MH Daily Bulletin: August 24

News relevant to the plastics industry:

At M. Holland

- M. Holland’s latest logistics outlook examines current challenges and industry trends that are impacting shipping, trucking and rail. Although the plastics industry is faring a little better than earlier this year, M. Holland’s experts predict disruption to continue well into 2023. Click here to read the full outlook for the remainder of 2022.

- M. Holland will be attending the North American Detroit Auto Show on Sept. 14-15. This annual showcase for emerging automotive technologies will be held at Huntington Place in Detroit, Michigan. If you’re attending, please RSVP for M. Holland’s reception or contact Mike Gumbko, Strategic Account Manager, to set up a meeting with our Automotive team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices surged 4% Tuesday on news of tighter supply in the U.S. and possibly Saudi Arabia.

- Crude prices continued rising Wednesday morning on fears that OPEC could cut production, with WTI up 0.4% at $94.18/bbl and Brent up 0.4% at $100.60/bbl. U.S. natural gas futures were up 0.9% at $9.28/MMBtu.

- The American Petroleum Institute reported a larger-than-expected crude draw of 5.63 million barrels last week, putting upward pressure on prices. U.S. government data will be released today.

- Freeport LNG pushed back the timeline for partially resuming operations at its fire-damaged Texas export facility from October to November.

- California lawmakers are working on deadline to pass a bill extending the life of the state’s last nuclear power plant, a response to fears of potential power shortages for years to come.

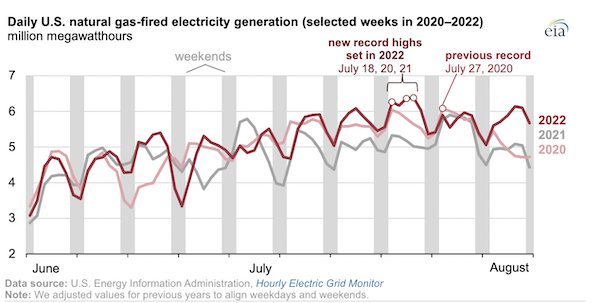

- Multiple factors, including unusually hot temperatures and declining coal capacity, led to record levels of U.S. electricity generation from gas-fired power plants this summer:

- Export disruptions on a Kazakhstan pipeline system carrying 1% of the world’s oil through Russia could last over a month, officials said Tuesday, likely lowering the nation’s output.

- British gasoline and diesel prices fell for a seventh straight week, their longest slide since 2020, though gas prices remain 27% higher than a year ago.

- TotalEnergies and partner SSE Renewables announced the inaugural production from a $4.3 billion wind farm offshore Scotland, the French oil major’s latest diversification into renewables.

- More oil news related to the war in Europe:

- European power prices soared to new highs Tuesday on forecasts of declining wind power, the latest in a string of daily records.

- Germany will prioritize shipments of coal and fuel for power stations on its rail network as it seeks to prevent a spiraling energy crisis ahead of winter.

- Finland warned residents to prepare for rolling power cuts this winter due to the energy squeeze caused by Russia’s war.

- Poland passed a new law to boost financial support for households and public buildings reeling from high energy costs, while Spain will start subsidizing housing renovations that improve energy efficiency.

- Germany may increasingly rely on Canada for LNG supplies as it works to replace sanctioned Russian deliveries. On Tuesday, officials from the two nations began talks on building a direct export route from Canada’s east coast.

- Two German power suppliers signed deals to start imports of green ammonia from Canada starting in 2025.

- A new gas levy on German consumers, designed to help energy firms cover the soaring cost of natural gas imports, may have to be adjusted as soon as this winter due to rapid market shifts, officials said.

- Norway plans to continue producing natural gas at high levels for the remainder of the decade as approvals come in for increased production from several of the nation’s fields.

Supply Chain

- With two-thirds of the continent in a state of alert or warning, Europe appears to be in its worst drought in at least 500 years, causing widespread disruption to inland shipping, electricity generation and crop yields.

- British officials say the government needs to begin planning now for water shortfalls in 2023 following the nation’s driest summer in 50 years.

- Texas’ governor signed a disaster declaration Tuesday after days of heavy rain and flash flooding swamped homes, businesses and roads in 23 counties.

- Chinese officials warned widespread drought conditions could severely impact the nation’s autumn crop harvest.

- Strikes at the U.K.’s largest container port of Felixstowe could extend beyond the eight days currently planned by unions, threatening even greater disruption to supply chains.

- Apple plans to manufacture its latest-generation iPhone 14 in India as China, its main supplier hub, clashes with the U.S. government and imposes widely disruptive lockdowns.

- European glass makers say gas rationing through next spring would cripple production, worsening a shortage of bottles.

- A major European fertilizer producer has stopped making key products due to soaring energy costs.

- Global airfreight rates are down nearly 50% from last year’s peak, according to freight booking platform Freightos.

- In the highly squeezed U.S. warehouse market, vacancy rates have dipped into the low single digits in some areas, turning more companies to ad hoc arrangements that include storing goods in parking lots and on truck trailers as they cope with excess inventories.

- U.S. imports from China totaled $271.7 billion in the first half of the year, nearly 19% higher than a year ago.

- Emirati port operator DP World posted a 60% gain in first-half revenue but expects shipping growth to slow later this year.

- European shipping line MPC Container Ships boosted its full-year outlook on expectations for high freight rates for several more quarters.

- Intel is partnering with Canada’s Brookfield Asset Management on a $30 billion expansion of the U.S. chipmaker’s cutting-edge facilities in Arizona.

- Tech component supplier Digi-Key Electronics opened a 2.2 million square-foot distribution center in the northern Minnesota town of Three River Falls.

- In the latest news from the auto industry:

- Volkswagen and Mercedes-Benz struck new supply agreements with Canada for key metals used in battery production.

- Ford will stop selling its Transit Connect van in the U.S. next year and has scrapped plans to build the vehicle’s next generation in Mexico due to low sales.

- Chinese electric vehicle maker Xpeng posted a larger-than-expected second quarter loss, mirroring wider disruption in the nation’s auto industry due to fallout from lockdowns and supply snarls.

- Swedish electric vehicle maker Polestar struck a multi-year supply agreement with Candela Speed Boat, a startup looking to electrify leisure boats and water taxis.

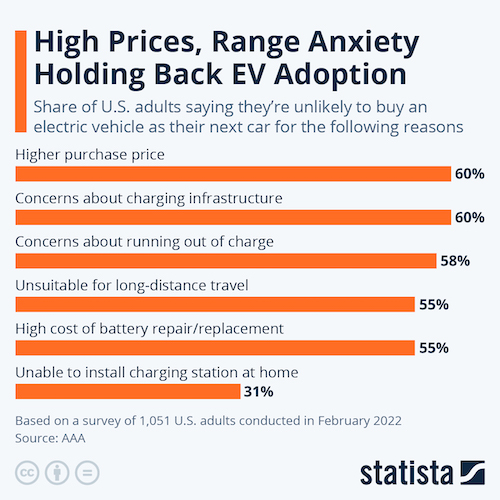

- Just one-quarter of Americans surveyed say they are likely to buy an electric vehicle as their next car.

- Toyota agreed to recognize California’s authority to set its own auto emissions standards, ending a years-long standoff that should make the automaker eligible for fleet purchases by the state.

Domestic Markets

- The U.S. reported 89,580 new COVID-19 infections and 387 virus fatalities Tuesday.

- The White House has finalized plans to send out 175 million Omicron-tailored COVID-19 vaccines starting in September, assuming approval from drug regulators.

- On Tuesday, the CDC gave full approval to the use of Novavax’s COVID-19 vaccine for teens aged 12 to 17.

- Moderna has formally applied for U.S. authorization of its COVID-19 vaccine tailored to the latest Omicron subvariants BA.4 and BA.5.

- Pfizer’s COVID-19 vaccine was nearly 75% effective in a trial of children six months through four years old, new data shows.

- U.S. private-sector business activity contracted for a second month in August to its weakest in over two years, according to S&P Global. The decline was led by softness in the services sector.

- Higher wages and import prices were the main drivers of near 40-year-high U.S. inflation, according to the New York Fed.

- Directors at two of the Federal Reserve’s 12 regional branches — St. Louis and Minneapolis — voted for a full 100 basis-point interest-rate hike at the central bank’s last meeting in July, signaling internal pressure for a bigger move than policy makers delivered.

- Some 20 million American households — about 1 in 6 homes — are behind on their energy bills, the largest share on record.

- Four in 10 U.S. employers are planning to use remote work to ease overall wage-growth pressures, according to a recent survey.

- A larger share of Americans is starting to believe that companies have regained the upper hand in hiring after two years of a historically tight labor market.

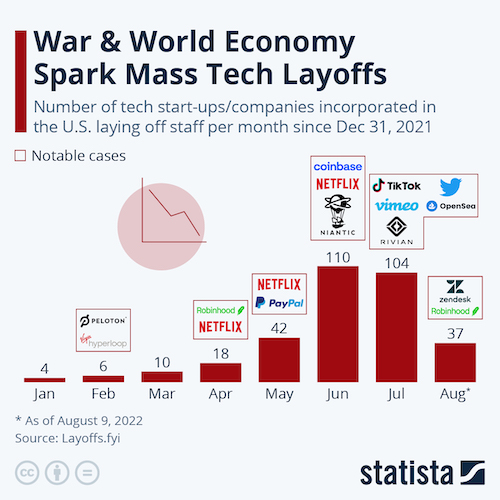

- More tech companies are freezing hiring, rescinding job offers and laying off workers amid uncertain economic conditions. Among startups and recently public companies, more than 37,000 positions were cut in Q2 compared to just 3,000 last year.

- U.S. college endowments lost 10.2% in the 12 months through June, the steepest loss since 2008’s financial crisis amid stock market upheaval.

- Over one-fifth of U.S. home sellers dropped their asking prices in July, the highest share since online real estate firm Redfin began tracking the metric a decade ago.

- Sales of new U.S. homes fell 12.6% in July, their sixth decline this year to the slowest pace in 6.5 years, as high borrowing costs and lower demand fuel a cooldown in the housing market.

- A Wells Fargo index of U.S. homebuilder sentiment fell below the breakeven level of 50 in August for the first time since the beginning of the pandemic, the bank said.

- Toll Brothers, the largest U.S. luxury-home builder, reported a 60% plunge in quarterly orders and cut its sales outlook as rising interest rates challenge buyers at the high end of the market.

- Global auditing firm KPMG will cut its office space in New York by more than 40%, part of a growing trend that has left Manhattan’s office market with record available space.

- Ride-hailer Lyft will sublease up to 45% of its biggest U.S. offices, becoming the latest company to shrink its real estate footprint to adjust to more employees working from home.

- Macy’s and Nordstrom are the latest U.S. retailers to lower financial targets for the year amid declining consumer spending and fears of an economic downturn. Nordstrom shares tanked 14% on the news.

- Dick’s Sporting Goods posted a better-than-feared 5% decline in net sales last quarter, prompting a boosted financial outlook for the year.

- Thousands of U.S. flights were canceled Monday and Tuesday due to bad weather in the New York region.

International Markets

- Japan reported 343 COVID-19 fatalities Tuesday, a record. Despite the recent wave, officials still plan to ease some of the toughest travel rules among G7 nations by scrapping a testing requirement for inbound travelers who are vaccinated.

- Hong Kong reported 6,617 new COVID-19 infections Monday, the fifth straight day above 6,000.

- Canada will soon receive 12 million doses of an Omicron-tailored COVID-19 vaccine made by Moderna.

- A spate of worse-than-expected business surveys released on Tuesday suggest the global economy is growing closer to recession.

- The World Trade Organization says global trade growth slowed to 3.2% in the first quarter from 5.7% the previous quarter and is currently stagnating.

- Euro-area consumer confidence unexpectedly rose in July but remained near record lows due to surging costs-of-living, according to the European Commission.

- Britain’s private sector slowed to a crawl in August as factory output fell sharply into contraction territory, according to S&P Global.

- Citigroup predicts British inflation could rise to more than 18% next year, a 50-year high due primarily to soaring energy prices.

- Argentina plans to launch new measures in the coming days aimed at restricting imports and preserving the central bank’s foreign currency reserves. Latin America’s third-largest economy is just one of many with dwindling foreign currency reserves that could lead to default.

- Births in China are poised to hit record lows this year as fallout from the pandemic raises costs for education and child-rearing, posing long-term problems for the nation’s economic growth.

- Ryanair upped its full-year forecast for passenger numbers after jumping on capacity left open by British Airways, which cut 10,000 scheduled flights through next March due to staffing shortages.

Some sources linked are subscription services.