MH Daily Bulletin: October 17

News relevant to the plastics industry:

At M. Holland

- During M. Holland’s Plastics Reflections webinar last week, our panelists discussed the macroeconomic factors influencing global and domestic economies — including what it means for suppliers, distributors and manufacturers in the plastics industry. In case you missed it, click here to gain access to the full recording.

- M. Holland, in collaboration with LyondellBasell, will boost medical packaging manufacturers’ access to medical-grade resins and help ensure regulatory confidence for OEMs. Click here to read the full press release. A recent Plastics News article also highlighted the agreement.

Supply

- Oil plunged 3% Friday due to recessionary fears and weak global demand, especially in China.

- In mid-day trading today, WTI futures were up 0.1% at $86.37/bbl, Brent was up 0.1% at $92.38/bbl, and U.S. natural gas was down 7.3% at $5.97/MMBtu.

- Active U.S. drilling rigs rose by seven last week, with oil rigs now at their highest level of the pandemic.

- U.S. refiners are reportedly preparing for the White House to ban some fuel exports in a bid to control prices.

- The U.S. has the lowest seasonal inventory of diesel in data going back to 1982.

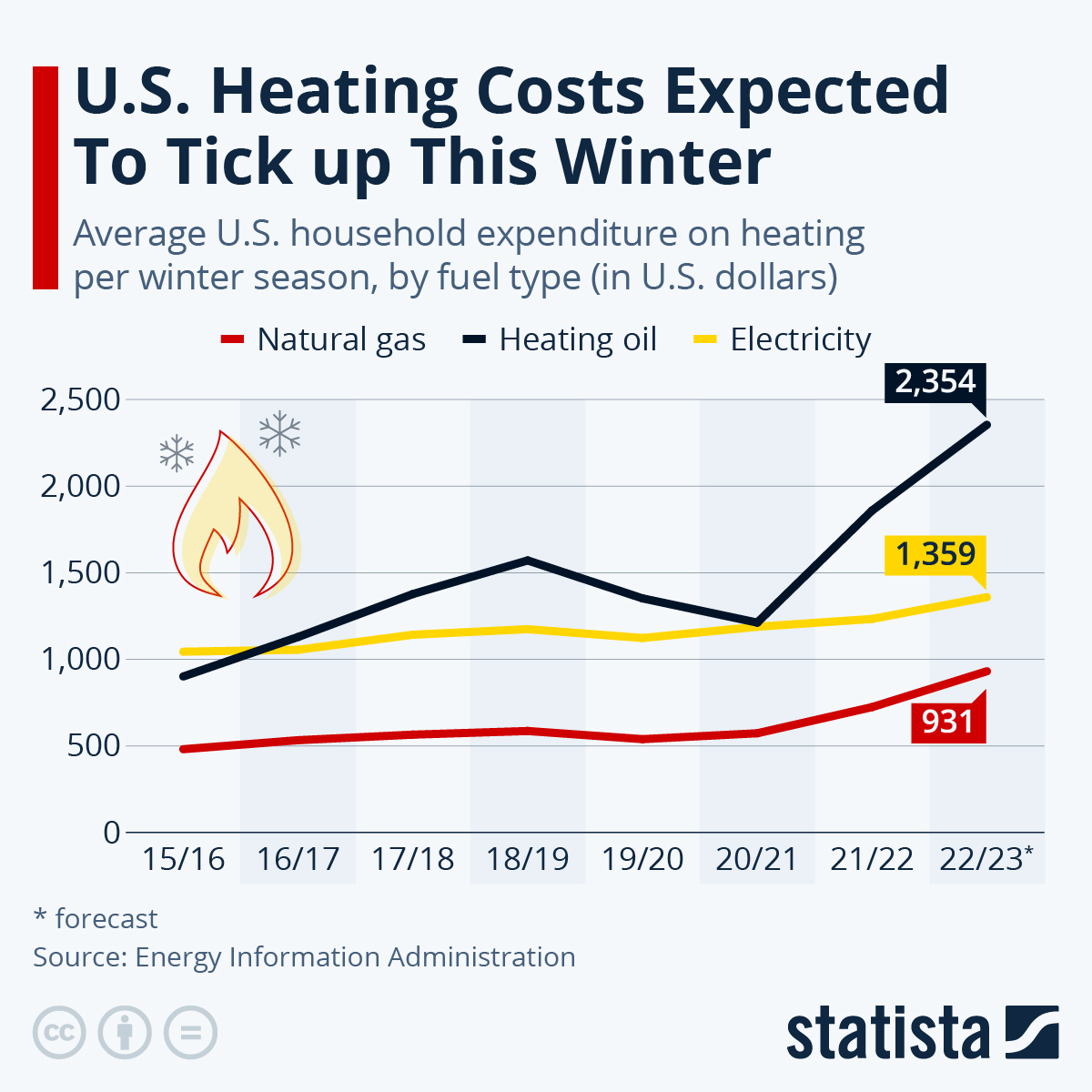

- Net U.S. gas bills were 33% higher in September than a year ago, while heating costs are poised to rise even more this winter.

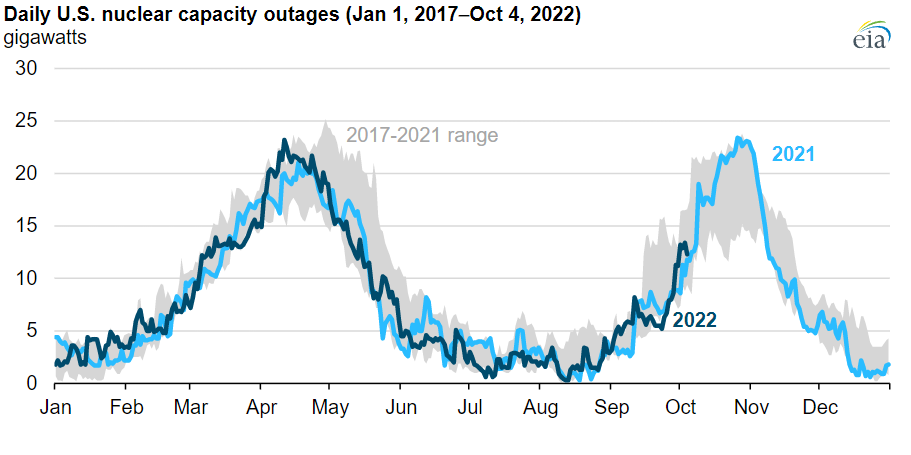

- Daily U.S. nuclear capacity outages averaged 2.5 GW this summer, 19% lower than 2021:

- A key union negotiating with TotalEnergies in France voted to continue striking over the weekend as nearly a third of the nation’s gas stations start to see supply problems. Other labor action has prevented at least five of France’s 18 nuclear sites from restarting.

- More oil and gas news related to the war in Europe:

- The deadline for a G7 price cap on Russian oil is Dec. 5, with the U.S. and major allies looking to release a draft plan by next month.

- Buying more gas from Norway and the U.S. has allowed Europe to fill its storage sites to over 90% capacity heading into winter.

- Gazprom says it will stop exporting Russian gas if G7 nations move to impose a price cap.

- Japan may extend the lifespan of its nuclear plants beyond their current 60 years in an effort to ease an energy crunch.

- Japan’s government says it will buy LNG this winter if private companies cannot afford it.

- Norway is beefing up security for energy infrastructure after a large drone was spotted flying over a gas processing plant on Friday.

Supply Chain

- The pandemic boom in warehouse demand is starting to slow as companies manage down high inventories, with average vacancy rates inching up from 3% to 3.2% in the third quarter.

- Slowing demand from the West is reducing Chinese exports and easing U.S. port congestion and container shortages after two years of historic disruption.

- Fewer than 100 container ships were awaiting berths at U.S. ports as of Friday, down 35% from the recent peak, with the biggest backlogs off Houston and Savannah.

- U.S. business inventories rose a lower-than-expected 0.8% in August but remained historically high, which could lead to a manufacturing slowdown in the coming year.

- Airfreight volumes out of the Asia-Pacific region were down 22% year over year at the start of October.

- U.S. railroads averaged 252,826 intermodal loads per week in September, down 4.8%, marking the seventh consecutive monthly decline in the past 15 months.

- A fifth rail union agreed to a tentative contract facilitated by a Presidential Emergency Board, leaving six left to ratify the agreement.

- U.S. barge rates are up about 200% year over year amid drought conditions on key waterways tied to the Mississippi River, drawing attention to the transportation mode that handles half of U.S. grains and soybeans for export.

- The jobs of dozens of senior executives at China’s largest chipmakers are in limbo due to tightened U.S. export rules that bar American citizens from supporting China’s advanced chip development.

- U.S. regulators will investigate units of Samsung, Qualcomm and TSMC over the use of semiconductor devices that may violate trade rules.

- In the latest news from the automotive industry:

- Tesla will not start mass production of battery cells at its German gigafactory until 2024 due to unexpected process issues.

- U.S. dealerships are raising concerns about Honda’s joint venture with Sony that would sell electric vehicles exclusively online starting in 2026.

- Hyundai will break ground this month on a $5.5 billion electric-vehicle and battery plant in Savannah, Georgia.

- Experts say the EU needs to boost regulatory incentives for its carmakers to scale up electric-vehicle production or risk losing market share to Chinese rivals.

- BMW will move production of its electric minis from the U.K. to China.

- Toilet paper supply chains are the latest to get hit by complications from sanctions on Russian exports.

- Delta Air Lines cargo revenue rose 27% in the third quarter to $240 million as overall profits fell to $695 million.

- Aircraft leasing company AerCap Holdings plans to buy up to 30 converted Airbus A321 freighters.

- Developers are building multi-story warehouses in Chicago and New York City.

- Britain’s Royal Mail could cut up to 10,000 jobs or more if strikes planned for the coming months go forward.

- Brazilian miner Vale and China’s Ningbo-Zhoushan port dropped a joint venture agreement to build a bulk terminal.

Domestic Markets

- The U.S. averaged 37,808 new COVID-19 infections last week, down from 41,855 the prior week. The virus case count is at its lowest since mid-April.

- Two Omicron subvariants — BQ.1 and BQ.1.1 — are spreading rapidly in the U.S. and now account for 10% of cases just a month after being detected.

- Nearly half of COVID-19 patients take months to fully recover.

- Booster doses of Omicron-tailored COVID-19 shots could help prevent infection with viral strains that don’t yet exist, according to new research.

- Overall U.S. retail sales were unchanged from August to September as food prices rose and gasoline and furniture prices fell.

- Economists say the U.S. has a 63% chance of a recession in the next 12 months, up from a 49% estimate made in July.

- U.S. import prices dropped 1.2% in September, the third month of declines led by fuel products.

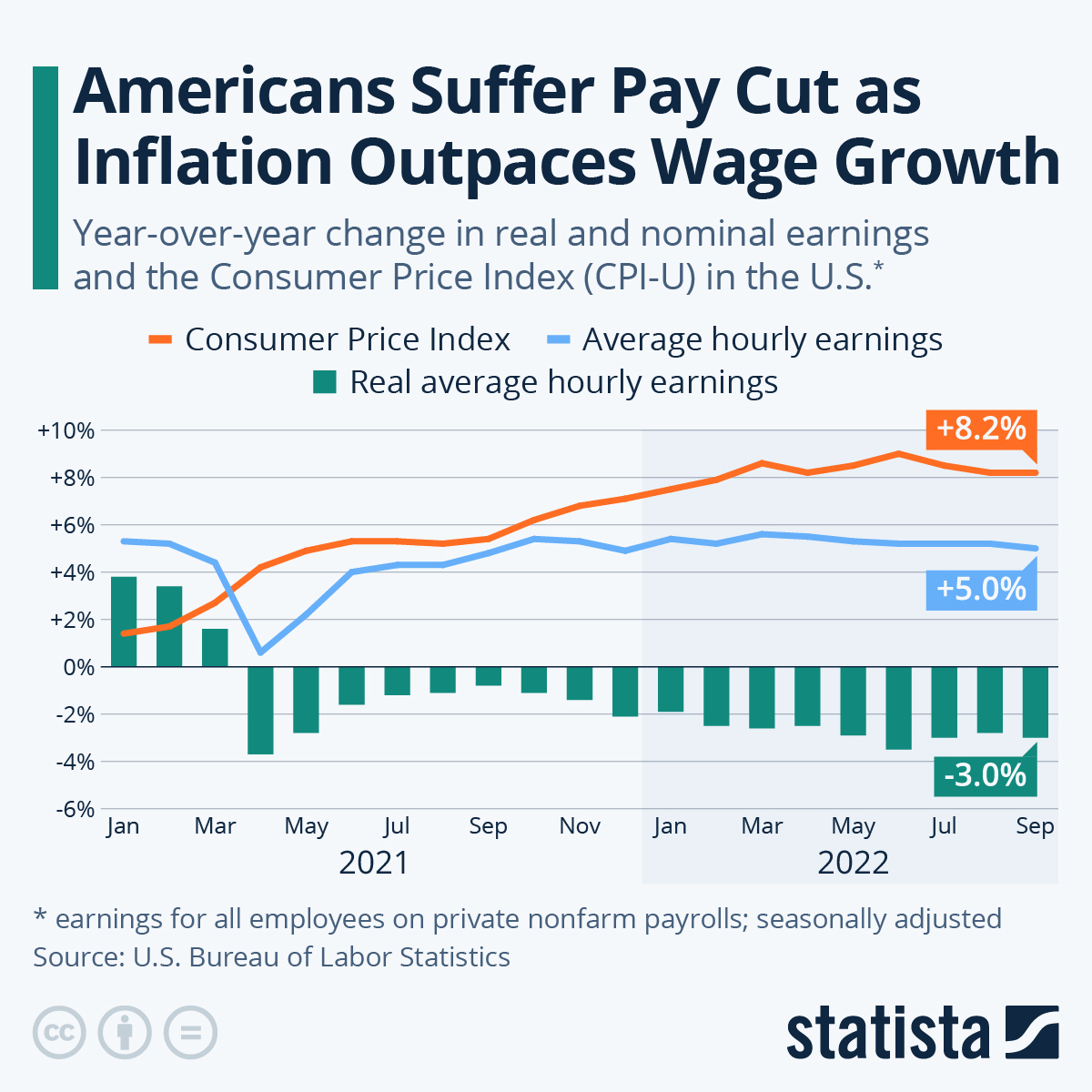

- Inflation has now been outpacing U.S. wage growth for 1.5 years, meaning real wages have persistently declined despite gains on paper.

- U.S. equity funds saw their third week of outflows as stocks were hit by concerns over a recession.

- JPMorgan Chase and Citigroup posted better-than-expected quarterly revenue despite steep declines in investment banking activity. Morgan Stanley and Wells Fargo saw slumps of over 30% in quarterly profit.

- Quarterly sales at industrial parts supplier Fastenal rose 16%, but its rate of growth slowed on softness in consumer and construction markets.

- Health insurer UnitedHealth raised its annual profit forecast for the third time as the direct impact of COVID-19 begins to ease.

- Kroger announced plans to acquire rival grocer Albertsons in a $25 billion deal, a mega merger likely to be intensely scrutinized by U.S. antitrust regulators.

- Beyond Meat will cut hundreds of jobs this year due to slowing demand for faux meat as consumers look for cheaper options.

- Honeywell lifted its outlook for business jet deliveries over the next decade after the pandemic spawned a wave of first-time users to the private flying market.

- Value retail stores captured 22.4% of U.S. apparel spending last year, up from 19.1% in 2014 as shoppers become more sensitive to prices.

- Fashion retailer Forever 21 plans to open 14 stores in the U.S. this year.

- Apple retail workers voted to form a union at an Oklahoma location, the tech giant’s second U.S. store to organize.

International Markets

- COVID-19 hospitalizations are on the rise in Canada, where current levels are more than double the same time last year.

- German health officials say the country should step up COVID-19 protections as new cases rise ahead of winter.

- Moderna and GAVI, a coalition dedicated to providing COVID-19 vaccines to developing countries, agreed to cancel remaining orders due to sufficient existing supplies.

- China’s government reaffirmed its commitment to its zero COVID-19 strategy, which has caused deep economic damage and societal disruption.

- Economies representing more than a third of global output will contract next year, while the world’s three largest economies — the U.S., EU and China — will essentially stall, the IMF says.

- Top Chinese officials say they are preparing for lower rates of economic growth as they seek to manage longer-term risks to the economy. China unexpectedly delayed the release of its latest GDP data on Monday without explanation.

- China’s inflation hit a 29-month high of 2.8% in September, driven mainly by food prices.

- The British pound and bonds continued to rally after the new chancellor of the Exchequer further backtracked on the administration’s ill-fated plan to cut taxes.

- Goldman Sachs downgraded Britain’s economic outlook after officials reversed a freeze on some corporate taxes.

- Canadian officials signaled they will stay aggressive on raising interest rates due to the U.S. dollar’s rising strength.

- Argentina’s central bank is set to hold its benchmark interest rate steady at 75%, breaking a tightening cycle in place since the start of the year.

- French food company Danone will shed control of its dairy business in Russia that could lead to a $978 million write-off.

- Pilots at Lufthansa’s budget Eurowings airline will strike for three days starting today over a pay dispute.

- LATAM Airlines, the biggest carrier in Latin America, plans to conclude its exit from bankruptcy in the first week of November.

- Japanese wholesale prices rose 9.7% in September, the most in five months, putting pressure on business profits.

- India’s retail inflation rate likely peaked in September at 7.41%, analysts say.

- Canadian mergers-and-acquisitions deals in the third quarter dropped 52% to $37 billion, the lowest since 2020, as volatile stock markets and rising borrowing costs spooked sentiment for dealmaking.

- Local Chinese governments have begun buying up homes in bulk to prop up the nation’s ailing real estate market, as new data shows the central government’s massive stimulus is failing to spark housing demand.

- The Bahamas is putting price control measures on 38 staple goods as it seeks to help households brave mounting inflation.

- A Brazilian court fined Apple $19 million and ruled that its iPhones must come equipped with battery chargers.

- Qantas Airways surprised markets with a stronger-than-expected profit forecast that underscores how some Asian airlines are recovering sharply from the pandemic.

- Europe’s largest airlines say demand for travel is holding up, calming worries that inflation could stall aviation’s recovery from the pandemic.

- IKEA reported record-high annual sales of $43.3 billion.

- British officials say the use of cheap carbon offsets could reduce the need for companies to truly reduce emissions and slow the delivery of climate goals.

Some sources linked are subscription services.