MH Daily Bulletin: February 3

News relevant to the plastics industry:

At M. Holland

- M. Holland will be exhibiting at MD&M West in Anaheim on Feb. 7-9. Stop by Booth #4115 to meet our Healthcare team and discuss how M. Holland’s line of medical-grade resins can help you develop safe and effective medical products and packaging.

Supply

- Oil fell less than 1% Thursday on news that U.S. factory orders fell last month, signaling a slowing economy.

- In mid-morning trading today, WTI futures were up 2.0% at $77.39/bbl, Brent was up 1.7% at $83.60/bbl, and U.S. natural gas was down 3.5% at $2.37/MMBtu.

- U.S. oil refiners are dialing back operating capacity this quarter to between 85%-89%, a bid to keep profit margins high during one of the weakest demand periods of the year.

- Jet fuel prices are up an average of 20% since Dec. 7, including a 77% surge on the U.S. East Coast, on swelling demand from a global rebound in travel.

- ConocoPhillips saw profit more than double to $18.7 billion in 2022, joining a parade of bumper earnings from major Western producers.

- Crude oil imports into Asia hit an all-time high in January, rising by 11% despite lower arrivals into China.

- More news related to the war in Ukraine:

- Analysts say the EU’s Feb. 5 ban on imports of Russian refined oil products, including diesel and jet fuel, will hurt Moscow more than the existing embargo on crude oil.

- Construction holdups at several key Middle Eastern refineries could hamper Europe’s ability to quickly replace Russian fuel imports, set to be embargoed Feb. 5.

- Spain’s LNG exports to Europe soared last year as it built out its port capabilities.

- Germany is expected to become a net power importer within years as it phases out nuclear and coal-fired power plants.

- Oil-rich Norway is set to tap its $1.3 trillion sovereign wealth fund to pay for long-term aid to Ukraine, officials said.

- The quarterly loss for wind turbine-maker Siemens Gamesa, soon to be folded into parent Siemens Energy, more than doubled on higher warranty provisions attached to faulty components.

Supply Chain

- Hundreds of thousands of Texans were without power Thursday on lingering impacts from storms this week. The U.S. Northeast is expected to be hit next over the weekend.

- U.S. industrial construction starts fell 24% last quarter compared to a year earlier, signaling a prolonged shortfall in logistics space.

- Canadian Pacific Railway’s fourth-quarter profit more than doubled on a 21% increase in revenue.

- Old Dominion Freight Line carried an average of 48,798 less-than-truckload shipments per day in the fourth quarter, down 8.6% from a year earlier.

- Hapag-Lloyd’s fourth-quarter operating profit fell about 21% to $3.3 billion.

- The pace of companies moving production and equipment to Mexico is putting a premium on logistics capabilities along the border with the U.S.

- Container throughput at China’s ports increased 4.7% last year, including 0.6% growth at the Port of Shanghai.

- U.S. officials and industry executives met with Indian policy makers as part of an effort to shift critical technology supply chains away from China.

- The orderbook for new container ships has grown to more than 900 vessels.

- In the latest news from the auto industry:

- Ford posted a lower-than-expected $1.3 billion quarterly profit as supply disruptions outweighed strong pricing and better inventory levels at dealerships. Sales of the automaker’s electric models doubled.

- Volkswagen’s Skoda Auto will further cut production next week due to component shortages.

- Harley-Davidson shares rose almost 10% Thursday after earnings beat forecasts for the seventh quarter in a row.

- Ferrari saw earnings rise 16% last year on a nearly 20% jump in deliveries.

- Honda plans to launch a hydrogen-powered SUV by the end of 2023.

- Global e-commerce sales, excluding travel, probably exceeded $1 trillion for the first time last year, according to Comscore.

- Amazon’s initial drone services in California and Texas have completed few deliveries because of regulatory constraints.

- CMA CGM ordered 12 methanol-powered container ships from South Korean shipyard Hyundai Samho.

Domestic Markets

- Employment growth surged in January, with employers adding 517,000 jobs, nearly triple economist estimates, as the unemployment rate fell to 3.4%, the lowest since 1969.

- Weekly unemployment filings dropped to a nine-month low last week of 183,000, signaling resiliency in the labor market.

- U.S. layoffs hit 102,943 in January, a two-year high, as tech firms cut jobs at the second-fastest pace on record.

- U.S. worker productivity rose at a 3% rate in the fourth quarter, indicating a moderation in the growth of labor costs.

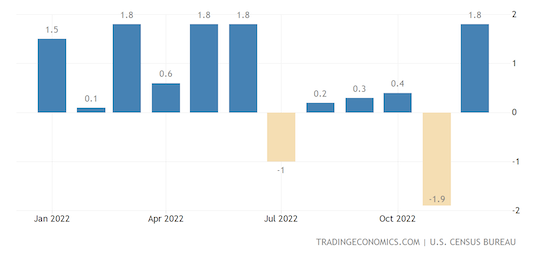

- New orders for U.S.-manufactured goods rebounded in December, up 1.8%.

- U.S. mortgage rates fell this week to an average of 6.09%, the lowest in five months.

- In the latest news from quarterly earnings season:

- Apple announced its first quarterly revenue decline in nearly four years due to manufacturing disruptions in China.

- Amazon beat projections with a 9% sales gain to a total of $149.2 billion, but investors are worried by slowing growth in its key e-commerce and cloud computing units.

- Google parent Alphabet said ad spending fell in the fourth quarter for only the second time in its history as the company reported a modest gain in year-over-year revenue.

- Starbucks posted record quarterly revenue although higher costs ate into its expected profit.

- Clorox raised its annual forecast after higher prices led to better-than-expected quarterly revenue and sales growth.

- Hershey’s saw holiday-quarter revenue rise 14% on steady demand for candy and chocolates despite higher prices.

- Beauty company Estee Lauder forecast a bigger drop in full-year profit, citing uncertainty around recovery in major market China.

- Qualcomm’s quarterly revenue dropped 12% from a year ago, including a steep decline in its key unit providing computer chips for handheld devices.

- Panasonic Holdings cut its annual operating profit forecast by 12.5%, citing headwinds from slowing demand and high raw material prices.

- Sony Group nudged up its annual profit forecast on strong quarterly results for its video-game division.

- Medical device-maker Siemens Healthineers saw a drop in quarterly profit driven by low demand in China.

- Farming machinery-maker CNH Industrial saw better-than-expected earnings but warned that soaring growth in industrial agriculture markets will likely slow by 2024.

International Markets

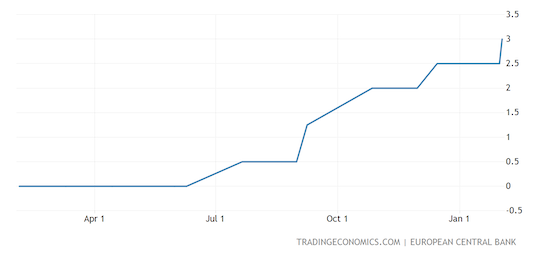

- Economists see at least two more European rate hikes this year after the European Central Bank raised interest rates by 0.5% on Thursday and signaled a hike of similar size for February.

- After the eurozone dodged a technical recession with a 0.1% growth rate in the fourth quarter, its Purchasing Managers’ Index (PMI) rose above 50 in January, the demarcation between expansion and contraction.

- In January, the services PMI in the U.K. fell to its lowest level since January 2021, when the country was on lockdown.

- German exports fell a larger-than-expected 6.3% in December.

- Ryanair flew 11.8 million passengers in January, a record for the month.

- Global crude steel production fell last year for the first time in seven years.

- Coca-Cola and Berry Global are introducing tethered caps for PET soda bottles in EU markets, more than a year before they are mandated.

Some sources linked are subscription services.