MH Daily Bulletin: January 4

News relevant to the plastics industry:

At M. Holland

- The U.S. Inflation Reduction Act (IRA) includes nearly $500 billion in new spending and tax breaks that will catalyze the clean energy transition, increase tax revenues and reduce healthcare costs. Dwight Morgan, Executive Vice President of Corporate Development at M. Holland, recently provided insight on what the IRA includes and key considerations for the plastics industry. Click here to read the full post.

Supply

- Oil fell 4% Tuesday, with Brent seeing the biggest decline in three months, on news of weak demand out of China.

- In mid-morning trading today, WTI futures were down 3.6% at $74.15/bbl and Brent was down 3.6% at $79.17/bbl.

- U.S. natural gas was trading around $4/MMBtu Tuesday, a level not seen since February on forecasts for unusually warm weather through mid-January. Futures were up 0.9% at $4.02/MMBtu in morning trading today:

- OPEC’s crude output rose by 120,000 bpd in December compared with the prior month, driven by a rebound in production by Nigeria.

- Pushed higher by a string of refinery closures during Winter Storm Elliott, U.S. gasoline prices are up 12.4 cents from last week to an average of $3.229 per gallon.

- The latest U.S. government estimates show crude demand rising by 620,000 bpd in 2023, about a third less than previous forecasts.

- China raised its fuel export quota by as much as 46% for the first allocations of 2023, a signal of poor domestic demand as the nation continues to battle a wave of COVID-19 infections.

- Unusually warm winter weather in Europe, Asia and the U.S. has eased concerns about global gas shortages to start the year. Temperatures are breaching records for this time of year in cities across Europe.

- More oil news related to the war in Europe:

- Crude tanker rates have surprised markets by falling double-digit percentages since Europe and the G7 tightened sanctions on Russian crude in early December. The move reflects a sudden expansion in capacity following a pre-sanction rush on crude across the globe.

- Russia’s crude shipments plunged in the last four weeks of 2022 to the lowest level of the year, with China, India and Turkey as the main destinations.

- Germany received its first shipment of U.S. LNG at a new North Sea floating terminal, a milestone in the nation’s quest to diversify its energy supplies.

- Britain will cut its support for businesses struggling with energy bills this spring in half, a bid to avoid higher taxes on households.

- French officials say the nation’s energy supplies should be stable the next few weeks due to lower consumption and an increase in nuclear capacity.

- France’s famous bakeries are being given the option to renegotiate their energy contracts if they struggle to pay bills, officials said Tuesday.

- Chevron’s refinery in Pascagoula, Mississippi, is set to receive the first U.S.-bound cargo of Venezuelan crude in nearly four years.

- Kentucky warned 11 financial firms, including Citigroup, JPMorgan Chase and BlackRock, of potential divestment over perceived hostility toward the fossil-fuel industry.

- Massachusetts denied requests from developers to renegotiate electricity contracts for proposed offshore wind farms after soaring inflation drove up costs, a move that effectively orders construction to go forward.

- Baker Hughes won a contract to supply equipment to the biggest offshore carbon-capture project in the world in Malaysia.

- A unit of Tokyo Gas is in advanced talks to buy U.S. natural gas producer Rockcliff Energy for about $4.6 billion, according to reports.

- Mexico’s administration is reportedly putting more pressure on heavily indebted state oil producer Pemex to repay its own bills in the first quarter, a break from years’ worth of substantial governmental support.

- India raised its windfall tax on petroleum, crude and jet fuel this week.

Supply Chain

- A pair of massive storm systems has tens of millions of U.S. southerners under severe weather threats, while more rain is coming to California just as the state recovers from deadly flooding over the weekend.

- Wide swaths of southern Africa are losing power due to extremely low water levels at major dams.

- Political protests halted logistics activity in Bolivia’s farming region of Santa Cruz.

- U.S. diesel prices rebounded from a seven-week slide, rising 4.6 cents to an average of $4.58 per gallon this week.

- Port Houston says it will move forward with a new container dwell fee set to start Feb. 1, a bid to improve cargo flows following an influx of ships from congested ports in Southern California.

- Dry-bulk freight prices saw their biggest decline on record Tuesday, pressured by weak demand from China, according to the widely tracked Baltic Exchange.

- Average freight shipping rates out of Shanghai fell 78% during 2022, according to the Shanghai Containerized Freight Index.

- Container lines are cutting vessel speeds and sending ships on longer voyages to limit capacity.

- The Logistics Managers’ Index, a widely tracked gauge of U.S. transportation pricing, plunged by the fastest rate in six years of records last month.

- Maersk completed its $61 million acquisition of Danish project logistics firm Martin Bencher Group.

- British shipbuilder Harland & Wolff slashed its revenue outlook amid supply-chain constraints and inflation pressures.

- Grain futures are expected to remain volatile this year as uncertainty caused by Russia’s continued offensives against Ukraine shows no sign of abating.

- In the latest news from the auto industry:

- Electric-vehicle-maker Rivian Automotive barely missed its full-year production target of 25,000 cars in 2022, the company said Tuesday.

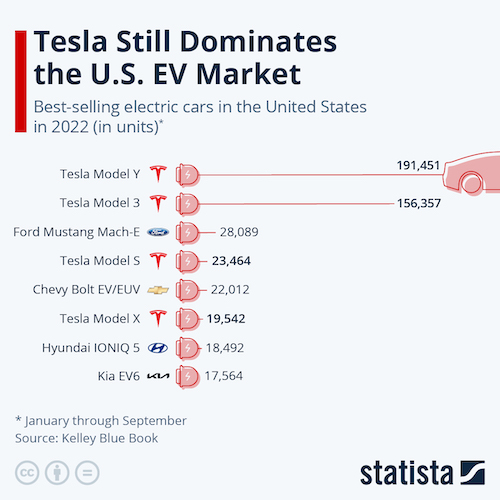

- Tesla captured roughly two-thirds of the U.S. electric-vehicle market during the first three quarters of 2022, including three out of four top-selling models:

- About $33 billion in new auto-factory investment was pledged across the U.S. in the first 11 months of 2022, adding to the $37 billion announced in 2021 for one of the biggest factory-building booms in decades.

- U.S. auto sales are expected to rebound this year after falling to the lowest in a decade in 2022, experts say.

- Ford’s F-Series trucks continued their decades-long dominance of the U.S. market in 2022, with the equivalent of one new truck selling every 49 seconds, the automaker said.

- Hyundai and affiliate Kia expect combined global sales to jump nearly 10% this year, even as last year’s sales fell short of targets due to supply-chain disruptions.

- New car sales in France fell 0.1% in December, bringing an end to a rebound that began in August.

- U.S. chipmaker Nvidia is pushing further into the auto market with a new partnership to develop self-driving car platforms with Foxconn and new supply agreements with Mercedes, Hyundai, Polestar and other automakers.

Domestic Markets

- The U.S. reported 85,792 new COVID-19 infections and 1,126 virus fatalities Tuesday.

- XBB, a new and highly infectious strain of Omicron, is expected to drive a new surge in U.S. COVID-19 cases after quickly surpassing 40% of all infections in the nation.

- The U.S. manufacturing sector had almost 750,000 job openings in October, according to the latest federal data, as over 70% of firms said finding and retaining talent remains a top challenge.

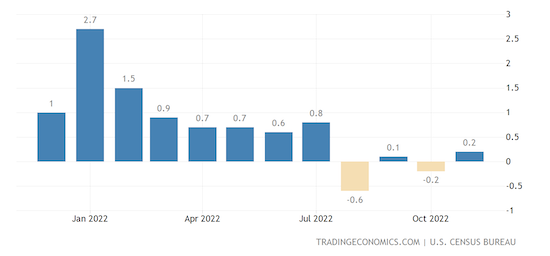

- U.S. construction spending unexpectedly rebounded by 0.2% in November, although single-family homebuilding continued to slump due to higher mortgage rates.

- Construction completion is expected on nearly half a million new apartment units in 2023, the most of any year since 1986, putting downward pressure on surging U.S. rent prices.

- The average office occupancy rate in 10 major U.S. cities remained below 50% for much of 2022, according to data from security firm Kastle Systems.

- Southwest Airlines expects to see significant impacts on fourth-quarter results from operational disruption caused by Winter Storm Elliott, executives said. In addition to reimbursing affected passengers for tickets and expenses, the company is offering them 25,000 bonus miles.

- A group of video-game testers at Microsoft voted to form the software company’s first labor union in the U.S., marking the latest example of workers from top tech firms organizing in recent years.

- Plastics are facilitating a revolution in healthcare technology, from more durable medical devices to products that can deliver active pharmaceutical ingredients to fabrics incorporating sensor technology.

International Markets

- In the latest China news:

- Nearly a dozen major Chinese cities are reporting a recovery in subway use, suggesting COVID-19 infections may have peaked in some urban areas. At the same time, global health experts say infections will likely spike as travel picks up during Lunar New Year celebrations this month.

- Europe is preparing to unveil masking and pre-flight COVID-19 testing requirements for travelers from China as the nation threatens retaliation against countries that impose travel restrictions on its citizens.

- Europe offered to send free COVID-19 vaccines to China, which the Chinese government promptly rejected.

- Japan saw over 27.5 million COVID-19 cases last year, an 18.4% increase over 2021. The nation’s virus fatalities have returned to the highest level in four months.

- German inflation eased for a second month in a row to 8.6% in December, primarily due to falling energy prices.

- Material shortages in the German manufacturing sector eased for a third month in December, according to new surveys.

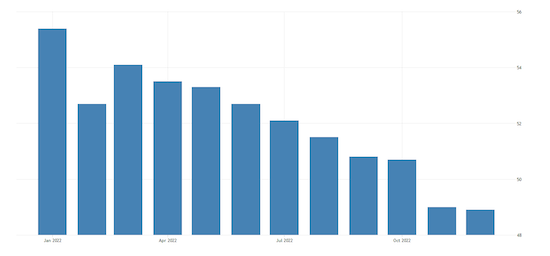

- Japanese factory activity fell in December at the sharpest pace in 26 months, a new purchasing managers’ index showed.

- Canadian manufacturing activity fell at a slightly faster rate in December, the fifth straight month of contraction that marks the longest slowdown in seven years.

- Canada added over 431,000 new permanent residents last year, the largest annual increase in its history as part of a government scramble to ease the country’s labor shortages.

- South Korean exports fell in December for a third straight month but were up 6.1% for the year to a new all-time high, data shows.

- Labor unrest could hit Vietnamese factories this month as wages suffer alongside a decline in the nation’s exports.

- Turkey’s annual inflation rate likely fell below 70% in December and will drop to nearly 43% by the end of 2023, economists say.

- Global reinsurance costs have risen as much as 200% as the war in Ukraine and extreme weather events drive up premiums and reduce what insurers are willing to cover.

- Israel’s new government will abandon the country’s tax on single-use plastic plates and utensils despite environmental concerns voiced by previous leadership.

Some sources linked are subscription services.