MH Daily Bulletin: November 28

News relevant to the plastics industry:

At M. Holland

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices settled 2% lower Friday for their third straight weekly decline, marked by demand worries in China.

- In mid-day trading today, WTI futures were up 1.2.% at $77.18/bbl, Brent was down 0.5% at $83.18/bbl, and U.S. natural gas was down 5.6% at $6.63/MMBtu.

- On Saturday, the U.S. granted Chevron a license to expand production in Venezuela for the first time in years after the South American country’s battling political factions pledged to cooperate on humanitarian aid and other measures.

- U.S. emergency crude reserves fell by 1.6 million barrels last week to their lowest level since March 1984. Overall, crude stocks fell more than expected while gasoline stocks surged, according to the Energy Information Administration.

- Active U.S. drilling rigs rose by two last week but remained 291 lower than the same time in 2019, Baker Hughes said.

- Exxon Mobil will face challenges boosting output from the U.S. Permian Basin because much of its best acreage sits atop potash mines used for fertilizer production, experts say.

- More oil news related to the war in Europe:

- European ministers suspended talks last week on joining a G7 plan to cap Russian crude prices as some EU countries consider the proposal too generous to Moscow. Negotiations will resume today, while Russia has said it will ban crude sales to any country participating in the deal.

- China and India are pulling back from buying Russian crude ahead of Europe’s ban on imports starting Dec. 5, new data shows.

- German gas giant Uniper says it will need another $25.8 billion on top of the $8 billion already approved by the German government to cover mounting losses.

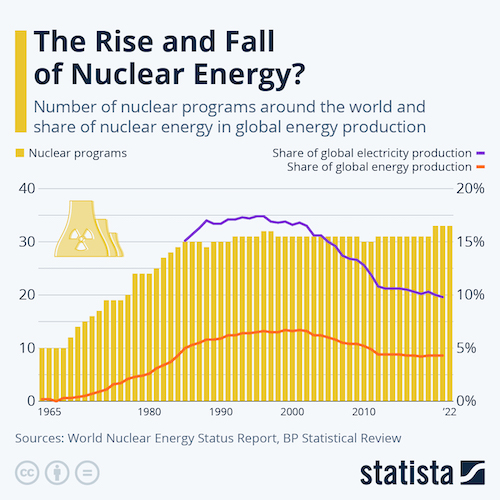

- Ukraine’s four nuclear plants were reconnected to the grid after Russian shelling completely shut down off-site power supplies last week. Some 6 million Ukrainians remain without power due to widespread infrastructure damage.

- British ministers are finalizing plans to help fund the rollout of small nuclear reactors in a drive to decarbonize electricity supplies.

- Component failures are delaying France’s $23 billion project to build a nuclear fusion reactor with the potential to generate unlimited clean energy.

- France’s windfall tax on energy company profits will cost debt-laden nuclear giant EDF over $5 billion next year.

- Microsoft signed the second largest corporate power agreement this year to power its Irish data centers with renewables.

- Germany’s Brenntag SE is in talks to buy U.S. rival Univar Solutions, Inc., in a deal cementing its position as the world’s biggest chemical distributor.

Supply Chain

- Record COVID-19 infections in China are once again threatening heavy disruption in global supply chains.

- Thousands of workers at the world’s largest iPhone factory in Zhengzhou, China, have left their job amid heightened tensions over COVID-19 restrictions that spilled over into violence last week. November shipments at the Foxconn-owned plant could fall over 30%, imperiling key holiday sales for Apple.

- In the latest labor action news:

- Unionized truckers in South Korea kicked off their second major strike in less than six months last week, threatening to disrupt manufacturing for a wide range of industries such as automotive and petrochemicals in the world’s 10th-largest economy. The South Korean government says it may step in to break up the strikes and is set to meet with union negotiators today.

- The U.S. administration says it continues to negotiate with unionized rail workers in a bid to avert a looming strike that could shut down supply routes across the country.

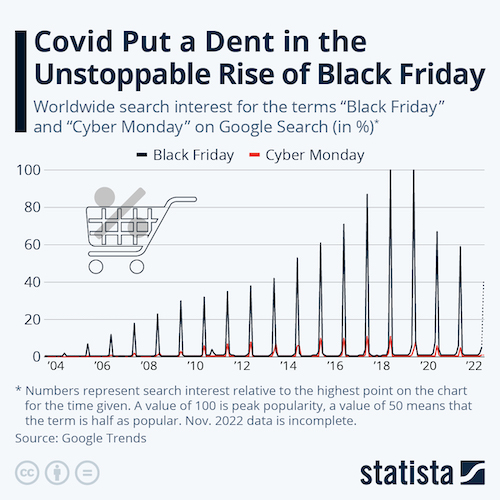

- Many Amazon workers in Germany and France walked off the job on Black Friday amid calls for better pay.

- Tens of thousands of British postal workers, teachers and university staff began striking last Thursday over wage disputes.

- Chilean truckers are striking indefinitely over fuel prices and security conditions, threatening production in the world’s largest copper and second largest lithium producer.

- Peruvian farmers and truckers staged over a dozen roadblocks last week to protest high gas prices and fertilizer shortages.

- CMA CGM warned of falling profits this quarter amid high energy prices and flagging consumer spending.

- Two years of container ship backups off the coast of Southern California have come to an end, officials say.

- Early numbers suggest Black Friday delivered mixed results, with online spending expected to set a record of over $9 billion, while physical traffic and sales likely rose only modestly from last year.

- Airbus is preparing to delay deliveries of medium-haul aircraft next year due to supply-chain and labor problems.

- Hong Kong flagship carrier Cathay Pacific is in talks on new orders for medium-haul aircraft and dedicated freighters.

- The EU agreed on a $44.4 billion plan to jump-start semiconductor production through more state funding and logistics assistance.

- West Africa’s Ivory Coast aims to become a regional shipping hub as it continues building port terminals financed largely by China.

- U.S. turkey and egg prices are surging amid the nation’s worst outbreak of bird flu on record.

- In the latest news from the auto industry:

- New U.S. car sales are expected to remain flat this month, according to J.D. Power.

- Hyundai is partnering with South Korea’s SK On to build a $1.88 billion battery factory in the U.S., likely in Georgia.

- Stellantis is putting more cars in storage, considering moving some production to India and reorganizing its European dealers’ network due to lingering supply-chain and cost issues.

- Vietnamese electric-vehicle-maker VinFast has shipped its first cars to the U.S., capping a five-year effort to build a production hub for markets in North America and Europe.

- BMW will double its Hungarian factory investment to $2.1 billion to start making electric vehicles by 2025.

Domestic Markets

- The U.S. averaged 43,582 daily new COVID-19 infections last week, up from 40,102 the prior week. The seven-day average for virus deaths increased to 378 from 317 a week ago.

- Lawmakers return to Washington this week with an agenda that includes passing key funding to keep the government running beyond Dec. 16.

- First-time jobless claims rose by 17,000 to a three-month high of 240,000 last week amid rising layoffs in the tech sector:

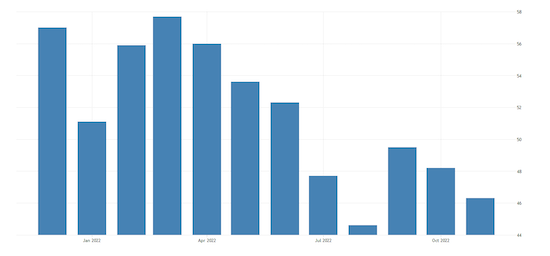

- U.S. business activity contracted for a fifth straight month in November, with S&P Global’s composite purchasing managers’ index falling from 48.2 to 46.3…

- ….meanwhile, average input prices, rose at their slowest rate in two years, but factories still faced challenges finding skilled labor, data shows.

- New orders for U.S.-made capital goods unexpectedly rebounded by 0.7% in October, suggesting solid business spending to start the fourth quarter, according to the Commerce Department.

- Most Federal Reserve officials supported easing the pace of interest-rate hikes at their next meeting in December, according to minutes of the central bank’s last meeting.

- U.S. mortgage rates fell sharply to a two-month low of 6.67% last week. At the same time, new home sales unexpectedly rose by 7.5%.

- U.S. grocery prices rose 12.4% year over year in October, the eighth month of double-digit growth.

- The U.S.’s persistently tight labor market is prompting more employers to eliminate college-degree requirements for high-paying jobs.

- Deere saw a 59% rise in quarterly sales of its large farm equipment amid easing supply-chain constraints.

- Consumer-goods, healthcare and entertainment firms with high cost junk debt face greater risks of credit downgrades and defaults as they battle rising interest rates and falling revenue, S&P Global says.

- The $39 billion U.S. toy industry is banking on a rush of last-minute holiday shoppers to prop up a 3% sales decline in the first nine months of the year.

- Federal Trade Commission officials are preparing to sue Microsoft to prevent its takeover of video-game-maker Activision Blizzard due to antitrust concerns, reports suggest.

- The U.S. will bar the sale or import of telecom equipment made by major Chinese firms including Huawei and ZTE over security risks.

International Markets

- In the latest news from China:

- Protests continue to erupt in major Chinese cities as the economic and social costs of its COVID-zero policies escalate amid record daily infections nationwide.

- China cut bank reserve requirements for the second time this year, freeing up some $70 billion to support lending in its faltering economy. The nation’s commercial banks are also adding billions of dollars in credit lines to ease a liquidity crisis among property developers.

- China’s industrial profits fell 3% in the first 10 months of 2022 as both domestic consumption and export demand cooled.

- China launched its first private pension scheme in dozens of cities as it grapples with the costs of one of the world’s most rapidly aging populations.

- China’s local government debt burdens are quickly becoming unsustainable, analysts say.

- COVID-19 cases in Brazil rose 230% week over week to the highest level since August.

- Major international trade groups and investment banks expect global economic growth to slow further next year.

- A downturn in euro-zone business activity eased slightly in November, according to S&P Global, although private-sector activity in France and Germany remained in contraction territory.

- Companies across Europe are offering one-off bonuses and renegotiating wages as surging inflation raises food and energy bills for staff over the winter.

- British economic activity fell at its fastest pace in two years in November, adding to signs of a recession, according to IHS Markit’s purchasing managers’ index.

- Japanese manufacturing activity shrank at the fastest pace in two years this month amid strong inflationary pressures.

- At 3.6%, Tokyo’s inflation rate rose at the fastest pace in 40 years in November.

- South Korea raised interest rates by a modest 25 basis points last week, slowing its pace of monetary tightening after producer inflation fell to a 16-month low in October.

- Mexico’s economy grew 0.9% in the third quarter, slightly below expectations. Analysts predict Mexico’s inflation fell more than expected from October to November.

- Canadian housing prices could start falling twice as fast as during the 2008 financial crisis, according to a poll of market experts.

- Europe is preparing for a ninth round of sanctions against Russia, officials say.

- European retailers widely expect to see the worst Christmas shopping season in a decade due to low demand and persistently high costs.

- IKEA owner Ingka posted a 9% rise in annual operating profit as price increases helped offset rising input costs.

- Chinese electronics-maker Xiaomi saw quarterly revenue fall 10% on a global slump in the smartphone market.

- Nestle plans to invest $1.86 billion to expand production in Saudi Arabia as the kingdom looks to diversify its oil-dependent economy.

Some sources linked are subscription services.