shutdown has forced Kurdistan to suspend $6 billion in payments to oil traders.

- A U.S. oil-lease sale for the Gulf of Mexico pulled in $264 million in bids for drilling rights this week, with Chevron as the top bidder.

- Russia continues to use Western insurance for more than half the oil cargoes it sells, giving allied nations more opportunity to increase sanctions on Moscow.

- Shell is stepping away from two biofuel projects it was considering in Singapore.

- EU member states agreed on Thursday to raise the target for renewables to 42.5% of the bloc’s energy consumption by 2030, up from 32%.

Supply Chain

- Historic winter storms are expected to completely refill California’s largest reservoir by the end of the year.

- U.S. warehouses and industrial properties are largely insulated from recent turmoil in the nation’s financial sector, analysts say.

- Russia and India plan to expand the use of Northern Sea shipping lanes that pass through the Arctic, the shortest shipping route between East Asia and Europe.

- U.S. and Japanese semiconductor exports to China plummeted in 2022 for the first time in three years.

- U.S. chipmaker Micron Technology took a $1.4 billion inventory write-down in the latest quarter as declining demand for consumer electronics weighs on the chip industry’s big suppliers.

- Vietnam’s smartphone exports fell 11.9% in the first quarter.

- South Korean and Taiwanese tech companies, including Samsung and SK Hynix, are reportedly growing concerned over investment restrictions accompanying new U.S. rules on semiconductor incentives.

- Optimism is growing that a downturn in the U.S. semiconductor industry has reached its low point, with a widely tracked semiconductor index hitting its highest level in a year this week.

- In the latest news from the auto industry:

- Ford is partnering with PT Vale Indonesia and China’s Zhejiang Huayou Cobalt to build a $4.5 billion nickel processing plant in Indonesia.

- Magna International plans to invest potentially over to $100 million to build a seating plant in Auburn Hills, Michigan, to supply GM electric vehicles, creating up to 500 jobs.

- DHL reached agreement with 600 logistics workers at a British Jaguar Land Rover plant, averting a strike.

- Avtovaz, Russia’s largest carmaker, is moving forward with its summer holiday shutdown amid persistent component shortages.

- Tesla’s solar-roof installations fell about 98% short of targets last year.

- Ford withdrew its request for U.S. regulators to approve its self-driving vehicle technology.

- Mercedes-Benz signed a supply agreement with Spain’s Iberdrola for 140 MW of wind energy.

- Mercedes-Benz leadership suggested the automaker is open to investing in mining in a bid to secure critical supplies.

Domestic Markets

- Consumer spending rose a better-than-expected 0.2% in February, while consumer price inflation rose a modest 0.3% and was up a better-than-expected 5.0% year over year.

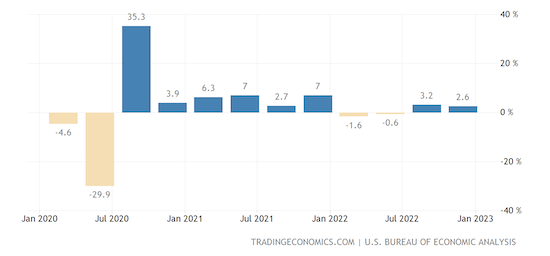

- The U.S. economy expanded 2.6% in the final quarter of 2022, slightly slower than initially thought:

- Researchers say the U.S. labor market would still be well short of workers even if all pandemic job losses were recovered, a conclusion based on demographic and other trends.

- Several Federal Reserve officials indicated the central bank could raise interest rates further this year due to persistent inflation.

- The White House is urging financial regulators to tighten regulations on mid-sized banks to require them to hold more liquid assets, increase their capital and submit to regular stress tests.

- U.S. corporate profits fell 2% in the fourth quarter of 2022.

- Large metro areas lost a net 800,000 residents in 2022, new data shows, an improvement from a 1.2 million drop the previous year.

- The average Wall Street bonus plunged 26% last year, the biggest drop since the 2008 financial crisis amid a slump in dealmaking.

- Streaming device-maker Roku will lay off 6% of its workforce, or about 200 employees, in its second round of job cuts in recent months.

- Boeing plans to boost 737 MAX production rates “very soon,” executives said.

International Markets

- Euro zone economic sentiment unexpectedly declined in March, pulled down by lower expectations for industry and services.

- Euro zone year-over-year inflation eased to 6.9% in March from 8.5% the prior month, but core inflation, excluding food and energy, inched higher.

- German year-over-year inflation hit 7.4% in March, easing significantly from 8.7% in February.

- The Bank of Mexico hiked the nation’s benchmark interest rate by 25 basis points to 11.25% Thursday, slowing the pace of its tightening cycle.

- The White House is pushing for American businesses to invest in Africa to counter China’s reach on the continent.

- China’s official purchasing managers index for services jumped to a more than decade high in March.

- China’s Big Five banks grew a healthy 3.5% last year but warned of shaky foundations for further recovery this year.

- Air China, China’s flagship carrier, posted a record annual loss of $5.61 billion last year after the country’s strict COVID-19 controls crushed demand.

- Chinese e-commerce giant JD.com will spin off its property and industrial units following Beijing’s sweeping regulatory crackdown on the nation’s technology sector.

- Shares in apparel retailer H&M surged 15% Thursday after the firm reported higher-than-expected operating profit as cost-cutting measures started to bear fruit.

Some sources linked are subscription services.