MH Daily Bulletin: March 3

News relevant to the plastics industry:

At M. Holland

- Plastics News named M. Holland among the Best Places to Work for 2023! This marks the company’s sixth consecutive year receiving this award. Congratulations to all 22 finalists this year!

- Plastics Business published a story written by M. Holland’s Todd Waddle, Director, Sustainability, which reviews key considerations for implementing post-consumer recycled (PCR) and post-industrial recycled (PIR) materials. Click here to read the full article.

Supply

- Oil rose 0.5% Thursday, boosted by signs of a strong economic rebound in China.

- In mid-morning trading today, WTI futures were flat at $78.18/bbl, Brent was down 0.2% at $84.58/bbl, and U.S. natural gas was up 2.1% at $2.82/MMBtu.

- OPEC raised crude production in February by 120,000 bpd amid a rebound in Nigerian output.

- Russia’s oil product exports were down 20% in February to the lowest level since last May and were 24% below pre-war levels. According to Bloomberg, Russia’s tax revenues from oil and gas plunged 46% in the month.

- China’s seaborne imports of Russian oil are set to hit a record high this month as refiners take advantage of cheap prices.

- The UAE is considering leaving OPEC over tensions with Saudi Arabia.

- Canada’s five biggest oil sands producers reported record 2022 profits of a combined $25.7 billion.

- The U.S. administration is offering $1.2 billion in funding for nuclear reactors at risk of retiring soon or that ceased operations in 2021.

- Saudi Arabia’s energy firm ACWA Power, which is developing the world’s largest utility-scale green hydrogen facility, plans to build three more massive projects in the country.

- China permitted more than six times the amount of coal power last year than the rest of the world.

- Petrobras’ chief executive says the firm is preparing for an “unavoidable” transition to clean energy.

- European chemical producers are painting a bleak outlook for 2023, citing continued fallout from Russia’s invasion of Ukraine and slowing economic growth.

Supply Chain

- California’s governor declared a state of emergency as the state continues to be hammered by severe weather.

- Hapag-Lloyd posted record profit of $18.08 billion last year, up 88% from 2021.

- Norfolk Southern and its rivals agreed to join a federal system that lets employees confidentially report close calls, a program the biggest freight railroads had refused to join for years.

- The U.S. administration is considering a pilot program to address risks related to outbound investment in China, officials say. New U.S. export restrictions were launched on dozens of big Chinese companies Thursday.

- Foxconn signed an agreement to invest in India’s southern Telangana state to manufacture electronics as the Apple supplier looks to pivot beyond China.

- Canada’s Methanex and Japanese carrier Mitsui O.S.K. Lines say they completed the world’s first net-zero voyage fueled by bio-methanol.

- In the latest news from the auto industry:

- Ford plans to restart production of its F-150 Lightning electric truck March 13, capping a five-week shutdown after a battery fire in early February.

- Electric-vehicle-maker Polestar posted a small quarterly loss while maintaining its production outlook for 2023.

- Tesla’s planned factory in northern Mexico’s Nuevo Leon state will be built on a site almost twice the size of the automaker’s Texas factory, with construction slated to start in three months.

- Nevada approved a more than $330 million tax abatement for Tesla, which is set to invest over $3.6 billion to expand its Gigafactory complex in the state.

- Shares of Chinese rare-earth miners plunged Thursday following Tesla’s surprise announcement that it will drop the use of the material in future models, citing health and environmental risks.

- Chile’s SQM, the world’s second-largest lithium producer, tripled fourth-quarter profit from a year ago on surging demand and tight supplies.

- Ford launched a new automated driving subsidiary, Latitude AI, just months after winding down operations of its former self-driving tech unit Argo AI.

- Chinese automakers largely filled the void left by the departure of Western automakers from Russia last year.

- Stellantis and Renault are increasingly turning to their own employees to tackle a shortage of truck drivers that’s preventing thousands of cars from making it to dealerships or customers.

Domestic Markets

- A central bank official said the Federal Reserve will need to raise rates to higher levels than previously thought if recent strength in hiring and consumer spending continues.

- Profits across the U.S. banking industry fell 6% in 2022, largely due to the Federal Reserve’s aggressive campaign to curb inflation.

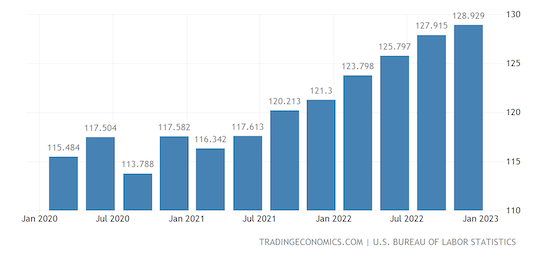

- U.S. labor costs grew at a 3.2% pace last quarter, faster than initially thought.

- General Electric plans to invest over $450 million in its existing U.S. manufacturing sites this year.

- Anheuser-Busch InBev, the world’s largest brewer, reported higher profit last quarter despite lower beer sales and said China’s recovery would boost results further this year.

- Kroger surprised Wall Street with bumper quarterly results and higher profit forecasts amid cost-cutting efforts across its digital business and supply chain.

- Costco Wholesale missed quarterly revenue estimates as consumers turned frugal on discretionary spending.

- Walmart plans to open 28 new U.S. healthcare centers in 2024, nearly doubling its current footprint.

- Dell Technologies forecast current-quarter revenue and profit below Wall Street estimates on weak demand for personal computers and servers.

- Broadcom says current-quarter revenue will rise more than expected as rising investments in artificial intelligence spur demand for its data-center chips.

- Following the lead of other major banks, Citicorp is laying off hundreds of employees in its mortgage and investment banking businesses.

- The average rate for a 30-year fixed mortgage rose above 7% yesterday.

- First-time homebuyers made up the smallest share of home sales on record last year at 26%.

International Markets

- February saw six interest-rate hikes by central banks overseeing the world’s most heavily traded currencies, including the U.S.

- The Bank of Canada will hold its key interest rate at the current level of 4.5% until the end of this year before starting to cut rates in January 2024, according to government predictions.

- Japan’s services sector grew at the fastest pace in eight months in February.

- Over the past three years, China’s working population fell by 41 million, roughly the size of Germany’s entire workforce, due to COVID-19 and demographic changes.

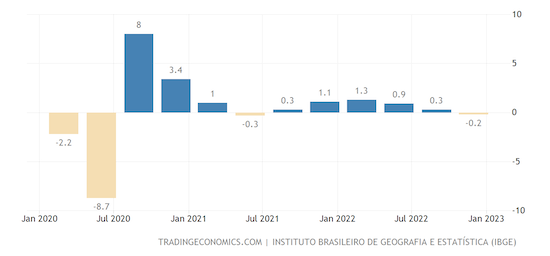

- Brazil’s economy contracted 0.2% in the fourth quarter, extending an overall slowdown last year.

- Sanctions and other roadblocks are delaying Western firms’ efforts to leave Russia.

- Argentina suspended all poultry exports following the discovery of a case of bird flu at an industrial farm.

- Germany’s Merck predicts earnings will slip this year due to a decline at its electronic chemicals unit and a drop in COVID-related demand for medical products.

- Nordstrom will discontinue its Canadian operations, likely leading to a $400 million decline in 2023 sales.

- Nestle is closing its factory in Myanmar amid turmoil in the country.

Some sources linked are subscription services.