MH Daily Bulletin: March 22

News relevant to the plastics industry:

At M. Holland

- M. Holland announced a new partnership with Lavergne, a global manufacturer specializing in the formulation of customized compounded engineered resins, to distribute PCR resins for customers in North America. Click here to read the press release.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil rose more than 2% Tuesday as the rescue of Credit Suisse eased concerns that a banking crisis would undercut the economy and fuel demand.

- In mid-morning trading today, WTI futures were up 0.3% at $69.91/bbl, Brent was up 0.4% at $75.59/bbl, and U.S. natural gas was down 4.0% at $2.26/MMBtu.

- U.S. crude stocks likely rose by 3.26 million barrels this week, according to the American Petroleum Institute. Government data is due today.

- U.S. gasoline demand hit multi-month highs to start the week, while selling prices are higher than they were a month ago.

- Several French refineries were still blocked from delivering products after two weeks of strikes, disrupting production and power supply.

- Texas added HSBC to its list of companies that allegedly boycott the oil and gas industry, which could ban some state entities from investing in Europe’s largest bank.

- Russia plans to maintain its oil output cuts of 500,000 bpd through June, though skeptics question whether the cuts are real.

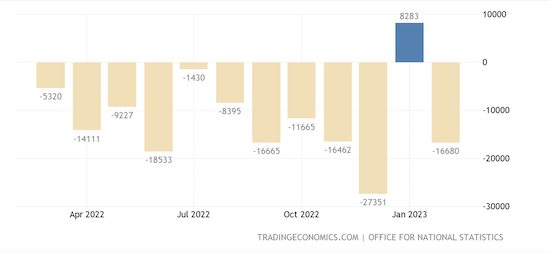

- Government support for energy bills pushed the U.K.’s budget deficit to a record 16.7 billion pounds in February.

- French lawmakers overwhelmingly approved a plan to boost investment in nuclear energy, including building six new reactors.

- A years-long rally in prices for soybean oil has cooled after U.S. regulators proposed reducing the mandate for biomass-based diesel through 2025.

- Chubb, a top-ten insurer to the oil and gas industry, said it is tightening coverage to ensure that producers are taking steps to reduce methane emissions.

Supply Chain

- U.S. retail diesel prices fell for their seventh week in a row amid uncertainty created by a potential banking crisis.

- Big commodity traders expect to see limited fallout in their markets from banking sector turmoil.

- Prices for new ships are up 2% year to date after plateauing for several months to end 2022, according to Clarksons Research.

- Knight-Swift Transportation Holdings is buying rival trucker U.S. Xpress Enterprises in a deal valued at about $808 million.

- Canadian National Railway reached a new contract agreement with members of its largest union in negotiations that started last fall.

- Insurance and compliance costs for companies in the transport industry are set to stay high amid the prospect of broader sanctions on Russia in the future, according to surveys.

- A pair of large German transport unions plan to strike next Monday in a move expected to cause widespread disruption on railways and at airports.

- FedEx is retiring its MD-11 aircraft and replacing them with 767 and 777 freighters.

- The U.S. government is awarding almost $95 million to 59 so-called “smart” mobility projects aimed at boosting road safety and reliability throughout the country.

- The U.S. Commerce Department released new rules aimed at preventing $52 billion in semiconductor funding from being used to expand or collaborate on projects based in China, Russia and other countries.

- Walmart has deployed the first of a recently developed packaging machine that will custom size corrugated boxes on demand, resulting in less waste and more efficient loading of trailers.

- In the latest news from the auto industry:

- Makers of electric-vehicle chargers are bracing for a slowdown in production and deployment as they work to comply with “Made in America” terms of a $7.5 billion federal program.

- Just over one-third of Americans would consider buying an electric vehicle for their next car, according to surveys.

- Stellantis and a Mexican unit of Daimler Truck reached deals with a union to raise wages around 9% this year, rivaling similar increases for Mexico-based workers at General Motors, Audi and Nissan.

- Top Chinese automaker BYD cut two shifts at a domestic assembly plant due to weak demand.

- European officials are proposing new concessions for countries like Germany that oppose plans to phase-out gas-powered vehicle sales by 2035.

- Global automakers facing stalling sales in China are putting more focus on India, a nation where passenger-vehicle sales surged 24% last year.

- Lithium prices are down 20% since January, surprising analysts as increasing supply outpaces the growth in demand for EV batteries.

Domestic Markets

- The U.S. index of leading economic indicators fell in February for the 11th consecutive month.

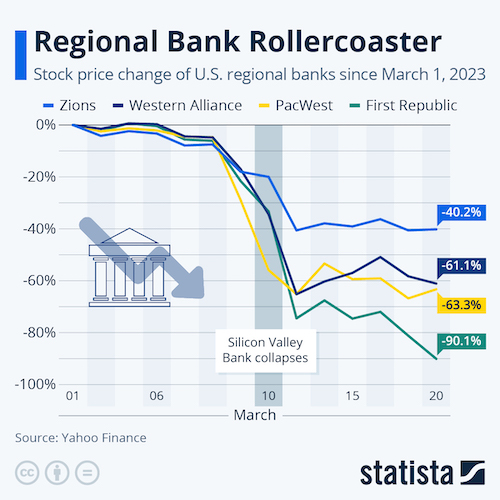

- U.S. Treasury officials indicated they were prepared to intervene to protect depositors in smaller U.S. banks suffering deposit runs that threaten more contagion.

- Wall Street’s top regulator delayed voting on a proposal aiming to protect stability of the financial system by detecting risk in the $20-trillion private asset-management sector.

- U.S. home prices fell year over year in February for the first time in 11 years, while sales of existing homes surged 14.5% from the prior month, the first gain in 12 months.

- Delta Air Lines will launch a flight academy to train pilots as the industry struggles with a shortage of aviators.

- Nike raised its full-year revenue outlook after beating quarterly expectations, boosted by a 27% sales gain in North America.

- U.S. chipmaker Nvidia unveiled plans to rent out powerful supercomputers to nearly any business amid rising demand for artificial intelligence applications.

International Markets

- Consumer prices in the U.K. jumped a higher-than-expected 10.4% in February, with food prices rising at the highest pace in 45 years.

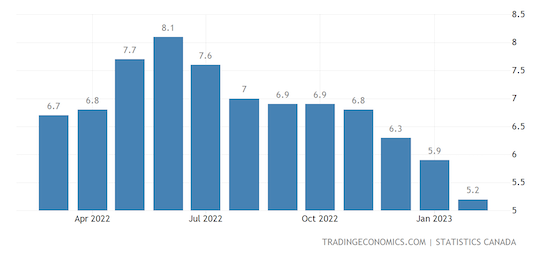

- Canada’s inflation rate slowed more than expected in February to 5.2%, its lowest level in 13 months.

- German exports to China fell a sharp 12.4% in February, dampening hopes of a trade revival.

- China’s capital Beijing saw its population decline in 2022 for the first time in almost two decades, a reflection of national trends.

- Ecuador declared a state of emergency Tuesday following a 6.8-magnitude earthquake that shook the country over the weekend.

- Ukraine expects its farmers to harvest up to 15% less grain this year than last, a stark sign of the war’s continued impact on critical food supplies.

- India plans to develop seven large textile manufacturing parks aimed at boosting the country’s exports to $100 billion by 2030.

Some sources linked are subscription services.