MH Daily Bulletin: September 7

News relevant to the plastics industry:

At M. Holland

- During M. Holland’s recent summer internship program, 15 bright college students worked both in-person and remotely across many departments. Click here to read more about their experiences at M. Holland and their perspectives on the plastics industry.

- M. Holland will be attending the North American Detroit Auto Show on Sept. 14-15. This annual showcase for emerging automotive technologies will be held at Huntington Place in Detroit, Michigan. If you’re attending, please RSVP for M. Holland’s reception or contact Mike Gumbko, Strategic Account Manager, to set up a meeting with our Automotive team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil fell 3% Tuesday, reversing a two-day rally on fears of weakening demand. Futures are down 25% the past three months to the lowest level since January.

- U.S. natural gas fell 5% to a four-week low Tuesday on forecasts of lower demand.

- In mid-morning trading today, WTI futures were down 3.7% at $83.65/bbl, Brent was down 3.3% at $89.8/bbl, and U.S. natural gas was down 3.0% at $7.90/MMBtu.

- China’s crude imports were down 1.1 million bpd in August compared with the year-ago period.

- Saudi Arabia cut oil prices for Asian and European customers for the first time in four months on Tuesday, a response to weaker demand forecasts.

- U.S. LNG export terminals are pushing to increase capacity, triggering surging demand for feedstock gas.

- Leading U.S. LNG exporter Cheniere Energy lost a bid to bypass pollution rules at two of its Gulf Coast terminals, which could lower production if the firm is forced to install new equipment.

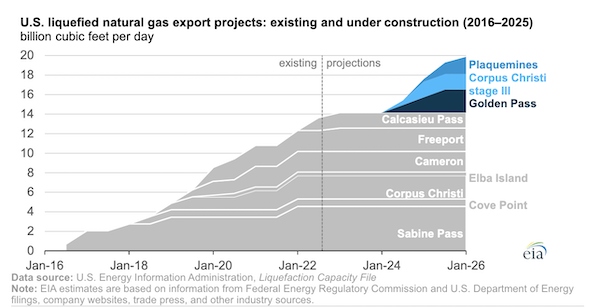

- U.S. LNG export capacity is forecast to grow 5.7 billion cubic feet per day by 2025 with the completion of three new facilities now under construction:

- EQT Corp., the largest U.S. natural gas producer, will acquire a private competitor for roughly $5.2 billion as it expands its holdings in the Marcellus shale region.

- U.S. strategic crude inventories fell 7.5 million barrels last week to their lowest level since 1984, according to the Department of Energy.

- More oil news related to the war in Europe:

- Russian officials say the Nord Stream 1 pipeline will not resume flows until Siemens Energy repairs alleged faulty equipment, a claim that Siemens disputes.

- Hundreds of German utilities could need government support after Russia indefinitely halted the Nord Stream 1 pipeline, industry groups say.

- European household energy bills could surge by $2 trillion in early 2023 to about 15% of the bloc’s GDP, according to Goldman Sachs.

- European energy trading is straining under margin calls of at least $1.5 trillion, putting pressure on governments to spend more to guarantee trades amid wild price swings, Equinor said.

- British policymakers are finalizing a $46 billion support package to help lower energy bills for U.K. businesses. A lobbying group says 6 in 10 of the nation’s manufacturers are at risk of closing due to soaring energy prices.

- France’s biggest energy users will meet later this month to formalize a plan to cut usage by 10% this winter to avoid blackouts.

- Poland may distribute anti-smog masks this winter on expectations that people will start burning trash amid a shortage of heating fuel.

- Italy is tightening temperature controls on households and businesses ahead of winter, a bid to reduce gas usage.

- Spain is extending a cap on gas prices to heavy industry amid fears that Russia will completely halt gas deliveries.

- Traders in China are starting to re-sell more incoming LNG cargoes to Europe, where a shortage commands higher prices.

- Oil and gas firm Sitio Royalties is poised to merge with Brigham Minerals in a $4.8 billion deal to create one of the U.S.’s largest publicly traded mineral and royalty companies.

- Baker Hughes announced plans to consolidate its operations from four business units to two starting in October, a move expected to deliver at least $150 million in savings.

- Shell and Exxon Mobil are selling one of Europe’s largest and oldest natural gas production ventures in the Netherlands for up to $1.5 billion.

- Japanese utility Jera Co. is partnering with Germany’s Uniper to help fund clean ammonia production in the U.S.

- Spain’s Repsol is selling 95,000 acres of oil and gas land in Alberta for over $300 million, a bid to cash in on soaring resource valuations.

Supply Chain

- Voluntary energy conservation was key to preventing rolling blackouts in California Tuesday evening, the seventh day in a row that the state’s grid operator declared an emergency as power demand surged to a 16-year high. Record-breaking temperatures will continue this week as the state grapples with its hottest September on record.

- Hurricane Kay will likely strengthen into a “major” Category 3 storm before hitting the coast of Mexico’s Baja California peninsula later this week.

- Historic flooding in Bangalore, the so-called “Silicon Valley” of India, has put several global firms and startups under water.

- South Africa resumed rolling blackouts Tuesday amid an energy crunch that already shrank the nation’s GDP back to pre-pandemic levels in the second quarter.

- The average U.S. diesel price surged 20.6 cents a gallon last week in the first weekly rise in two months.

- Just eight ships were queued for berths at the ports of Los Angeles and Long Beach last week, the lowest level since summer 2020.

- Congestion at ports in northern Europe is declining as demand falls and labor supply grows.

- Chinese container line Cosco Shipping projects a 74% rise in first-half net profit to almost $10 billion.

- MSC and Shell are among several partners piloting new ways to reduce methane emissions from LNG ships, with potential commercial technology available by next year.

- Texas-Mexico trade volume could reach $1.5 trillion by 2050 on an 80% surge in tractor-trailer freight transport, state researchers predict.

- U.S. freight railroads are reversing a years-long push to streamline operations by bringing back more locomotives and reopening idled assembly yards to reduce service delays.

- Two more U.S. rail unions reached a contract agreement with railroads last week. About 21,000, or 15%, of 140,000 unionized workers have now reached some form of agreement with their employers.

- Labor experts fear one of the biggest strikes in American history could result from next spring’s labor negotiations between the Teamsters and UPS, which handles an estimated 6% of U.S. GDP and is the world’s largest package delivery service.

- Over 75% of supply chain executives believe wages and bonuses will need to be raised to attract and retain warehouse workers.

- The U.S. government could start taking applications for almost $40 billion in computer-chip manufacturing subsidies by February, officials indicated.

- U.S. and EU imports of Russian aluminum and nickel rose as much as 70% in the second quarter, as sanctions largely spared the industrial metals sector.

- The U.S. administration reportedly remains undecided about easing tariffs on billions of dollars of Chinese imports.

- In the latest news from the auto industry:

- China imposed new lockdowns in the southern city of Guiyang, home to automakers such as Geely and leading battery-maker Contemporary Amperex Technology.

- Volkswagen said it would list its iconic sports car brand Porsche in one of the biggest initial public offerings in years, with a potential valuation of up to $85 billion.

- Mercedes-Benz announced plans to terminate 3,600 workers in a restructuring of its Brazilian truck and bus plant in Sao Paulo.

- New car sales in Germany edged up in August after falling over 10% since January.

- China’s CATL, the world’s largest maker of electric vehicle batteries, says its new technology could extend charging ranges to over 430 miles.

- Chinese electric vehicle and battery maker BYD surpassed LG Energy to become the world’s second-largest supplier of batteries in July.

- Chinese automakers are taking advantage of Western sanctions to expand their share of the Russian auto market, where new car sales fell 62% year over year in August.

- Australia could soon impose its first-ever fuel efficiency standards to encourage laggard electric vehicle adoption.

- Abu Dhabi, capital of the UAE, plans to soon build an electric vehicle manufacturing site that could produce up to 10,000 cars per year.

- Taiwanese battery-maker ProLogium Technology plans to build an $8 billion lithium battery plant in either France, Germany, Poland or the U.K.

- Honda inked a partnership with Japanese trader Hanwa Co. for medium- and long-term supplies of battery metals.

- Margins for U.S. processors of pork fell 70% year over year in August, as rising costs for grain and fuel led hog farmers to shrink the size of their herds.

- Online pet-products seller Chewy continues to build out its automated fulfillment services with the recent opening of a third facility in Reno and the planned opening of a fourth in Nashville this fall.

Domestic Markets

- The U.S. reported 69,828 new COVID-19 infections and 342 virus fatalities Tuesday.

- U.S. health officials will likely start recommending COVID-19 vaccines annually, similar to flu shots.

- By the end of this week, over 90% of Americans will live within 5 miles of sites carrying the newest COVID-19 vaccines modified to fight fast-spreading Omicron subvariants, according to the White House.

- COVID-19 cases in New York state fell 9% last week.

- The U.S. finance industry is leading the charge on winding down remote work and recalling employees to the office full-time.

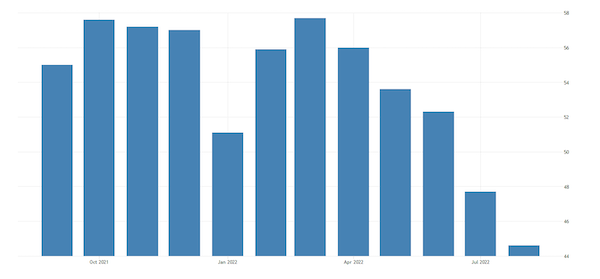

- S&P Global’s composite U.S. purchasing managers’ index fell from 47.7 in July to 44.6 in August, the sharpest decline in private-sector business activity in over two years:

- In contrast, the U.S. services sector expanded for a second month, while measures of supply bottlenecks and price pressures eased, according to the Institute for Supply Management.

- Bank of America says U.S. consumers and businesses are still in good financial shape despite fears of a recession, with customer spending rising 10% year over year in August while account balances were higher than in 2019.

- Financial pain is spreading in the junk-loan market, which saw over $6 billion in defaults in August, a two-year high.

- Global investors continue piling into U.S. stocks as a relative shelter from economic turmoil, with U.S. equity funds pulling in money for four of the past six weeks.

- The U.S. Labor Secretary says immigration will need to be overhauled as a lack of available workers poses greater threats to the national economy than inflation.

- The National Labor Relations Board is proposing a rule change allowing workers to claim they work for two employers at once, a move that could make it easier for workers to hold companies liable by their franchisees and contractors.

- The International Brotherhood of Teamsters, one of the largest U.S. labor unions, launched a new division to focus on unionizing employees of Amazon.

- Ernst & Young executives are poised to green-light a split of its auditing and consulting businesses this week in what will be the biggest shake-up in the accounting profession in decades.

- U.S. officials screened 8.76 million air travelers over the four-day Labor Day weekend, the first time that holiday weekend volumes exceeded pre-pandemic levels.

- United Airlines threatened to suspend service at New York’s JFK airport unless federal regulators review runway use and allow the carrier to increase daily operations.

International Markets

- China continues to battle COVID-19 flare-ups, leading to new lockdowns in Guiyang; tightened travel restrictions in Beijing; movement controls in Shenzhen; and an extended lockdown in Chengdu.

- Japan will shorten COVID-19 isolation periods this week to limit widespread societal disruption.

- Taiwan will resume visa-free entry for visitors from countries including the U.S. and Canada starting next week as it continues to ease pandemic controls.

- India and China have introduced needle-free COVID-19 vaccines that can be sprayed in the mouth or squirted into the nose.

- The Bank of Canada is expected to raise interest rates by at least 75 basis points today.

- The European Central Bank is widely expected to lift interest rates sharply when it meets on Thursday.

- Argentina has secured over $5 billion in added financing from the Inter-American Development Bank as the nation seeks to quell financial turmoil that has pushed inflation to over 90% this year and left 40% of its people in poverty.

- Germany will soon drop mask requirements on commercial flights.

- Lufthansa reached a tentative contract agreement with its pilots’ union Tuesday, averting a second strike in less than a week that was planned for today.

- Widespread air travel disruption in Europe will likely continue this fall amid more worker strikes and staff shortages.

Some sources linked are subscription services.