MH Daily Bulletin: November 15

News relevant to the plastics industry:

At M. Holland

- M. Holland is hosting a free 3D Printing Technology Forum in Chicago on Nov. 16! Attendees will learn how additive manufacturing technologies can support the development of applications — especially injection molding. Click here to RSVP, or contact 3dinfo@mholland.com for more information.

Supply

- Oil fell 3% Monday, dragged down by potential demand impacts from surging COVID-19 cases in China.

- In mid-morning trading today, WTI futures were down 1.2% at $84.88/bbl and Brent was down 1.1% at $90.80/bbl.

- U.S. and European natural gas prices surged Monday on forecasts of colder weather this week. U.S. natural gas futures were up 0.3% at $5.95/MMBtu in mid-morning trading today.

- Permian Basin output will rise to a record 5.499 million bpd in December, according to the U.S. administration.

- U.S. oil and gas companies fracked fewer wells than they drilled for the first time in more than two years in October, indicating a possible slowdown in production.

- The top 25 North American oil and gas companies posted combined profit of $70.04 billion last quarter, 186.3% higher than last year’s third quarter.

- Led by declines in Saudi Arabia and Angola, OPEC production fell by 210,000 bpd in October and was well below output targets for the month.

- OPEC cut its forecast for global growth in oil demand for the fifth time since April.

- Chinese refiners are slowing purchases of Russian crude as uncertainty rises ahead of Europe’s sanctions.

- BP refinery workers began slowing work in Rotterdam after labor talks failed on Monday.

- More oil news related to the war in Europe:

- Germany will spend $13.44 billion to nationalize parts of Russia’s Gazprom in a bid to guarantee energy supply. Poland announced a similar measure.

- Asia is quickly becoming Russia’s preferred target for crude exports, which spiked 22% last week ahead of Europe’s ban on seaborne shipments. Although volumes are steady now, Europe’s embargo will likely lead to a sudden drop in Russian oil exports of 1 million bpd.

- Pakistan, the world’s fifth most populous country, could halt household gas supply for up to 16 hours a day to preserve fuel for winter.

- Exxon Mobil partnered with an Indonesian firm to build a $2.5 billion carbon-capture plant in the nation.

- A week of talks at the United Nations’ COP27 summit has produced little progress on a global carbon-credit trading program.

- Coal development in China threatens to offset efforts by other nations to phase out the fuel source.

- The U.S. government awarded $48 million to upgrade wind turbine staging and assembly infrastructure on Staten Island, which will made it an East Coast hub for offshore wind installations.

- A group of startups and researchers are developing technologies to expand the global output of geothermal energy.

- The U.S., Japan and other partners pledged to help raise $20 billion to transition Indonesia away from coal-fired power generation.

- Billionaire Amazon founder Jeff Bezos intends to devote the bulk of his $124 billion net worth to fight climate change.

Supply Chain

- A third U.S. rail union rejected a tentative contract reached in September, but pledged to continue negotiating. A rail strike could disrupt nearly a third of America’s freight by weight and cost the economy $2 billion a day.

- Truck drivers in Spain began their second major strike of 2022, protesting road freight rules and soaring costs of living.

- Other Asian countries are increasingly taking China’s market share of exports to the U.S., according to the latest data.

- Over 27% of global container trade passed through China- or Hong Kong-owned terminals in 2021.

- The Port of Savannah saw its second-busiest month on record in October as the U.S. East Coast continues to benefit from an eastward shift of imports.

- Shippers are aggressively pursuing lower rates to make up for exorbitant prices charged by carriers the past two years.

- The U.S. Postal Service will raise prices for multiple shipping services next year as it grapples with lower volumes and inflationary pressures.

- Microsoft unveiled software that it says will use artificial intelligence to predict shortages and supply constraints, among other features.

- U.S. environmental regulators are considering tougher emissions standards for locomotives.

- In the latest news from the auto industry:

- U.S. truck stops have fallen behind on building charging infrastructure to support the rollout of electric semis.

- On Dec. 1, Tesla will unveil its first semitruck model available for delivery.

- Sales of Toyota’s Prius hybrid fell to just 86,000 last year, down from a peak of over 500,000, as consumers lean toward fully electric cars.

- U.S. electric-vehicle startups, including Lucid and Rivian, are losing hundreds of thousands of dollars per vehicle sold due to staggering production costs.

- Cummins will partner with India’s Tata Motors to build hydrogen engines, fuel cells and battery-electric systems for cars in the Indian market.

- Aided by over $500 million in government subsidies, Toyota, Sony and Softbank are joining with Japanese chip companies to bulk up the country’s computer-chip supply chains.

- Several major automakers plan to deploy less expensive iron batteries that promise to lower electric vehicle prices but deliver less driving range.

- Vietnamese electric-vehicle-maker VinFast could list on a U.S. stock exchange as soon as January.

- Startups in Europe and the U.S. are racing to develop electric vehicle batteries using sulfur and sodium to reduce costs and the industry’s dependence on China for batteries.

- Prices for industrial metals are rising as traders expect greater demand from China after it eased its COVID-19 rules.

- U.S. farming exports hit a record $196.4 billion in the fiscal year ending Sept. 30, some 14.4% higher than the previous record.

- Global coffee prices plummeted 20% last month on favorable weather in major producing nations.

Domestic Markets

- The U.S. reported 47,969 new COVID-19 infections and 203 virus fatalities Monday.

- U.S. infections of the new BQ.1.1 variant of Omicron are quickly overtaking the highly infectious BA.5 variant.

- COVID-19 cases and hospitalizations are back on the rise in Los Angeles.

- COVID-19 cases in Florida jumped by 12,000 last week, the highest weekly sum in two months.

- Moderna released its first batch of research showing its updated COVID-19 boosters are more effective than original shots against the newest variants of Omicron.

- In a sign of easing inflation, the Producer Price Index increased a smaller-than-expected 0.2% in October compared with September, with prices falling for services and goods excluding food and energy.

- The Federal Reserve’s vice chair says the central bank will likely soon slow its interest-rate hikes.

- Americans raised their year-ahead inflation expectations from 5.4% to 5.9% in October.

- Prices for Thanksgiving staples surged in October.

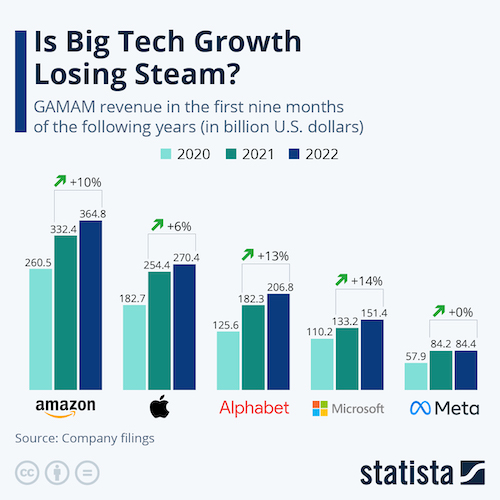

- Amazon became the latest major U.S. firm to plan thousands of layoffs ahead of a potential economic downturn.

- Home Depot saw a better-than-expected 4.3% gain in quarterly sales, helped by higher prices and steady demand for home improvement tools from professional builders.

- Tyson’s quarterly revenue rose 7% to $13.7 billion as prices across its business rose 5%.

- Google will pay nearly $400 million to settle allegations that it misled consumers about tracking and location data.

- Home builder Lennar is partnering with 3D printing company Icon to build 100 homes in the largest on-site 3D printed housing community in the nation.

International Markets

- China’s largest cities — including Beijing, Chongqing, Guangzhou and Zhengzhou — saw record COVID-19 infections Monday as nationwide cases hit their highest since April.

- After easing some COVID-19 restrictions last week, China’s ruling party reasserted its commitment to its COVID-zero policy, even as crowds of people in Guangzhou crashed through COVID-19 barriers and grappled with authorities Monday night in protest.

- New data shows China’s economy cooled across the board in October, with retail sales shrinking unexpectedly for the first time in five months.

- China’s industrial output rose 5% in October from a year ago, slowing from September’s 6.3% pace as COVID-19 restrictions weighed on factory activity.

- JPMorgan cut its forecasts for economic growth in China due to the country’s ongoing COVID-19 policies.

- The International Monetary Fund says its outlook on the global economy has worsened due to global interest-rate hikes the past month.

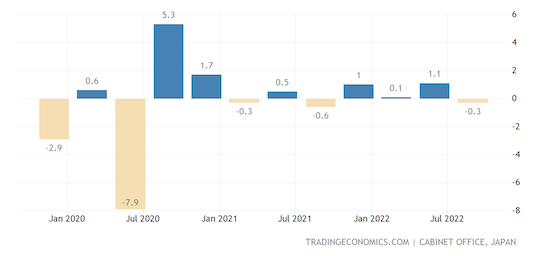

- Japan’s economy unexpectedly shrank for the first time in a year last quarter.

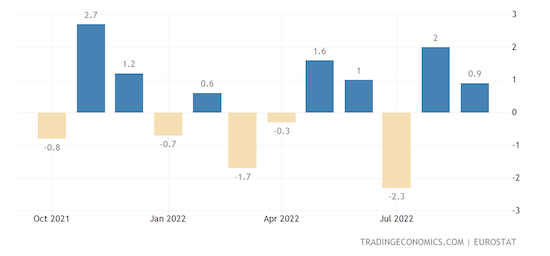

- Euro zone industrial production rose more than expected in September, the latest data shows.

- Germany’s wholesale prices grew 17.4% in October, the slowest rate since the start of the war in Ukraine.

- India’s annual retail inflation dipped below 7% for the first time in three months in October.

- South Korean import prices softened to a 15-month low in October, while export prices also declined.

- Spanish officials are predicting stronger-than-expected GDP growth for 2022 after inflation slowed from 8.9% in September to 7.3% in October.

- The global population is set to cross a milestone 8 billion people today even after the pandemic weighed on life expectancy and fertility rates.

- China’s shrinking population could lead to disastrous economic effects, experts say.

- Hong Kong’s Cathay Pacific Airways, effectively shut down for much of the pandemic, expects to operate at 70% of pre-pandemic capacity by the end of 2023.

- Brazilian plane-maker Embraer narrowed its third-quarter loss but said annual deliveries would remain at the lower end of forecasts.

- India’s smartphone exports fell 10% year over year last quarter.

- Several dozen major global retailers have agreed to buy more alternative fibers for clothing and packaging to help reduce global emissions.

Some sources linked are subscription services.