MH Daily Bulletin: November 8

News relevant to the plastics industry:

At M. Holland

- At our recent Plastics Reflections Web Series event, M. Holland experts discussed the macroeconomic factors influencing global and domestic economies, including impacts on the plastics industry. Click here to read the recap.

- M. Holland is sponsoring the Association of Rotational Molders (ARM) Annual Meeting in Atlanta on Nov. 6-9! Please stop by Booth #19 to meet our team of Rotational Molding experts and learn more about our product offerings and grinding capabilities.

Supply

- Oil prices eased Monday, paring gains after hitting two-month highs to end last week.

- In mid-morning trading today, WTI futures were down 0.5% at $91.34/bbl, Brent was down 0.2% at $97.73/bbl, and U.S. natural gas was down 9.5% at $6.29/MMBtu.

- China’s crude imports hit a five-month high in October as two major refiners prepared to ramp up operations.

- Britain is poised to announce a major natural gas deal with the U.S. in the next two weeks.

- U.S. producer Diamondback Energy and Dallas-based refiner HF Sinclair were the latest to report bumper third-quarter earnings driven by robust fuel prices.

- Dominion Energy is in talks to sell its multi-billion-dollar stake in the Cove Point LNG facility in Maryland’s Chesapeake Bay.

- Italy’s Eni will resume taking cargoes of Venezuelan oil under an oil-for-debt exception to U.S. sanctions on the country that was paused for four months.

- Zhejiang Petroleum and Chemical, China’s largest private refiner, is ramping up diesel output and reducing petrochemical production this month to cash in on higher export margins for the industrial fuel.

- More oil news related to the war in Europe:

- The EU’s executive arm signaled it does not expect to pass a bloc-wide cap on the price of imported natural gas.

- Europe’s retail natural-gas prices are up 100% over the past year even as governments spend billions to help shield consumers from the continent’s energy crisis. Continued funding measures could substantially impact the bloc’s 2023 budget plans, officials say.

- Germany is preparing to spend as much as $83 billion to fund a cap on electricity and gas prices next year.

- Russia’s seaborne crude shipments hit a five-month high last week as traders scramble to secure shipments ahead of the EU’s December 5th ban.

- India’s state-owned oil producer wants to keep its 20% stake in the massive Sakhalin-1 offshore project in Russia’s Far East, which Moscow effectively took over earlier this year.

- Hundreds of thousands of Ukrainians remain without power as Russia continues its shelling of the nation’s key energy infrastructure.

- TotalEnergies (7.4 GW) is widening the gap with Shell (2.2 GW) and BP (2 GW) in renewable energy production.

- Saudi Arabia says it will contribute $2.5 billion to a green initiative in the Middle East over the next decade.

- Kuwait pledged to reach carbon neutrality in its oil and gas sector by 2050.

- Maersk says the oil industry is holding back a clean energy transition in shipping by not providing enough affordable green fuel.

- Maersk plans to build a large methanol production facility in Spain.

Supply Chain

- Subtropical Storm Nicole is strengthening into a hurricane over the Bahamas and is expected to hit Florida’s east coast Wednesday with heavy rain, flooding and a storm surge.

- Shipping groups say the White House may have to broker another deal between unions and freight railroads as the odds become slimmer that two big unions will ratify the previous deal come Nov. 21.

- Year-to-date U.S. rail carloads were roughly flat with 2021, while intermodal volumes fell 4.8%.

- Quarterly earnings at Atlas Air Worldwide fell nearly 50% to $60.1 million.

- Iron-ore prices have slumped to a three-year low in response to China’s lockdowns and a sharp slowdown in the nation’s homebuilding.

- Foxconn, the world’s largest contract manufacturer and a key supplier for Apple, revised down its fourth-quarter outlook due to the pandemic affecting its operations in Zhengzhou, China.

- Apple cut its iPhone 14 production by 3 million units this year due to weaker-than-expected demand.

- Japan plans to spend nearly $2.4 billion in collaboration with the U.S. to develop and help produce next-generation semiconductors.

- Nvidia, facing hundreds of millions in lost revenue in China due to recent U.S. export restrictions, is offering Chinese customers a lower bandwidth alternative that complies with the new restrictions.

- UAE ports operator DP World will put $500 million into lowering operational emissions over the next five years.

- MSC says it will pass along to customers the cost of complying with Europe’s new carbon trading system.

- One thousand workers at British corrugated packaging group DS Smith voted to strike over a contract dispute.

- Canadian National Railway saw its best month ever for western Canadian grain movements in October.

- In the latest news from the auto industry:

- Foxconn will invest $170 million in Ohio-based electric vehicle maker Lordstown Motors, the once-troubled startup that recently began building its first electric pickup.

- Amazon expanded its partnership with electric vehicle maker Rivian to bring custom-made vans to more than 100 U.S. cities by the year’s end. The vans have completed some 5 million deliveries since launching in July.

- Luxury electric vehicle maker Lucid is suing Texas over its requirements that new cars be sold through dealerships.

- The U.S. government faces a year-end deadline to give specific guidance on how automakers can meet electric vehicle tax credits.

- Renault is forming a joint venture for gas-powered and hybrid cars with China’s Geely Automobile as the French automaker prepares to split itself into several divisions.

- A subsidiary of Chinese electric vehicle maker Geely plans to build an electric cargo van for the European market by 2024.

- New car sales in Russia slumped 62.8% year over year in October.

- Ouster and Velodyne, two firms that make the key self-driving sensor technology lidar, are merging their operations to boost profitability.

- Seating supplier Adient saw quarterly sales rise 32% from a year ago while its earnings more than doubled to $227 million.

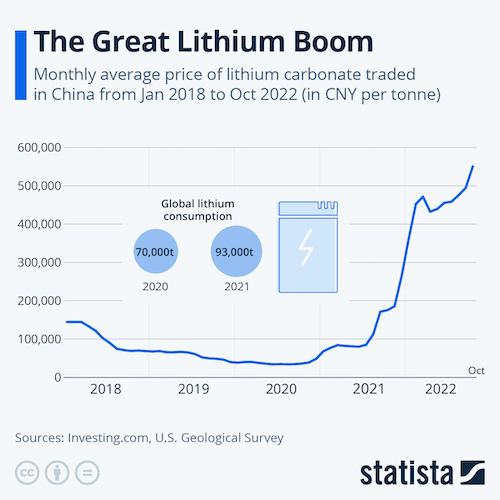

- The global scramble for lithium is pushing some Chinese ceramic makers into the lithium production market.

- Australian miner Arafura Rare Earths signed a deal to supply Hyundai and Kia with up to 1,500 tonnes of rare-earth oxide per year.

- Canada’s Ritchie Bros Auctioneers, seller of heavy industrial equipment, will acquire U.S.-based vehicle marketplace IAA for $7.3 billion.

- FedEx Freight is testing dimension-based pricing that breaks with the industry’s long-standing classification system.

- Overstock.com and UPS are partnering on a return service to let customers get their unboxed returns picked up from the front door.

Domestic Markets

- The U.S. reported 38,418 new COVID-19 infections and 130 virus fatalities Monday.

- COVID-19 cases are back on the rise in Florida, according to the latest weekly data.

- COVID-19 is keeping millions of Americans out of work and reducing the productivity of millions more.

- BioNTech raised its revenue guidance on healthy demand for its updated COVID-19 boosters and higher prices.

- An American research group is shutting down travel to Antarctica after 10% of its expedition members caught COVID-19.

- Goldman Sachs downgraded earnings forecasts for the S&P 500 for 2023, citing weak economic conditions, but ranked the probability of a U.S. recession in the next 12 months at just 35%.

- Financial executives at large U.S. firms are increasing their foreign currency hedges and covering longer time periods as the strong dollar takes a toll on earnings.

- U.S. property developers facing rising vacancies and falling rents are throttling back key development projects.

- Industrial parts supplier Fastenal saw its October sales jump 13.6%.

- Healthcare products distributor Cardinal Health plans to raise prices to cover rising labor and shipping expenses.

- Shares in Lyft fell sharply Monday after the ride-hailer reported its slowest growth in more than a year and said third-quarter passenger volumes remained below pre-pandemic levels.

- Walgreens-backed VillageMD will buy urgent-care provider Summit Health for $9 billion, the latest in a string of acquisitions by big retailers aiming to delve deeper into medical care.

- Royal Caribbean saw third-quarter revenue jump sevenfold from a year ago on surging demand for cruises.

- Airfares will remain unusually high as travel demand surges and airlines struggle with capacity constraints, executives say.

- Twitter is reportedly asking dozens of fired employees to return to their jobs after abruptly laying off 50% of its workforce last Friday.

- U.S. air regulators paved the way for startup Joby Aviation to get clearance for its electric air taxis as early as 2025.

International Markets

- Violence broke out in China between authorities and citizens protesting the country’s strict COVID-19 restrictions.

- China is pondering steps toward reopening after nearly three years with the world’s strictest pandemic restrictions, even as new cases yesterday surged to 7,475, up from 5,496 the day before, with a third of the new cases in industrial hub Guangzhou.

- Japan is being urged to stop rolling out Omicron-tailored booster shots for free amid weak demand.

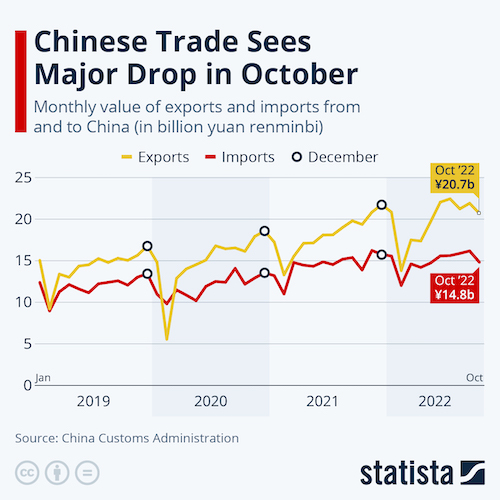

- China’s exports and imports unexpectedly contracted in October, the first simultaneous slump since May 2020.

- Grocery inflation in the U.K. rose to a record 14.7% in October.

- Economists say persistently high inflation in Mexico will push its central bank to raise interest rates by 75 basis points to a record 10% this week.

- U.S. citizens, many of them remote workers, are moving to Mexico at the fastest rate in over a decade.

- Britain’s home prices fell 0.4% in October to a five-month low.

- Vietnam’s garment industry faces declining orders from key markets over the next two quarters as global demand cools.

- Ryanair saw record profit for its key summer season and said it expects strong passenger demand and fare growth for years to come, as it consolidates its hold on Europe’s budget air market.

- Aeromexico is expanding flights to Europe and Asia as it works to recover its Category 1 aviation rating from the U.S.

- Kenya Airways shut down 80% of its flights Monday due to pilot strikes.

- Brazilian plane maker Embraer saw a 10% boost in third-quarter deliveries.

Some sources linked are subscription services.