MH Daily Bulletin: August 16

News relevant to the plastics industry:

At M. Holland

- M. Holland Company has appointed Ton Koenders as its inaugural director of sales for Europe to support international growth and address customer needs in Europe. Click here to read the press release.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices fell 3% Monday after disappointing economic data from China renewed fears of a recession.

- China’s crude demand dropped almost 10% year over year in July, while refinery output slipped to 12.53 million bpd, its lowest since March 2020.

- In mid-morning trading today, WTI futures were down 0.4% at $88.06/bbl, Brent was down 0.5% at $94.64/bbl, and U.S. natural gas was up 4.6% at $9.13/MMBtu.

- The U.S. Permian Basin is on track to hit a record 5.408 million bpd of output in September, as American shale activity rises to its highest level of the pandemic.

- TerraPower, a Washington state firm working on small-scale nuclear reactor development, has raised $750 million to pursue building its first facility in Wyoming by 2028.

- Tax credits in the $430 billion U.S. climate bill set to become law this week will kickstart carbon capture and storage projects in the oil industry, offsetting startup costs that have long deterred investment.

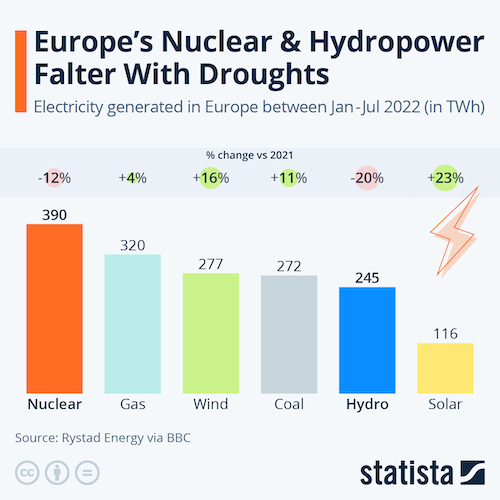

- European natural gas futures spiked almost 7% Monday on fears that low river levels will choke the transport of key fuel supplies. Spot power prices also surged on forecasts of lower wind and nuclear generation.

- Global oil supply could rise if Iran and the U.S. accept an offer from the EU to remove sanctions on Iranian oil exports.

- South Africa’s largest coal exporter is looking to expand after first-half profit surged on record-high fuel prices.

- Several Israeli energy firms plan to pursue renewable projects in North Africa and the Middle East, including in Saudi Arabia and Oman, where Israel has no official ties.

- Norway must phase out some of its old oil and gas fields prematurely to achieve its 2030 goal of a 55% reduction in emissions levels, officials said.

Supply Chain

- California and parts of the Pacific Northwest will see near-record heat this week as a high-pressure dome builds across the region, taxing power supplies and worsening drought conditions.

- Water levels on Germany’s Rhine River will remain critically low throughout the week, hampering transport of vital commodities to inland Europe. In response, some governments are moving to prioritize key fuel shipments by overland rail.

- A heat wave in China is likely to last for another two weeks, making it the longest sustained period of extreme temperatures since records began in 1961, officials said.

- Freight demand across the U.S. is showing signs of softening heading into peak shipping season, with the closely watched Cass Freight Index declining 1.7% from June to July, the second monthly decline in a row.

- The container ship backup at the ports of Los Angeles and Long Beach fell to an all-time low of nine vessels last week, down from a record high of 109 set in January. Container rates from Asia to the West Coast are down 11% this week.

- U.S. ports are projected to import 12.8 million TEUs in the second half of 2022, down 1.5% from last year and about 5% below the first half of this year, according to Global Port Tracker.

- Global container volumes ticked up slightly from May to June but were down modestly from the year before.

- More communities in California’s Inland Empire, the key logistics hub east of Los Angeles, are suspending new warehousing projects over pollution fears even as demand hits all-time highs.

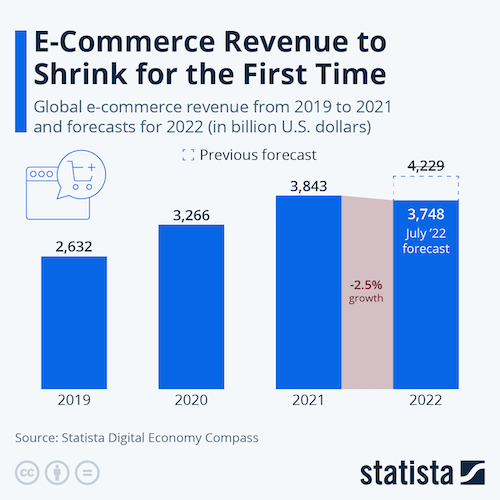

- Supply chain issues will be the major contributor to a decline in e-commerce revenues in 2022, according to new projections:

- A White House pilot project to share freight data among shippers has doubled in size to 36 members since its launch in March, adding momentum to the government’s push for visibility across the U.S. supply chain.

- Air cargo volumes fell 9% year over year in July as a shift back to ocean transport weighed on demand.

- Australia’s Qantas Airways plans to add six Airbus converted freighters to its domestic fleet to replace aging Boeing 737s and expand cargo-carrying capacity.

- Second-quarter volumes at BNSF Railway fell 6%, but higher pricing boosted revenue 14% to $6.6 billion.

- Shipper United Heavy Lift says ships in its project transport sector are almost fully booked for 2023 on strong demand from the oil and gas industry.

- Ship broker Clarkson’s first-half profit rose by half to about $50 million on improved conditions for its oil rig-supplying clients, the firm said.

- Trade between Ireland and the U.K. climbed 54% in the first half of this year despite ongoing disputes over checks on goods resulting from Brexit.

- German steelmakers are in talks with the government about an exemption from possible gas rationing under exceptions being considered for critical industries.

- BHP Group, the world’s largest mining company by market value, saw annual profit nearly triple to almost $40 billion as it benefited from the sale of its petroleum business and strong commodity prices. The firm forecasts demand for copper will double in the next three decades, boosting the bulk shipping industry that carries the raw materials.

- Conagra Brands will close half its distribution centers and heavily automate others as part of a supply-chain overhaul aimed at gaining $1 billion in cost savings.

- Major infrastructure funds have raised about $130 billion this year for power plants, telecom towers and data centers, already outpacing the record of $125 billion set last year.

- In the latest news from the auto industry:

- More Indian automakers, including Ola Electric and Mahindra, are committing to plans to produce electric vehicles by 2024, spurred in part by supply agreements with Western automakers.

- Stellantis is considering investing billions on retooling one of its northern Mexico plants to become a hub for hybrid and electric-vehicle production. The firm plans to end production of its gas-powered Challenger and Charger muscle cars by the end of 2023.

- Self-driving startup Aurora Innovation will delay the launch of its first vehicle by a year until the first half of 2024 due to supply issues.

- The U.S. administration is expected to sign a bill today that will eliminate most electric-vehicle tax credits for most vehicle models currently getting up to $7,500.

- Almost $5 billion of investment has been pumped into the global electric-vehicle charging industry this year, driven by the growth and availability of government funding.

Domestic Markets

- The U.S. reported 95,209 new COVID-19 infections and 411 virus fatalities Monday.

- More cruise companies are scrapping COVID-19 vaccination and testing requirements as passenger volumes continue to linger behind pre-pandemic levels.

- Apple set a Sept. 5 deadline for corporate employees to be in the office at least three days a week, marking its latest policy change after spikes in COVID-19 delayed return-to-office plans several times.

- North Carolina ended its COVID-19 state of emergency Tuesday.

- Two years of pandemic burnout has created one of the U.S.’s worst teacher shortages ever, as states and local governments scramble to boost incentives and fill vacancies.

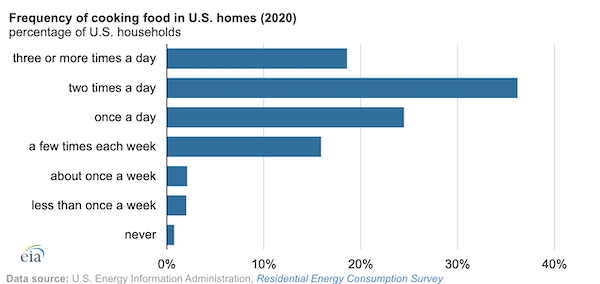

- Consumer prices at grocery stores rose at almost twice the rate of restaurant prices in July, bolstering claims that fast-food chains and sit-down restaurants provide greater value in the current inflationary environment.

- A gauge of U.S. homebuilder sentiment fell for an eighth month in August, marking the worst stretch since the housing market collapsed in 2007.

- Wells Fargo plans to significantly shrink its market leading mortgage business after lending revenue declined 53% in the second quarter from last year.

- A gauge of New York state manufacturing activity plunged this month by the second-most in data going back to 2001, with sharp declines in orders and shipments indicating an abrupt drop-off in demand.

- Year-to-date flight cancellations and delays in the U.S. have surpassed 2019 levels by 11%, reaching almost 1 million.

- American Airlines cut 16% of domestic and international flights from its November schedule as part of efforts to reduce disruptions during the busy Thanksgiving holiday.

- Best Buy is cutting hundreds of store jobs across the country as the tech retailer works to lower costs in response to falling consumer demand.

- HBO is laying off about 14% of its workforce, the latest move in a broader round of cost-cutting by new leadership at parent Warner Bros. Discovery.

- Apple is laying off many of its contract-based recruiters as part of a push to rein in hiring and spending.

International Markets

- Chaos erupted at a Shanghai IKEA Monday as shoppers sought to escape authorities attempting to lock down the store due to a potential COVID-19 infection inside.

- Major Wall Street banks are restarting some trade in Russian debt to allow investors another chance to dispose of assets widely seen in the West as toxic.

- Bayer says it will continue supplying Russia with essential agricultural inputs, reversing course from exit plans discussed earlier this year.

- China cut its holdings of U.S. Treasuries for a seventh consecutive month in June.

- Saudi Arabia’s sovereign wealth fund invested $7.5 billion in blue chip U.S. stocks in the second quarter to diversify its holdings.

- Canadian home sales fell 29.3% year over year in July while prices fell for a fourth straight month, signaling a deepening correction in the nation’s housing market.

- ING bank cut its forecast for China’s 2022 GDP growth to 4%, down from a previous projection of 4.4%, and said a further downgrade was possible.

- Venezuela’s inflation slowed to 7.5% month over month in July, falling from 11.4% the previous month.

- One-third of South Koreans between ages 70-74 are still working, the highest percentage in the world, amid a severe foreign labor crunch.

- London’s Heathrow Airport will extend its daily cap on flight departures through October to cut down on travel disruption.

- The recovery of global business-travel spending has been pushed out at least 18 months to mid-2026 by a combination of inflation, labor shortages and lockdowns, analysts say.

Some sources linked are subscription services.