MH Daily Bulletin: September 12

News relevant to the plastics industry:

At M. Holland

- M. Holland has announced expanded access to 3D printing filaments from Braskem, a global chemical company, providing clients with access to polyethylene (PE) and glass fiber reinforced polypropylene (PP) filaments. Click here to read the full press release.

- Are you attending the North American Detroit Auto Show this week? We invite you to join our networking reception at the Detroit Athletic Club on Thursday, Sept. 15 at 4 pm. To RSVP for our reception or set up a meeting with our Automotive team, please contact Mike Gumbko, Strategic Account Manager.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices rose about 4% last Friday but ended the week slightly lower for the second week in a row.

- In mid-morning trading today, WTI futures were up 1.9% at $88.43/bbl, Brent was up 1.8% at $94.51/bbl, and U.S. natural gas was up 3.0% at $8.24/MMBtu.

- Active U.S. oil and gas rigs fell by one last week to 759, down for the fifth out of the last six weeks. Active oil rigs fell to a two-month low.

- The U.S. administration walked back comments suggesting it could release more strategic crude reserves beyond the 180 million barrels originally planned.

- Texas saw a 25% surge in tax revenue for the 2022 fiscal year, led by inflows from the oil and gas industry.

- Power prices in Europe dipped today on rising output from nuclear and renewable sources.

- Defying expectations, global coal-fired power generation declined in the first half of the year, despite the energy crisis.

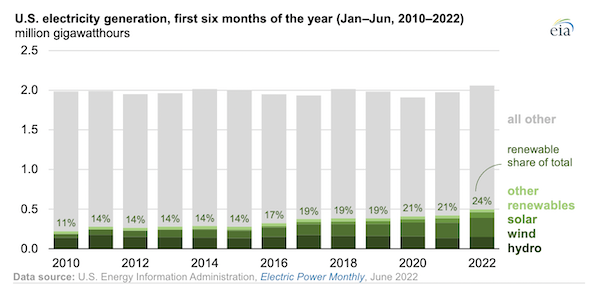

- Almost 24% of U.S. electricity came from renewables in the first half of 2022, up from 21% the same time last year:

- More oil news related to the war in Europe:

- Operations at the Russian-held Zaporizhzhia nuclear plant in Ukraine have been fully halted as shelling continues to spark fears of a nuclear disaster.

- Meeting late last week, EU energy ministers failed to agree on mandates for member nations to reduce energy demand this winter. Countries are now being urged to develop strategies to reduce consumption by at least 10%.

- The U.S. Treasury Department issued guidance for navigating the expected labyrinth of newly formed companies and abnormal shipping routes that could arise when Russian oil prices are capped by the West.

- The European Central Bank has refused to give short-term financing to energy firms facing significant margin calls, which could total as high as $1.5 trillion following wild swings in power and gas prices.

- Natural-gas and electricity prices have jumped by about a quarter since Russia shut down the Nord Stream pipeline to Germany.

- Germany is considering direct intervention in its energy market to avoid a wave of insolvencies and soaring gas prices, key lawmakers said.

- Russian gas giant Gazprom is poised to rake in around $100 billion in revenue this year, some 85% higher than 2021.

- German energy providers are signing more long-term LNG contracts to avoid future shortages, a potential roadblock to meeting the nation’s environmental targets.

- Many European companies face an existential threat due to the cutoff of Russian gas, possibly ushering in a permanent restructuring of industry on the continent.

- Regulatory uncertainty is delaying a number of green hydrogen projects slated for Europe.

- British Columbia, Canada, is rationing water to the oil and gas industry in response to persistent drought.

- China’s silicon industry group stopped releasing prices of key solar material polysilicon as rising supply chain costs “shock” the stability of the solar industry, the group said.

Supply Chain

- U.S. railroad and union negotiators worked through the weekend to secure new contracts for roughly 90,000 unionized workers who have yet to reach agreement. With a September 17 walkout deadline looming, some rail lines are warning of potential service disruptions and a trade group is predicting a strike could cost the economy $2 billion a day.

- Dutch rail unions reached a deal with employers to boost pay, ending strikes that disrupted service for much of the past several weeks.

- Workers at Britain’s port of Liverpool are planning a two-week walkout next Monday, Sept. 19, over a wage dispute.

- The cost to ship a 40-foot container from China to the U.S. West Coast has fallen 60% since January to about $5,400 a box, according to the Freightos Baltic Index. Asia-to-Europe rates are down some 42% over the same period.

- Earnings for computer-chip related companies in the S&P 500 are projected to be flat in 2023, down from expectations of 12% growth just three months ago.

- Online sales are poised to rise 9.4% this year to $1 trillion, the first time growth has slipped into the single digits as inflation-weary consumers curb their spending.

- With California’s electricity usage poised to rise 18% by 2030, analysts question how the state’s power grid — already reeling from the strains of high temperatures — will keep up.

- India pushed back bidding in the privatization of the Shipping Corporation of India until the first quarter of 2023.

- A New York shipper is seeking $180 million from Maersk in a complaint alleging the carrier rejected contracted loads in favor of spot-market customers.

- In the latest news from the auto industry:

- Ford’s U.S. sales rose 27% in August in a rebound from production shortages last year.

- Volvo resumed production in Chengdu, China, for the first time in a week on Friday even as the city remains under lockdown.

- Volkswagen is boosting incentives for workers at its main plant in Mexico in a bid to speed up progress on new labor contracts and avoid a strike.

- Unionized workers at a Stellantis plant in Indiana walked off the job Saturday over working conditions.

- Vietnamese carmaker VinFast delivered its first electric SUVs last week, with U.S. shipments expected to begin in October.

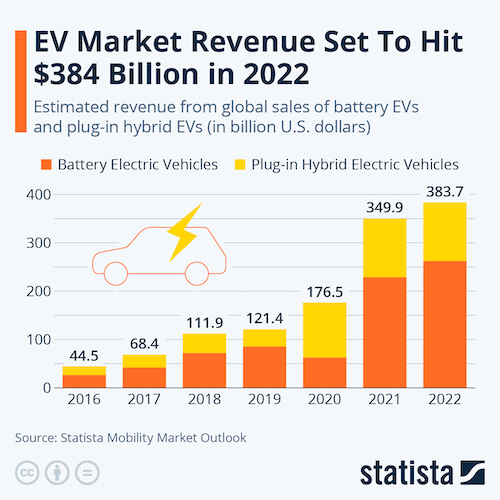

- Global sales of electric and plug-in hybrid vehicles will hit $384 billion this year and more than double to $869 billion by 2027, according to projections.

- GM’s CEO said the semiconductor shortage hampering the industry could last well into next year and perhaps beyond.

- Amazon acquired Cloostermans, a warehouse-robot firm based in Belgium, as the e-commerce giant expands its automated logistics.

- Amazon has called off or pushed back opening 66 delivery stations since announcing a pause on its U.S. warehouse expansion earlier this year.

- Despite slowing sales, major retailers continue to step up their technology investments.

- Deere soon expects 10% of its revenue to come from software fees as the world’s largest farm equipment maker targets autonomous tech for tractors and other tools.

- Rolls-Royce pulled its bid to make engines for Boom Technology’s supersonic jets, saying the supersonic market is not a priority.

- High temperatures in the Western U.S. continue to hit the produce industry, damaging crops and leaving fewer products on grocery shelves. Water cuts in California have had a particularly harsh effect on rice yields.

Domestic Markets

- The U.S. reported 67,400 new COVID-19 infections and 318 virus fatalities Sunday. With deaths averaging around 320 per day, COVID-19 is on pace to remain the country’s third-leading cause of death this year.

- Some Florida communities are seeing a sharp uptick in COVID-19 cases caused by the BA.2.75 subvariant, nicknamed “Centaurus.”

- More companies are quietly dropping their COVID-19 vaccine mandates as fast-spreading subvariants complicate the landscape for which shots are needed and when.

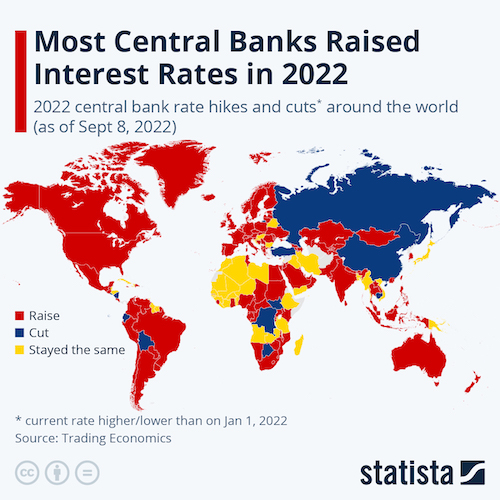

- August inflation data due this week will provide insight about whether the Federal Reserve will raise rates by an expected 75 basis points for the third straight month when it meets on Sept. 20.

- This month, the Federal Reserve will nearly double the pace of its monetary tightening as it sheds much of the $9 trillion in assets it accumulated during the pandemic, a historic unwinding of central bank assets.

- U.S. household spending jumped more than twice as fast as incomes last year as consumers splurged on food and entertainment after lockdowns were eased.

- Investment banks are set to make a record $20 billion trading and financing commodities this year, more than triple pre-pandemic levels.

- COVID-19 infections are suppressing the U.S. labor force by about 500,000 workers.

- The U.S. government expects to issue all the extra employment-based green cards issued this fiscal year by the end of the month, averting the risk of letting thousands go to waste for the second year in a row.

- Excluding fuel, sales at Kroger grew 5.8% in the latest quarter, prompting the grocer to raise its full-year guidance as more shoppers buy groceries to save money on dining out.

- A federal labor official concluded the union victory by labor organizers at an Amazon facility in New York should be upheld.

- Hollywood movies earned just $3.43 billion in North American theaters this summer, 21% lower than pre-pandemic levels.

International Markets

- China indefinitely extended its COVID-19 lockdown in Chengdu, the western industrial hub of 21 million people. Hundreds of thousands in smaller cities are also under lockdown, such as in the Xinjiang region, where food and medical supplies are running short. In Beijing, authorities are imposing school lockdowns after the emergence of COVID-19 clusters from students returning from holidays.

- Japan plans to end its 50,000-person daily limit on overseas arrivals by October.

- Hong Kong scrapped its three-day quarantine requirement for air crews Saturday, an easing of some of the strictest restrictions on in-flight personnel in the world. Cathay Pacific, the island’s flagship carrier, said it will gradually increase flying capacity in the coming months.

- New Zealand dropped most of its remaining pandemic restrictions.

- EU policymakers are convinced the bloc’s central bank will need to raise its key interest rate past 2% to start curbing record-high inflation, despite a likely recession.

- Money managers yanked $3.4 billion from European stock funds last week, taking total outflows in the past six months to $83 billion as the continent’s energy crisis makes investors wary.

- Ukraine’s inflation rate spiked by 23.8% in August, its seventh rise in a row.

- Canada’s jobless rate unexpectedly jumped for a third month in August, a potential sign that interest-rate hikes have started to cool the tight labor market.

- Economists believe Argentina’s yearly inflation rate will top 95%, as the country struggles to overcome a prolonged economic crisis.

- The International Monetary Fund is stepping up bailout efforts for financially distressed developing nations, helping to avert a potential default crisis.

Some sources linked are subscription services.