MH Daily Bulletin: January 9

News relevant to the plastics industry:

At M. Holland

- M. Holland is the headline sponsor for AMI’s Thermoplastic Concentrates in Orlando on Jan. 24-26. Stop by Booth #16 to speak with our experts and attend a talk on regulatory compliance changes by Christopher Thelen, M. Holland’s Senior Regulatory Specialist, on Jan. 24 at 4:20 pm.

- M. Holland will be exhibiting at MD&M West in Anaheim on Feb. 7-9. Stop by Booth #4115 to meet our Healthcare team and discuss how M. Holland’s line of medical-grade resins can help you develop safe and effective medical products and packaging.

- The U.S. Inflation Reduction Act (IRA) includes nearly $500 billion in new spending and tax breaks that will catalyze the clean energy transition, increase tax revenues and reduce healthcare costs. Dwight Morgan, Executive Vice President of Corporate Development at M. Holland, recently provided insight on what the IRA includes and key considerations for the plastics industry. Click here to read the full post.

Supply

- Oil fell about 8% last week, marking the biggest weekly decline to start the year since 2016.

- In mid-morning trading today, WTI futures were up 3.3% at $76.17/bbl, Brent was up 2.9% at $80.87/bbl, and U.S. natural gas was up 8.3% at $4.02/MMBtu.

- Active U.S. drilling rigs fell by seven last week to a total of 772, about 303 rigs lower than in 2019, according to Baker Hughes.

- Saudi Aramco’s Motiva refinery, the largest crude refinery in the U.S., returned to production after shutting down during Winter Storm Elliott in late December.

- Phillips 66 acquired DCP Midstream LP in an $8.7 billion deal that will help bulk up the U.S. refiner’s natural gas liquids business.

- Earnings from Shell’s LNG trading operations surged in the fourth quarter despite an output drop caused by plant outages, the producer said.

- The U.S. proposed new rules on Friday that would toughen soot regulations on factories and vehicles, potentially costing industry up to $390 million in annual compliance.

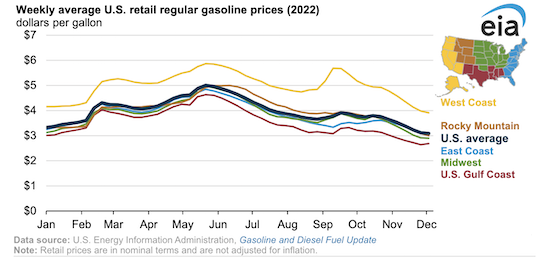

- At $3.09 a gallon, average U.S. gasoline prices ended 2022 about 19 cents lower than they started the year due to greater refinery production and lower demand in the second half:

- More oil news related to the war in Europe:

- More of France’s nuclear capacity is coming back online, easing concerns about power supply in the nation and in Europe.

- Norway became Germany’s largest natural gas supplier in 2022, overtaking Russia with a 33% share of the country’s imports.

- European imports of U.S. diesel and gasoil are on track to hit a two-year high this month, worsening U.S. domestic stockpiles of gasoline and distillates.

- Optimism is growing that Europe will be able to make it through this winter and next without severe fuel shortages, analysts say. Unusually warm weather has pushed gas prices down by almost half the past month.

- India continues to take advantage of Western sanctions to buy large volumes of discounted Russian crude, including importing Russia’s Arctic grades for the first time ever.

- Azerbaijan has more than doubled revenues from oil and gas exports after making more deals to help the EU replace Russian supplies.

- Starting in April, the U.K. is set to reduce the level of support it gives to businesses to help with soaring energy bills by 85%.

- Britain’s wind farms contributed a record 26.8% of the country’s electricity in 2022, although gas-fired power plants remained the biggest source of power.

- TotalEnergies will cut power prices for very small businesses in France, the energy giant said.

Supply Chain

- Northern and central California will see more severe weather this week after torrential downpours and damaging winds killed at least 12 people and left over 500,000 without power last week.

- Hundreds of Australians in the country’s northwest were airlifted out of “once in a century” flooding from severe cyclone Ellie over the weekend.

- Union workers who have been on strike since May at CNH Industrial factories in Wisconsin and Iowa voted down the latest proposed contract.

- New pandemic disruptions in China are challenging a months-long easing in global supply-chain pressures, according to the New York Federal Reserve. China’s logistics sector shrank for a third straight month in December, new figures show.

- Average airfreight spot rates from Asia-Pacific to North America dropped to $5.38/kg in December, down 58% from the prior year but 87% higher than pre-pandemic levels.

- European operators are beefing up intermodal connections on the momentum of a post-pandemic shift to rail freight.

- U.S. rail freight traffic was down 2.8% in 2022 compared with the prior year. U.S. parcel carriers had strong on-time delivery performance during the holiday season, new data shows.

- Forward Air announced plans to acquire rival expedited trucker Land Air Express for $56.5 million.

- Kuehne + Nagel International plans to double its airfreight forwarding operations in France.

- NOVA Infrastructure acquired ATS Logistics Inc., a transportation and warehouse operator at the Port of Charleston.

- India could produce as many iPhones as China by 2027, according to reports.

- Panasonic plans to invest $373 million in China through 2024 to build and expand factories making home appliances for the local market.

- Fertilizer prices are starting to fall from 2022 records, potentially spurring farmers to boost production.

- The presidents of the U.S. and Mexico and Canada’s prime minister will meet tomorrow to address supply chain and trade challenges and immigration.

- In the latest news from the auto industry:

- Tesla cut prices in China for the second time in three months Friday, fueling forecasts for a wider price war amid weaker demand in the world’s largest auto market and prompting protests from recent buyers demanding compensation for the cuts. The automaker also cut prices on its best-selling model in South Korea.

- Renault is considering building a mass-market electric vehicle (EV) in India, a budding market for EVs.

- South Korea’s SK On plans to produce a new, lithium-iron-phosphate electric-vehicle (EV) battery by 2025 as part of an effort to deliver lower-cost batteries to automakers squeezed by rising EV costs.

- U.S. air regulators signed an agreement with South Korea to collaborate and share information on advanced air mobility projects, including low-altitude air taxis.

Domestic Markets

- The daily average for new COVID-19 cases climbed to 67,243 last week from 57,504 the week before, while average fatalities rose to 390 from 361. The number of hospital patients with COVID-19 has more than doubled in the past month.

- The highly infectious XBB.1.5 strain of COVID-19 likely accounts for over 60% of infections across the U.S., the CDC says.

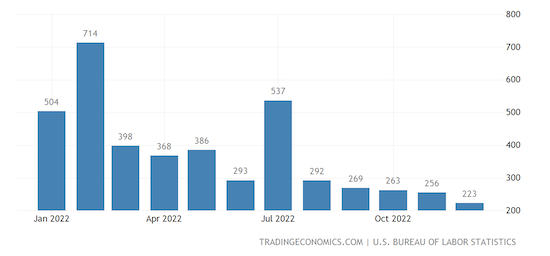

- The U.S. added a larger-than-expected 223,000 nonfarm jobs in December, pushing the unemployment rate back to 3.5%. A record 165 million Americans were either in jobs or looking for them, signaling a long-awaited improvement in labor supply.

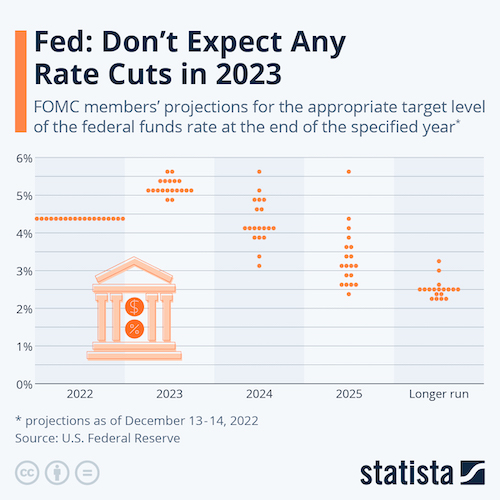

- The Atlanta Fed says the latest U.S. jobs figures are another sign that the economy is gradually slowing, potentially allowing the central bank to step down to a quarter-percentage-point rate hike at its next policy meeting.

- Average hourly earnings in the U.S. rose 0.3% in December and were up 4.6% year over year, the smallest rise in about 1.5 years.

- New orders for U.S.-manufactured goods dropped a larger-than-expected 1.8% in November amid a sharp decline in bookings for aircraft.

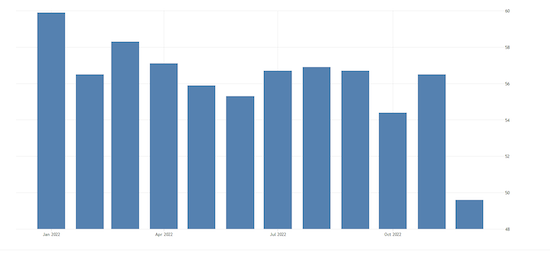

- U.S. service-sector activity contracted for the first time in 2.5 years in December amid weakening demand, with the Institute for Supply Management’s index dropping from 56.5 to 49.6. A separate survey showed input prices falling considerably for the sector, however.

- With corporate earnings season kicking off this week, analysts expect companies in the S&P 500 to report their first year-over-year earnings declines since the height of the pandemic.

- Funding for U.S. startups fell by a third in 2022 from the record $344.7 billion recorded in 2021, according to data released Friday.

- The number of Americans relying on credit cards to cover daily expenses jumped to 35% in December, up from just 21% a year-and-a-half ago when data collection began.

- With a potential hit to pretax income of up to $825 million, Southwest Airlines expects to post a loss in the fourth quarter after it canceled over 16,700 flights due to a tech meltdown during Winter Storm Elliott.

- Party City is preparing to file for bankruptcy within weeks as inflation dampens sales, according to reports.

- Macy’s expects that a deeper-than-expected lull in holiday shopping will push fourth-quarter earnings to the lower end of its forecasts.

- Costco Wholesale hinted at a better-than-expected holiday season by posting a 6.4% sales gain in December.

- Cloud-based software firm Salesforce is looking to cut costs by up to $5 billion after rapid pandemic hiring left it with a bloated workforce amid an economic slowdown, its chief executive said.

- Quarterly sales at Walgreens fell on waning demand for COVID-19 tests and vaccines.

International Markets

- In the latest China news:

- Tens of thousands of travelers began to fly in and out of mainland China Sunday as Beijing removed almost all of its border restrictions. Other data suggests consumers in major Chinese cities are rapidly boosting spending on entertainment and domestic travel.

- Saturday marked the first day of the 40-day Lunar New Year travel season, considered the world’s largest annual migration of people, leaving authorities bracing for a new surge in COVID-19 infections.

- China’s aviation regulator wants passenger traffic to reach around 75% of pre-pandemic levels this year, up from 38% in 2022.

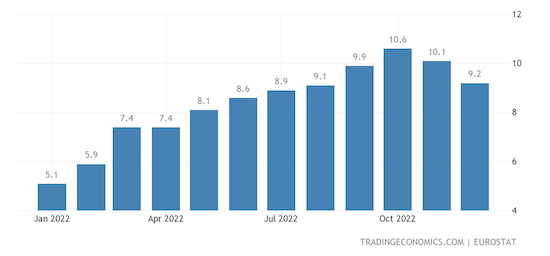

- Euro zone inflation landed well below forecasts at 9.2% in December, down from 10.1% a month earlier:

- Euro zone economic sentiment improved in December for the first time since Russia invaded Ukraine, including a sharp drop in inflation expectations, new surveys show.

- German industrial orders saw the sharpest drop in more than a year in November, falling 5.3% due to weakening foreign demand, versus expectations of a 0.5% decline. Orders from euro zone countries declined 10.3% on the month.

- German air travel is expected to get to 78% of the pre-pandemic level in the first half of 2023, the slowest recovery among EU nations.

- British home prices slid by 1.5% in December, capping the largest quarterly drop since the 2008 financial crisis.

- Japan reported its worst real-wage decline in more than eight years on Friday, a possible outcome of the nation’s decision to keep interest rates ultra-low at a time of rising borrowing costs across the globe.

- The Japanese operator of McDonald’s announced its third price hike in less than a year, the latest sign of inflationary pressures on the nation’s consumers.

- Taiwan’s exports, a bellwether of global tech demand, fell 12.1% in December for the fourth straight monthly decline.

- Canadian economic activity contracted in December by one of the sharpest paces of the pandemic, with the Ivey Purchasing Managers’ Index falling from 51.4 to just 33.4. The economy added a larger-than-expected 104,000 jobs, however.

- Business confidence in Mexico fell for a second straight month to the lowest in nearly two years.

- Housing prices in Mexico City rose about 10% last year, driven in part by “digital nomads” relocating to the city.

- Global food prices hit a record high in 2022 due to impacts from Russia’s invasion of Ukraine, according to the United Nations.

Some sources linked are subscription services.