MH Daily Bulletin: October 5

News relevant to the plastics industry:

At M. Holland

- Plastics News interviewed experts at M. Holland about how material and chemical suppliers are working to meet automotive OEM demands for both electric and internal combustion vehicles amid an ongoing market shift. Click here to read the article!

- M. Holland is a Gold Sponsor of the SPE Automotive TPO Engineered Polyolefins Global Conference happening this week in Troy, Michigan. If you’re planning to attend, please stop by M. Holland’s booth to meet our Automotive team!

- We are sponsoring MAPP’s Benchmarking & Best Practices Conference in Indianapolis on Oct. 5-7! If you’re planning to attend, don’t forget to stop by M. Holland’s booth and tune in for our session featuring Debbie Prenatt, Market Manager, Sustainability. Click here to read more.

- Come see us at the IWCS Cable & Connectivity Industry Forum in Providence, Rhode Island, on Oct. 10-13! M. Holland is a Gold Sponsor. If you are attending, please stop by Booth #113 to discuss our materials and offerings serving the wire and cable market.

- At our Plastics Reflections Web Series event on Oct. 13, M. Holland will host panelists from Maersk and Bank of America to discuss the macroeconomic factors influencing global and domestic economies, including impacts on the plastics industry. Click here to register!

- M. Holland’s latest press release features our post-consumer recycled (PCR) resins, which are cleaner and easier to color, enabling brand owners and OEMs to meet aggressive sustainability goals. Click here to read the full press release.

Supply

- The OPEC+ consortium agreed at its meeting today to cut output by 2 million bpd in November.

- In mid-morning trading, WTI futures were up 1.0% at $87.42/bbl, Brent was up 1.2% at $92.85/bbl, and U.S. natural gas was up 0.9% at $6.90/MMBtu.

- U.S. crude inventories unexpectedly fell by 1.77 million barrels last week, according to the American Petroleum Institute. Government data is due today.

- Refinery outages in the U.S. West and Midwest raised the national average price of gasoline by 7 cents last week despite 60% of states seeing a weekly drop in price.

- Exxon Mobil and oil trade groups published a joint letter expressing concern the federal government may try to limit fuel exports to control domestic prices.

- Exxon Mobil says third-quarter operating profit will be strong but well below its all-time high of $17.9 billion in the second quarter.

- More oil news related to the war in Europe:

- European natural gas prices are down 50% from late-August highs as mild weather and ample stockpiles ease concerns about shortages.

- Future price caps on Russian oil may be complicated by slightly different plans proposed by the EU and the U.S.-led Group of Seven, although European officials say the plans would work in tandem. Under both schemes, sanctions would begin Dec. 5.

- European industry’s planned cuts of up to 30% of gas use this winter should keep the continent from energy disaster, analysts say.

- Germany’s largest power-grid operator says it could restrict electricity exports this winter to avoid blackouts.

- Germany is facing criticism for unilaterally creating nearly $200 billion in subsidies for its domestic energy industry.

- Fears are rising that Moscow will attack Ukraine’s energy infrastructure this winter, as Ukrainian officials urge people to stock up on firewood and generators.

- Russia may soon cut off gas supplies to Moldova over a payment dispute.

- Turkey is asking Russia to delay a portion of its payments due for natural gas.

- Mexico could face punitive tariffs under the USMCA trade pact amid an escalating dispute over its alleged prioritization of state energy firms.

- Germany’s largest power producer RWE is moving up its coal phase-out by eight years to 2030.

- The U.S. is asking the Democratic Republic of Congo to withdraw some of the 30 oil blocks it recently put up for auction in order to protect Congolian rainforests, the world’s only major rainforests that absorb more carbon than they emit.

- A California-based recycler says it can inexpensively extract 95% of high-value material in old solar panels for recycling.

Supply Chain

- In extreme weather news:

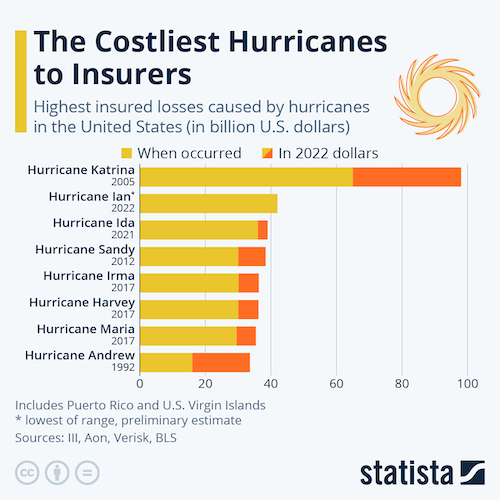

- Hurricane Ian’s death toll reached 103 on Tuesday, while 391,000 Florida homes and businesses remained without power.

- Hurricane Ian could be the second most expensive storm by insured monetary losses in U.S. history.

- Canada is establishing a $220 million fund to help its Atlantic provinces recover from the destruction of Hurricane Fiona last month.

- Workers at South Africa’s state-owned logistics firm Transnet will strike this Thursday over a wage dispute, halting exports of key minerals and other cargo.

- Striking dockworkers at the U.K.’s Port of Liverpool are planning a second seven-day walkout this month.

- Workers with Britain’s Royal Mail service plan to strike 19 days over the next two months.

- Container capacity on the Pacific fell 13% in September as carriers scrapped dozens of scheduled sailings.

- The Port of New York and New Jersey is moving ahead with rules and fees meant to quickly move empty containers to make room for imports.

- Charter rates for LNG carriers are soaring amid a global shortage of ships. Rates could double to over $1 million a day in the fourth quarter, analysts warn.

- Spot rates on some air cargo routes out of Asia have fallen below long-term contract levels.

- LAX is planning a major modernization of its aging cargo facilities, including a replacement of most existing infrastructure.

- Growing stockpiles of slow moving inventory among large companies is squeezing smaller companies out of warehouse space.

- U.S. chipmaker Micron plans to invest up to $100 billion over the next 20 years to build the nation’s largest chip manufacturing complex in upstate New York.

- European lawmakers approved a first-of-its-kind requirement that electronic devices use a single charging port, sending shares in European semiconductor makers sharply upward. The move will force Apple to change chargers for its European iPhones by autumn 2024.

- Of Apple’s more than 180 suppliers, 48 had manufacturing sites in the U.S. as of last September, up from just 25 a year earlier, as the tech giant builds out operations in California.

- Amazon is halting hiring in its core retail division through the end of the year.

- Boeing signaled it would not meet a December deadline to win regulatory approval for its 737 MAX 10 jets, potentially delaying the aircraft’s entry into service by a significant period of time.

- Plane-makers will at best reach 90% of production targets this year due to skilled staffing shortages, according to the head of the world’s largest aircraft lessor.

- Australian miner BHP, the world’s largest shipper of dry bulk commodities, is getting three more LNG-powered carriers in the coming months as part of long-term plans to slash shipping emissions.

- In the latest news from the auto industry:

- Ford’s U.S. sales fell 9% in September on a sharp decline in truck purchases. Quarterly sales were up, including a tripling of electric vehicle sales.

- Rivian Automotive says it is on track to meet full-year production targets after making a record 6,584 deliveries in the third quarter.

- New electric vehicle tax breaks in the U.S. are riling key allies in Asia and Europe who allege the rules unfairly leave out foreign automakers.

- German car rental firm Sixt plans to buy 100,000 electric vehicles from China’s BYD in the coming years.

- Walmart’s white-label delivery service GoLocal is now shipping from over 5,000 retail and business sites, surpassing its year-end goals.

- Texas-based trucker Lone Star Dedicated is shutting down after 12 years of operation due to surging costs.

- U.S. butter prices are 80% higher than a year ago.

- More U.S. fast-food chains are beginning to use robots to automate certain processes like fry cooking.

Domestic Markets

- The U.S. reported 42,355 new COVID-19 infections and 542 virus fatalities Tuesday.

- Adults with disabilities are rejoining the U.S. workforce at a quickening pace due to widespread remote-work options.

- Almost one-third of survey respondents say they are willing to quit their jobs or start looking for a new one if forced to return to the office full-time. Office occupancy rates have stalled at around 47% in major metropolitan areas.

- Facebook parent Meta plans to shrink some of its offices as many employees continue working from home.

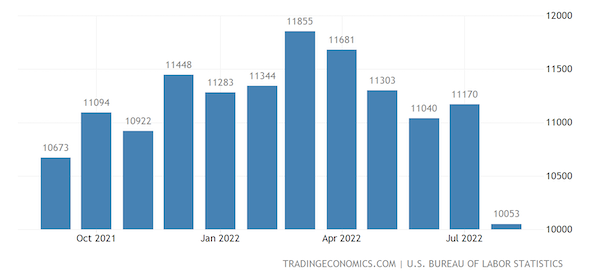

- Despite a 10% drop in U.S. job openings in August, employees continued to switch jobs at a high rate:

- Real wages for a majority of U.S. workers have declined 8.5% when factoring for inflation, according to the Dallas Fed.

- Ninety-one percent of 400 large-company CEOs surveyed expect a recession in the U.S. in the next 12 months.

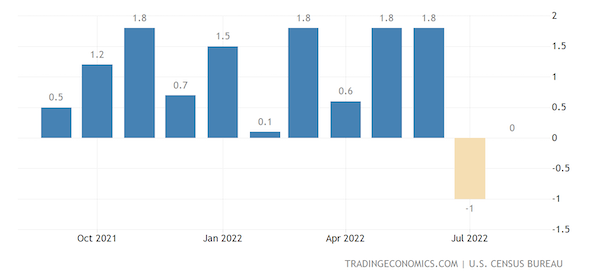

- New orders for U.S.-manufactured goods were flat in August:

- Manhattan co-op and condo sales dropped 3.7% in the third quarter and more than 18% from a year ago amid a housing market cooldown.

- NYC office leasing rose 27.6% in the third quarter, the strongest quarterly gain since 2019.

- Top U.S. MBA programs are seeing enrollment fall over 10% as potential students choose to stay in the workforce.

- Hasbro lowered its full-year outlook and warned third-quarter revenue likely fell 15% due to impacts of inflation and currency fluctuations.

- Bayer has won five consecutive lawsuits targeting its Roundup weedkiller, a shift in momentum after the firm set aside $16 billion for settlements.

International Markets

- COVID-19 cases in France are back above 45,000 a day, the highest level since early August.

- The WTO lowered its forecast for growth in global trade volumes from 3.4% to just 1% in 2023 due to surging energy costs and inflation.

- The World Bank says countries in eastern Europe and Central Asia will return to modest growth in 2023 while Europe will likely see recession due to the impending cutoff in Russian energy supplies.

- Euro zone producer prices rose a greater-than-expected 5% from July to August, driven mainly by energy costs.

- Thousands of businesses across the U.K. are at significant risk of closure due to soaring inflation, analysts say.

- The currency values of Mexico and Brazil are up against the U.S. dollar this year, an unusually resilient performance after Latin America’s largest economies took quicker steps than the U.S. to tackle inflation.

- Spain may extend windfall taxes on banks and energy firms beyond the next two years to help ease cost-of-living pressures.

- Turkey’s foreign trade deficit widened by almost 300% year over year in September due to surging energy costs.

- Tourism in Mediterranean countries is approaching pre-pandemic levels, while tourist spending rises even faster.

- Ryanair flew 15.9 million passengers in September, up 13% over pre-pandemic levels for its third-busiest month on record.

- Ryanair’s Spanish cabin crews plan to strike from Monday to Thursday every week until January to press demands for better pay and conditions.

- Pilots at Lufthansa’s budget airline Eurowings will go on strike Thursday after contract talks failed.

- European airports say it could cost $7 billion to upgrade facilities to meet resurgent travel demand.

Some sources linked are subscription services.