MH Daily Bulletin: December 29

News relevant to the plastics industry:

At M. Holland

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

- M. Holland will be closed Monday, Jan. 2 for the New Year’s holiday.

Supply

- Oil fell about 1% Wednesday on news of persistently rising COVID-19 cases in China.

- In mid-morning trading today, WTI futures were down 2.0% at $77.39/bbl, Brent was down 1.5% at $82.04/bbl, and U.S. natural gas was down 4.1% at $4.49/MMBtu.

- U.S. crude stocks fell by 1.3 million barrels last week, adding to a decline of 3 million barrels the previous week, according to the American Petroleum Institute. Government data is due today.

- A full return of U.S. motor fuel output could take up to two weeks after Winter Storm Elliott disrupted refineries on the Gulf Coast.

- Exxon Mobil is suing the EU to force it to scrap the bloc’s new windfall tax on oil groups.

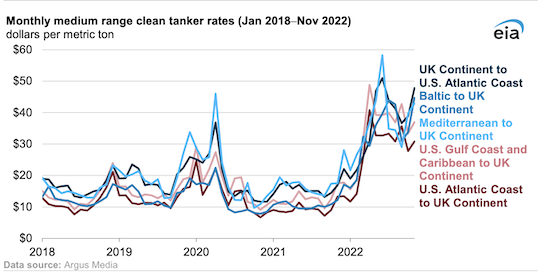

- New and used tanker values continue to rise on surging demand following Russia’s invasion of Ukraine.

- Joint venture partners in a major offshore wind farm project off the U.S. East Coast are asking that the project be delayed as inflation and supply-chain issues challenge its economics.

- Ireland is seeing rapid development of renewable energy projects.

- U.S. LNG developer NextDecade will boost sales to China under a new purchase agreement with China’s ENN Natural Gas.

- More oil news related to the war in Europe:

- A host of shipping insurers canceled their war-risk coverage across Russia, Ukraine and Belarus following an exit by reinsurers from the region in the face of steep losses. At least 12 of the 13 organizations in the International Group of P&I Clubs — the main insurer of risks such as collisions and spills — have changed their policies in recent days.

- Seven crude tankers filled with Russian oil left Russian waters yesterday after complying with the G-7 $60/bbl price cap.

- Piped Russian gas exports to key foreign markets plummeted 45% this year, primarily due to a drop in flows to Europe.

- France’s energy watchdog says the nation could start seeing risks to power supply starting in mid-January.

- Finland’s first floating storage and regasification unit anchored this week, heralding a major move in the country’s goal of reducing dependence on Russian gas.

Supply Chain

- In the latest news from Winter Storm Elliott:

- Western New York is still dealing with significant transport fallout from Elliott, while the region’s death toll rose to 37. Thawing snow could now lead to flooding, prompting authorities to bring in state and military police for traffic control.

- Natural gas production at EQT Corp., the nation’s largest producer, fell 30% as Winter Storm Elliott impacted the Appalachian Basin.

- The U.S.’s top energy regulator is investigating the rotating blackouts that affected millions of households over the weekend in a bid to better protect against reliability issues.

- Southwest Airlines canceled over 60% of its schedule again on Wednesday, bringing total cancellations to more than 11,000 flights since Dec. 22. Rival airlines begin capping fares in some cities in response to an influx of last-minute transfers from Southwest, while Congress joined in an administrative probe of the carrier’s operational failures.

- A parade of storms is expected to bring rain, wind and snow to the West Coast over the next week-and-a-half.

- The average U.S. diesel price fell to $4.537 per gallon Wednesday, marking a decline of 80.4 cents over the past seven weeks.

- The Port of New York and New Jersey ranked as the busiest port in the U.S. for a fourth consecutive month in November, handling 723,069 TEUs of cargo, down 4.8% from the same month last year but up 20.6% from pre-pandemic levels.

- Dwell times for containers at the ports of Los Angeles and Long Beach have returned to pre-pandemic levels of around 2.8 days, reflecting improving congestion conditions amid a steep drop in inbound containers.

- Congestion is easing at the Port of Oakland after container throughput fell 15% in November compared to a year ago.

- China-West Coast container rates dropped to $1,378 per FEU this week, down 93% from an all-time high in September 2021 and nearly matching pre-pandemic levels.

- Frustration is rising among shippers locked into long-term ocean contracts as spot rates from Asia plunge.

- DHL Supply Chain will lay off 400 workers at two of its facilities in Livermore, California, starting in February.

- GXO Logistics will cut 85 employees at a facility in Fort Wayne, Indiana, adding to its growing list of layoffs planned for the new year.

- Analysts expect U.S. warehouse rents to rise between 12% and 15% next year amid continued strong demand and near record-low vacancy rates.

- The Port of Long Beach received federal approval for a $200 million channel deepening project aimed at improving the movement of bigger vessels.

- The Port of Long Beach ended its COVID-19 vaccination program for seafarers calling in the San Pedro Bay.

- The U.S.’s decoupling of trade with China since 2018 has sent China’s trade with Southeast Asia surging 71% to almost $1 trillion.

- South Korea’s semiconductor output fell by 15% in November from a year earlier, the most since the 2008 global financial crisis.

- Canada’s First Quantum Minerals says its Panama copper mine is running as normal after talks resumed with the Panama government over a tax dispute from earlier this month.

- Britain’s iconic ceramics industry is slashing production and cutting jobs due to surging energy bills, industry groups say.

- The logistics subsidiary of apparel retailer American Eagle Outfitters intends to roll out next-day delivery across the U.S. within three years.

- Salesforce projects this season’s holiday returns will rise 57% over last year as shoppers returned goods bought early to repurchase them at lower prices as the holidays approached.

- Unionization drives at Amazon are beginning to falter as fears rise over the impacts of a potential recession.

- In the latest news from the auto industry:

- Tesla has lost more than half its market value since Oct. 1 as investors worry about demand in China, among other issues.

- Chinese electric-vehicle-maker Nio expects to see a challenging first half of 2023 due to a cut in government subsidies and a broader slowdown in local demand.

- New incentives in California could put hydrogen trucks on price parity with traditional diesel rigs, experts say.

- Traditional brand loyalty is dissolving in the U.S. electric-vehicle market as automakers quickly roll out new models.

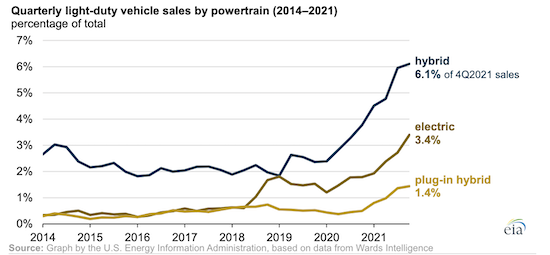

- Electric vehicles and hybrids surpassed 10% of U.S. light-duty car sales in the fourth quarter of 2021:

Domestic Markets

- The U.S. reported 104,201 new COVID-19 infections and 901 virus fatalities Wednesday.

- Severe attendance issues at U.S. schools are persisting even after the pandemic conditions that prompted them subside.

- Initial jobless claims rose by 9,000 last week to 225,000, somewhat higher than expected and the highest level since February.

- The U.S. leading economic index, a compilation of 10 economic gauges, fell a sharp 1% in November, twice the decline expected and the ninth consecutive monthly decline. While the economy continued to expand, the index was brought down by high inflation, a weakening jobs market and a soft housing market.

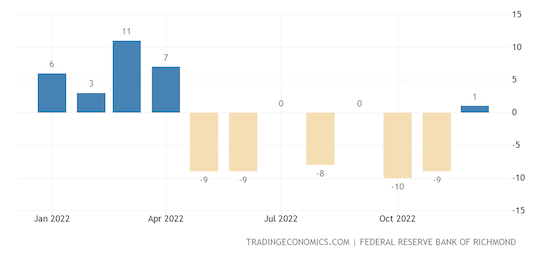

- The Richmond Fed’s manufacturing index, measuring activity from Maryland to South Carolina, saw its first expansion since April, the latest data shows:

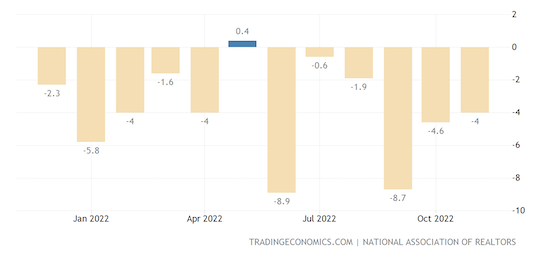

- U.S. pending home sales fell 4% in November, their sixth straight month of declines to the second-lowest level on record.

- High-end metro U.S. home sales slumped 38% in the three months ended Nov. 30, the biggest drop on record, according to real estate brokerage Redfin.

- Data suggests U.S. inflation hit middle-income households the hardest in 2022, with purchasing power from paychecks falling 2.9%, the largest drop of any population segment. Buying power increased for the bottom and top fifths of households.

- The U.S. dollar, up 8.9% this year, the biggest increase since 2014, has given back half its gains since peaking in September when it hit a more than two-decade high against an index of 16 other currencies.

- Over one-third of pet owners surveyed said they were concerned about expenses due to high inflation, with half saying they may have to give up their pet.

- U.S. baby formula imports will be subject to tariffs again starting in 2023 as exemptions imposed during the nationwide shortage expire.

- Cal-Maine, the largest U.S. egg producer, saw quarterly sales more than double from a year ago as rapid inflation and effects from an avian-flu outbreak pushed prices higher.

International Markets

- In the latest China news:

- Local reports suggest Chinese hospitals and funeral homes remain under intense pressure as surging COVID-19 cases continue to drain resources.

- Wealthy people in China are stockpiling supplies of Pfizer’s COVID-19 antiviral pill as the nation’s hospitals are stripped of resources and many people struggle to access medication.

- Authorities are racing to beef up medical facilities in the vast Chinese countryside as city workers prepare to return to their families for the Lunar New Year.

- The U.S. CDC issued a travel alert yesterday urging people to “reconsider” trips to China due to the COVID-19 infection risks and strained healthcare system there.

- Five countries, including the U.S. and Japan, now require negative COVID-19 tests for all inbound travelers from China. Italy imposed the rule after nearly half of Chinese passengers on flights to Milan were infected with the virus.

- China’s relaxed travel restrictions, planned for Jan. 8, have not yet had a substantial effect on global airlines’ plans to resume service there.

- China’s decision to abruptly scrap its COVID-19 restrictions could concentrate losses in the coming months while shortening the duration of economic shocks throughout 2023, economists say.

- The global financial hub of Hong Kong announced plans to scrap most of its remaining COVID-19 restrictions.

- Japan logged over 216,000 new COVID-19 cases Wednesday along with a record number of virus fatalities.

- Vietnam’s economy grew 8.02% this year, the fastest pace in Asia.

- South Korea’s retail sales fell for a third month in November, while industrial production was down 3.7% from a year earlier, the sharpest decline in over two years:

- Mexico City has become a leading global hub for remote-working foreigners during the pandemic, causing problematic surges in local housing prices.

- Fast-food chains in France will be required to use reusable cutlery and plates for in-person diners starting Jan. 1, one of the biggest changes to their restaurants in decades.

Some sources linked are subscription services.