MH Daily Bulletin: September 6

News relevant to the plastics industry:

At M. Holland

- During M. Holland’s recent summer internship program, 15 bright college students worked both in-person and remotely across many departments. Click here to read more about their experiences at M. Holland and their perspectives on the plastics industry.

- M. Holland will be attending the North American Detroit Auto Show on Sept. 14-15. This annual showcase for emerging automotive technologies will be held at Huntington Place in Detroit, Michigan. If you’re attending, please RSVP for M. Holland’s reception or contact Mike Gumbko, Strategic Account Manager, to set up a meeting with our Automotive team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil jumped as much as 4% Monday after OPEC said it would curb output and Russia indefinitely halted a key supply of gas to Europe.

- In early afternoon trading today, WTI futures were down 0.5% at $86.40/bbl, Brent was down 3.5% at $92.40/bbl, and U.S. natural gas was down 6.9% at $8.18/MMBtu.

- OPEC+ agreed Monday to cut oil production for the first time in over a year by 100,000 bpd, citing demand concerns and the possibility of more supply coming from Iran.

- Iran announced plans to boost its oil output to over 4 million bpd by March 2023, hoping to increase oil exports next year.

- Renewed clashes broke out over the weekend in Libya’s capital, again threatening the nation’s oil output that has seesawed for much of the past seven months.

- Indonesia’s state-owned oil giant Pertamina, Asia’s biggest gasoline importer, has deferred some September deliveries after the government hiked fuel prices, a move likely to hit demand.

- Overall U.S. fracking costs are set to jump 27% this year due to shortages of equipment and labor, researchers say.

- The U.S. administration is poised to break with tradition by providing three-year guidance for biofuel blending mandates, instead of just one year, in a bid to give longer-term certainty to refiners.

- The U.S.’s recently passed climate and healthcare bill will unleash billions in funding for small-scale nuclear power proposals through subsidies and tax incentives, especially for projects built near closing coal plants or industrial sites.

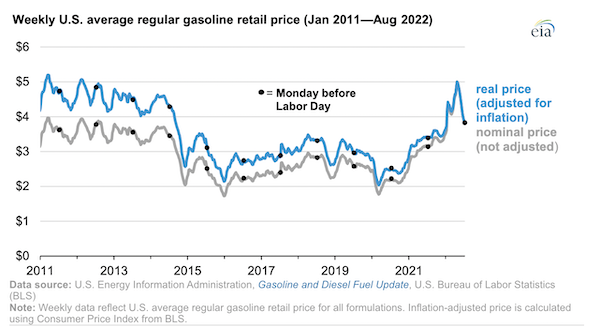

- Labor Day weekend gasoline prices in the U.S. were the highest since 2014 at an average of $3.83 a gallon:

- More oil news related to the war in Europe:

- After abruptly suspending gas supplies to Germany on the Nord Stream 1 pipeline over alleged maintenance issues Friday, Russia said it would not resume flows after G7 nations agreed to cap Russian oil prices. On Monday, wholesale gas prices in Europe soared by as much as 30%. Gas prices are now about 400% higher than a year ago, as governments such as Germany race to give financial support to utilities and households.

- EU energy ministers will discuss more details of the G7’s proposed price cap on Russian oil at a meeting this Friday. Early reports suggest the plan will ban the insurance and financing of Russian oil shipments to global markets, aided by London’s near-complete control of the global ship insurance market. Moscow said it will stop selling oil to countries that impose the cap.

- Germany’s struggling gas giant Uniper may soon need more emergency funding from the government, while fears rise that the utility could soon start rationing gas.

- Germany will keep two of its last three nuclear plants online past their December shutdown deadline in an effort to buttress power supplies.

- Russian shelling has now completely severed Ukraine’s Zaporizhzhia nuclear plant, Europe’s largest, from the national power grid.

- Sweden and Finland will guarantee up to $33 billion to power companies and traders to prevent a collapse of the power derivatives market.

- Italy’s net energy import costs will more than double this year to nearly $100 billion.

- Norway’s Equinor says it has completely exited Russia.

- ArcelorMittal, the world’s second-largest steelmaker, will indefinitely shut one of two blast furnaces in Bremen, Germany, due to surging energy costs.

Supply Chain

- Blistering heat in California led to the highest electricity usage in five years Monday, prompting the state’s grid operator to declare a level-2 emergency, the last warning before rolling blackouts.

- South Korea raised its highest weather alert as approaching Typhoon Hinnamnor forces flight cancellations and widespread business closures. The storm pounded western Japan Monday, leading automakers and other companies to suspend factory production.

- Tropical Storm Danielle strengthened into the first hurricane of the 2022 Atlantic hurricane season and is forecast to meander over open waters the next couple days.

- Rates for bulk shipping’s largest vessels surged late last week for their biggest single-day rise in over two years, according to the Baltic Exchange.

- CMA CGM is building a five-year, $1.5 billion investment fund aimed at boosting its transition to new and low-emission fuels across its sprawling operations.

- Consultants estimate that Amazon has recently scrapped or delayed plans to open at least 60 facilities with 53 million square feet of space as the firm reduces its delivery operations amid slowing sales growth.

- Taiwan exports, a bellwether for global tech demand, likely rose for the 26th straight month in August although at a slower pace than in July, traders predict.

- In the latest news from the auto industry:

- Volkswagen and Foxconn are keeping factory workers in an on-site closed-loop system in China’s Chengdu city to maintain production amid COVID-19 lockdowns.

- Shenzhen-based electric-vehicle maker BYD sold a record 173,977 cars in August, up 188% from a year ago.

- Toyota’s truck and bus unit Hino Motors will halt production of some medium and heavy-duty trucks for at least another year following the unraveling of a data falsification scheme in March.

- Volvo Cars saw its August sales fall 4.6% year over year on continued disruption from the global computer chip shortage.

- Self-driving software firm Aurora Innovation is considering a sale to Apple or Microsoft, according to reports.

- General Motors is expected to offer buyouts to all its 2,000 U.S. Buick franchise dealers as it moves to make the brand all-electric by 2030.

- South Korean officials are slamming the U.S.’s move to favor American-made electric vehicles for thousands in consumer tax subsidies, saying the new law will disproportionately impact brands like Kia and Hyundai.

- Berlin aims to replace its 1,600 diesel-powered buses with a new fleet of electric buses by 2030, part of a broader trend of electrifying public transport across Germany.

- Turkey prices are 57% higher than their five-year average after a springtime outbreak of bird flu devastated flocks.

- The United Nations’ gauge of global food prices fell for a fifth month in August as a resumption of grain exports from Ukrainian ports improved supply.

Domestic Markets

- The U.S. reported 83,939 new COVID-19 infections and 407 virus fatalities Monday.

- Florida reported 1,614 COVID-19 fatalities in August, leading the nation for the third month — and third summer — in a row.

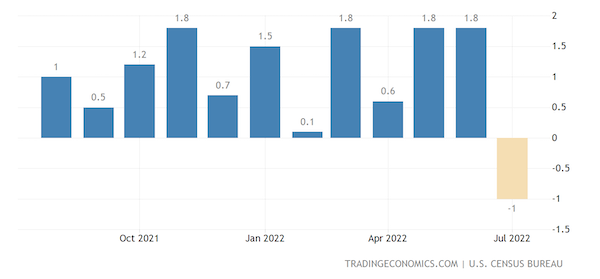

- New orders for U.S.-manufactured goods fell a surprise 1% in July, led by a decline in bookings for defense aircraft. Orders for computers and electronic products rose 0.8%.

- The average U.S. interest rate for credit cards is up to nearly 18%, the highest level since 1996 at a time when inflation is forcing more consumers to rely on credit.

- The average U.S. mortgage rate rose to 5.66% last week, nearly double the level from a year ago, according to Freddie Mac.

- Citigroup is the latest bank to start trimming its mortgage workforce as part of an industrywide downsizing spurred by higher interest rates.

- Job hoppers in July enjoyed an average net raise of about 8.5%, the highest in more than two decades.

- Higher spending power from the strong U.S. dollar is mitigating the impact of inflation for American consumers.

- Walmart’s Sam’s Club will raise its annual membership fees for the first time in nine years starting Oct. 17, as surging inflation has driven an increase in consumers looking to purchase items in bulk.

- U.S. antitrust regulators have begun reviewing Amazon’s $1.7 billion takeover of robot vacuum maker iRobot and the firm’s $3.49 billion acquisition of primary care provider One Medical.

- After beating out other buyers including Amazon and UnitedHealth, drugstore chain CVS is in advanced talks to buy home-healthcare company Signify Health for about $8 billion, with a potential deal announcement coming this week.

- Apple will unveil new smartphones this week at a time when strong demand for the tech giant’s premium devices bucks an industrywide decline in smartphone sales.

International Markets

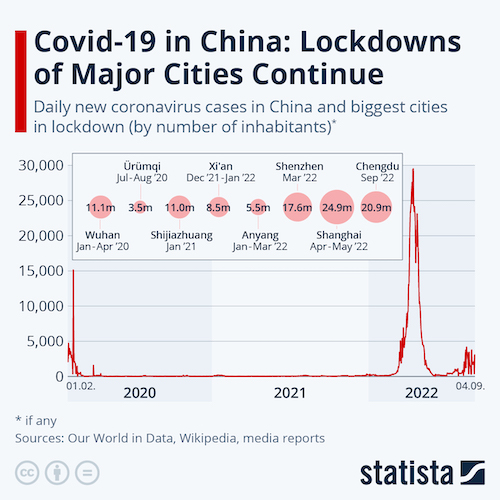

- Shenzhen emerged from a weekend lockdown to easing COVID-19 restrictions Monday, while most of the 21 million residents of Chengdu city faced tightened curbs on movements. Currently, 33 Chinese cities are under partial or full lockdowns, affecting more than 65 million people:

- Russia posted over 50,000 new COVID-19 cases for two days in a row last weekend, the highest level in six months.

- Britain is the latest country to approve Pfizer’s updated COVID-19 vaccine tailored to the fast-spreading Omicron variant.

- China approved a homegrown, inhalable COVID-19 vaccine for use as a viral booster.

- In the latest news on the health of the global economy:

- Global inflation eased to a 0.3% monthly pace in July, led by economic woes in China. Meanwhile, the pace and scale of interest-rate hikes across developing markets slowed.

- A relentless rally in the U.S. dollar has driven the euro, British pound and Japanese yen to multi-decade lows. China, also, is cutting banks’ reserve requirements in a bid to bolster a weakening yuan.

- Euro zone business activity contracted for a second month in August, with S&P Global’s PMI index falling to an 18-month low of 48.9.

- Germany and France saw disappointing service-sector growth in August, while Italy’s improved.

- British business activity contracted for the first time since February 2021 last month, while the nation’s manufacturing sector took its steepest dive of the pandemic. The nation has fallen behind India as the world’s sixth-largest economy.

- China’s services sector cooled in August due to COVID-19 flare-ups, while Japan’s services sector contracted for the first time in five months. India, an outlier, saw faster-than-expected services growth, leading firms to hire at their quickest pace in 14 years.

- Mexico’s economy is forecast to return to pre-pandemic levels sometime in 2023, lagging behind peers after suffering its biggest contraction since the Great Depression in 2020.

- Russian officials are privately warning of deep and prolonged damage to the national economy as a result of Western sanctions, according to reports.

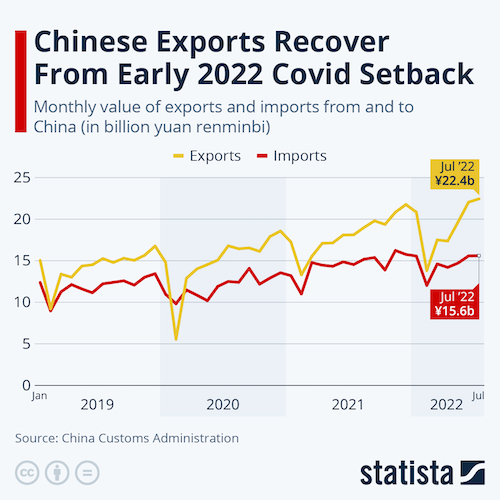

- China’s export growth likely lost steam in August due to weakening global demand, economists say:

- Economists expect new home sales and prices in China to continue falling this year as the nation’s property crisis deepens.

- Credit Suisse is in talks to cut about 10% of its global workforce, or 5,000 jobs, as part of a cost-reduction plan for Switzerland’s second-biggest bank.

- Israel will ban Boeing 747 and similar aircraft with four engines starting in March to reduce noise and air pollution, authorities said.

- Ryanair flew 16.9 million passengers in August, a record for the fourth month in a row as it continued to consolidate its position as Europe’s largest airline.

Some sources linked are subscription services.