MH Daily Bulletin: March 24

News relevant to the plastics industry:

At M. Holland

- M. Holland’s partnership with Lavergne, a global manufacturer of customized compounded engineered resins, was recently shared in Plastics Today. To learn more about this agreement to distribute post-consumer recycled (PCR) resins for customers in North America, click here.

Supply

- Oil fell 1% Thursday after the U.S. Energy Secretary said refilling U.S. strategic reserves could take several years.

- In mid-morning trading today, WTI futures were down 2.1% at $68.51/bbl, Brent was down 2.0% at $74.42/bbl, and U.S. natural gas was up 2.5% at $2.21/MMBtu.

- Oil tankers are being rerouted to Rotterdam to avoid French ports as strikes disrupt operations at the nation’s’ refineries, LNG terminals and nuclear sites, causing fuel shortages.

- Venezuelan crude exports have been largely halted amidst a corruption probe after it was revealed the state oil company has accumulated over $21 billion in accounts receivable over the past three years.

- LNG freight rates for Atlantic Basin cargoes slid to a seven-month low as natural gas prices in Europe continue falling.

- The EU’s ban on imports of Russian oil products has led to a supply glut in Asia, particularly for diesel, traders say.

- Italy is preparing a new $5.5 billion funding package to help businesses and families cope with costly energy bills.

- China is speeding up its already rapid rollout of renewable energy with a sweeping new plan for projects in rural areas, officials said Thursday.

Supply Chain

- The U.S. Treasury said Thursday that falling shipping costs are likely to keep bringing down inflation.

- U.S. container imports from Asia hit a three-year low in February.

- U.S. railroads moved 226,046 intermodal units last week, a 15.2% decline from a year ago and the fourth straight double-digit weekly decline.

- Maersk has reportedly idled 29 ships with total capacity of more than 281,000 TEUs, according to Alphaliner.

- Orient Overseas Container Line is projecting a recovery in shipping demand later in 2023.

- The finance heads of the world’s largest commodity trading houses expect to report record profits for 2022.

- Rates for bulk shipping’s largest vessels are declining on reduced steel output from China.

- Delivery slots at China’s three major shipyards are filled until 2027.

- Walmart is laying off hundreds of workers at five U.S. e-commerce facilities.

- Florida-based Flagship Transport abruptly ceased operations, leaving 455 drivers unpaid and out of work.

- An Irish drone-maker started its first U.S. trial for last-mile operations in the Dallas-Fort Worth region.

- EU countries on Thursday reached a preliminary agreement to reduce greenhouse gas emissions in the maritime sector by increasing the use of renewable fuels on ships.

- Five shipping groups are seeking common action to set safety standards for the transport of lithium-ion batteries.

- In the latest news from the auto industry:

- Ford expects its electric vehicle business unit to lose $3 billion pre-tax this year, the company said.

- Multinational firms are pouring billions of dollars into Canada’s electric-vehicle manufacturing sector, lured by government incentives, access to raw materials and cheap renewable energy.

- Volvo plans to build its new electric passenger car in China and export it to Europe and Japan.

- Renault is in talks with Nissan about collaborating to build out an electric-vehicle charging network in Europe.

- The U.S. and EU have reached a tentative agreement to extend U.S. electric-vehicle tax incentives to critical minerals extracted or processed in Europe.

- China’s lithium prices are plunging faster than expected this year, down 34% in the last four weeks alone, amid a slump in demand for electric vehicles.

- Sales of new vehicles in the U.S. are expected to jump this month due to pent-up demand, according to J.D. Power.

Domestic Markets

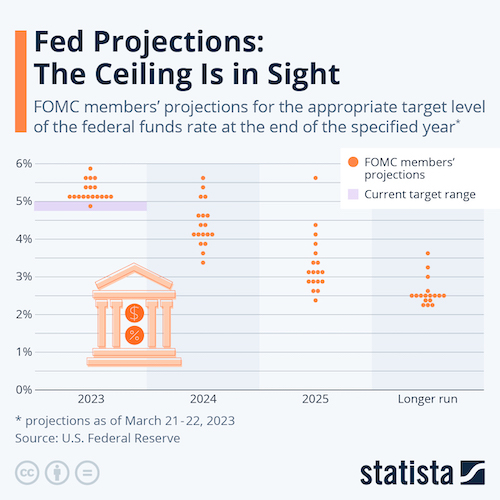

- Bank of America and UBS trimmed their forecast for terminal U.S. interest rates to 4.75%-5% after the Federal Reserve hinted it might pause its rate-hike campaign due to banking-sector turmoil.

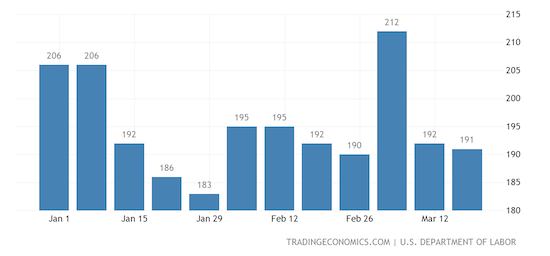

- New U.S. jobless claims fell by 1,000 to 191,000 last week, showing few signs that recent financial turmoil is having an impact on the job market.

- Irish-American professional services giant Accenture announced plans to cut 2.5% of its workforce, or around 19,000 jobs, in the latest sign of worsening corporate demand for IT services.

- JPMorgan Chase estimates that the U.S.’s most vulnerable banks likely lost at least $500 billion from outflows following the recent collapse of Silicon Valley Bank.

- Emergency lending from the Federal Reserve hit record levels the past two weeks amid continued large-scale extensions of credit to the financial system.

- Corporate financings have stalled since the collapse of Silicon Valley Bank, with no initial public stock offerings and, for the first time in 13 years, no high-grade bond sales in the week ended March 17.

- The U.S. current account deficit, which measures the inflows and outflows of goods and services, narrowed 5.6% in the fourth quarter to a total of $206.8 billion.

- General Mills raised its fiscal 2023 forecasts for a fourth time after beating estimates for quarterly results, boosted by price increases and steady demand for its packaged foods.

- Some companies are now looking at flexible remote-work setups as a liability amid slowing economic conditions.

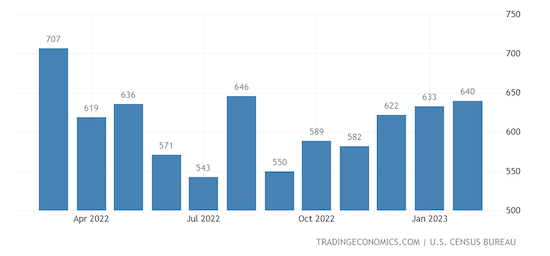

- Sales of new U.S. single-family homes rose to a six-month high in February, new data shows:

International Markets

- Deutsche Bank shares sank as its bond insurance rates spiked on fears of a default by the German investment bank. Bank stocks led European stock markets lower Friday.

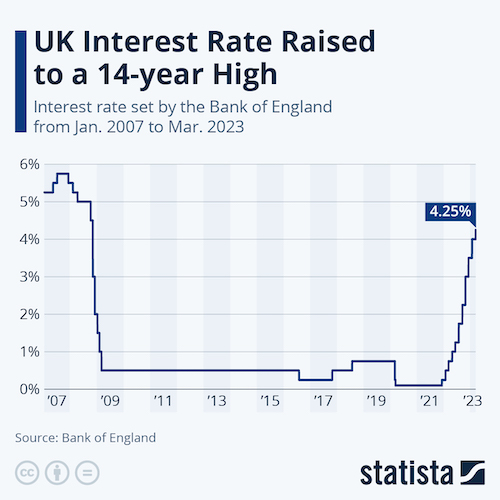

- Yesterday’s 25 basis points rate hike by the Bank of England, the 11th increase in a row, raised rates to a 14-year high.

- Corporate distress levels in Britain accelerated in the three months to February to their highest level in almost three years.

- The EU purchasing managers index jumped unexpectedly to 54.1 this month from 52.0 in February as strong services activity offset continued weakness in manufacturing.

- More than 1 million demonstrators took to the streets across France on Thursday to protest the government’s pension overhaul.

- Headline inflation in Mexico eased modestly to 7.12% in the first half of March.

- Toshiba’s board accepted a $15.2 billion buyout offer from a group led by a Japanese private equity firm, potentially ending years of upheaval at the conglomerate.

- Canadian jet-maker Bombardier raised 2025 revenue and free-cash targets amid a swelling order backlog for private jets in the U.S.

- European officials rolled out proposals aimed at forcing companies to back up environmental and sustainability claims with scientific evidence.

Some sources linked are subscription services.