MH Daily Bulletin: August 12

News relevant to the plastics industry:

At M. Holland

- M. Holland Company has appointed Ton Koenders as the company’s inaugural director of sales for Europe to support international growth and address customer needs in Europe. Click here to read the press release.

- The EU enacted the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulation to protect human health and the environment from the effects of chemicals. Click here to learn more about what REACH compliance means for the plastics industry.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- The IEA raised its forecast for oil demand growth this year as high gas prices prompt more countries to switch to oil as a fuel source. Oil prices gained over 2% Thursday on the news.

- In mid-morning trading today, WTI futures were down 2.2% at $92.29/bbl and Brent was down 1.7% at $97.91/bbl. Still, oil is on track for its biggest weekly gain in four months.

- U.S. natural gas futures jumped 8% Thursday on a drop in gas output and forecasts for higher demand over the next two weeks. In mid-morning trading today, prices were down 0.4% at $8.84/MMBtu.

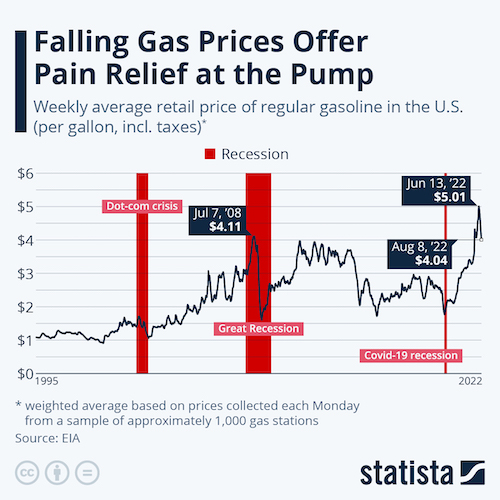

- The average U.S. gasoline price fell for the 58th consecutive day to under $4 a gallon Thursday, the lowest since March.

- Shell halted production at three U.S. Gulf of Mexico deepwater platforms due to a pipeline leak. The firm did not estimate when the platforms, which provide roughly 410,000 bpd of output, will resume operation.

- Nine companies, including Valero and Phillips 66, will buy 20 million barrels of oil in the latest sale from U.S. strategic reserves, officials said Thursday.

- U.S. refiner Citgo Petroleum posted surging quarterly earnings of $1.28 billion, a record driven by higher crude processing volumes and stronger margins.

- Freeport LNG is still capturing small amounts of natural gas from pipelines at its shuttered export plant in Texas to help feed a power plant that serves the state’s grid. Freeport expects to resume partial service at its liquefaction plant in early October.

- U.S. power plant developers added less than half of planned solar capacity in the first half of 2022 due to supply constraints, high costs and a shortage of workers.

- More oil news related to the war in Europe:

- European power prices rose to fresh records Thursday as a heat wave limits energy supplies and wildfires rage across France. In France, the contract price rose to 622 euros a megawatt-hour, which equates to about $1,100 for the equivalent energy of a barrel of oil. Britain saw prices spike 17% to more than six times the seasonal average.

- Some European retailers are turning off lights and shortening hours ahead of winter as energy bills mount and the threat of rationing increases.

- Oil flows through the Druzhba pipeline should resume within days to the Czech Republic, the last European country to get back its deliveries after payment issues were resolved this week. Flows resumed to Hungary and Slovakia Thursday.

- Germany’s Uniper is prepared to swap Australian LNG for U.S. shipments in a bid to quickly boost supplies before winter, officials said.

- The IEA says Russian oil production will likely drop by 20% if its exports don’t find a home with Asian buyers when an EU embargo takes full effect this February.

- At least two floating LNG terminals are heading for Europe in the next several months as the region works to replace supplies cut off by Russia.

- Cuba is imposing blackouts as long as 18 hours in the wake of a fire that destroyed 40% of the nation’s main fuel depot and shattered its only supertanker port.

- China’s Sinopec says it discovered a massive oil field in the Tarim Basin containing some 1.7 billion tons of reserves.

- Saudi Aramco plans to start permanently storing CO2 in one of the world’s largest storage facilities in 2026, part of a goal to reach net-zero emissions by 2050.

- Brazil’s Petrobras is searching for bidders for its potassium mining rights in the Amazon basin, a major source of fertilizer output.

Supply Chain

- July was the second hottest month in Mexico since 1953, as drought conditions left just 10% of its dams full, with many seeing levels drop below half.

- Most of Europe is baking in high temperatures that have triggered huge wildfires, with unprecedented droughts causing water shortages, threatening crops and making river shipping impossible at key gateways.

- The U.S. Logistics Managers’ Index fell 4.3 points to a total of 60.7 in July, its fourth straight monthly decline.

- China’s Hudong Zhonghua shipyard launched the world’s largest container ship for Mediterranean Shipping, with a total capacity of 24,116 TEUs.

- California won $25 million in new federal funding to advance its high-speed rail project beyond the 119 miles now under construction to connect the cities of Madera and Merced.

- The median annual wage for truckload drivers approached $70,000 in 2021, up 18% from 2019.

- In the latest news from the auto industry:

- EU and South Korean officials raised concerns that new U.S. legislation would give impermissible tax credits to domestically assembled electric vehicles, hurting foreign manufacturers.

- China’s auto sales surged 29.7% in July from a year ago, though sales for the first seven months of the year fell 2%.

- Toyota affirmed its production target of 9.7 million vehicles this fiscal year even after suspending more lines at Japanese factories Thursday. The automaker expects material costs this fiscal year to be $12.8 billion higher than initially thought.

- Miners will struggle to expand U.S. operations fast enough to meet a deadline for sourcing key minerals domestically before electric vehicle tax credits wear out, experts say.

- Electric vehicle-maker Rivian Automotive saw its net loss triple to $1.7 billion in the second quarter as it forecast a wider operating loss for the year due to higher raw material costs and supply chain challenges.

- Volvo will build a large battery-cell plant in Sweden to supply its commercial electric vehicles, including trucks.

- SMC, China’s largest chipmaker, posted a higher-than-expected net income of $514.3 million in the second quarter after technology advances helped cushion the impact of U.S. sanctions.

- South Korea’s SK Hynix aims to select a U.S. site for its advanced chip packaging plant and break ground in the first quarter of next year, reports suggest.

- AerCap, the world’s largest aircraft lessor, predicts plane-makers will be hampered by supply chain issues for years, further slowing new jet deliveries and boosting leasing demand.

- July sales at industrial parts distributor Fastenal rose at an accelerating pace, including a 17.8% year-over-year increase in the U.S.

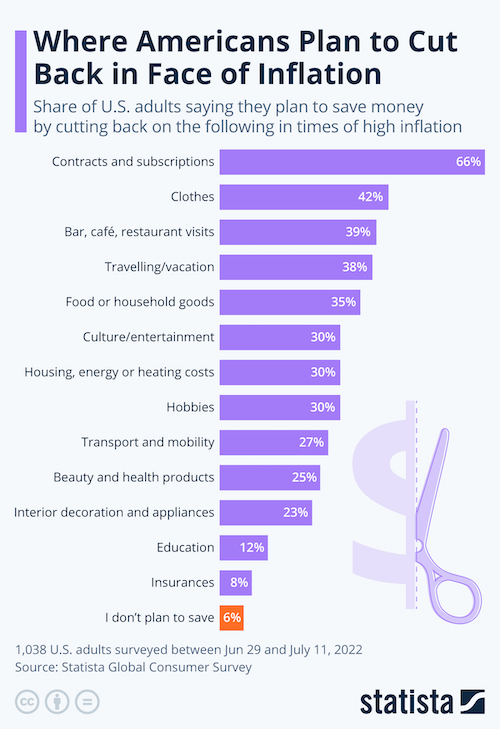

- Growth in Bangladesh’s garment exports could fall by half this year as U.S. and European customers grapple with cost-of-living pressures.

Domestic Markets

- The U.S. reported 103,613 new COVID-19 infections and 400 virus fatalities Thursday. Average COVID-19 cases are down 12% the past week.

- The CDC relaxed its COVID-19 guidelines Thursday, including dropping the recommendation that Americans quarantine themselves if they come into close contact with an infected person.

- Los Angeles County is no longer in the “high” COVID-19 risk level that put the county close to a renewed indoor mask mandate in recent weeks.

- Four in 10 Americans say life has returned to pre-pandemic normalcy, while an even larger percentage report ignoring virus precautions despite continued risk of infection.

- Moderna plans to roll out a single-dose booster shot each year to cover coronavirus, the flu and another common respiratory virus by 2027.

- The labor market is experiencing an unprecedented paradox, with businesses struggling to fill open positions at the same time layoff announcements are increasing. Last week, initial jobless claims increased for a second straight week to 262,000, the highest since November, signaling further softening in the labor market.

- July’s cooler U.S. inflation reading may spur the Federal Reserve to slow its interest-rate increase to 50 basis points at its September meeting, officials indicated.

- Airlines have canceled thousands of flights over the past two days due to a severe storm system in Texas.

- The median price for a U.S. home surpassed $400,000 for the first time ever, while the average mortgage bill jumped to $1,841 in the second quarter, up 32% from the first quarter.

- The average U.S. mortgage rate rose this week, jumping from 4.99% to 5.22%.

- North American hotel prices are expected to rise an average of 22% this year compared to 2021, followed by an additional 11% rise in 2023.

- Walgreens is offering signing bonuses of up to $75,000 for pharmacists in some markets as the company struggles to remedy a chronic worker shortage.

- Luxury companies, including Ralph Lauren, Louis Vuitton and Canada Goose, have seen little to no impact from rising inflation as demand from higher-income customers continues to surge.

- JBS SA, the world’s largest meatpacker, posted a 10% drop in quarterly profits driven by a shortage of cattle from the U.S., where drought conditions have forced ranchers to reduce their herds.

- Johnson & Johnson will stop selling baby powder made with talc in 2023, citing a decline in customer demand amid safety concerns.

- Wayfair’s business declined at a sharp pace in the second quarter as the online furniture seller struggled to maintain consumer interest.

International Markets

- China reported a three-month high of 1,993 new COVID-19 cases Thursday, mostly concentrated in the locked-down tourist spot of Hainan Island.

- Russia posted 25,815 new COVID-19 cases Thursday, its highest tally since March.

- Hong Kong saw its steepest population drop in six decades in the year to June 30, largely a result of its ultra-strict COVID-19 restrictions. Economists say the island’s economy will remain flat this year amid gathering economic headwinds.

- The U.K. economy shrank by 0.1% in the second quarter for the first time since early in the pandemic, driven by a decline in household spending and manufacturing.

- The Bank of Mexico hiked its benchmark interest rate by 75 basis points to a record 8.5% Thursday, mirroring the U.S. Federal Reserve’s most recent policy decision.

- Argentina’s central bank raised its benchmark interest rate by 950 basis points Thursday as the country struggles to tamp down spiraling inflation that hit a 20-year high of 71% in July.

- Rising global food prices and shortages of grain and fertilizer stemming from the war in Ukraine could spur further economic turmoil and social unrest, analysts say.

- The global population is set to cross 8 billion within weeks as experts raise warnings that it may be near a peak.

- McDonald’s said it plans to reopen restaurants in Ukraine over the next few months in an early sign of Western businesses returning to the country, even as the conflict with Russia continues.

- Five of China’s largest state-owned companies, including PetroChina and China Petroleum & Chemical Corp., announced plans to delist from U.S. exchanges as the two countries struggle to come to an agreement allowing American regulators to inspect audits of Chinese businesses.

- Roughly 9% of pre-sold housing in China the past two years risks delayed completion due to financial troubles among developers, affecting some 2.4 million households, Bank of America said. The nation’s deflating property bubble could imperil its economic growth for years, economists say.

- French vaccine-maker Valneva cuts its full-year revenue outlook, citing lower demand for its COVID-19 shot from EU member states.

Some sources linked are subscription services.