MH Daily Bulletin: October 18

News relevant to the plastics industry:

At M. Holland

- During M. Holland’s Plastics Reflections webinar last week, our panelists discussed the macroeconomic factors influencing global and domestic economies — including what it means for suppliers, distributors and manufacturers in the plastics industry. In case you missed it, click here to gain access to the full recording.

- M. Holland, in collaboration with LyondellBasell, will boost medical packaging manufacturers’ access to medical-grade resins and help ensure regulatory confidence for OEMs. Click here to read the full press release. A recent Plastics News article also highlighted the agreement.

Supply

- Oil settled flat after choppy trading on Monday.

- In mid-day trading today, WTI futures were down 1.3% at $84.12/bbl, Brent was down 0.9% at $90.77/bbl, and U.S. natural gas was down 0.2% to $5.75/MMBtu.

- Global oil demand rebounded to 99% of pre-pandemic levels in August.

- After climbing for four weeks, the average U.S. gasoline price fell 5.4 cents to $3.86 a gallon on Monday.

- The White House is poised to announce another release of up to 15 million barrels of oil from strategic reserves in a bid to balance markets.

- The operator of New England’s power grid warned of blackouts this winter if a severe cold spell strains already tight LNG supplies.

- Oil output from the U.S. Permian Basin is forecast to hit a record 5.453 million bpd in November.

- Independent U.S. oil producer Continental Resources will be taken private at a valuation around $27 billion.

- The White House issued a second waiver of U.S. shipping rules that will help boost shipments of LNG to hurricane-hit Puerto Rico.

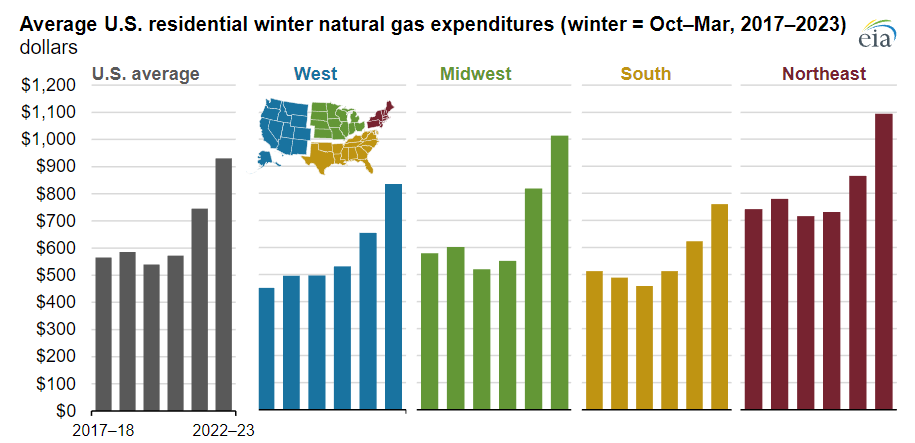

- U.S. households that use natural gas for heating will likely see bills rise an average of 28% this winter:

- More oil and gas news related to the war in Europe:

- China’s state-owned energy firms have been told to stop reselling LNG to Europe and Asia to ensure domestic supplies for winter.

- Moscow has pushed Exxon Mobil out of the massive Sakhalin-1 venture in Russia’s Far East and transferred the U.S. oil major’s stake to a Russian entity. The move comes shortly after project output collapsed due to Exxon’s refusal to accept insurance from a Russian entity after Western insurers withdrew from Russia due to sanctions.

- The EU will today unveil a new emergency package to help tackle its energy crunch through joint gas purchases and limits on market volatility while staying away from an immediate cap on gas prices.

- Dozens of LNG ships are circling off the coasts of Spain and other European countries as coastal storage and processing sites are filled to the brim.

- Rosneft, Russia’s biggest oil exporter, expanded its tanker business to ease oil shipments for buyers hit by Western sanctions.

- Boosted solar and wind capacity saved Europe almost $11 billion in gas costs between March and September.

- German investigators say the recent explosions on Russia’s Nord Stream gas pipelines to Europe were the result of deliberate sabotage.

- Europe’s largest nuclear plant in southern Ukraine ran on emergency generators Monday after Russian shelling cut off its power supply.

- Equinor may spend billions buying British North Sea oil fields from China’s CNOOC, what would be the U.K. continental shelf’s largest deal in years.

- Some Australian coal miners are boosting production plans as prices for the commodity rise.

- BP plans to buy U.S. biogas producer Archaea Energy for $4.1 billion in the renewable natural gas market’s largest acquisition on record.

Supply Chain

- Over 3,000 people in Clark County, Washington, near Portland have been forced to evacuate due to a fast-spreading wildfire that ignited Monday.

- The drought-hit Mississippi River was closed on Monday about 125 miles north of Memphis due to low water levels, constraining U.S. agriculture exports.

- South African logistics firm Transnet reached a wage deal with workers that will end a two-week strike.

- Port of Liverpool dockworkers are planning another two-week strike starting Oct. 24, while leadership at the Port of Felixstowe has tried to downplay the impacts of similar strikes.

- The average U.S. diesel price surged 50.3 cents the past two weeks to $5.339 a gallon.

- The Port of Houston saw its second best month on record in September, handling 353,525 TEUs, 26% above last year’s level.

- California issued a call for projects for nearly $1.2 billion in planned funding for port expansions and upgrades.

- Third-quarter U.S. industrial asking rents hit $8.70 per square foot, some 22% higher than a year ago.

- Experts say large parcel carriers are unlikely to scrap holiday surcharges this year even in the face of lower demand, overcapacity and shipper resistance.

- Texas trucking fleets are looking toward foreign drivers to help fill employment gaps.

- The U.S. administration quietly let lapse a two-year-old hours-of-service waiver that gave truck drivers and carriers more flexibility to transport essential goods during the pandemic.

- The U.S. administration’s new proposal that redefines independent contracting could significantly impact business for trucking operators.

- U.S. rail shippers’ expectations for price increases are tracking lower this quarter.

- Apple halted plans to use memory chips from China’s Yangtze Memory Technologies in its products after the White House imposed tighter export controls against Chinese tech firms.

- U.S. chipmaker Broadcom will seek early antitrust approval from European regulators for its proposed $61 billion takeover of cloud-computing company VMware.

- Global shipments of desktop and laptop computers fell in the third quarter by a record 18%, with notebook shipments particularly hard hit.

- In the latest news from the automotive industry:

- Stellantis plans to double the share of electric-vehicle models it produces in France.

- Skoda Auto, the Czech unit of Volkswagen, expects its parent group to decide by year’s end on the location of a massive new battery plant in Eastern Europe.

- Tesla had over 6,900 jobs on its career website last week, almost 50% more than in mid-June.

- Mercedes-Benz signed a deal to get 25% of its power use in Germany from offshore wind by 2027.

- Mercedes-Benz is broadening its battery-powered lineup with an SUV scheduled to go on sale later this year that could take on Tesla’s Model Y.

- Europe’s proposal to ban fossil-fuel cars by 2035 should be more accommodative to hybrid vehicles, Stellantis says.

- France boosted subsidies for low-income families to buy electric vehicles.

- Mobileye, Intel’s self-driving car unit, is planning an initial public offering at less than half the $50 billion valuation originally proposed.

- U.S. merchant wholesalers held roughly $897 billion in inventory in August, 25% more than the same time last year.

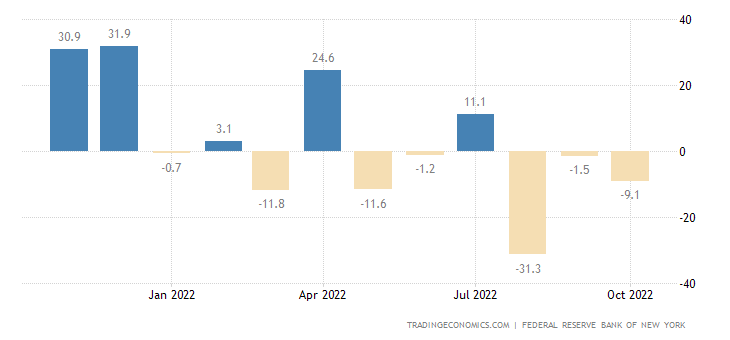

- Manufacturing activity in New York state dropped sharply in October for the third consecutive month:

- Hydrogen-fuel-cell-maker Plug Power says supply-chain issues are impeding its ability to complete projects.

- Airbus’ massive Beluga ST freighter, an aircraft typically reserved for ferrying airplane parts between manufacturing and assembly plants, is being increasingly used by commercial customers with outsized freight shipments.

- Norfolk Southern plans to start routing grain shipments for export through the Port of New York and New Jersey.

- Ukrainian grain exports this month were just 2.4% lower than a year ago, although Russia has said it will close the Black Sea grain corridor that lets shipments proceed unless Western sanctions are eased.

- The world’s largest miners reported mixed results for third-quarter iron ore production partly due to weak demand from China.

Domestic Markets

- The U.S. reported 38,276 new COVID-19 infections and 332 virus fatalities Monday.

- In a pandemic “baby bump,” the birthrate in the U.S. increased in 2021 for the first time since 2007.

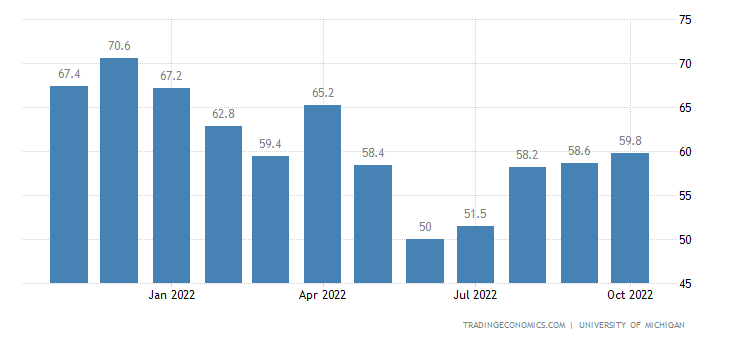

- The University of Michigan’s widely tracked index shows U.S. consumer sentiment rose slightly in October.

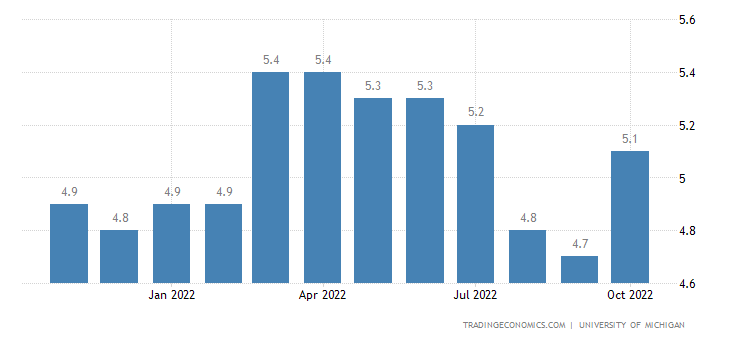

- …even as Americans’ year-ahead expectations for inflation rose.

- Blue-chip U.S. firms saw cash levels fall 14% in the second quarter due to impacts from rising inflation.

- Bloomberg economists predict the U.S. has a 100% chance to fall into recession within a year.

- Goldman Sachs plans to fold its biggest businesses into three divisions as part of a massive restructuring that would combine its flagship investment banking and trading units. The news comes after the bank’s third-quarter profit plummeted 43% as deal-making dried up.

- Bank of America posted a smaller-than-expected 9% drop in quarterly profit and said U.S. consumers are showing little weakness in the face of rising interest rates and high inflation.

- Johnson & Johnson beat Wall Street estimates for quarterly revenue and profit on healthy demand in its pharmaceuticals unit. The firm tightened its full-year profit forecast due to impacts from a stronger dollar.

- San Francisco’s return-to-office rates have been stuck around 40% of pre-pandemic levels, consistently ranking among the lowest of major U.S. metros.

- Microsoft is the latest tech company to announce layoffs.

- U.S. regulators asked Boeing to launch a review of its safety paperwork for the 737 MAX 7, another setback for the plane-maker’s push to win approval for the jet before a year-end legal deadline.

- Amazon’s latest Prime Day-like event appears to have fallen short of the company’s summer sale.

- Federal regulators say there is a shortage of the drug Adderall and its generic versions after ADHD prescriptions surged during two years of pandemic telehealth.

International Markets

- Britain’s ill-fated tax-cut plan was entirely scrapped on Monday, including provisions that would have supported energy costs for households and businesses.

- The U.S. and Britain will further cooperate to impose sanctions against Russia, officials said Monday.

- A majority of Canadian businesses expect slower sales growth and a likely recession within the next 12 months, according to surveys.

- China’s central bank kept interest rates unchanged for a second month on Monday, while the country’s major state-owned banks vowed to step up credit support to its slowing economy. Many economists inside China now believe a 5% annual GDP growth rate for the next 15 years will not be achievable as hoped for.

- Cash is leaving China’s financial markets at the fastest clip in years as investors flee the nation’s falling currency and sputtering economy.

- Foreign banks are accumulating U.S. dollar reserves in a sign of worry over a potential dollar funding crunch as the Federal Reserve shrinks its balance sheet and the globe tips toward recession.

- Officials say India’s central bank should pause interest-rate hikes to avoid stalling its economic rebound from the pandemic.

- Brazil’s economy is set to expand just 0.8% in 2023 compared to 2.7% this year, according to forecasts.

- Pilots at Lufthansa’s Eurowings began a three-day strike on Monday, disrupting travel for tens of thousands of European passengers.

- Lufthansa raised its full-year forecast after third-quarter revenue almost doubled from a year ago.

- Boeing is offering 737 MAX jets once slated for Chinese customers to Air India as China’s three-year ban on their deliveries stretches on.

- Vodafone and Altice are launching a joint venture to challenge Deutsche Telekom by building a $6.8 billion fiber broadband network in Germany.

Some sources linked are subscription services.