MH Daily Bulletin: August 8

News relevant to the plastics industry:

At M. Holland

- The European Union enacted the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulation to protect human health and the environment from the effects of chemicals. Click here to learn more about what REACH compliance means for the plastics industry

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices closed last week at their lowest levels since February, with WTI falling 8% and Brent falling 11%.

- In mid-morning trading, WTI was down 0.6% at $88.45/bbl, Brent was down 0.6% at $94.38/bbl, and U.S. natural gas was down 2.2% at $7.88/MMBtu.

- Active U.S. oil rigs fell by seven to a total of 598 last week, the first weekly decline in over two months. Weekly production was flat at 12.1 million bpd.

- Shale drillers report increasing costs for everything from labor to raw materials and services, which could slow new drilling and production.

- Lightning sparked a fire at one of Cuba’s largest oil storage sites in Matanzas Friday evening, with rescue teams from Mexico and Venezuela helping battle the blaze through the weekend.

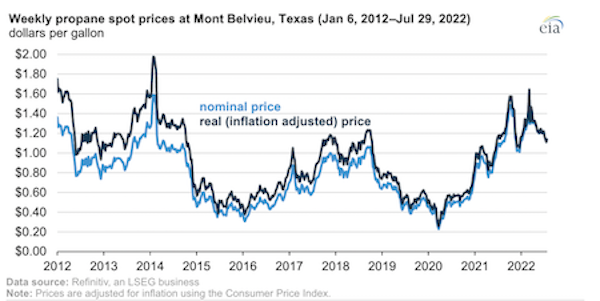

- U.S. propane prices are down 32% from multiyear highs in March, consistent with the recent decline in crude oil prices:

- More oil news related to the war in Europe:

- On Friday, Turkey agreed to purchase Russian oil with rubles.

- Benchmark power prices in Europe set fresh records Friday as hot and dry conditions force suppliers to curb electricity output. More firms are making plans to use less gas and pass energy costs to consumers as the continent’s energy crisis deepens.

- EU nations formally approved a plan to cut gas use by 15% through winter to prepare for a possible complete shut-off in deliveries from Russia.

- British electricity customers will be hit with over 281 million pounds in passed-on costs from the failing of energy suppliers in the first quarter.

- Norway could soon reduce its electricity exports as dry weather begins to impact hydropower generation.

- Hungary eased protections on native forests so that loggers can supply more wood for heating fuel, one example of the extreme steps some nations are taking to prepare for gas shortages this winter.

- Russia is attempting to ban investors from so-called unfriendly nations from selling shares in key energy projects and banks until the end of the year.

- With the supply of compressed wood pellets from Russian and Ukraine cut off by the war, pellet exports from the U.S. to Europe and Asia are booming.

Supply Chain

- Dangerously high temperatures are expected to linger through midweek in the U.S. Pacific Northwest, Central Plains and Northeast, forecasters say.

- Northern California’s McKinney fire expanded to more than 60,000 acres Sunday with 40% containment.

- France and Italy are in the midst of record-setting drought conditions, while unprecedented heat in England has led to discussion of water rationing.

- Asian traffic through U.S. East Coast ports was up nearly 19% year-over-year in the second quarter as shippers avoid the West Coast in fear of a labor strike. Only 20% of ships are arriving on time on the East Coast due to rising congestion.

- Nearly 2,000 dock workers at Britain’s biggest port of Felixstowe will strike for eight days on Aug. 21 in a dispute over pay.

- Japanese companies, including automakers and mail carriers, are temporarily shutting offices and suspending production due to a surge of COVID-19 infections among employees.

- The Baltic Dry Index for bulk shipping rates fell to its lowest level in five months in late July, indicating weaker markets.

- Hapag-Lloyd raised its earnings guidance to as much as $20 billion this year, saying strong freight rates are offsetting flat container volumes.

- Emirati port operator DP World saw a 2.8% increase in volume to 20.2 million TEUs across its global terminal network in the second quarter.

- Canadian Pacific Railway’s net profit fell sharply to about $596 million in the second quarter despite a 7% increase in revenue.

- Freight forwarder DB Schenker posted a 35% rise in second-quarter revenue while operating profit nearly doubled despite declining volumes across its services.

- Schneider National raised its full-year earnings guidance even on projections of moderating freight demand.

- Less-than-truckload carrier Yellow bested Q2 forecasts on a 29.7% rise in revenue per 100 pounds shipped.

- Foreign-trade container throughput at eight major Chinese ports rose 14.5% in July, accelerating from an 8.4% gain in June, while the port of Shanghai saw record volume.

- Tech companies with inventory-management software are seeing booming business as more retailers embrace direct-to-consumer sales.

- A convoy of ships carrying Ukrainian crops sailed from Black Sea ports for the first time since late February this weekend, despite continued Russian shelling in nearby areas. Ukraine also received its first foreign-flagged commercial vessel since Russia’s invasion.

- In the latest news from the auto industry:

- Truck-maker Paccar delivered 46,900 trucks in the second quarter, up 17% from a year ago.

- Engine maker Cummins posted record revenue of $707 million in Q2, up 11% from a year ago, primarily on strength in the North American market.

- Tata Motors agreed to a $92 million acquisition of Ford’s plant in the western Indian state of Gujarat to bolster its manufacturing capacity.

- Chinese electric car maker BYD is considering buying its own shipping vessels.

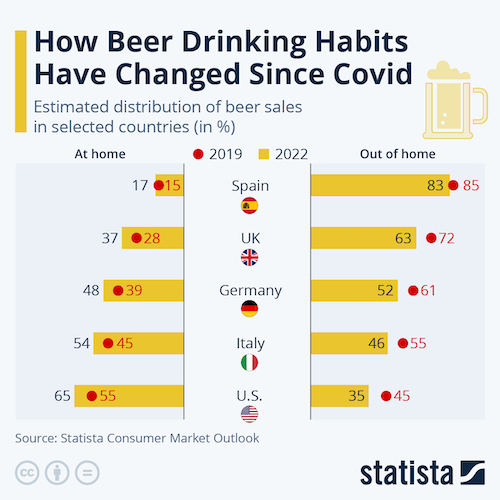

- The latest shortage affecting the craft brewing industry: a nationwide shortage of carbon dioxide that gives beer its taste and fizz.

Domestic Markets

- The U.S. reported 114,830 new COVID-19 infections and 393 virus fatalities Sunday. Elevated fatality levels make it less likely that the CDC will change masking, testing and isolating guidelines in its new report due this week.

- The BA.5 COVID-19 variant now accounts for nearly 86% of known virus cases in the U.S.

- The White House is expected to extend the state of emergency for COVID-19 into early 2023, marking its fourth year in effect.

- The U.S. president left isolation Sunday, the first time he has left the White House in 18 days, after testing negative for COVID-19 twice since suffering a virus rebound last week.

- Despite health officials greenlighting the use of COVID-19 vaccines for children aged six months to four years last month, only 4%-5% have received the doses, new data shows.

- Public schools in New York City will discontinue their weekly randomized on-site PCR COVID-19 testing when classes resume.

- The U.S. Senate on Sunday passed a sweeping $430 billion spending bill intended to fight climate change, lower drug prices and raise some corporate taxes.

- Most economists surveyed by the Wall Street Journal last month expect the U.S. economy to grow in the third quarter and in 2022 as a whole.

- Despite the still-tight jobs market, major employers are reporting reduced turnover and greater success in attracting and retaining employees.

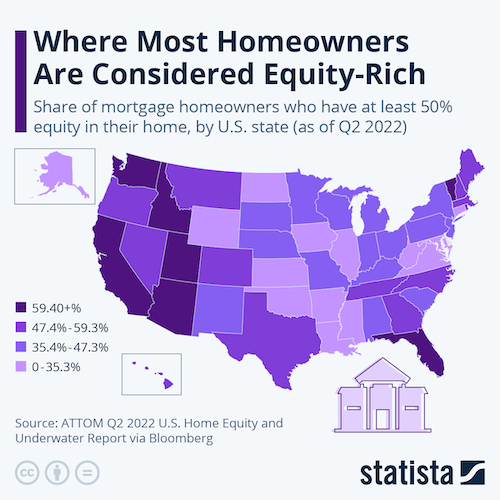

- Nearly half of U.S. mortgaged properties were considered equity-rich in the second quarter, the ninth straight quarterly rise fueled by soaring home valuations and larger down payments by recent buyers.

- Major hotel chains including Marriott, Hilton and MGM Resorts saw double-digit profit growth in the second-quarter on higher occupancy levels and an easing worker shortage.

- Most U.S. news publishers and TV networks reported declining second-quarter ad revenue as ad buyers react to an expected slowdown in consumer spending.

- Amazon will acquire Roomba vacuum maker iRobot for $1.7 billion, a further push into internet-connected home robotics.

- CVS is seeking to buy Signify Health as it looks to expand its in-home health services, according to reports. An initial bid will likely be announced this week.

International Markets

- COVID-19 cases in China spiked to 807 Sunday, with 504 reported in Hainan Province, where tens of thousands of tourists are stranded in lockdowns.South Korea reported 105,507 new COVID-19 infections Sunday, its sixth straight day of infections topping 100,000.

- Russia saw 20,303 new COVID-19 cases Sunday, its highest since March.

- Hong Kong is reducing mandatory quarantine for international visitors to three days from a week.

- Weekly COVID-19 infections in Britain fell by over 500,000 each of the past two weeks.

- Japan plans to roll out a new, Omicron-tailored COVID-19 vaccine as early as October.

- Thailand announced that it will downgrade its classification of COVID-19 to a disease that “needs monitoring,” the same level as influenza, as the nation’s virus situation begins to stabilize.

- China reduced the suspension time for inbound international flights on routes found to have COVID-19 infections to just one week in some cases.

- China’s trade surplus rose to a record $101 billion in July as exports grew 18% year-over-year, easing some concerns of waning global demand.

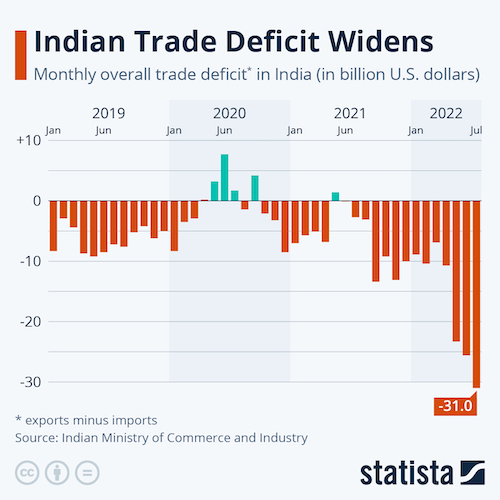

- India’s trade deficit widened further in July to a record $31 billion as high import prices combined with dwindling demand from major buyers like the U.S.:

- Canadian unemployment unexpectedly fell for a second month in July due to more workers dropping out of the labor force, a sign the nation’s economy is losing momentum.

- Australia’s Qantas Airways is calling on some of its business executives to work as baggage handlers for three months at airports in Sydney and Melbourne to help ease staffing shortages plaguing the airline.

- Lufthansa says it passed the peak of summer travel disruption but faces continued challenges due to COVID-19 infections among staff.

- Over 1,000 pilots at Scandinavian airline SAS reached a contract agreement to end a strike that grounded almost 4,000 flights the past two weeks.

- Japanese technology investor SoftBank saw a loss of more than $23 billion in the April-June quarter stemming from a global selloff in technology shares.

- China’s decision to suspend bilateral talks with the U.S. on climate change is casting doubt on the world’s ability to effectively combat global warning for decades to come, experts say.

Some sources linked are subscription services.