MH Daily Bulletin: August 4

News relevant to the plastics industry:

At M. Holland

- The European Union enacted the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulation to protect human health and the environment from the effects of chemicals. Click here to learn more about what REACH compliance means for the plastics industry

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices slid 4% on Wednesday, approaching six-month lows after U.S. data showed a rise in crude stocks last week.

- In mid-morning trading today, WTI futures were down 3.0% at $87.97/bbl, Brent was down 3.3% at $93.63/bbl, and U.S. natural gas was down 1.4% at $8.15/MMBtu.

- U.S. crude inventories unexpectedly rose by 4.5 million barrels last week as exports fell and refiners lowered runs. Gasoline stocks also posted a surprise build on waning demand.

- Crude inventories are rising at the top U.S. storage hub in Cushing, Oklahoma, as the spread shrinks between WTI and Brent futures and U.S. export demand softens.

- U.S. gas prices fell for a 50th day on Wednesday, with the national average declining 3 cents to $4.16 a gallon.

- OPEC and its allies agreed to modestly raise production by 100,000 bpd in September, an amount equal to about 0.1% of global oil demand.

- LNG volumes through the Panama Canal are down 30% since early June, when a fire shut down the U.S.’s second-biggest export facility run by Freeport LNG. Certain operations at the site can resume in October, according to U.S. regulators.

- U.S. producer APA Corp saw second-quarter profit nearly triple to $926 million, while the firm bought more than $500 million of property in west Texas to expand its operations in the Permian basin.

- U.S. producer Occidental plans to use its soaring earnings to accelerate debt payments and cash distribution to shareholders but will not raise oil production, the firm said.

- Brigham Minerals, which owns the rights to extract oil and natural gas from land across numerous U.S. shale basins, is exploring a sale or merger, according to reports.

- U.S. shale giant Chesapeake will focus on its key shale gas plays as it gradually exits non-core oil projects.

- U.S. LNG exporter Cheniere Energy struck a 20-year supply agreement with Thai state-owned energy company PTT.

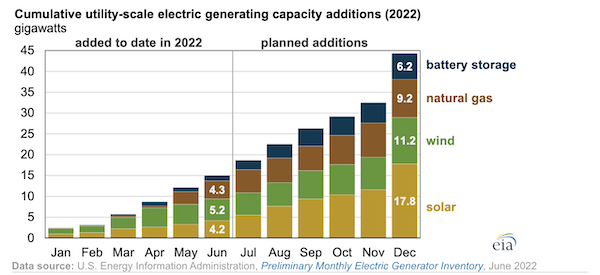

- The U.S. power grid added 15 GW of new utility-scale electricity generation in the first half of 2022, with another 29 GW potentially coming online by the end of the year.

- More oil news related to the war in Europe:

- Natural gas prices in Europe eased Wednesday amid rising inventories and signs of reduced demand, while supplies from Russia remained steady at low levels.

- Germany’s government confirmed rumors that it may delay the planned closure of several nuclear plants to offset the drop in Russian energy supplies.

- Gazprom will receive 50% of a new Russian entity taking control of the massive Sakhalin LNG project north of Japan.

- Saudi Arabia raised oil prices for buyers in Asia to a record high above the regional benchmark Wednesday.

- U.S. officials traveled to Vienna Wednesday to resume indirect talks that could potentially bring more oil to the market from Iran.

- The Caspian Pipeline Consortium, which connects Kazakh oil fields with Russian Black Sea ports, said supplies were significantly down on Wednesday but did not provide figures.

- France will continue cutting nuclear generation as high temperatures make it difficult to cool reactors. EDF France, Europe’s biggest atomic producer and a net exporter of power, has begun importing.

- The restart of a redeveloped gas field in Denmark is delayed by at least several months due to supply chain issues.

Supply Chain

- Severe drought across California has pushed up the price of water by 56% since the start of the year, choking off supplies to cities and farms.

- Intensifying heat in Texas will test the state’s power grid today with demand expected to top 80 GW for the first time ever.

- China’s military exercises around Taiwan will disrupt supply chains through Sunday as shippers avoid Taiwanese ports and trade routes that pass through the area.

- Commercial transport on Dutch rivers is at risk after weeks of drought prompted officials to declare a water shortage.

- The Port of Oakland is suing truckers and others involved with recent protests that shut down container flows and worsened congestion earlier this month.

- BNSF and Union Pacific have started metering containers out of Southern California to avoid another intermodal meltdown like last summer, but the move is causing some import boxes to sit for six weeks or longer.

- Stanley Black & Decker announced plans to shrink its manufacturing footprint and slash its product portfolio by 40% as part of a multi-year, $1.5 billion cost-cutting program.

- Maersk posted net profit of $8.6 billion in the second quarter, driven by “exceptional market conditions” in container shipping. The liner expects container demand to fall this year, however, as inventories pile up in warehouses.

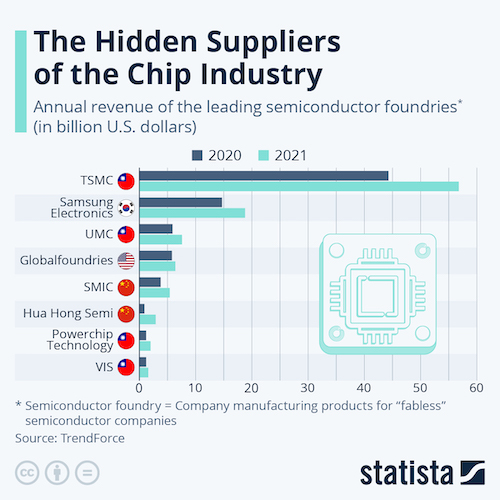

- The U.S. president plans to sign a bill providing tens of billions of dollars to the domestic chip making industry next Tuesday after Congress passed the measure last week.

- In the latest news from the auto industry:

- Chinese electric vehicle maker BYD extended its lead over rivals in July, selling a record 162,539 units, up threefold from last year.

- BMW says vehicle sales will start to normalize by year’s end after its all-time order backlog clears.

- GM’s autonomous driving technology will soon be available on over 400,000 miles of North American highways, double its current operating area.

- Subaru’s U.S. sales rose 19% in the latest quarter, marking the automaker’s strongest growth of any region.

- Swedish truck maker Volvo Group plans to build a large-scale production site for electric vehicle battery cells to help meet growing demand for zero-emission transport.

- July sales at Volvo fell 21.5% as supply chain problems continued to hamper production.

- Geopolitics may delay a decision by China’s CATL, the world’s largest battery maker, to build production in North America, according to reports.

- Electric vehicle maker Lucid Group slashed the number of vehicles it expects to make this year by half, citing supply chain and logistics challenges.

- Albemarle Corp, the world’s largest producer of lithium for electric vehicle batteries, expects profit to surge 500% in its lithium division this year.

- Carmakers are reporting lower demand in Europe and North America amid what analysts say is growing evidence that consumers are balking at high prices amid budget belt tightening.

- China’s exports of electric vehicles to Western Europe and Southeast Asia more than doubled in the first half of the year.

- RoadOne Intermodal Logistics will work with IKEA and Nikola to test the use of electric trucks at the Port of Baltimore.

- Landstar is telling owner-operators in California that they need to relocate out-of-state to remain independent contractors with the carrier.

- The ports of Rotterdam and Singapore plan to build the world’s longest “green corridor” for maritime shipping by 2027, a route that will prioritize zero-emissions ships and logistics solutions.

- A union representing nearly 2,500 Boeing workers near St. Louis voted to accept a three-year contract offer from the plane-maker, averting a potential strike.

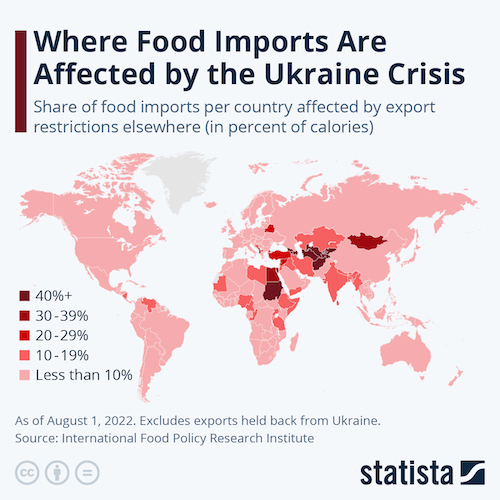

- Staple crop prices have tumbled in recent weeks to about where they were a year ago amid an exodus of speculative traders from the commodities market.

- The London insurance sector is preparing to cover Ukrainian grain and fertilizer shipments through a secure corridor from the Black Sea in voyages that may need up to $50 million of cover per cargo.

Domestic Markets

- The U.S. reported 119,034 new COVID-19 infections and 387 virus fatalities Wednesday.

- The CDC is expected to update its pandemic guidance for public schools in the coming days, including eased quarantine and social-distancing recommendations.

- New Jersey reported its most COVID-19 fatalities in five months this week.

- Alabama ended its daily COVID-19 updates despite rising infections across the state.

- Apple dropped its mask mandate for corporate employees at most locations on Wednesday.

- Eli Lilly plans to begin commercial sales of its COVID-19 antibody treatment this month, testing whether the treatment will remain accessible if shifted to private markets.

- First-time jobless claims rose by 6,000 last week to 260,000, the highest since November.

- Federal Reserve officials are indicating support for a 50-basis-point interest-rate hike when they meet next month, down from the 75-point hikes at the central bank’s last two meetings.

- The U.S. service sector unexpectedly picked up in July, according to the Institute for Supply Management. Meanwhile, a measure of prices paid by businesses dropped by the most since 2017, benefiting from falling commodity prices.

- New orders for U.S.-manufactured goods rose 2% in June, while business spending was stronger than initially thought, according to the Commerce Department.

- North American construction costs are between 5% and 11% higher than a year ago, impacting home construction and prompting some developers to stall or cancel big projects.

- Second-quarter capital expenditures from companies in the S&P 500 are up 20% from last year to around $150 billion, an encouraging signal to investors. At the same time, more businesses are reducing office space, scaling back on consulting and taking other cost-saving measures to stay ahead of a downturn.

- Walmart began laying off hundreds of its corporate workers Wednesday, marking a start to the retailer’s restructuring in the face of lower profit forecasts.

- The U.S. administration proposed new rules requiring airlines to refund travelers for delayed flights and provide vouchers for customers who drop flights due to pandemic concerns. The proposal comes amid calls for the U.S. to boost its airline oversight and address skyrocketing disruption.

- Almost three-quarters of U.S. small-cap stocks are beating estimates for top-line quarterly revenues, a record high.

- In the latest news from second-quarter earnings season:

- Sales at Moderna rose 9%, while costs tied to a surplus of its COVID-19 vaccines contributed to a 21% profit decline.

- Baltimore-based Under Armour lowered profit targets after price markdowns and high freight costs ate into earnings.

- CVS Health Corp raised its full-year outlook after reporting an 11% rise in sales.

- Allstate swung to a $1.04 billion loss as inflation drove up costs to repair and replace automobiles.

- eBay topped quarterly estimates after its shift to selling more luxury products tempered the hit from slowing consumer spending.

- Yum Brands, owner of Taco Bell and KFC, plans to double down on promotional offerings after its earnings missed estimates on rising costs for ingredients, labor and packaging, which pushed overall expenses up 4%.

- The New York Times forecast a drop in ad revenue this quarter as brands cut back on spending in the face of an economic slowdown.

International Markets

- Japan’s rolling average of new COVID-19 infections hit 1,628 per million people Wednesday, the highest among G7 nations. Pandemic-induced worker shortages are crippling the nation’s hospitals, public transit and other essential services.

- South Korea reported over 110,000 new COVID-19 cases on Wednesday, a three-month high.

- The Bank of England raised interest rates by 50 basis points, the biggest hike in over 25 years.

- Euro zone retail sales plunged 1.2% in June while factory gate prices continued to rise, according to new data. Euro zone business activity also contracted in July for the first time since early last year.

- China’s services activity grew at the fastest rate in 15 months in July despite a dip in foreign demand and more companies cutting staff.

- Bank of America downgraded its 2023 growth forecast for Mexico’s economy from 1% to 0% due to potential fallout from a U.S. downturn, which could also stall rebounding activity in the nation’s airline industry, according to forecasts.

- European budget carrier Ryanair flew a record 16.8 million passengers in July, putting it ahead of Lufthansa as Europe’s largest airline by passenger volume.

- Japan’s Nintendo sold 23% fewer of its flagship Switch consoles in the latest quarter, a result of continued chip shortages.

- Russian shoppers flocked to H&M after the retailer opened its doors for the last time in the country, offering steep discounts to get rid of inventory.

Some sources linked are subscription services.