MH Daily Bulletin: February 14

News relevant to the plastics industry:

At M. Holland

- Last week, Plastics News featured business insight from M. Holland’s market experts, including predictions for 2023. Read the full Plastics News article here.

Supply

- Oil rose 0.5% Monday as investors weighed Russia’s plans to cut crude production with short-term demand concerns.

- In mid-morning trading today, WTI futures were down 1.0% at $79.33/bbl, Brent was down 0.9% at $85.87/bbl, and U.S. natural gas was up 6.6% at $2.56/MMBtu.

- U.S. shale production in the seven biggest shale basins is expected to rise to its highest on record in March, according to the Energy Information Administration.

- A 46% drop in natural gas prices so far this year is expected to reduce U.S. drilling activity and dampen dealmaking while spurring more use for electricity production.

- The U.S. administration plans to sell 26 million crude barrels from strategic reserves, part of a 2015 budget mandate for the current fiscal year.

- Freeport LNG sought permission Monday to restart commercial operations at its long-idled LNG export plant in Texas.

- Crude tankers restarted some operations at a key terminal in Turkey after earthquakes devastated the region last week.

- European gas prices fell to their lowest in almost 1.5 years Monday, a result of higher projections for wind generation. Europe now derives more than half of its electricity from clean energy sources, mostly hydro and nuclear.

- Europe’s bill to shield households and companies from soaring energy costs has climbed to roughly 800 billion euros, researchers say.

- EU leaders endorsed plans to relax government subsidy rules and repurpose existing funds to support the bloc’s clean-tech industry.

- The U.S. Treasury will open applications for $4 billion worth of new tax credits for clean-energy projects at the end of May, including $1.6 billion slated for communities hit by closures of coal mines and coal-fired power plants.

- Qatar is finalizing a massive long-term LNG deal with China National Petroleum Corp, China’s largest gas importer, following the execution of a similar deal with Sinopec in November.

- On Monday, Israel loaded its first ever oil cargo for export after reaching agreement on maritime borders with Lebanon last October.

- This week, Lufthansa will start offering optional “green fares” that include fees to fully offset flight-related carbon emissions.

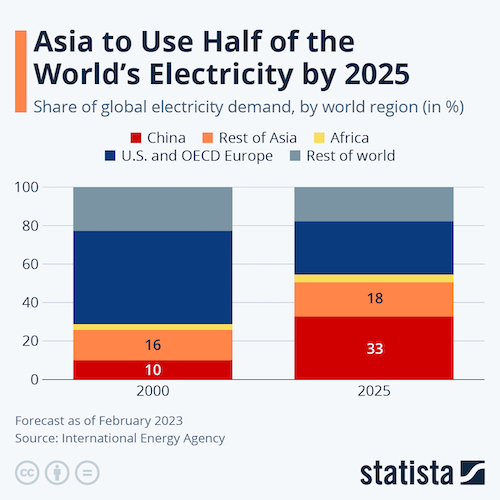

- Countries in Asia are expected to use half the electricity in the world by 2025, the International Energy Agency says:

Supply Chain

- Cyclone Gabrielle wreaked havoc in New Zealand, prompting the government to issue an emergency declaration for only the third time in the nation’s history.

- The Port of Long Beach saw just over 263,000 TEUs of loaded container imports in January, down 32.3% from a year earlier.

- Port officials in Houston announced the completion of the first segment of a $1 billion expansion project for the Houston Ship Channel.

- Global airfreight shipments fell 8% last year from 2021’s record level and were 1.6% below 2019, with expectations they could slide another 5.6% from pre-pandemic levels this year.

- Israeli container line Zim is adding capacity and frequency to its U.S. East Coast-Asia service.

- More semiconductor equipment suppliers are shifting operations from China to Southeast Asia.

- Emirates SkyCargo and Air Canada Cargo signed a deal to work together on air cargo operations.

- Aerospace suppliers are facing increased competition for skilled workers from plane-makers as the industry ramps up for the pandemic recovery.

- UPS says it is taking extra steps to reduce its workforce in regions where delivery demand has softened.

- In the latest news from the vehicles industry:

- The European Parliament passed legislation mandating that all new vehicles emit zero-emissions starting in 2035, effectively banning the sale of gasoline-powered vehicles in the bloc.

- Toyota’s new chief executive is looking to quicken development of parts and manufacturing methods for electric vehicles as part of an “EV-first mindset.”

- Ford plans to cut 3,800 staffers in Europe, 1 in 9 jobs there, as it invests $50 billion in its transition to electric vehicles.

- Ford confirmed rumors that it will invest $3.5 billion to build a battery plant in Michigan.

- Nikola started work on a network of hydrogen plants and signed up more suppliers of the fuel, part of its plan to provide enough hydrogen for 7,500 heavy-duty trucks by 2026.

- Nissan and Renault will invest $600 million to make six new car models in India, one of three markets in which the two automakers plan to coordinate closely as part of their revamped alliance.

- A surge in supply is expected to dampen prices for battery metals later this year.

Domestic Markets

- Inflation eased slightly in January from the prior month to 6.4%; economists had expected a lower 6.2%.

- Americans expect inflation one year from now to hold steady at 5%, according to the latest New York Fed survey.

- With about 80% of the S&P 500 having reported, fourth-quarter earnings are on track to miss estimates by 1%, according to Bank of America.

- Investors and corporate leaders remain optimistic that highly indebted businesses will be able to weather the coming quarters, as evidenced by rallying loan prices, low defaults and unchanged business plans.

- The U.S. agriculture industry is predicting another strong year in 2023.

- Consumer products maker Newell Brands slashed its financial forecasts for the year.

- Manhattan workers are spending at least $12.4 billion less per year due to about 30% fewer days in the office than before the pandemic.

International Markets

- The International Monetary Fund says markets have good reason to be more upbeat about the global economy as nations continue to recover from the pandemic.

- Euro zone economic growth is likely to be stronger than expected this year, while inflation will be lower than forecasts made at the end of 2022, the European Commission said.

- China’s consumer prices rose 2.1% year over year in January.

- High levels of debt and a struggling housing market in China are casting doubts on expectations for the nation to lead a global economic resurgence.

- Global investors are losing their appetites for Chinese government bonds amid rising interest rates and concerns about regulatory tightening.

- Japan’s economy advanced 0.6% on an annualized basis in the fourth quarter, well below market estimates of 2% growth.

- British employers expect to raise wages for staff by the most in over a decade this year as they struggle to retain workers in a tight labor market.

- Insolvencies among British bars and pubs spiked 83% last year primarily due to high energy prices.

- Mexican cement producer Cemex reported a surprise quarterly loss due to lower demand in the U.S. and Europe.

Some sources linked are subscription services.