MH Daily Bulletin: January 30

News relevant to the plastics industry:

At M. Holland

- M. Holland will be exhibiting at MD&M West in Anaheim on Feb. 7-9. Stop by Booth #4115 to meet our Healthcare team and discuss how M. Holland’s line of medical-grade resins can help you develop safe and effective medical products and packaging.

- Every year, M. Holland’s market managers take time to reflect on the major trends of the past 12 months. Click here to read M. Holland’s 2023 Plastics Industry Trends & Predictions, including business insight and recommendations for the 3D printing, automotive, color and compounding, electrical and electronics, healthcare, packaging, rotational molding, sustainability, and wire and cable markets.

- Automotive, Electrical & Electronics and Wire & Cable were top performers in 2022 as electrification incentives and digitalization efforts expanded market opportunity. Click here to read 2023 predictions from our market managers for these three markets.

Supply

- Oil settled lower Friday, with WTI ending the week down 2% and Brent ending the week flat.

- In late-morning trading today, WTI futures were down 1.5% at $48.49/bbl, Brent was down 1.5% at $85.39/bbl, and U.S. natural gas was down 4.8% at $2.71/MMBtu.

- U.S. gasolines prices are up 9% this year to an average of $3.51 per gallon, according to AAA, with some states seeing larger increases.

- Active U.S. drilling rigs were flat last week at a total of 771, about 304 lower than pre-pandemic levels, according to Baker Hughes.

- Jet fuel prices are hitting record highs for the month of January as demand rises from rebounding travel activity in China. The International Energy Agency says jet fuel will likely lead oil demand growth this year.

- OPEC+ delegates are set to meet this week to decide on future production levels, with most analysts expecting the group to stick to its current output policy.

- Norway’s decision to offer temporary tax breaks to oil and gas companies is expected to result in increased flows from the North Sea, which has seen declining production and investment in recent years.

- More news related to the war in Ukraine:

- London’s Intercontinental Exchange plans to launch a “parallel” market for some European gas trading next month, a bid to escape the bloc’s upcoming price cap on gas derivatives.

- Oil loadings from Russia’s Baltic ports are set to rise by 50% this month as sellers try to meet strong demand in Asia, traders say.

- German crude oil imports rose 11% in 2022, resulting in a doubled crude import bill of almost $56 billion.

- Italian energy company Eni signed an $8 billion gas production deal aimed at boosting supplies from Libya.

- Norwegian officials are contemplating limiting electricity exports to neighboring countries due to the risk of shortages at home.

- Small startups are snapping up aging oil tankers in a bid to cover Russian fuel exports to Asia, as most Western-owned ships no longer deal with the country.

- Equinor and BP submitted a joint bid to build the second stage of a massive offshore wind project near the coast of New York.

- Wind turbine-maker Vesta warned of a slow year ahead after 2022 sales came in lower than expected due to project delays and impairments.

- The U.S. and other major economies invested an initial $8.5 billion to speed up coal-dependent South Africa’s green energy transition.

- The Nuclear Regulatory Commission announced the first U.S. design certification for a Small Modular Reactor, a technology that could be a game-changer in the quest for clean, safe power.

Supply Chain

- New York City broke a 50-year-old record on Sunday for the longest start to a winter without snow.

- Public transport in France will be heavily disrupted this week due to labor strikes against the government’s pension reform proposals.

- Global container shipping capacity expanded by 4.1% in 2022, according to Alphaliner.

- The dry bulk market is expected to be the best trade of 2023 due to improved demand for raw materials and rising construction projects in emerging economies, leading to an increase in vessel transport and newbuild orders.

- American Airlines’ fourth-quarter cargo revenue dropped 22.9%, as passenger revenue surged 44.7%.

- Knight-Swift Transportation saw fourth-quarter net profit slump 41.6% to $148.7 million.

- Staff walkouts at Britain’s Royal Mail service cost the carrier nearly $250 million last year.

- Japan and the Netherlands will join the U.S. in restricting exports of advanced semiconductor manufacturing equipment to China.

- In the latest news from the auto industry:

- TravelCenters of America is partnering with Electrify America to install 1,000 fast-charging stations at 200 TravelCenters locations across the nation.

- LG Energy Solution is targeting 25%-30% revenue growth this year and plans to raise capital expenditure by 50% or more due to strong demand for electric-vehicle batteries in North America.

- Electric-truck-maker Nikola created a new unit for hydrogen production and distribution in an effort to focus on its core electric-vehicle business.

- China’s electric-vehicle manufacturers have put the nation on course to overtake Japan as the world’s top car exporter this year.

- Auto suppliers are exploring options to relocate their production facilities to North America to meet growing demand for truck components.

- Shares of electric-vehicle-maker Lucid surged 43% after reports emerged that Saudi Arabia’s public investment fund is in talks to acquire the remaining stake in the company.

- India’s Tata Motors reported its first quarterly profit in two years.

- The rise of electric vehicles is causing the mega-rally in palladium prices to reverse as demand for the metal used in catalytic converters drops.

- LG Energy Solution is in talks to supply batteries to Tesla’s Arizona factory, according to the company.

- Workers at the Veliki Krivelj copper mine in Serbia have gone on strike and shut down the mine, significantly impacting the nation’s copper production.

Domestic Markets

- The daily average for new COVID-19 cases declined to 42,163 last week from 47,459 the week before, while average fatalities fell to 537 from 565.

- The XBB.1.5 subvariant of Omicron has likely become the dominant strain in the U.S., accounting for some 61.3% of infections, according to the CDC.

- U.S. consumers entered 2023 with the most optimism in nine months, according to a University of Michigan gauge:

- The Federal Reserve is expected to halt interest-rate hikes by March as slowing inflation and a weaker economic outlook has caused uncertainty among investors and policymakers.

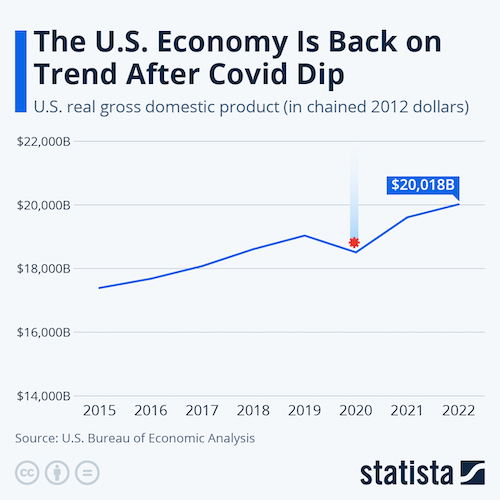

- The U.S. economy has returned to its pre-pandemic growth trajectory, according to preliminary data showing a 2.1% GDP boost in 2022:

- More Americans are now falling behind on their car payments than during the 2008 financial crisis, likely a result of the average loan rate surging past 8% in December.

- In the latest news from quarterly earnings season:

- American Express and Visa reported consensus-beating quarterly results late last week, easing worries of waning consumer demand. Payment companies are expecting a further boost on China’s travel boom, analysts say.

- Intel saw about $8 billion wiped off its market value Friday after the U.S. chipmaker forecast dismal earnings due to a slump in the PC market and slowing data-center business.

- The world’s second-largest clothing retailer H&M reported a significant drop in profits due to rising costs and fallout from exiting the Russian market last year.

- Boeing says it will hire 10,000 workers this year as it boosts jetliner production.

- Air India sealed half an order for some 495 Boeing jets late last week, according to reports.

- Ohio-based Goodyear Tire & Rubber plans to cut 500 jobs and warned of a shortfall in earnings due to higher raw material costs.

- Walmart and CVS are responding to labor shortages with a reduction in pharmacy hours and increased use of technology to automate the dispensing of medicine.

- Kitchenware-maker Instant Brands hired restructuring advisers as it copes with declining consumer demand.

- Bed Bath & Beyond’s efforts to find a buyer ahead of a potential bankruptcy filing have stalled, reports suggest.

International Markets

- The EU is prepared to pay more for Pfizer COVID-19 shots as part of a bargain to reduce its purchase commitments due to growing stockpiles of the medicine.

- The French government extended the requirement for mandatory COVID-19 tests for travelers from China until Feb. 15.

- Lunar New Year trips inside China surged 74% from last year after authorities scrapped COVID-19 curbs, though the number of journeys was still only half of pre-pandemic levels.

- China’s smartphone sales fell 13% in 2022, the largest drop in a decade as consumer spending declined sharply.

- Signify, the world’s largest lighting-maker, raised its view on profit margins in 2023 on the back of improving demand in China.

- German wholesalers expect sales growth to halve this year after most of 2022’s gains were fueled exclusively by rising prices, a trade association said.

- Global food giant Nestle plans to invest $100 million in Colombia over the next three years.

- Norwegian researchers claim to have discovered a massive seabed deposit of metals and minerals that could spur the Nordic country to open its offshore areas to deep-sea mining.

Some sources linked are subscription services.