MH Daily Bulletin: March 8

News relevant to the plastics industry:

At M. Holland

- Each year, M. Holland joins organizations around the globe to celebrate the profound achievements and ongoing efforts of women on International Women’s Day. To celebrate, a few Mployees shared their thoughts on this year’s theme of #EmbraceEquity. Click here to watch the video.

- Plastics Business published a story written by M. Holland’s Todd Waddle, Director, Sustainability, which reviews key considerations for implementing post-consumer recycled (PCR) and post-industrial recycled (PIR) materials. Click here to read the full article.

Supply

- Oil fell 3.5% Tuesday on signals that the U.S. Federal Reserve will rase rates higher and for longer than previously thought.

- In mid-morning trading today, WTI futures were down 0.7% at $77.04/bbl, Brent was off 0.5% at $82.86/bbl, and U.S. natural gas was down 5.1% at $2.55/MMBtu.

- Some private U.S. oil firms expect the nation’s daily production this year to grow by a substantially smaller amount than government forecasts.

- The U.S. administration cut its full-year price forecast for natural gas and said it expects the lowest domestic first-quarter consumption of the fuel in five years.

- International buyers are increasingly seeking U.S. crude grades, such as West Texas Intermediate and Light as a replacement for Russian Urals oil.

- Kazakhstan is finding itself unable to meet increased crude demand from Europe after the continent lost its Russian fuel imports.

- The UAE has been taking more cargoes of Russian crude as Western sanctions on Russia shift traditional energy trade flows.

- India is rapidly expanding imports of U.S. ethane.

- Several major crude processors on the U.S. Gulf Coast are looking to reconfigure refineries to incorporate hydrogen and carbon-capture technology.

- Floating solar farms are being built in dozens of countries across the world amid concerns about the space requirements for overland projects.

- The state of Georgia plans to soon start commercial operation of the U.S.’s first new nuclear plant since 2016.

Supply Chain

- California has seen historic amounts of snow in recent months.

- In its third major safety incident in just over a month, a Norfolk Southern conductor was killed yesterday when he was struck by a truck at a Cleveland, Ohio, steelyard, prompting an investigation of the railroad’s safety culture by the National Transportation Safety Board. Norfolk Southern plans to add about 200 temperature detectors along its tracks in the aftermath of two recent derailments in Ohio.

- Thousands of union workers for Canadian National Railway voted in favor of striking as soon as March 21 over a contract dispute.

- Siemens AG announced plans to invest over $220 million to build a rail car manufacturing facility in North Carolina.

- The most recent reading of a widely tracked gauge of U.S. transportation costs showed prices falling at their fastest pace in 6.5 years of record-keeping.

- Spot rates for the largest dry-bulk vessels rose to $11,026 Monday, the highest in almost two months.

- U.S. lawmakers are trying to maneuver around strict trade policies in a bid to boost domestic production of infant formula and prevent a repeat of the 2022 supply shortage.

- Germany is considering banning certain components from Chinese companies Huawei and ZTE in its telecom networks over security concerns.

- A new supplier problem has stymied deliveries of Boeing’s 767 freighter and KC-46 tanker, the company said.

- A group of the world’s biggest copper producers is aiming to slash direct and indirect emissions to zero by 2050.

- In the latest news from the auto industry:

- A new wave of car and battery factories in America is shifting the country’s automotive heartland further south from the Great Lakes.

- Bank of America warned of a possible oversupply of lithium this year as rising supplies coincide with easing demand.

- Iran said it has discovered a massive lithium deposit in Hamedan Province.

- Indonesia initiated a subsidy program for electric cars to help win investment deals with electric-vehicle-makers such as Tesla and China’s BYD.

- S&P Global cut Nissan’s credit rating to junk status this week, with expectations that the Japanese automaker’s earnings will remain weaker than previously thought.

- Tesla plans its next-generation small car to operate primarily in an autonomous mode.

Domestic Markets

- The Federal Reserve is likely to lift interest rates higher and potentially faster than previously anticipated in response to recent strong data, according to the central bank chief.

- Job openings fell in January to 10.8 million, down from 11.2 million in December, a sign that labor markets might be weakening.

- The U.S. Justice Department filed an antitrust lawsuit Tuesday seeking to block JetBlue Airways’ $3.8 billion acquisition of Spirit Airlines.

- Thor Industries cut its sales and earnings outlook as Americans hold off on buying new recreational vehicles amid persistent inflation.

- Dick’s Sporting Goods beat fourth-quarter earnings estimates and raised its full-year profit outlook on strong demand for athletic gear.

- Climate change may trigger declines in asset values in coming years that could cascade through the U.S. financial system, according to the Treasury.

International Markets

- The U.S. State Department renewed its travel warnings for Mexico due to violent crime risks following the kidnapping of four U.S. citizens and killing of two that crossed the border into Matamoras.

- China’s exports fell 6.8% in the first two months of the year from the same period in 2022, clouding the outlook for its economy.

- China’s administration unveiled the biggest overhaul of the nation’s bureaucracy in decades, part of a sweeping push to become more resilient in the face of rising competition with the U.S.

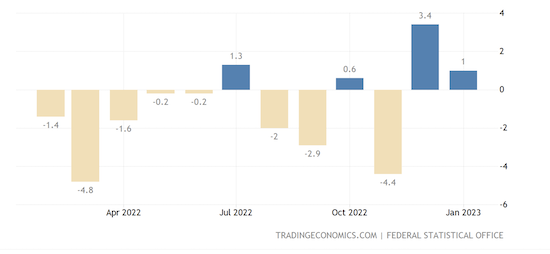

- German factory orders jumped a surprise 1% in January, largely due to aircraft and cars, while industrial output rose a higher-than-expected 3.5%.

- Workers across France walked off the job and took to the streets Tuesday, kicking off what unions are touting as an open-ended standoff with the nation’s administration over pension reforms.

- Walmart’s unit in Mexico and Central America, known as Walmex, plans to boost spending in the region 27% from last year to a total of $1.49 billion in 2023.

- European plane-maker Airbus narrowed a gap with last year’s jetliner deliveries after a sharp increase in February.

- Dutch toy-maker Lego saw sales jump 17% in 2022 from strong demand in Western Europe and the Americas.

Some sources linked are subscription services.