MH Daily Bulletin: October 19

News relevant to the plastics industry:

At M. Holland

- During M. Holland’s Plastics Reflections webinar last week, our panelists discussed the macroeconomic factors influencing global and domestic economies — including what it means for suppliers, distributors and manufacturers in the plastics industry. In case you missed it, click here to gain access to the full recording.

- M. Holland, in collaboration with LyondellBasell, will boost medical packaging manufacturers’ access to medical-grade resins and help ensure regulatory confidence for OEMs. Click here to read the full press release. A recent Plastics News article also highlighted the agreement.

Supply

- Oil fell 2%-3% Tuesday on fears of higher U.S. supply and lower Chinese demand. Prices have fallen by a third since early June, erasing all the gains from Russia’s invasion of Ukraine.

- In mid-day trading today, WTI futures were up 2.2% at $84.49/bbl, Brent was up 1.88% at $91.72/bbl, and U.S. natural gas was down 3.59% at $5.54/MMBtu.

- The White House will soon sell the remaining strategic crude reserves from its 180-million-barrel release announced earlier this year. Analysts say it’s possible that new sales could be authorized this winter.

- The U.S. administration is still considering limiting fuel exports, according to reports.

- The average U.S. gasoline price hit $3.89 a gallon to start the week, about 20 cents higher than a month ago.

- U.S. crude stocks saw a larger-than-expected draw last week, according to the American Petroleum Institute. Government data is due today.

- Major oil field service companies including Schlumberger, Halliburton and Baker Hughes are poised to deliver their strongest third-quarter results in years.

- The U.S. government will hold its first-ever lease sale for a commercial floating wind development offshore California on Dec. 6.

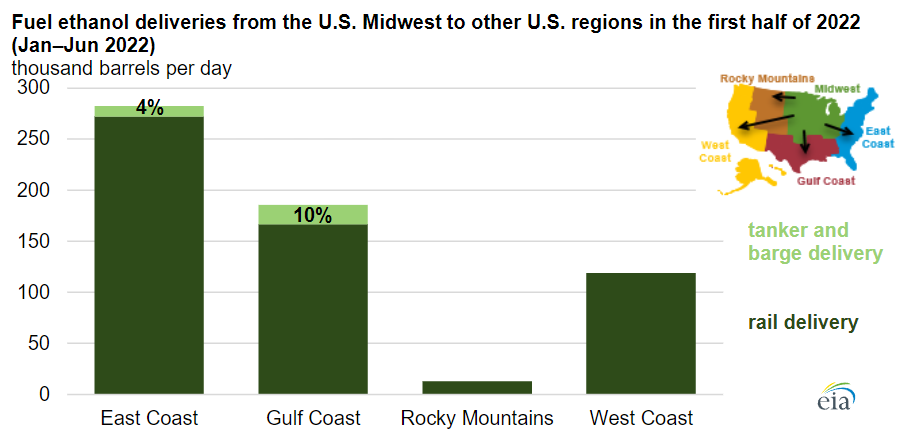

- Roughly 95% of all U.S. fuel ethanol deliveries were made by rail this year, mostly originating in the Midwest:

- More oil and gas news related to the war in Europe:

- Spain’s gas operator may limit LNG imports until November as industrial demand cools and storage sites fill to the brim. Tarrying ships may soon start looking at non-European ports to offload cargo.

- Traders and refiners are aggressively booking storage tanks ahead of European sanctions on Russian oil slated for December.

- Two major Indian refiners suspended Russian crude purchases for delivery starting the day that Europe’s embargo on Russian oil takes effect.

- The EU’s proposed sanctions on insuring Russian oil tankers could backfire and cause a global supply shock, some experts warn.

- Russia has destroyed a third of Ukraine’s power stations in just a week. Ukraine’s Zaporizhzhya nuclear plant, the largest in Europe, is also on the brink of an incident.

- Qatari officials say Europe will have a more difficult time filling next year’s winter gas storage after using up reserves this year.

- Europe’s executive arm unveiled a plan on Tuesday seeking to address the bloc’s energy crisis through joint gas purchases and limits on market volatility. A much-discussed gas cap was not proposed.

- European policymakers are calling for heightened security of energy assets after Danish police all but confirmed that recent damage to the Nord Stream pipelines was the result of a detonation.

- China’s crude imports jumped by 2 million bpd in September as the country prepared to supply more fuel to Europe.

- A contest between Venezuelan political parties could decide whether the U.S. government will let Chevron expand its operations there.

Supply Chain

- Some European passenger train services were halted Tuesday due to spreading civil unrest in France.

- Spot rates for LNG carriers are soaring to new highs near $450,000 a day, while rates for very large crude carriers are also surging.

- Imports into U.S. seaports will probably fall the rest of the year as overstocked retailers cancel overseas orders, putting a damper on the holiday freight market.

- Demand for outbound cargo from the Port of Seattle is down 35% since mid-August.

- Intermodal traffic on U.S. Class I railroads fell 1% year over year in the third quarter, while revenue per load was up 17%.

- Slowing revenue growth at Marten Transport, the first truckload carrier to report third-quarter earnings, signaled industrywide impacts from rising capacity and falling rates.

- J.B. Hunt beat third-quarter expectations with a 4% year-over-year gain in volume and a 12% gain in revenue.

- German trucking companies are facing a shortage of AdBlue, a key liquid mixture that keeps diesel engines running.

- Mexico is nearing a decision to end daylight saving time, a move likely to disrupt cross-border shipments with the U.S.

- In the latest news from the automotive industry:

- Stellantis is eyeing two more electric-vehicle battery plants in North America by 2030, on top of two already planned.

- BYD, China’s biggest electric-vehicle maker, likely quadrupled quarterly profit as it extended its sales lead over Tesla.

- Apple supplier Foxconn says it wants to control 5% of global electric-vehicle manufacturing by 2025.

- Tesla was No. 1 for German electric-vehicle registrations in the first nine months of the year, beating Volkswagen.

- Renault says global computer chip shortages continue to affect production.

- Hyundai is considering selling its idle factory in Russia.

- Hyundai and Kia will book a combined $2 billion provision in their third-quarter results due to impacts from years-old engine recalls.

- GM is investing $69 million into an Australian project aimed at securing nickel and cobalt supply.

- Toyota-backed Joby Aviation, a U.S. air taxi startup, could soon start testing urban transport services in Japan.

- Apple is curtailing iPhone 14 production due to weak demand.

- Oracle and Nvidia are expanding their partnership to build artificial-intelligence computer chips for the cloud.

- The total population of industrial robots around the world has reached an all-time high of 3.5 million, while robot technology advances rapidly.

- The U.S. still faces a shortage of baby formula some eight months after nationwide supplies were recalled.

- Suppliers to the biggest brands in fashion are struggling to stay afloat amid sky-high energy costs in Europe.

- A logjam of Ukrainian grain vessels in Turkey is thinning with only a month of a U.N.-brokered grain-export deal remaining.

- World hunger is growing as food importers in Africa and Asia struggle to contend with the rising value of the U.S. dollar.

- China’s pork prices are skyrocketing due to drought-induced delays of U.S. feedstock exports.

Domestic Markets

- The U.S. reported 32,831 new COVID-19 infections and 400 virus fatalities Tuesday.

- California plans to formally end its COVID-19 state of emergency in February.

- New York’s most famous entertainment venues are dropping their mask mandates for the first time in years.

- New strains of COVID-19 could render ineffective one of the only virus treatments left for Americans with autoimmune disease.

- More than a million Americans are out of work with long-COVID at any given time, costing some $50 billion in lost output.

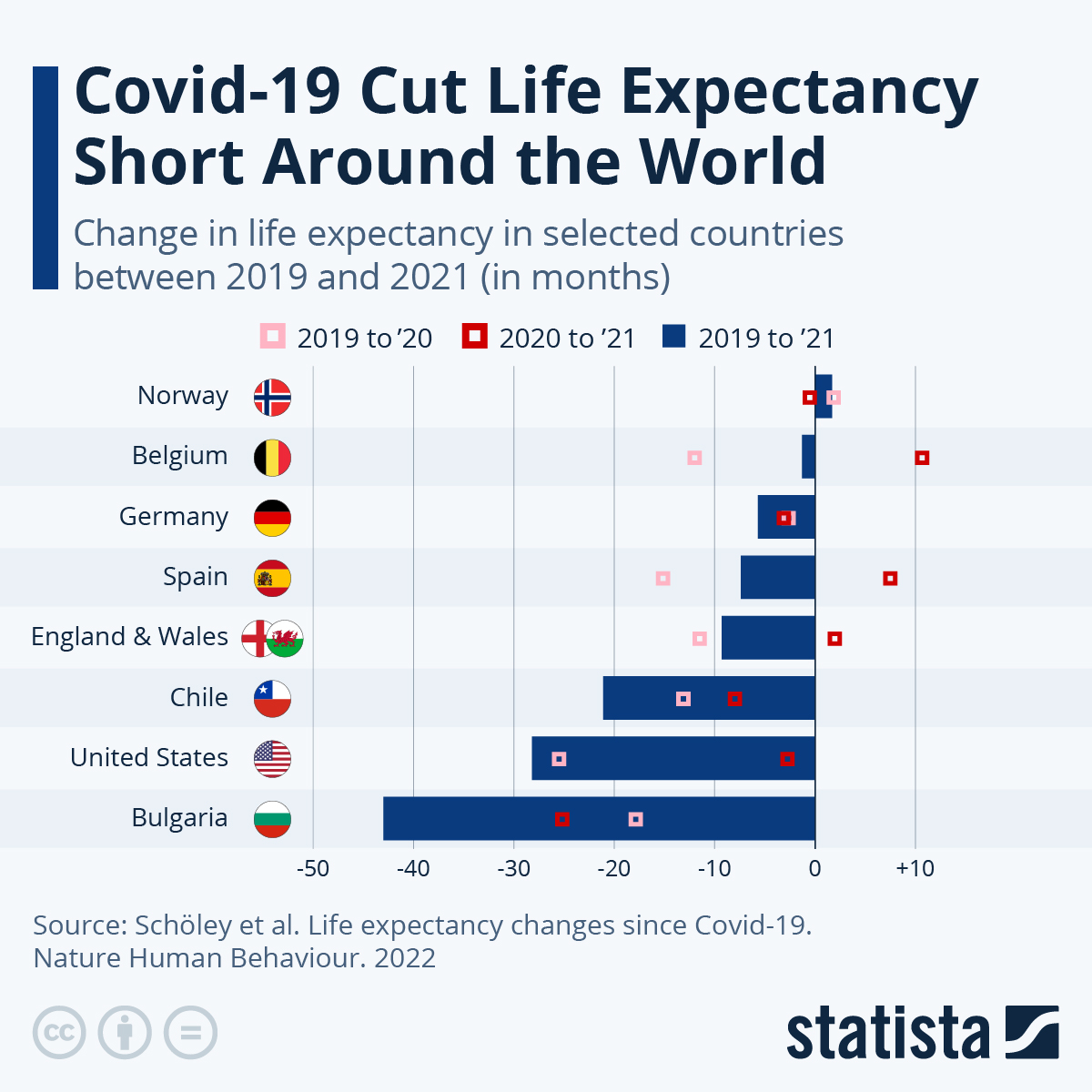

- Spurred by the pandemic, U.S. life expectancy fell by 2.7 years between 2019 and 2021 to 76.1 years, the lowest since 1996.

- U.S. manufacturing output rose a healthy 0.4% in September.

- U.S. retailers expect this season’s Halloween spending to grow 5% over last year to $10.6 billion.

- Ratings agency Fitch says real U.S. GDP will likely expand 0.3% in the third and fourth quarters on the back of a strong labor market and healthy consumer demand.

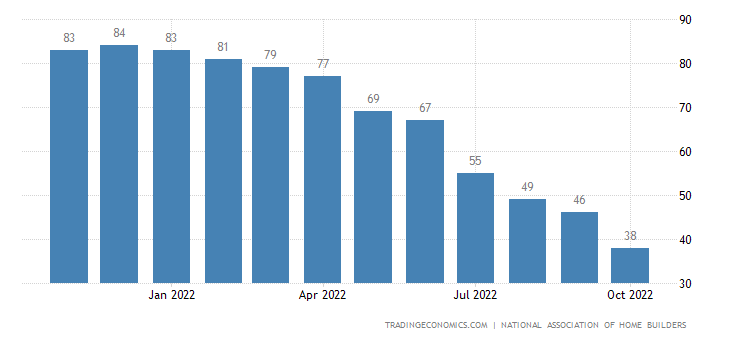

- U.S. homebuilder confidence fell for a 10th month in October:

- California home sales plunged 30% in September from a year ago.

- The IRS is raising tax bracket thresholds and the standard deduction by 7% next year due to inflation.

- Harley-Davidson may repurpose its 500,000-square-foot Milwaukee headquarters as it looks to a permanent future of remote work.

- General Electric is winding down office space in Boston and other cities as it prepares to split into three independent businesses.

- Female business leaders are leaving the workforce at the highest rate on record, according to a recent McKinsey study.

- Americans who work from home have reclaimed some 60 million hours that they used to spend on commuting, using it mostly for additional sleep, according to the New York Fed.

- New York and other large U.S. cities are seeing their highest office occupancy rates of the pandemic at around 50%.

- U.S. airports screened nearly 2.5 million passengers on Sunday, the highest daily figure since February 2020.

- United Airlines posted its strongest quarterly earnings in three years on robust demand for air travel. The carrier expects profit margins to surpass pre-pandemic levels in the fourth quarter.

- Lockheed Martin posted stronger-than-expected quarterly revenue and maintained its 2022 revenue forecast. The defense firm expects a return to sales growth in 2024 after smoothing out supply-chain issues.

- Netflix returned to growth with the addition of 2.41 million subscribers in the third quarter, sending the streaming giant’s shares up 14%.

- Johnson & Johnson will start making cuts to its labor force next year as it works through a separation of its consumer health business.

- Procter & Gamble said the stronger U.S. dollar erased most of its 7% gain in organic third-quarter sales, leading the consumer goods giant to predict its first annual sales decline in half a decade.

- Hasbro’s quarterly revenue fell 15% as the toy-maker’s move to raise prices to offset commodity costs hurt sales.

- An activist investor is pushing for Colgate-Palmolive to spin off its pet nutrition business into the rapidly expanding market for pet-related products.

- U.S. senators will hold an antitrust hearing on the proposed merger of Kroger and Albertsons, signaling growing scrutiny of the deal.

- Amazon workers rejected a union organizing effort at a New York state warehouse on Tuesday by a two-to-one margin.

International Markets

- COVID-19 cases in the U.K. rose 31% the past 10 days.

- COVID-19 cases are rising in South Korea, Taiwan, Japan and Singapore.

- COVID-19 may be entering a new phase, with emerging vaccine-evading variants causing concern for health experts.

- The economic impact of sanctions on Russia will be sharp and long-term, according to economists. The country’s battlefield losses are also hastening population decline.

- Britain’s annual rate of inflation returned to a 40-year high of 10.1% in September, cementing the Bank of England’s plans to raise interest rates early next month.

- Civil unrest is growing across Europe as high energy prices worsen a cost-of-living crisis.

- Canada’s central bank will raise its benchmark interest rate by 50 basis points on Oct. 26, a smaller amount than at previous meetings.

- Central Europe is growing as a destination for some firms looking for lower costs and lower inflation.

- Switzerland’s Roche, the world’s largest biotech firm, posted a 6% decline in quarterly sales on low demand for COVID-19 treatments and diagnostic testing.

- Russia’s flagship airline Aeroflot has seen passenger volumes fall 8.2% in the first nine months of 2022.

Some sources linked are subscription services.