MH Daily Bulletin: August 31

News relevant to the plastics industry:

At M. Holland

- During M. Holland’s recent summer internship program, 15 bright college students worked both in-person and remotely across many departments. Click here to read more about their experiences at M. Holland and their perspectives on the plastics industry.

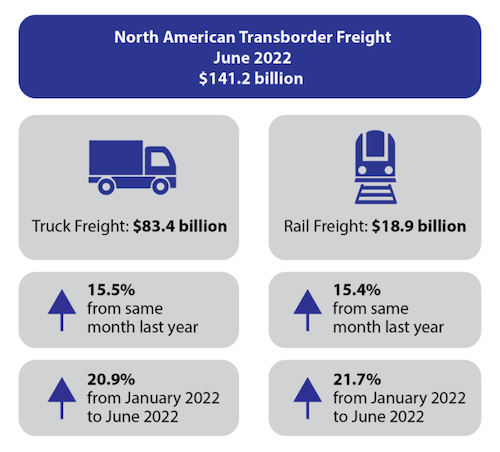

- M. Holland’s latest logistics outlook examines current challenges and industry trends that are impacting shipping, trucking and rail. Although the plastics industry is faring a little better than earlier this year, M. Holland’s experts predict disruption to continue well into 2023. Click here to read the full outlook for the remainder of 2022.

- M. Holland will be attending the North American Detroit Auto Show on Sept. 14-15. This annual showcase for emerging automotive technologies will be held at Huntington Place in Detroit, Michigan. If you’re attending, please RSVP for M. Holland’s reception or contact Mike Gumbko, Strategic Account Manager, to set up a meeting with our Automotive team.

- M. Holland will be closed Monday, Sept. 5, in observance of the Labor Day holiday.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices spiked 4% Monday, extending last week’s gain, on concerns over lower output from OPEC.

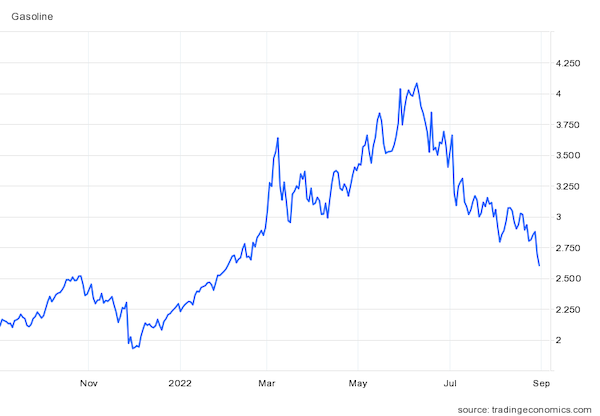

- In mid-morning trading today, WTI futures were down 3.8% at $93.28/bbl, Brent was down 4.0% at $100.90/bbl, and U.S. natural gas was down 4.1% at $8.96/MMBtu.

- Crude inventory in U.S. strategic reserves fell by 3.1 million barrels last week to 450 million barrels, the lowest since December 1984.

- Energy expenditures made by U.S. consumers fell to $1 trillion in the first year of the pandemic, the lowest level since 2002:

- Weekend unrest in Libya’s capital sparked concern that the nation could slide into a full-blown conflict, further disrupting oil production.

- Political violence in Baghdad is not expected to impact OPEC-member Iraq’s oil exports; however, rocket attacks on a major natural gas field in northern Iraq sent Western contractors fleeing and stalled efforts to double output to offset Russian shortfalls.

- Saudi Arabia may slash October prices for most crude grades it sells to Asia on a plunge in spot prices caused by weakening fuel demand, refiners say.

- Pemex’s six refineries in Mexico boosted processing by 15% from June to July while crude exports rose slightly. The news comes after Pemex scrapped a plan to drastically reduce crude exports several months ago.

- Brazil’s Petrobras will cut aviation fuel prices by 15.7% starting Thursday, the second time in recent weeks that the firm has lowered gas prices in the sector.

- Reliance Industries, the India-based operator of the world’s biggest refining complex, plans to spend $9 billion over five years to expand its oil-to-chemical business.

- More oil news related to the war in Europe:

- Inspectors with the United Nations began a mission Monday to Ukraine’s Zaporizhzhia nuclear power plant, Europe’s largest, after weekend shelling in nearby towns raised fears of a possible radiation mishap.

- European natural gas and power prices plunged over 20% Monday on positive news that the EU is on track to meet fuel storage requirements for winter. Year-ahead energy futures remained at record highs, however.

- German power supplier Uniper is seeking an additional $4 billion in government funding after fully using its existing $9 billion emergency credit line to manage higher costs.

- European energy ministers will hold a rare emergency meeting Sept. 9 to discuss an EU-wide solution to the spike in power markets. Solutions could include a structural revamp of the continent’s power markets, according to reports.

- A new proposal from German policymakers would reform power markets so that prices are no longer coupled to the most expensive supplier, a move allowing renewable producers with lower costs to sell at lower prices.

- French officials urged companies to draft energy savings plans by next month, warning they would be the first hit if the nation is forced to ration power supplies in coming months.

- Six months into its invasion of Ukraine, Russian fuel exports continue to exceed expectations, with monthly revenue of $20 billion so far in 2022 compared with $14.6 billion a month last year.

- Shell says Europe may need to deal with exorbitant power bills and electricity rationing for several more winters.

- German and Dutch officials say a $9 billion offshore wind farm set to come online by 2030 will power up to 4.5 million homes and be a substantial driver in reducing energy dependence on Russia.

- Exxon Mobil plans to sue the Russian government unless Moscow allows it to exit the major Sakhalin-1 oil and gas project in the nation’s Far East.

- Chinese state-owned refiner Sinopec officially launched the nation’s largest carbon storage facility in east China Monday, with plans to build two more plants of similar size by 2025.

- Norwegian carbon storage firm Northern Lights, a joint venture founded by Equinor, TotalEnergies and Shell, secured a deal to store emissions from a major Dutch fertilizer maker starting in 2025, a commercial breakthrough that marks the world’s first agreement for cross-border CO2 transport.

- Arizona-based First Solar, the U.S.’s biggest solar-panel maker, plans to spend $1.2 billion to boost production by 75% with help from incentives under the recently passed climate and healthcare law.

Supply Chain

- Record-breaking temperatures will hit the U.S. West this week including in Southern California and Arizona, where more than 30 million people are already under heat advisories.

- With five straight months of below-average rainfall, Britain saw its driest July since 1935, prompting widespread restrictions from utilities on water use.

- U.S. freight railroads struck contract deals with unions representing 15,000 of some 115,000 unionized workers Monday, a positive signal in negotiations that have lasted over two years. The Drewry Shipping Consultants’ index for container rates from Shanghai to Los Angeles fell 6% last week to $6,127, down 45% from January.

- A measure of rates for the bulk sector’s largest capesize vessels fell 30% in a single day late last week.

- The container ship backlog outside the ports of Los Angeles and Long Beach dropped to eight vessels Monday, the lowest level in two years.

- Outbound shipments from the congested Port of Oakland fell 30% from June to July, the biggest drop since 1997. Some industries are signing deals for new trade routes that skip the port entirely.

- The Port of Oakland will spend $2 million to build infrastructure to handle electric vehicles in its cargo operations.

- Tanker operator Frontline swung to a $42.2 million second-quarter profit as it prepares to merge with rival Euronav.

- Maersk’s port unit APM Terminals plans to sell its 30% stake in Global Ports Investments, Russia’s top container terminal operator, as part of its plan to fully exit from the country.

- California-based Applied Materials, a supplier of equipment used in computer chip manufacturing, says its backlog for parts and equipment continues to grow despite declining sales of smartphones and PCs.

- UPS plans to buy eight new Boeing 767 freighters to support continued strength in parcel shipping, expanding its total 767 fleet to 108 aircraft.

- In the second quarter, Korean Air saw 42% more freight traffic compared to 2019 while freight revenues were up 44% year over year, a salve for declining passenger volumes.

- Kroger is expanding the reach of its online grocery delivery network with the recent opening of two automated fulfillment centers in Tennessee and Illinois.

- Over 500,000 tons of U.S. grain were shipped through the Great Lakes’ St. Lawrence Seaway in the second quarter, a 37% increase from a year ago.

- The Canadian government launched a formal challenge to U.S. softwood lumber duties under the USMCA trade deal on Monday.

- Washington State Ferries, the U.S.’s largest ferry system, plans to transition to a fully hybrid-electric fleet by 2040.

- China’s search engine giant Baidu posted a better-than-feared 5% decline in second-quarter revenue on strong activity in its cloud unit.

- Taiwan’s China Airlines agreed to buy 16 Boeing 787-9 widebody planes to replace its aging fleet of Airbus A330s, a deal worth around $2.1 billion.

Domestic Markets

- The U.S. reported 82,044 new COVID-19 infections and 396 virus fatalities Monday.

- The U.S. government will end its free shipments of at-home COVID-19 tests starting Friday due to a lack of funding and the need to preserve dwindling supplies for a potential rise in infections this fall. Poor funding could also slow the rollout of Omicron-tailored COVID-19 booster doses.

- U.S. citizens have until Friday to order their third supply of free COVID-19 tests.

- COVID-19 cases in New York state and Florida are beginning to decline.

- College campus re-openings have led to a 33% increase in local COVID-19 cases, according to new research.

- Almost one-fifth of Americans surveyed say they are not resuming activities they pursued before the pandemic due to continued risks from long-COVID and immune system complications.

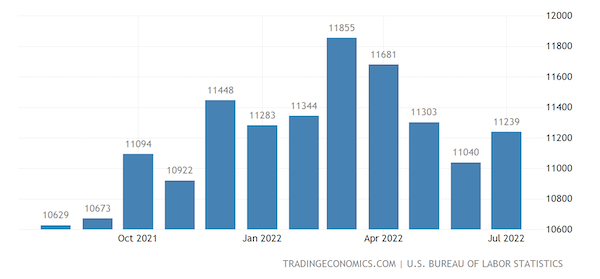

- Estimates suggest as much as 15% of the U.S.’s 10.7 million worker shortage is due to people suffering from long-COVID symptoms.

- School districts in Texas, New York and California are creating permanent, full-time virtual schools for the first time this year after the pandemic’s shift to remote learning exposed a niche option for some students.

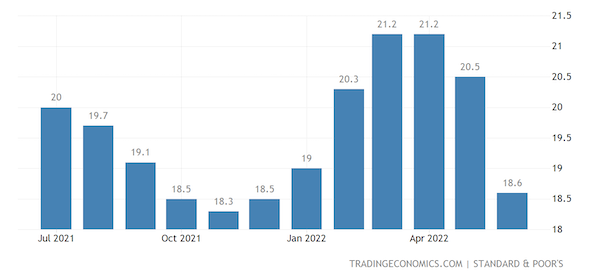

- The U.S. dollar touched a fresh 20-year high Monday on signals that the Federal Reserve will continue raising interest rates to restrict growth.

- The Federal Reserve’s quantitative easing will ramp up this week as the central bank lifts the monthly selloff of its nearly $9 trillion portfolio to $95 billion per month.

- U.S. teenagers aged 15 to 19 accounted for almost 13% of new hires in May, up from around 2% in 2019 amid persistent worker shortages.

- The Dallas Fed’s index of Texas manufacturing activity hit -12.9 in August, remaining in contraction territory despite substantially improving over July’s reading of -22.6:

- U.S. electric vehicle maker Lucid filed for a new security offering of up to $8 billion as the automaker looks to beef up working capital while supply snarls crimp production. Tesla launched a lawsuit seeking to invalidate a Louisiana law that bars the automaker from selling its electric vehicles directly to consumers rather than using dealerships as intermediaries. Fitness equipment maker Peloton will delay publication of its annual report, citing more time needed to sort out accounting tied to its restructuring effort. Shredded COVID-19 personal protective goods such as gowns, masks and gloves can increase the strength of concrete by 20%, providing a solution for the solid waste challenge presented by the pandemic.

- U.S. electric vehicle maker Lucid filed for a new security offering of up to $8 billion as the automaker looks to beef up working capital while supply snarls crimp production.

- Tesla launched a lawsuit seeking to invalidate a Louisiana law that bars the automaker from selling its electric vehicles directly to consumers rather than using dealerships as intermediaries.

- Fitness equipment maker Peloton will delay publication of its annual report, citing more time needed to sort out accounting tied to its restructuring effort.

- Shredded COVID-19 personal protective goods such as gowns, masks and gloves can increase the strength of concrete by 20%, providing a solution for the solid waste challenge presented by the pandemic.

International Markets

- Japan is considering easing some isolation requirements on people with asymptomatic COVID-19 cases as daily infections continue to hit record numbers.

- More Western tech firms, including Ericsson, Nokia and Logitech, announced plans for complete exits from Russia Monday, following Dell last week.

- Russia says its economy is on pace to shrink a smaller-than-expected 3% this year, while inflation will likely hit 13%.

- Britain’s service businesses reported a record increase in costs over the past three months while a gauge of overall business optimism sank to its lowest since May 2020.

- India’s economy is believed to have grown at the fastest rate in a year last quarter driven by healthy consumption, with GDP rising 15.4% compared to just 4.09% in Q1.

- Tourism to Europe is expected to reach as much as 80% of pre-pandemic levels this year.

- More than half of U.S. firms surveyed say China’s strict COVID-19 controls top the list of reasons to cancel or delay investments in the world’s second largest economy. At the same time, over one-fifth of U.S. firms said they were pessimistic about their strategic outlook in China, more than double the level from last year.

- China’s ICBC bank, the world’s largest commercial lender by assets, posted worse-than-expected quarterly results on a 15% increase in soured property debt. Meanwhile, the nation’s largest property developer saw net profit almost halve in the first half of 2022 while warning the property crisis has yet to bottom.

- China’s search engine giant Baidu posted a better-than-feared 5% decline in second-quarter revenue on strong activity in its cloud unit.

- Taiwan’s China Airlines agreed to buy 16 Boeing 787-9 widebody planes to replace its aging fleet of Airbus A330s, a deal worth around $2.1 billion.

- China’s ICBC bank, the world’s largest commercial lender by assets, posted worse-than-expected quarterly results on a 15% increase in soured property debt. Meanwhile, the nation’s largest property developer saw net profit almost halve in the first half of 2022 while warning the property crisis has yet to bottom.

- China’s search engine giant Baidu posted a better-than-feared 5% decline in second-quarter revenue on strong activity in its cloud unit.

- Taiwan’s China Airlines agreed to buy 16 Boeing 787-9 widebody planes to replace its aging fleet of Airbus A330s, a deal worth around $2.1 billion.

Some sources linked are subscription services.