MH Daily Bulletin: March 29

News relevant to the plastics industry:

At M. Holland

- M. Holland’s partnership with Lavergne, a global manufacturer of customized compounded engineered resins, was recently shared in Plastics Today. To learn more about this agreement to distribute post-consumer recycled (PCR) resins for customers in North America, click here.

Supply

- Crude rose half-a-percent Tuesday, extending gains from the previous session on further hopes that U.S. financial-sector turmoil is being contained.

- In mid-morning trading today, WTI futures were up 0.6% at $73.60/bbl, Brent was up 0.2% at $78.81/bbl, and U.S. natural gas was down 0.6% at $2.02/MMBtu.

- U.S. crude stocks likely fell by just over 6 million barrels last week, according to the American Petroleum Institute. Government data is due today.

- A month of protests against the French government’s pension overhaul has crippled the country’s supply to refineries, experts say.

- OPEC+ is expected to maintain current production targets when the group meets next week, according to reports.

- Russian officials say the country has completely redirected its crude and fuel exports without reducing sales following EU embargoes and price caps set by the West.

- The EU may allow individual member countries to effectively block importing natural gas from Russia without imposing broader sanctions, underscoring the bloc’s determination to limit its dependence on Russian energy.

- BP and Abu Dhabi’s state oil giant offered to jointly acquire 50% of Israeli offshore natural gas producer NewMed Energy for around $2 billion, a move to expand in the gas-rich offshore basin straddling Egypt, Israel, Cyprus and Lebanon.

- Turkish and Middle Eastern buyers are paying “substantial” prices for old crude tankers, analysts say.

- California lawmakers passed a bill Tuesday that would limit the amount of profit that oil companies can earn in the state, a bid to penalize refiners who charge excessively high margins, according to bill proponents.

- Europe extended a cap on natural gas prices for power generation in Spain and Portugal until 2024, among efforts to protect consumers from sharply higher rates.

- Italy approved new funding totaling $5.41 billion to support households and businesses in paying energy bills.

- Canada’s latest budget proposal includes tens of billions of dollars aimed at attracting investment in low-carbon projects and technology, an effort to close competitive gaps with the U.S.

- China currently dominates in terms of renewable energy production capacities.

Supply Chain

- The average price of diesel in the U.S. fell 5.7 cents last week to $4.128 per gallon, the lowest level in more than a year.

- Union Pacific agreed with a union to maintain two-person crews, dropping its recent demand for one-person crews.

- Major Japanese construction equipment manufacturers with facilities in China are turning that country into an export hub for their products amid a slowdown in Chinese infrastructure investment and domestic demand.

- The Georgia Ports Authority announced a $170 million investment to acquire 55 next-generation hybrid cranes.

- South Africa’s government demanded that its state-owned rail and port operator mend plaguing operations issues to end a national logistics crisis, which has stranded stockpiles of commodities and forced shippers to redirect traffic to ports outside the country.

- Maersk’s port operating arm APM Terminals is partnering with the Vietnamese Hateco group to expand capacity at Vietnam’s northern Haiphong City port.

- Big apparel retailers are expanding their use of radio-frequency identification (RFID) to track individual items more closely within stores.

- Supply-chain issues with advanced alloys are slowing China’s production ramp-up of military aircraft.

- New data from Pitney-Bowes shows that parcel delivery volumes fell 2.2% in 2022 with FedEx suffering the biggest decline.

- New U.S. rules for semiconductor development are forcing many of the world’s biggest manufacturers to choose between expanding in the U.S. or China.

- Micron Technology expects third-quarter revenue to tumble nearly 60% from a year earlier amid a supply glut in the chip industry.

- In the latest news from the auto industry:

- The EU approved a ban on the sale of new carbon-emitting cars beginning in 2035.

- Electric-vehicle-maker Lucid Group will lay off 1,300 employees, or 18% of its workforce, as the startup looks to cut costs ahead of a second model release next year.

- Chinese electric-vehicle-maker BYD posted an elevenfold increase in quarterly profit, extending its substantial lead in China’s domestic market.

- Chinese electric-vehicle-maker Nio is testing faster, more efficient battery-swapping stations in a bid to make the process a viable alternative to rapid charging.

Domestic Markets

- The Conference Board’s widely tracked index of U.S. consumer confidence rose unexpectedly to 104.2 in March, up from 103.4 in February.

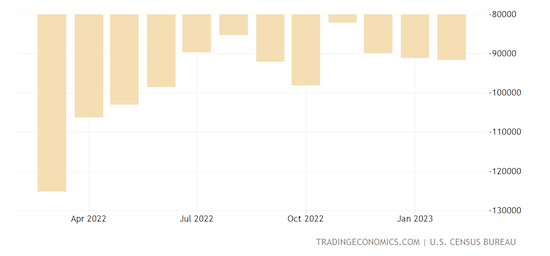

- The U.S. trade deficit in goods widened by 0.6% in February to $91.6 billion, mostly on a decline in exports, according to the Commerce Department.

- More than 1,000 artificial intelligence experts signed an open letter calling for a pause in AI development until rules and protocols can be established to mitigate potential harmful effects on society.

- Nearly 20% of the U.S. workforce is exposed to job encroachment by advanced AI chatbots, according to new research.

- U.S. single-family home prices fell 0.2% in January compared with the prior month and rose a modest 3.8% year-over-year, according to the widely tracked Case-Shiller index, potentially pulling more buyers back into the housing market.

- Americans expect home prices to rise just 2.6% over the next year, sharply lower than the 7% expectation measured a year ago.

- Defaults and vacancies are rising at high-end office buildings across the U.S., a result of dual pressures from remote work and rising interest rates.

- Shares of ride-hailing company Lyft fell Tuesday after its incoming CEO said the firm was not for sale, contrary to market expectations.

- Spice-maker McCormick beat quarterly estimates after benefitting from multiple price increases.

- Walgreens Boots Alliance says a national shortage of pharmacy workers is easing.

- U.S. investment bank Jefferies Financial Group reported a smaller-than-expected drop in quarterly profit despite a lull in dealmaking.

- Apple launched a new “buy now, pay later” service in the U.S., threatening disruption to companies in the financial-tech sector.

- Apparel-maker Lululemon Athletica says annual sales and profits will exceed market expectations as consumer demand remains strong.

- The Illinois House passed a bill that would ban polystyrene foam foodware by 2025.

International Markets

- Global experts say Russia’s economy is starting a descent into long-term regression.

- China’s air pollution spiked this month, a result of rebounding industrial activity and unusually warm weather.

- Canada recorded a record budget deficit of $6.44 billion Canadian dollars in the first ten months of the current fiscal year.

- A gauge of South Korean consumer sentiment rose to 92 in March, its highest level in nine months, as inflation expectations eased from a month earlier.

- Australia’s annual rate of inflation hit 6.8% in February, an eight-month low.

Some sources linked are subscription services.