MH Daily Bulletin: December 1

News relevant to the plastics industry:

At M. Holland

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil rose 3% Wednesday on expectations of greater demand in China, where two major cities modestly eased some COVID-19 curbs.

- In afternoon trading today, WTI futures were up 1.3% at $81.56/bbl, Brent was up 0.4% at $87.28/bbl, and U.S. natural gas was down 2.6% at $6.75/MMBtu.

- The U.S. is reportedly weighing more releases from strategic crude reserves if prices spike following Europe’s ban on Russian oil imports.

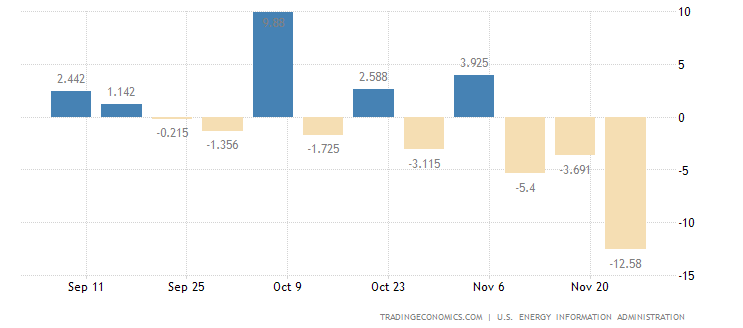

- U.S. crude stocks fell by the most in three years last week, according to the Energy Information Administration.

- U.S. oil output climbed 2.4% to 12.27 million bpd in September, the highest of the pandemic.

- The White House is considering steps to double heating oil reserves in the Northeast this winter as the region faces the country’s worst shortage of fuels.

- OPEC’s production fell by more than 700,000 bpd from October to November after the alliance pledged steep output cuts to support prices.

- Venezuela wants the U.S. to ease even more sanctions on the country’s beleaguered oil industry after Chevron gained its first license to operate there in years.

- Australia’s No. 1 independent gas producer warned of mounting cash-flow issues as it struggles to pass environmental checks needed to boost drilling.

- More oil news related to the war in Europe:

- The EU Commission is recommending that member states adopt a price cap on Russian oil of $60/bbl. The cap must be agreed upon by all 27 EU member countries as well as the G-7.

- Russian crude production could fall by 2 million bpd to start 2023 as tighter sanctions take hold, according to the International Energy Agency.

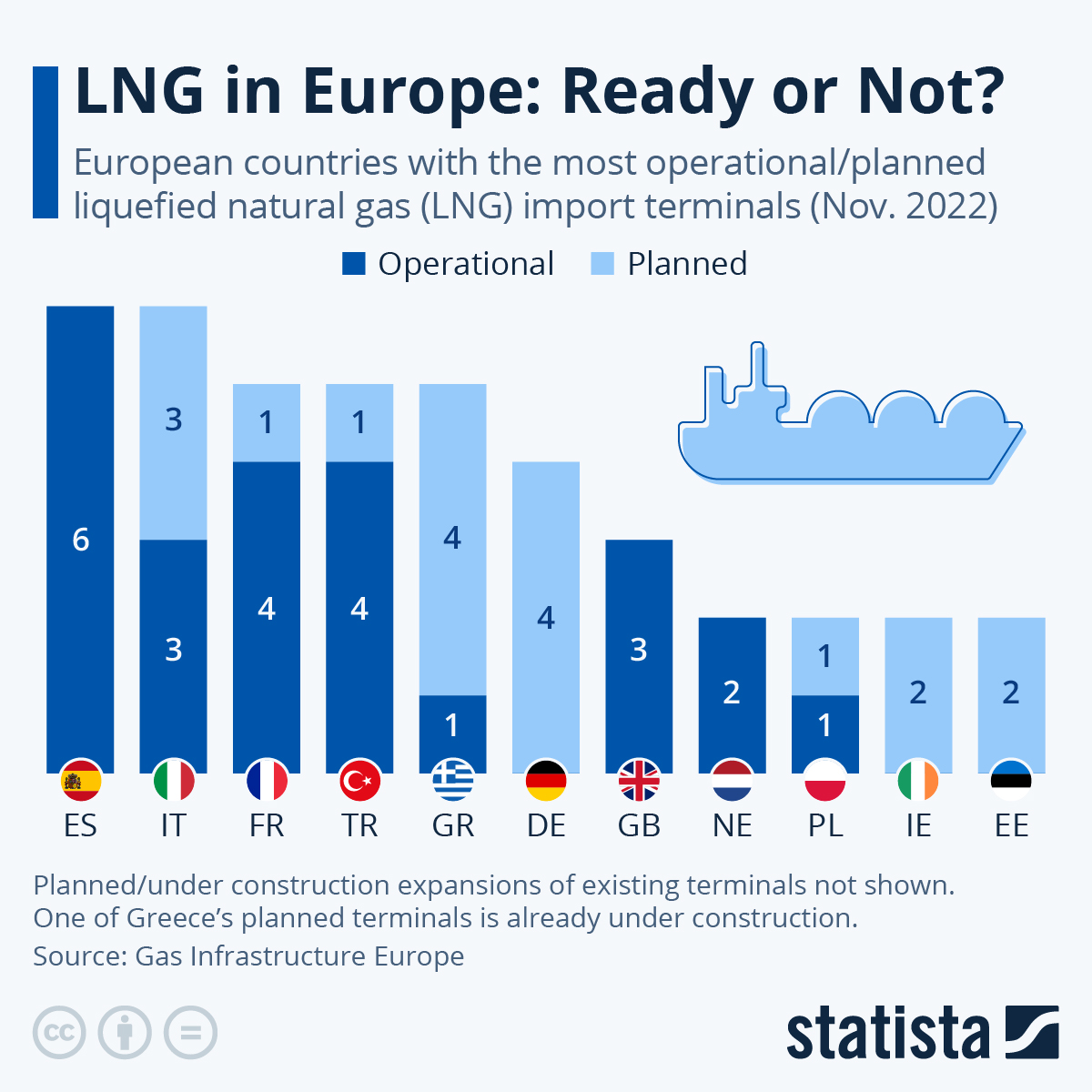

- Europe’s LNG imports from Russia are up 40% over the past year, a sharp contrast to the bloc’s purchases of sanctions on Russian coal and crude.

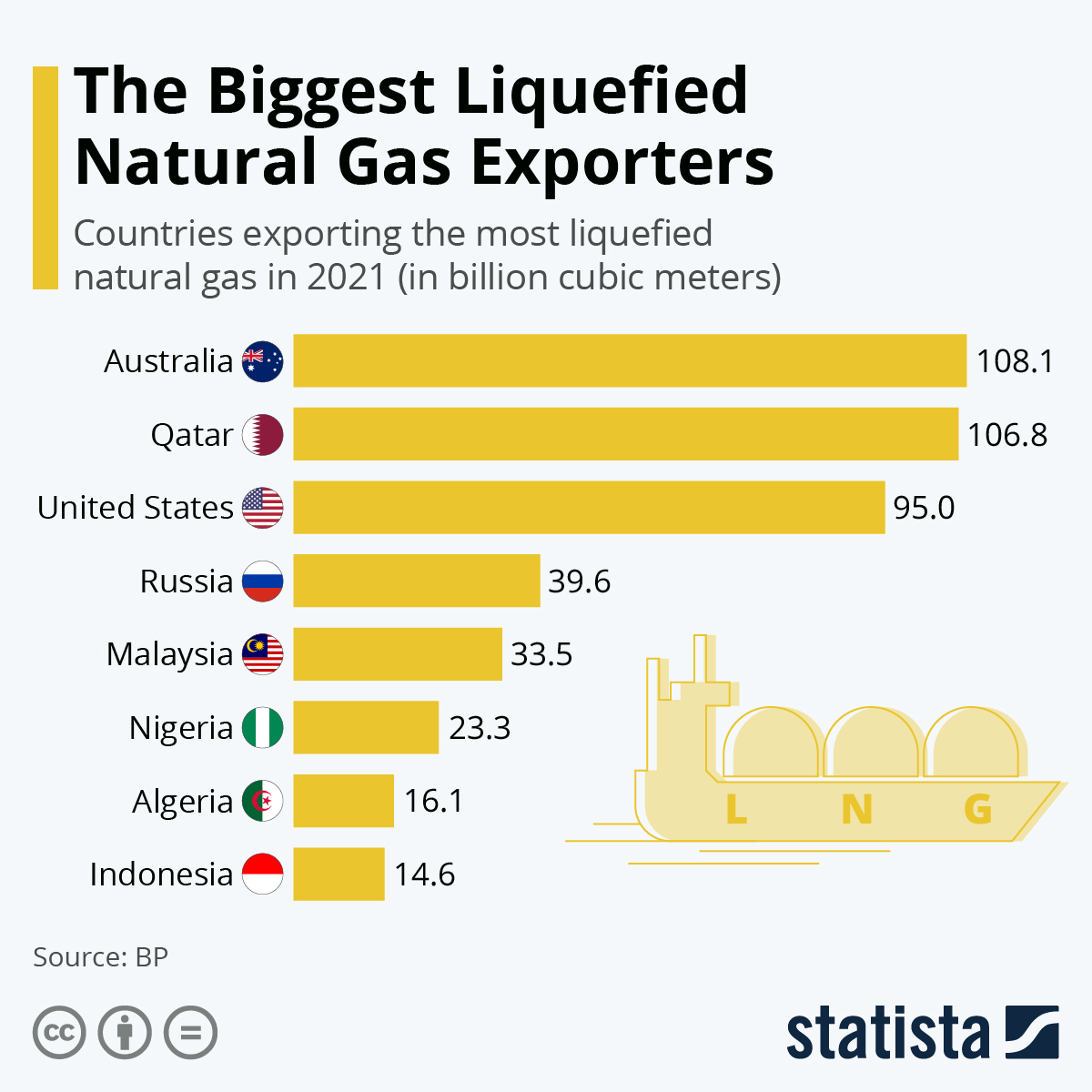

- The U.S., which this year surpassed Australia and Qatar to become the world’s largest LNG exporter, will see export capacity increase 40% by 2025 from current expansion projects.

- France, struggling under outages at many of its nuclear sites, prepared a contingency plan to impose rolling blackouts if power shortages are severe enough this winter.

- Secondhand tanker values are surging ahead of Europe’s embargo on Russian oil.

- EU policymakers are looking to repurpose $250 billion of emergency pandemic funds into bolstering the continent’s energy infrastructure, particularly for renewables.

- China’s administration signaled it wants to boost energy trade with Russia.

- Millions of Ukrainians remain indefinitely in refugee status as Russia’s destruction of the country’s critical energy infrastructure makes it impossible for them to return home.

Supply Chain

- Dozens of tornadoes are believed to have touched down in the U.S. Southeast Wednesday as a line of intense weather rolled from Texas to Georgia and as far north as Indiana.

- The 2022 Atlantic hurricane season ended Wednesday after wrapping up with some of the most catastrophic storms in recent years, particularly in Florida.

- A House-approved bill to head off a potentially devastating strike among U.S. rail workers heads to the Senate today where it has already drawn bipartisan support.

- More than 10,000 ambulance workers in Britain’s national health system are preparing to strike before Christmas.

- Container shippers’ net profit hit $58.9 billion in the third quarter, up 22.4% from a year ago but down 6.6% from the second quarter.

- Ocean carriers Kalypso and Ellerman are launching trans-Atlantic container services for U.S. shippers.

- U.S. regulators approved a plan for East Coast seaports to operate a shared pool of truck chassis in a program set to launch next October.

- In the latest news from the automotive industry:

- China’s lockdowns are roiling the nation’s auto industry, with Volkswagen and Honda announcing new factory shutdowns Wednesday.

- Xpeng, a U.S.-listed electric-vehicle-maker based in Guangzhou, expects fourth-quarter deliveries to plunge 52% due to the impacts of lockdowns.

- BYD was the top-selling car brand in China this month, outperforming Volkswagen.

- Airbus is partnering with Renault to develop next-generation electric batteries for cars and planes.

- Tesla says it will boost production to 75,000 vehicles at its Texas gigafactory in the first quarter of 2023.

- Volkswagen-owned Skoda plans for electric vehicles to make up 70% of its total sales by 2030.

- Volkswagen’s CEO said electric-vehicle battery production in Europe will be “practically unviable” unless the EU can stabilize high energy costs.

- Amazon started operating Rivian electric delivery vans in Seattle.

- GM’s self-driving robotaxi unit plans to expand into new markets and sharply scale up operations next year.

- Honda says its most advanced self-driving technology will be available in the second half of the 2020s.

- Missouri-based Orange EV is adding a manufacturing site in Kansas to expand its production of truck-terminal vehicles.

- Amazon is taking cues from its extensive retail operations as it unveils a new supply-chain management service for its web business.

- Canadian officials say rising geopolitical risks and climate concerns should prompt firms to shift supply chains to more reliable trading partners.

- The EU will add shipping to its carbon market for the first time, forcing vessels to pay for their emissions and increasing pressure on the maritime sector to adopt cleaner fuel.

Domestic Markets

- The U.S. reported 109,986 new COVID-19 infections and 567 virus fatalities Wednesday.

- Up to 30% of Americans who contract COVID-19 also develop long-haul symptoms, U.S. health officials say. The economic impact of long-COVID could eventually total $3.7 trillion, according to one estimate.

- COVID-19 mortality rates among young adults rose sharply in 2021 as the demographic got fewer vaccines and took fewer precautions than other age groups.

- Wednesday comments from the chair of the Federal Reserve suggest the central bank will slow its pace of interest-rate hikes to 50 basis points at the next meeting in December. U.S. stocks surged on the news.

- Varied data released Wednesday painted a mixed picture of the U.S. economy in recent months:

- Third-quarter GDP rose at a 2.9% pace, higher than the 2.6% initially reported.

- Personal consumption, the biggest component of the U.S. economy, climbed a higher-than-expected 1.7% in the third quarter on greater outlays for services.

- The personal consumption expenditures price index, one of two key inflation gauges preferred by the Fed, rose 4.6% in the third quarter.

- Pretax corporate profits fell 1.1% in the third quarter, the first decline since 2020.

- The U.S. trade deficit in goods widened by 7.7% in October to $99 billion, the most since June.

- The Fed’s “Beige Book” of financial anecdotes suggests U.S. economic growth eased this fall as companies became more downbeat in their outlook.

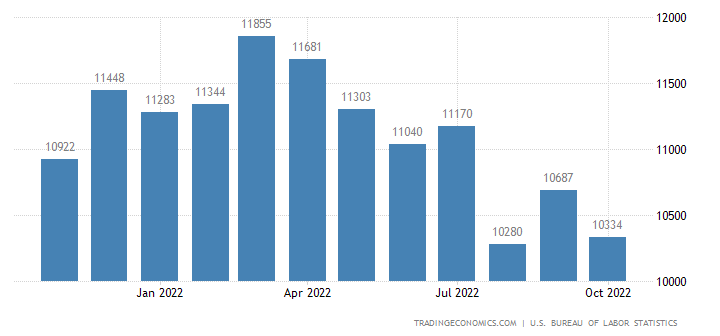

- U.S. job openings fell from 10.7 million in September to 10.3 million in October, a hopeful sign for the Fed’s effort to curb demand.

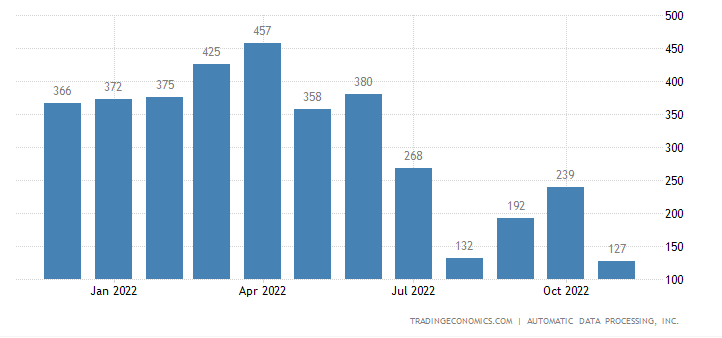

- U.S. private payrolls added just 127,000 positions in November, nearly half of October’s gain, according to ADP.

- U.S. pending home sales fell for a fifth straight month in October as higher mortgage rates slowed demand.

- U.S. apartment rents dropped 1% in November, the steepest decline in five years.

- The number of U.S. shoppers choosing to shop at physical stores over Thanksgiving weekend surged 17% from a year ago.

- Amazon says it recorded its biggest ever Thanksgiving shopping weekend but did not release specific data.

- General Electric and defense contractor L3Harris are among companies vying to acquire rocket-maker Aerojet Rocketdyne, according to reports.

- Hormel Foods’ sales fell 5% last quarter on a pullback in demand for refrigerated goods.

- The New York Stock Exchange’s proceeds from initial public offerings are down 93% this year as market volatility dissuades companies from going public.

International Markets

- China reported 36,061 new COVID-19 infections Wednesday, slightly down from a day earlier. The megacities of Guangzhou and Chongqing eased some restrictions yet declined to make meaningful policy shifts away from zero-COVID.

- Major Western banks are in wide agreement that global economic growth will dip beneath 2% next year.

- Factory output slumped widely across Asia in November, according to a batch of private surveys.

- China’s economic activity contracted across the board in November, with gauges in manufacturing, services and construction all falling more than expected. The nation’s GDP growth could be the weakest in decades this year, some economists say.

- Japan’s manufacturing activity contracted for the first time in two years in November. Factory output was also down.

- The Bank of Japan says it will keep interest rates ultra-low to promote wage growth, making it an outlier in the global wave of monetary tightening.

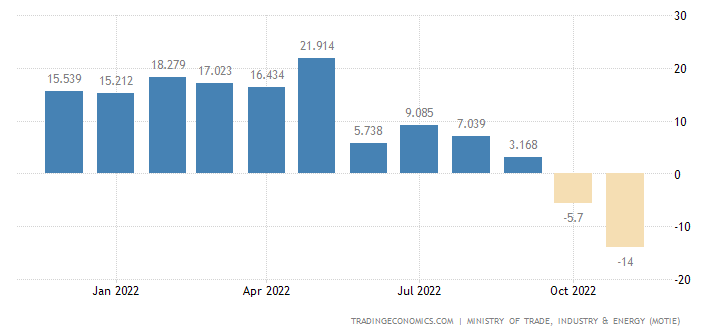

- South Korea’s exports plummeted 14% in November from a year ago, the steepest decline in 2.5 years.

- India’s GDP rose at a 6.3% pace in the latest quarter, less than half the growth of the previous three months.

- Russia’s economy reportedly shrank 1.7% year over year from January to September, withstanding the impact of Western sanctions better than initially expected.

- Sweden’s H&M, the world’s No. 2 fashion retailer, is laying off over 1,500 employees as part of efforts to cut $190 million in costs per year.

Some sources linked are subscription services.