MH Daily Bulletin: July 27

News relevant to the plastics industry:

At M. Holland

- M. Holland has obtained Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) compliance for its Mtegrity™ line of materials. Click here to read the full press release.

- Plastics News has recognized four M. Holland Mployees as Women Breaking the Mold in the industry in 2022! Learn more about Tracy Conrady, Daisy Serdan Corona, Suky Lawlor and Lindy Holland Resnick.

Supply

- Oil prices fell Tuesday as traders braced for the release of 20 million more barrels of U.S. crude reserves, part of the White House’s plan to release 180 million barrels between March and September.

- In mid-morning trading today, WTI futures were up 0.5% at $95.42/bbl, Brent was up 0.6% at $105.10/bbl, and U.S. natural gas was down 2.2% at $8.80/MMBtu.

- The American Petroleum Institute reported a larger-than-expected crude draw of 4.037 million barrels this week. Government data will be released today.

- The U.S. government will start the process of replenishing strategic crude reserves as early as this fall as the stockpile hits its lowest level in nearly 40 years, officials said. So far, releases have reduced gasoline prices by as much as 40 cents a gallon.

- Liberty Oilfield Services is the latest U.S. producer to plan an output boost in the coming months, as more firms shift from purely rewarding shareholders to spending on new capacity.

- Chinese LNG importers are not procuring additional shipments for winter in anticipation that the nation’s COVID-zero policies will keep demand depressed even as other nations scramble for supplies.

- More oil news related to the war in Europe:

- On Tuesday, EU policymakers approved a plan for member nations to voluntarily cut gas use by 15% until March, which could become binding in the event of a supply emergency. Benchmark European gas futures spiked 10% on the news and are now about 430% higher than a year ago.

- BASF will cut production of ammonia used to make fertilizer to reduce its natural gas use, exacerbating an already tight market for fertilizer.

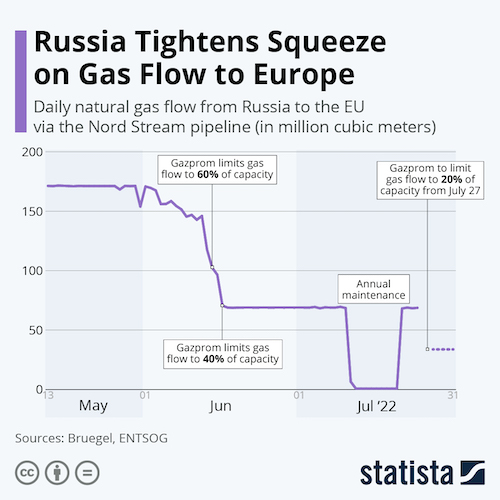

- German power supplier Uniper is getting just 33% of its Russian gas orders after flows were reduced on the Nord Stream pipeline this week. Experts say Russia will continue reducing flows to raise pressure over Western sanctions, curtailing Europe’s ability to store fuel for winter.

- Ukrainian officials warned of possible ruptures on the Nord Stream pipeline to Europe after a sudden and unexpected increase in pipeline pressure initiated by Gazprom.

- German industry associations say the government must speed up approvals for higher emission limits as more firms switch to coal or oil as a short-term solution for replacing gas use.

- On Tuesday, Naftogaz became the first Ukrainian government entity to default since Russia’s invasion.

- Workers at Shell’s Prelude LNG platform in Australia extended a strike to Aug. 11, which will keep shipments from the facility at zero.

- U.S. clean power installations, such as wind and solar, fell 55% in the second quarter due to trade issues and inaction by Congress.

- The number of U.S. solar industry jobs rose 9% last year to more than 255,000, mostly in installation and project development.

- Japan and South Korea generated a record amount of electricity from solar power in May.

Supply Chain

- Portland, Oregon, declared a state of emergency through Sunday as a sweltering U.S. heatwave lingers in the Pacific Northwest.

- Central California’s Oak Fire, the state’s largest wildfire this year, grew at a slower pace on Tuesday while containment rose to 26%.

- Half of Britain’s overground rail network could shut down today as more than 40,000 workers stage a one-day strike.

- Amazon is raising the cost of Prime memberships by 31% across most of Europe in September, echoing a similar move in the U.S. in a bid to combat rising operational costs.

- In the latest supply chain news from second-quarter earnings season:

- UPS reported better-than-expected profit as an 11.9% jump in per-package revenue offset a 4.9% decline in volume, which was partly due to its enforcement of maximum package volumes on Amazon, its largest customer.

- Chipmaker Texas Instruments beat expectations while raising its profit forecast for the current quarter, helping to counter widespread fears of a slowdown in electronics demand.

- U.S. aerospace firm Raytheon missed forecasts as supply chain issues dented production. In a positive signal, the firm reported a jump in demand for its Pratt & Whitney jet-engine segment.

- General Electric beat expectations with a 27% revenue jump in its jet-engine unit but slashed cash-flow estimates due to supply constraints and lower orders in its renewables division.

- French tire maker Michelin saw half-year sales rise 18.7% despite a hit to profit after it pulled business from Russia.

- In the latest news from the auto industry:

- German lawmakers will scrap incentives for electric vehicles next year as consumer demand grows rapidly.

- Volkswagen began assembling electric compact SUVs at its Chattanooga, Tennessee, plant on Tuesday, marking the start of a campaign to sharply ramp up U.S. EV production.

- GM will curtail hiring in response to looming economic uncertainty.

- GM’s South Korean unit resumed production at two factories Tuesday after weeks of shutdowns caused by procurement issues.

- GM announced new multi-year agreements for battery materials from LG Chem and Livent Corp. as the automaker seeks to assemble 1 million electric vehicles per year by 2025.

- New electric vehicle factories costing hundreds of millions of dollars are planned in Italy and Indonesia.

- French auto supplier Valero maintained its full-year guidance on expectations of rising global car output.

- The U.S. Senate advanced a bill providing some $76 billion in incentives for domestic computer chip production on Tuesday, with final approval potentially coming later this week.

- Logitech’s chief executive says impacts from the global chip shortage could be completely clear by December.

- South Korea’s SK Group floated plans for up to $21 billion in new U.S. investment in semiconductors, green energy and bioscience projects.

- Canadian e-commerce firm Shopify plans to lay off 10% of its global workforce amid a pullback in online spending.

- Turkey plans to supervise a trading lane that would safeguard passage of Ukrainian grain from Black Sea ports, potentially freeing as many as 100 commercial vessels trapped since late February.

Domestic Markets

- The U.S. reported 124,549 new COVID-19 infections and 367 virus fatalities Tuesday. Fatalities are up 10% in the past two weeks.

- The BA.5 subvariant of Omicron now accounts for 82% of all COVID-19 cases in the U.S., according to the CDC.

- The FDA asked vaccine manufacturers to target the fast-spreading BA.5 and BA.4 subvariants for an updated booster shot this fall. Meanwhile, health officials are urging people over age 50 to get another booster shot, adding that doing so would not prevent them from getting an Omicron-tailored shot in the fall.

- A recent COVID-19 outbreak at Los Angeles International Airport has led to over 400 cases among TSA and airline staff.

- Amid reports that the White House may declare monkeypox a public health emergency, new data shows that the U.S. leads the world in infections, with over 3,400 reported during the pandemic.

- U.S. consumer confidence fell to its lowest in a year and a half in July due to inflationary and interest-rate concerns, according to the Conference Board’s latest index.

- Over 40% of American consumers expect to add to their debt levels in the second half of the year as inflation forces them to put less money aside for emergencies and long-term financial goals.

- More than a quarter of the 20 million Americans who quit their jobs in the first five months of the year are reconsidering whether they made the right choice, a new survey shows.

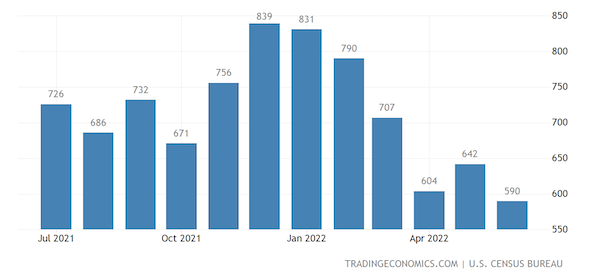

- New home sales fell 8.1% in June to an annualized rate of 590,000, a two-year low, while construction backlogs rose to the highest level since January.

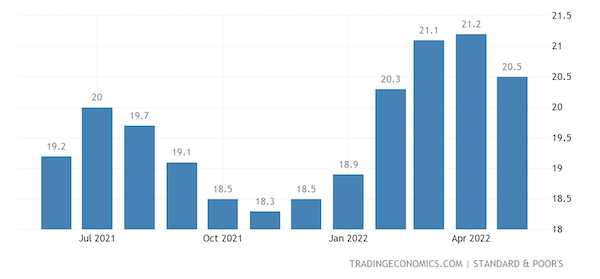

- U.S. home price growth remained strong in May, with S&P’s Case-Schiller index rising 19.7% year-over-year despite rising interest rates, according to the latest data:

- The median monthly U.S. rent for a one-bedroom apartment rose 11% year-over-year to $1,450 in July, according to Zumper, with the highest price in New York City at $3,780.

- U.S. hotel staffing levels remain 16% below pre-pandemic levels, adding to disruption in the rebounding travel industry.

- Shares of U.S. retailers fell sharply Tuesday after industry bellwether Walmart cut forecasts, stoking fears of a slowdown in consumer spending.

- Minnesota-based 3M announced plans to spin off its healthcare operations by 2023 in a deal potentially worth $45 billion. The industrial giant also sought bankruptcy protection for its beleaguered unit that makes earplugs for the U.S. military and set aside $1 billion to settle related product liability lawsuits.

- GM lost $5 million per day during the second quarter at its Cruise robotaxi business in San Francisco, raising its total losses at the unit, which recently began charging for rides, to nearly $5 billion since 2018.

- In the latest news from second-quarter earnings season:

- Microsoft and Google parent Alphabet reported some of their worst quarterly financials in two years, citing among other reasons a slowdown in digital advertising and cloud activity. The firms expressed optimism about the coming months, however, sending shares higher in morning trading on Wednesday.

- Coca-Cola, Mondelez and Chipotle topped forecasts on strong demand despite higher product prices.

- McDonald’s saw a 10% jump in same-store sales but said rising expenses would impact margins for the rest of 2022.

- Visa, the world’s largest payments processor, said higher travel activity contributed to a 12% jump in payment volumes.

- Logitech reported a 38% profit decline and lowered its full-year sales forecast, citing currency movements and lower consumer confidence.

International Markets

- Over 1 million people in a district of Wuhan, China, have been completely locked down after four COVID-19 cases were discovered on Tuesday.

- COVID-19 hospitalizations in Australia hit a second straight all-time high Tuesday, fueled by the BA.4 and BA.5 subvariants of Omicron.

- The International Monetary Fund cut its forecast for global GDP growth to 3.2% in 2022, its third downgrade this year amid what is potentially the worst economic slowdown since the 1970s. Among industrialized nations, Britain and Germany are expected to see the slowest growth.

- Profitability for China’s industrial sector grew in June after two months of contraction.

- Inflation expectations in South Korea are at their highest level in at least 20 years this month, according to a central bank survey.

- Japan’s government released its first optimistic view on the nation’s economy in three months Tuesday, despite warnings of rising raw material prices and continued supply constraints.

- Brazilian inflation hit 11.39% year-over-year in July, slightly below expectations.

- London Heathrow says its daily 100,000-passenger limit has improved operations over the past month, although luggage operations remain disrupted due to a shortage of ground handlers.

Some sources linked are subscription services.