MH Daily Bulletin: July 22

News relevant to the plastics industry:

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

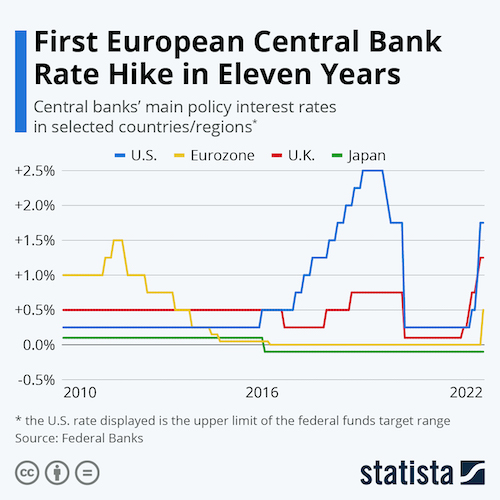

- Oil prices fell 3% Thursday after the European Central Bank raised interest rates, sparking recessionary fears.

- In mid-morning trading today, WTI futures were up 0.9% at $96.72/bbl, Brent was up 0.9% at $104.80/bbl, and U.S. natural gas was down 4.4% at $8.28/MMBtu.

- U.S. retail fuel prices have fallen for 37 consecutive days, with the average gasoline price down to $4.41 a gallon, according to AAA.

- Valero, Marathon and Phillips 66 are set to bring in a collective $14 billion in cash from operations this quarter, the most ever, according to S&P Capital. Earnings at the U.S.’s eight biggest refiners could surge over 650% from last quarter.

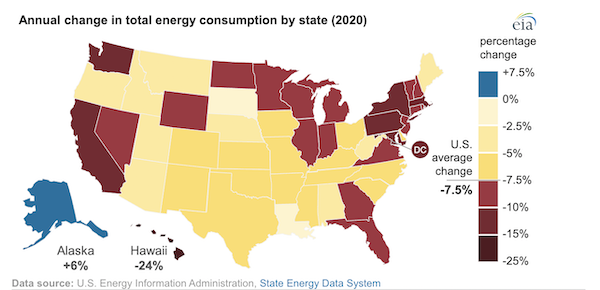

- U.S. energy consumption fell by a record 7.5% in 2020, with only Alaska registering an increase:

- More oil news related to the war in Europe:

- Spain, Portugal and Greece rejected the EU’s proposal for member nations to cut natural gas use by 15% for the next eight months. The news came as the International Energy Agency called for even larger cuts.

- Supplies on the Nord Stream pipeline, which accounts for more than one-third of Russian gas exports to the EU, resumed Thursday at roughly 40% of capacity, equal to the pipeline’s pre-maintenance flows. The news brought relief to European industry.

- Germany raised its targets for gas storage this year, reflecting growing concern about supplies heading into winter. The nation’s metal, chemical and paper industries would be hit hardest by rationing.

- Germany is in the final stage of a roughly $8.1 billion deal to bail out power supplier Uniper.

- U.S. officials say their goal is to have a price cap on Russian oil by the end of this year.

- Faced with the growing global risk of shortage-induced blackouts, localities from Brooklyn to Tokyo are providing more incentives for customers to curb power use.

- In California, batteries now contribute 60 times more to peak power capacity than in 2017, a sign of the technology’s growing use as a backstop to overstretched power grids.

- Libya’s National Oil Corp resumed crude production at several oil fields after lifting force majeure on exports last week.

- The European Investment Bank will spend $406 million to build a link between the power grids of Germany and Britain, the first of its kind.

Supply Chain

- A sweltering heat wave scorched the U.S. for a third consecutive day Thursday, particularly in East Coast and Southern states, as 160 million Americans face temperatures above 100 degrees this weekend.

- Extreme heat in Texas has sparked over 7,000 acres of wildfires this week.

- Europe’s heat wave moved steadily eastward Thursday, prompting emergency alerts throughout Italy, Poland and Slovenia.

- California’s administration held firm on enforcing a 2019 state law that tightens rules for non-employee truck drivers, as hundreds of protesters continue to block truck movements into and out of the Port of Oakland, the third largest port on the West Coast.

- The queue of vessels awaiting berths at the Port of Los Angeles is down 80% since the start of the year.

- Union Pacific is charging customers extra for delayed freight pickup from trains as pressure mounts for railroads to quickly clear containers from backlogged West Coast ports.

- FedEx is suspending Sunday residential delivery in certain U.S. markets starting Aug. 15, a move following pleas from independent contractors for better compensation and an easing of shipping volumes amid rising costs.

- Mexico could face up to $30 billion in tariffs as the U.S. and Canada ramp up a trade spat over the nation’s energy policies. The dispute could affect the nation’s energy, automotive and agriculture sectors and cloud North America’s investment attractiveness just as manufacturers are looking to return manufacturing from Asia.

- The 60,000-member trade union of Mexico’s Telmex went on strike for the first time in nearly 40 years Thursday after failing to reach a contract deal with the Mexican telecom giant.

- U.S. transit systems are faltering due to a severe shortage of bus drivers.

- Contract workers at South Korea’s Daewoo Shipbuilding offered to end a strike if the company drops legal threats.

- Aviation supplier lead times for sourcing material can now run six months to over a year, threatening plane-makers’ plans to boost output.

- Swiss automation firm ABB, seen as a barometer of global manufacturing, reported a 20% increase in orders last quarter amid easing supply chain constraints.

- Mattel’s second-quarter sales rose 20%, signaling continued strong demand for toys even as inflation reduces household budgets.

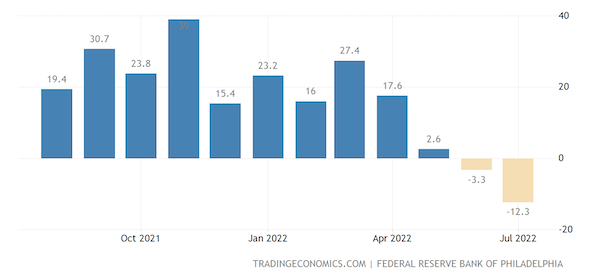

- The Philadelphia Fed’s monthly index of Mid-Atlantic factory activity slumped in July to the lowest since May 2020, with economists seeing further slowdown in the months ahead.

- In the latest news from the auto industry:

- Ford unveiled a series of measures meant to quicken its shift to producing electric vehicles, including new sourcing deals with China’s CATL, Australian mining giant Rio Tinto and ioneer Ltd.’s Nevada lithium mine. The automaker now expects to have capacity to supply more than half a million electric vehicles by late 2023 compared to just over 27,000 in 2021.

- Hyundai turned its best quarterly profit in eight years, as a weak South Korean currency lifted the value of its earnings abroad while demand stayed high for its SUVs.

- Top U.S. auto retailer AutoNation reported a 14% year-over-year revenue decline in Q2 amid sharply falling new vehicle sales.

- Companies planning to electrify their shipping operations are looking to turn warehouses into hubs for charging fleets of electric trucks and cargo vans.

- Porsche says it could soon make more money from electric cars than from gas-fueled cars, as it expects 80% of its models to be electric by 2030.

- Rivian plans to significantly expand its electric vehicle lineup with the construction of several new factories by 2030.

- Tesla and at least six suppliers stationed in Nuevo Leon, Mexico, are expediting shipments through a dedicated lane at the state’s border crossing with Texas.

- Samsung Electronics is in the early stages of a plan to build 11 new chipmaking plants in Texas at a cost of $200 billion.

- More manufacturers, including automakers and appliance-makers, report an easing of the global chip shortage.

- China’s government says it is preparing to intervene as steadily rising prices for polysilicon suppress demand for solar panels, especially at utility-scale farms.

Domestic Markets

- The U.S. reported 125,827 new COVID-19 infections and 347 virus fatalities Thursday.

- The White House announced on Thursday that the president is suffering a mild COVID-19 infection.

- COVID-19 cases in New York City surged 14% the past two weeks.

- Los Angeles County health officials warned that an indoor mask mandate could be reimposed next week, even for the fully vaccinated. The news drew widespread opposition from the county’s business community.

- Roughly one-quarter of people with COVID-19 still have symptoms 12 weeks after infection, while over 3.3 million adult Americans are estimated to be out of work full-time due to long-COVID.

- Over 60% of U.S. nurses surveyed are looking to leave the profession amid continued stresses caused by the pandemic.

- U.S. initial jobless claims rose for a third week to 251,000, an eight-month high.

- Private equity firms spent a record $226.5 billion taking companies private in the first half of 2022, up 39% from the same time last year as lower corporate valuations made it easier to lure businesses away from stock markets.

- Despite surging rent costs, it is still more affordable to rent than to purchase a home in 38 of the 50 largest U.S. metro areas, research shows.

- Shares of American Airlines and United Airlines fell over 9% Thursday despite both carriers posting their first quarterly profit without U.S. government aid since the pandemic began, as higher costs threaten to offset booming demand.

- Flight capacity at American Airlines (-10%) and United Airlines (-13%) will be trimmed well below 2019 levels this year in a bid to halt travel disruptions.

- Boeing won orders for 297 aircraft at this week’s first Farnborough Airshow of the pandemic, handily beating Airbus’ 85 orders.

- AT&T says more of its customers are falling behind on their bills, a sign that rising costs are pinching many households on essential services.

- Social media company Snap Inc. posted its weakest-ever quarterly sales growth as economic turmoil hits digital advertising. U.S. social-media giants shed nearly $90 billion in market value following the news.

- Domino’s Pizza missed quarterly profit estimates Thursday amid soaring costs and a severe labor shortage.

International Markets

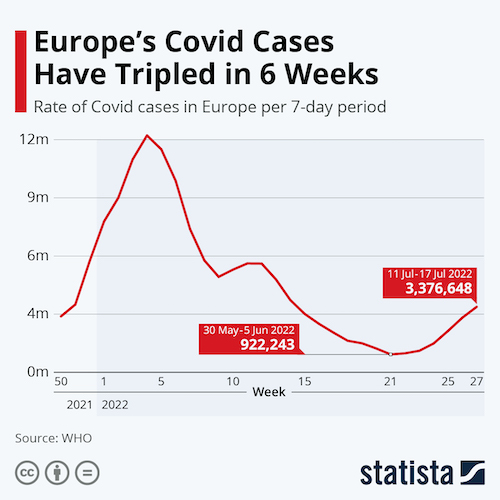

- Global COVID-19 cases have doubled over the past six weeks, according to the World Health Organization.

- Over 3.3 million people contracted COVID-19 in Europe last week, with cases tripling the past six weeks:

- China’s southern megacity of Shenzhen is mobilizing to curb a slowly spreading COVID-19 outbreak, including new orders for widespread testing and lockdowns for all COVID-affected buildings.

- China’s southern tourist hub of Beihai went into a snap lockdown Thursday, stranding some 2,000 tourists as a COVID-19 outbreak surpassed 1,400 infections.

- Australian lawmakers declined to impose new mask mandates despite surging infections and near-record hospitalizations.

- New Zealand is seeing record COVID-19 fatalities.

- More news related to the war in Europe:

- Corporate default rates in emerging markets could spike above 10% this year for the first time since the 2008 financial crisis due to fallout from the war in Ukraine, economists say.

- Turkish negotiators say Ukraine and Russia will sign a deal today allowing Ukraine to resume grain shipments from its Black Sea ports.

- HSBC agreed to sell its Russia business to Expobank, a privately owned Russian bank, shortly after Moscow moved to restrict sales of Western firms in retaliation for sanctions.

- French officials lowered forecasts for GDP growth next year from 2.5% to 1.4% in the face of mounting uncertainty caused by geopolitical conflict.

- The European Central Bank raised its key interest rate by a larger-than-expected 50 basis points Thursday, the first hike in a decade that ends an eight-year era of negative rates. Policymakers also agreed on a new bond purchase scheme for the bloc’s big debtor nations, including Italy.

- An S&P Global survey of private-sector activity in the euro area dropped to a 17-month low in July, led by worsening output among manufacturers and a near-stalling of service-sector growth.

- The Bank of Japan maintained its ultra-low interest rates Thursday despite raising forecasts for inflation this year.

- South Africa surprised markets by delivering a 75-basis-point interest-rate hike on Thursday, its largest in over two decades.

- Global mergers and acquisitions activity dropped 20% year over year by volume in the first half of 2022, according to PricewaterhouseCoopers.

- European budget carrier Ryanair reached a tentative agreement on pilot contracts that could improve operations in France and Spain.

- Australia’s Qantas Airways scrapped over 8% of domestic flights last month, making it the country’s least reliable carrier.

- China’s search engine giant Baidu unveiled an autonomous vehicle with a detachable steering wheel, which the firm plans to use in robotaxi services by next year.

Some sources linked are subscription services.