MH Daily Bulletin: September 9

News relevant to the plastics industry:

At M. Holland

- M. Holland has announced expanded access to 3D printing filaments from Braskem, a global chemical company, providing clients with access to polyethylene (PE) and glass fiber reinforced polypropylene (PP) filaments. Click here to read the full press release.

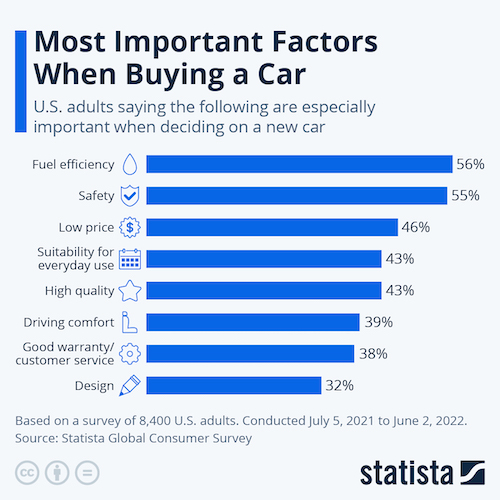

- M. Holland will be attending the North American Detroit Auto Show on Sept. 14-15. This annual showcase for emerging automotive technologies will be held at Huntington Place in Detroit, Michigan. If you’re attending, please RSVP for M. Holland’s reception or contact Mike Gumbko, Strategic Account Manager, to set up a meeting with our Automotive team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil rose 1% Thursday as traders bought into the recent dip in prices.

- Oil futures, on pace for their second consecutive week of declines, were higher in mid-morning trading today, with WTI up 2.9% at $85.98/bbl and Brent up 2.8% at $91.67/bbl. U.S. natural gas was up 0.5% at $7.96/MMBtu.

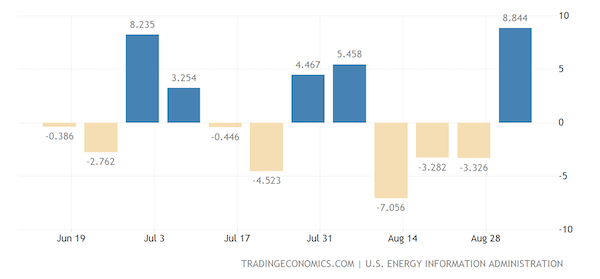

- U.S. crude stockpiles surged by almost 9 million barrels last week on a new release from strategic reserves, according to the EIA.

- The U.S. administration is considering releasing more crude from strategic reserves after the current program ends in October.

- Global coal-fired power generation fell in the first half of 2022 on lower demand from locked-down China. Renewable power generation rose 17%, led by the U.S. and China.

- Employment in the global energy sector has surpassed pre-pandemic levels, primarily due to hiring in clean energy.

- 2022 could be the first down year in more than a decade for new corporate procurement of clean energy due to spiking costs and supply issues.

- Nigerian oil workers are threatening to strike over widespread theft that has slashed the nation’s exports by hundreds of thousands of barrels.

- More oil news related to the war in Europe:

- A number of EU member nations oppose the bloc’s plan to impose a price cap on Russian gas, fearing Russia will halt all shipments to Europe in retaliation.

- EU officials are meeting today to discuss emergency measures to avoid social and economic upheaval during energy shortages this winter.

- Energy-starved utilities in Europe have taken to indefinitely holding LNG shipments on vessels as onshore terminals max out their storage capacity.

- Two floating LNG terminals are setting up in a Dutch port, the first in a wave of specialized tankers that Europe is hoping will ease its energy crunch.

- EU officials say winter gas shortages could last for the next three years due to LNG bottlenecks.

- Almost 50% of Guyana’s oil shipments have gone to Europe this year, more than triple the level from 2021.

- Britain will cap consumer energy bills for two years and funnel billions to prop up power companies under a plan unveiled Thursday by the nation’s new government.

- Hungarian officials say rising energy bills will lead to the collapse of small business and mass unemployment.

- Solar panels produced 12% of Europe’s electricity in the second quarter, a record that saved the bloc over $30 billion in equivalent gas costs.

- France’s first offshore wind farm will start up by the end of this year and bring enough power to handle 700,000 homes in the western part of the country.

- India increased its Russian oil imports from 2% pre-invasion to about 12%-15% now, according to traders.

Supply Chain

- California’s power grid is under its fifth day of a heat-induced emergency as households and businesses are urged to reduce consumption to avoid blackouts. Punishing heat is also raising the risk of wildfires, leading at least one utility to warn of planned outages through the weekend.

- Oregon could shut off power to tens of thousands of people this weekend due the extreme wildfire danger from excessive heat.

- Hurricane Kay weakened into a tropical storm on Mexico’s Pacific coast Thursday but could still cause heavy rains and flooding along the Baja California peninsula and northwestern Mexico through Saturday.

- Europe this year saw its hottest summer since data going back to 1991, breaking temperature records across the continent and causing wildfires to surge in France and Spain.

- With a Sept. 16 contract deadline looming, new research suggests a U.S. railroad strike could cost the national economy over $2 billion per day in output while threatening supplies of food and fuel.

- HSBC forecasts an 80% slide in container line earnings over the next two years on rising capacity and declining demand.

- Container shipping rates from Hong Kong to Los Angeles fell another 18.1% last week to around $4,000 per 40-foot container, approaching the break-even point for large carriers.

- The ISM’s index for supplier deliveries hit 55.1 in August, a positive signal indicating that delivery times expanded at their slowest rate of the pandemic.

- The Baltic Dry Index, a widely tracked gauge of dry-bulk shipping rates, is poised to fall between 20%-30% this year as goods trading sinks on lower demand.

- The global freight brokerage market will nearly double within a decade to $91 billion in revenue, according to a new report from Allied Market Research.

- Germany’s government has agreed to sell the Schenker logistics business of rail operator Deutsche Bahn in a rumored $20 billion deal.

- In the latest news from the auto industry:

- Tesla is in talks to build a lithium refinery on the Gulf coast of Texas, the first of its kind in North America, according to reports.

- GM says its all-electric Equinox will start at $30,000 MSRP next year, a price level many automakers haven’t achieved due to high production costs. Sales will begin with higher-end trims assembled in Mexico.

- Rivian is working with Mercedes-Benz to build a new European factory to make both companies’ electric vans.

- Chinese electric-vehicle-maker BYD signed a deal to build its first manufacturing plant in Thailand, which could produce 150,000 vehicles annually by 2024.

- Tesla has tripled deliveries of cars made at its Shanghai factory after upgrades to the plant were completed in July.

- Jeep announced plans to launch four all-electric SUVs by 2025 in a bid to lead the electric off-road market.

- GM is launching a direct-to-consumer sales channel for premium electric vehicles in China, targeting wealthy consumers with niche U.S. imports.

- Volkswagen’s new CEO endorsed an ambitious electric vehicle strategy, but said traditional combustion engines could also play a role in the company’s plans.

- German auto supplier Bosch will spend more than $200 million to build fuel cells for electric heavy trucks in South Carolina.

- Brazilian workers at Mercedes-Benz began striking Thursday after the automaker announced plans to lay off over 3,600 employees in Sao Paulo.

- Drone-maker Matternet received the first-ever non-military FAA certification for its unmanned machines this week, a milestone for the commercial drone market.

- Airbus revoked all 19 remaining A350 orders from Qatar Airways as a contractual dispute escalates between the two firms.

- South Korea is doling out $6.6 million to the country’s small and medium-size enterprises to encourage exports.

- India, the world’s biggest rice shipper, imposed a 20% tax on some exports in an effort to secure domestic supply after reduced planting this year.

Domestic Markets

- The U.S. reported 70,488 new COVID-19 infections and 313 virus fatalities Thursday.

- The annual U.S. COVID-19 vaccine market could be between $5 billion and $13 billion in the future, according to Moderna.

- The emerging BA.4.6 subvariant of Omicron could evade the only known COVID-19 treatment for immunocompromised people, according to new research.

- COVID-19 proteins that linger in the body could be a root cause of long-COVID symptoms, a new study says. Research also suggests those who felt stressed or anxious about COVID-19 before getting infected were more likely to see lengthy symptoms.

- Amazon has no plan to bring corporate employees back to the office full-time, its chief executive said.

- Initial U.S. jobless claims, a proxy for layoffs, fell to 222,000 last week, the fourth week of declines and the lowest level in three months, signaling continued tightness in the labor market.

- The U.S. Treasury Secretary said falling gasoline prices may put further downward pressure on August’s inflation numbers due to be released next Tuesday.

- U.S. banks reported $64.4 billion in profits in the second quarter, about 8.5% below a year ago.

- The average U.S. mortgage rate rose for the third week in a row this week, approaching 6%, the highest level since 2008.

- San Francisco home prices tumbled 7% last month as soaring interest rates and an exodus of tech workers battered demand in one of the most expensive U.S. housing markets.

- United Airlines invested $15 million in electric-air-taxi maker Eve Air Mobility, its second investment in an air taxi producer in as many months.

- Uber Eats is expanding its use of autonomous, driverless delivery vehicles in Houston, Texas, and Mountain View, California, this year.

- Macy’s expects another early start to the holiday shopping season this year even though supply-chain issues show signs of easing and store shelves are adequately stocked, executives said.

- Faring better than rivals during the pandemic, T-Mobile announced a $14 billion share buyback program that will run to next September.

International Markets

- Lockdowns were extended in China’s Chengdu city Thursday, the nation’s largest metropolis to be hit with curbs since Shanghai in April and May. Travel was restricted for millions more in other parts of China as daily COVID-19 cases topped 1,200.

- Kids as young as age 5 will be banned from public venues in Hong Kong unless they are vaccinated against COVID-19, authorities said on Thursday.

- A new study estimates that nearly 8 million children globally have lost a parent or primary caregiver during the pandemic.

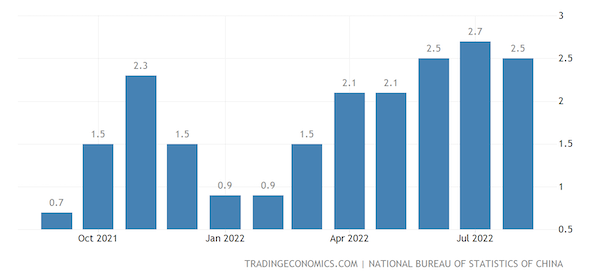

- China’s consumer prices rose a slower-than-expected 2.5% year over year in August, while producer inflation eased to 2.3%, its lowest in 18 months.

- Ukraine’s GDP plummeted by 37% in the second quarter, new data shows.

- Germany’s leading economic institutes lowered their forecast for Europe’s largest economy next year, citing the impacts of high energy prices.

- Over $31 billion has exited European equity funds this year, the largest outflow since 2016.

- Japan is tapping into $24 billion in emergency reserves this month to cushion the blow from rising food and energy prices, officials said.

- Mexico’s annual inflation hit a higher-than-expected 8.7% in August, its highest level in 22 years, prompting expectations the central bank will continue raising interest rates.

- The U.S. administration is weighing an executive order to screen and possibly restrict U.S. overseas investment in cutting-edge tech development in China, a plan that could be announced in the coming months.

- Economic officials from the U.S. and 13 Indo-Pacific countries launched negotiations Thursday in Washington’s first major pan-Asian trade initiative in nearly a decade.

- Australia’s trade surplus almost halved in July as key overseas shipments of coal and iron ore tumbled, while imports jumped 5%.

Some sources linked are subscription services.