MH Daily Bulletin: December 5

News relevant to the plastics industry:

At M. Holland

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices settled lower Friday but notched their first weekly gain in three weeks on fears that new European sanctions will tighten global supplies.

- In mid-morning trading today, WTI futures were down 0.9% at $79.26/bbl, Brent was off 0.7% at $84.97/bbl, and U.S. natural gas was down 7.2% at $5.83/MMBtu.

- OPEC+ agreed Sunday to stick to its production cuts of 2 million bpd — a plan initially agreed to in October — amid mounting demand worries from pandemic lockdowns in China.

- Average U.S. gasoline prices have fallen 30% from record highs to $3.43 per gallon last week. Prices are below $3 per gallon in seven states.

- Active U.S. oil and gas rigs, an indicator of future output, were flat last week, according to Baker Hughes.

- New data shows U.S. shale output gains are slowing while executives from some of the largest shale companies warn of future declines from overworked oilfields and less productive wells.

- Chevron signed its first production contracts with Venezuela after receiving a new U.S. license to operate in the country for the first time in years.

- European power prices are rising as cold weather sets in and normally abundant supplies from French nuclear reactors decline.

- Japan is targeting imports of at least 840,000 tons of LNG per year to create a strategic buffer against an energy crunch.

- Norwegian producer Aker raised its spending targets by 20% to a total of $19 billion for developing new projects offshore Norway by 2028.

- Canada’s TC Energy, which once spearheaded the effort to build the Keystone oil pipeline, is preparing to unload $3.7 billion of assets next year outside of its core gas business.

- More oil news related to the war in Europe:

- The Group of Seven (G7) advanced democracies agreed to cap the price of Russian crude oil at $60/bbl, a plan that will take effect today, Dec. 5. Western officials say the move will not trigger supply disruptions and price volatility as Russian oil currently trades well below the cap. Moscow plans to ban trading with any countries that participate in the scheme.

- Along with a G7 cap on the price of Russian crude, Europe’s new ban on seaborne crude imports from Russia also takes effect today, Dec. 5, and could force Moscow to cut 1 million bpd of output by early next year.

- Asia imported record volumes of oil last month to stock up before Europe’s and the G7’s harshest sanctions on Russian oil take effect.

- India plans to continue buying Russian crude even after the G7’s price cap takes effect today, officials said.

- Shipping companies have snapped up dozens of used oil tankers this year that some experts fear will become part of a “shadow fleet” of ships attempting to carry Russian crude and evade sanctions.

- The first round of negotiations on a global plastics treaty ended last week without agreement on key enforcement measures. Over 2,000 delegates from 160 countries will continue meeting to craft the first legally binding agreement on plastic pollution by the end of 2024.

Supply Chain

- Container volume from China to the U.S. is down 21% since August due to a collapse in factory orders, which could prompt Chinese manufacturers to shut down early for the Chinese New Year.

- Supply-chain disruptions, once thought to be a temporary effect of the pandemic, could turn into the “new normal” of the U.S. economy, some Federal Reserve officials say.

- Apple is speeding up plans to shift production out of China and into Vietnam and India to avoid disruption from Beijing’s COVID-19 policies.

- More than half of Japanese manufacturers plan to reduce dependence on Chinese suppliers, according to a survey.

- The U.S. will impose new import duties on Chinese solar panel makers after a months-long investigation found evidence of tariff dodging. The measure could undermine U.S. efforts to use more renewables.

- The Port of Houston pushed back a fee on long-dwelling containers due to software problems.

- Trucking jobs in the U.S. rose modestly in November, while warehouse jobs shrank and are now 63,500 below their June peak and lower than the level of January.

- Europe is bracing for a trade confrontation with the U.S. over the recently passed Inflation Reduction Act, which gives businesses big incentives to invest more in the U.S.

- Robust hiring at Airbus this year shrank the labor pool for its suppliers, putting more pressure on the plane maker’s weakened supply chain. Airbus will need to deliver a near-record number of jets this month to reach its full-year delivery goals.

- Three years of pandemic disruptions and Russia’s war in Ukraine are completely revamping global supply chains and potentially making them more reliable, experts say.

- In the latest news from the auto industry:

- Ford’s electric vehicle sales more than doubled year over year in November, while its overall unit sales were down 7.8%.

- GM and LG Energy will invest another $275 million in their Tennessee battery-cell joint venture to boost production by more than 40%.

- Renault and Nissan scrapped this week’s planned announcement of a deal to restructure their auto alliance.

- China Evergrande Group’s electric-vehicle unit suspended mass production of its only model due to a lack of new orders.

- Volvo’s sales grew 12% year over year in November on robust underlying demand, the automaker said.

- Uber is expanding its self-driving freight program in Texas to ship more goods this holiday season.

- Some Chinese automakers are buying their own ships to handle transportation.

Domestic Markets

- Tuesday marks the third anniversary of the world’s first case of COVID-19, a viral disease that has taken the lives of an officially recorded 6.6 million people.

- The U.S. daily average of new COVID-19 infections was up 22% last Thursday from two weeks earlier, while hospitalizations were up 21% and 40 states reported rising case counts.

- Respiratory hospitalizations among U.S. children are surging after COVID-19 prevention measures kept most viruses in check last year.

- Americans over age 65 have one of the lowest rates of COVID-19 booster uptake despite having the highest virus fatality rate of any age group.

- Los Angeles County may soon reimpose indoor mask mandates as COVID-19 cases and hospitalizations continue to rise in the area.

- Boston is seeing a spike in the levels of COVID-19 in its wastewater, signaling a potential new virus wave.

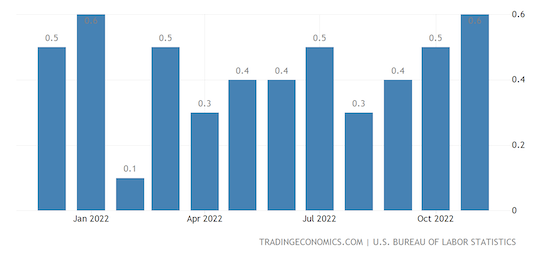

- The Federal Reserve may have more incentive to raise interest rates after monthly wages rose 0.6% in November, its strongest pace since January, while U.S. employment topped forecasts, surging by more than 263,000 jobs for the month.

- Some analysts believe the Federal Reserve’s benchmark interest rate could reach 5% next year.

- Many firms that grew quickly early in the pandemic have been forced to adapt to weaker revenue, leading to rising layoffs and investment reconsiderations, particularly at tech and major media companies.

- High home prices are pushing buyers out of the most affordable U.S. markets, even as mortgage rates drop to a two-month low and a record number of homes are delisted amid declining demand.

- An expected 12% peak-to-trough drop in U.S. home prices would be about one-third as severe as the last market correction 15 years ago, analysts say.

- Delta Air Lines reached a tentative deal to boost pilot wages by 34% over the next four years, setting a bar for other carriers negotiating with pilots.

- Boeing could lose up to $50 billion in orders if it fails to persuade lawmakers to lift a Dec. 27 deadline to upgrade cockpit-alerting systems.

- United Airlines is nearing a deal to order dozens of Boeing 787 Dreamliners, what would be a victory for the plane maker over its rival Airbus, which competed for the order.

- Business-software firms say customers are being more cautious with their spending in response to slowing economic activity, adding to recent troubles in the tech industry.

- Johnson & Johnson denied having plans to make a tender offer for Horizon Therapeutics, a developer of medicines for rare autoimmune and inflammatory diseases.

- CVS is testing a system to remotely fill prescriptions as it grapples with a growing shortage of pharmacists.

- Big Lots will lower prices after sales fell and margins contracted last quarter.

- The Federal Reserve is seeking public comment on a proposal that would force large banks to incorporate climate-related financial risks in their strategic planning.

International Markets

- Global health experts say a potentially deadly new COVID-19 variant could emerge as countries keep relaxing viral prevention measures.

- Shanghai, Beijing, Shenzhen and Guangzhou became the latest major Chinese cities to relax some pandemic curbs, even as nationwide infections hover near record highs. Researchers say the country’s low vaccination rates and lack of herd immunity could lead to a surge in virus fatalities.

- Analysts have upgraded forecasts for China’s corporate earnings next year on hopes that its economy will benefit from easing COVID-19 restrictions.

- Six of the world’s 10 most advanced economies delivered 350 basis points of interest-rate hikes in November.

- Euro zone producer prices fell by a larger-than-expected 2.9% from September to October, bolstering predictions that inflation may have peaked. Prices were up 30.8% year over year:

- The euro zone’s unemployment rate dropped to a record-low 6.5% in October, holding up well despite forecasts for a bloc-wide recession.

- The European Central Bank is expected to start offloading some of its $5.3 trillion of bond holdings next year as part of quantitative tightening used to cool credit and investment.

- German exports fell a larger-than-expected 0.6% in October as inflation and supply-chain snags hit demand in its key trading partners.

- The Bank of England signaled that higher interest rates could lead to a deeper and longer recession than initially thought.

- Ratings agency S&P Global cut France’s outlook from “stable” to “negative,” reflecting its view of rising risks to the country’s public finances.

- Brazilian industrial production rose 0.3% from September to October, returning to positive territory after two straight monthly declines.

- Top U.S. and Mexican trade officials agreed to set out a plan by early 2023 to spur the relocation of companies from Asia to North America.

- Tourist visits to Spain soared 39% year over year in October but remained just shy of pre-pandemic levels.

- Global food prices fell marginally for the eighth consecutive month in November, according to the United Nations.

Some sources linked are subscription services.