MH Daily Bulletin: July 21

News relevant to the plastics industry:

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices fell modestly Wednesday on news of lower U.S. gasoline demand.

- In mid-morning trading today, WTI futures were down 3.7% at $96.16/bbl, Brent was down 2.8% at $103.90/bbl, and U.S. natural gas was up 0.1% at $8.02/MMBtu.

- U.S. natural gas futures are up 48% this month, including a 10% jump Wednesday, as a heatwave drives demand.

- U.S. crude inventories fell by 446,000 barrels last week, reversing forecasts for a build. Meanwhile, gasoline inventories were higher than expected after a 7.6% drop in gasoline demand from the same time last year.

- Declining favor for new crude projects has led U.S. midstream firms to boost plans for natural gas pipelines and export terminals, a key growth opportunity.

- Canada’s Keystone oil pipeline operated at reduced rates for a third day following a pump failure in South Dakota.

- Oil field services provider Baker Hughes reported a larger-than-expected Q2 loss, led by a $365 million charge from its Russian operations and supply chain issues.

- Shell is exploring a sale of its stakes in two U.S. Gulf of Mexico oil and gas developments, potentially raising as much as $1.5 billion for the energy major.

- Houston’s Cheniere Energy reached a long-term deal to supply PetroChina with LNG from 2026 to 2050.

- U.S. power grids are increasing their resilience in the face of more frequent extreme weather events, industry leaders say.

- The International Energy Agency says global demand for electricity is slowing sharply due to recessionary fears and high prices.

- More oil news related to the war in Europe:

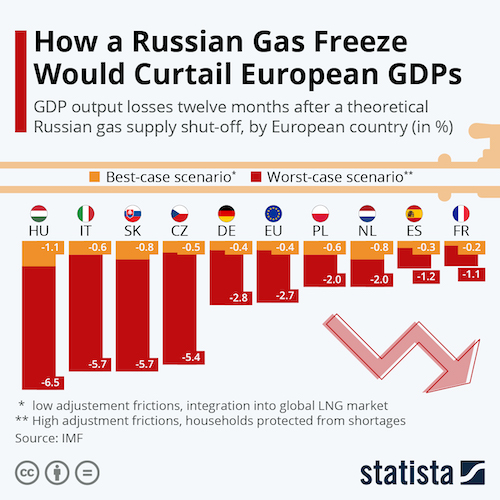

- The EU formally proposed that member nations cut their natural gas consumption by 15% over the next eight months in a plan that would affect all households, power producers and industry.

- Shipments of natural gas on the key Nord Stream pipeline from Russia to Germany resumed at a reduced rate this morning, ending 10 days of tense speculation about whether Moscow would completely halt flows.

- A European bailout for German power supplier Uniper could be finalized this week, allowing for greater governmental control but also for higher prices for customers.

- China’s large purchases of discounted Russian crude are upending global trade flows.

- In the first quarter of this year, China approved new coal-fired power capacity equivalent to its capacity approvals through the first half of last year.

- Striking workers are disrupting LNG production at one of Shell’s offshore locations in Australia.

Supply Chain

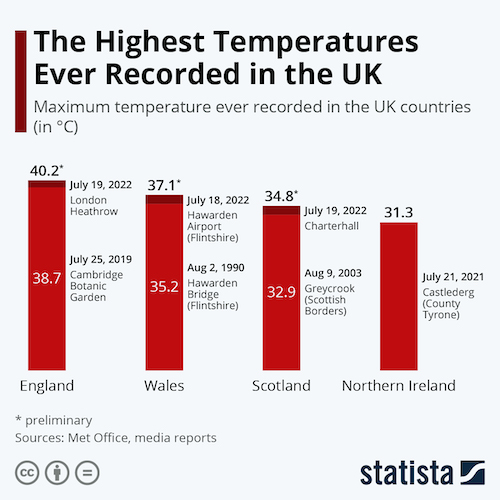

- Over 100 million Americans are under heat warnings this week as temperatures rise above 100 degrees in many locations. Texas, Louisiana and Arkansas will see new all-time highs, forecasters say.

- Hundreds have died and thousands have been evacuated as sweltering heat continues to grip a wide swath of Europe, spurring unusual fire activity.

- Low water levels on major transport rivers in drought-stricken Germany will dent the nation’s output this year, banks warn.

- Truckers say they are prepared to block the West Coast’s third-busiest container port in Oakland until reforms are made to the state’s tightened rules on non-employee drivers, which could take weeks or months.

- Containers are piling up at rail terminals across the U.S. as the White House’s recent intervention helped avoid a labor strike but did little to alleviate a crippling worker shortage.

- U.S. trucking volumes rose 2.3% from Q1 to Q2, reversing declines in the previous two quarters.

- The U.S. took its first step toward imposing new tariffs on a range of Mexican products Wednesday, part of an escalating dispute over Mexico’s energy policies.

- Britain’s Royal Mail service is losing up to 1 million pounds per day as inflation-hit consumers cut back on online shopping and postal workers threaten to strike.

- Prices for key solar-panel material polysilicon rose for the eighth week to their highest in a decade, threatening to slow installations.

- Soaring earnings at shipping companies signal the need for tougher competition rules, according to the OECD’s International Transport Forum.

- In the latest news from the auto industry:

- GM’s South Korea unit suspended production at two factories due to procurement issues.

- Ford plans to cut 8,000 jobs, primarily from its recently formed Ford Blue business unit that makes internal combustion engines, as part of its plan to cut $3 billion in operating costs and shift to e-vehicles.

- The U.S. Postal Service plans to buy at least 25,000 electric delivery vehicles — accounting for 40% of all new orders — as it works to replace an aging fleet.

- Tesla beat second-quarter earnings estimates with a 27% boost in global deliveries from last year.

- Electric vehicle sales in Europe rose by one-third in the first half of 2022 compared to last year, boosting their market share from 7.5% to 9.9%.

- Supply-chain bottlenecks are slowing delivery of new electric vehicles to retail customers.

- Toyota is partnering with Japanese mini-vehicle specialists to develop small electric vans and fuel-cell electric trucks.

- Volkswagen and Franco-Italian chipmaker STMicroelectronics plan to build a new auto-specific semiconductor that could alleviate Volkswagen’s shortages.

- The U.S. House plans to vote as early as next week on a slimmed-down version of legislation providing tens of billions of dollars in subsidies and tax credits for the semiconductor industry.

- Shares of major chipmaking firms are down by double-digit percentages this year as a chip shortage turned into an inventory glut in some sectors.

- U.S. computer chipmaker SkyWater announced plans to build a $1.8 billion factory at Purdue University in Indiana.

- Projected global sales of semiconductor manufacturing equipment should hit $117.5 billion this year, up 14.7% from last year’s record level, according to trade group Semi.

- Chile’s state-owned Codelco, the world’s top copper producer, put a temporary halt on construction of all mining projects following the death of two workers in less than a month.

- Ukraine has resumed loading bulk vessels with grain at the Port of Odessa following reclamation of the strategic Snake Island.

Domestic Markets

- The U.S. reported 126,018 new COVID-19 infections and 353 virus fatalities Wednesday.

- New COVID-19 cases in California rose 36% the past month, while 90% of Californians live in areas with high infection rates.

- New York extended its pandemic state of emergency as virus hospitalizations rise, straining medical facilities.

- Less than 50% of eligible Americans have gotten booster shots against COVID-19, the CDC says.

- Survey results show only 36% of Americans typically wear a mask outside their homes, the lowest number since the pandemic began.

- Omicron differs from earlier variants of COVID-19, with sore throat and hoarse voice its top symptoms.

- People who catch COVID-19 have a greater risk of being diagnosed with diabetes and heart conditions for weeks after infection, according to a new study.

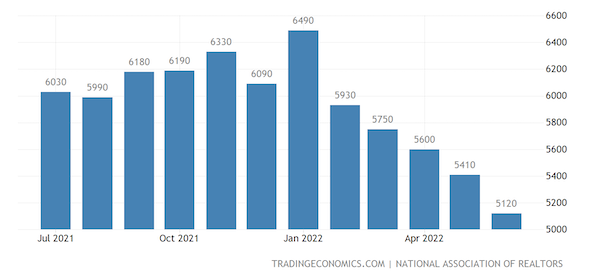

- U.S. home sales fell 5.4% to an adjusted rate of 5.12 million units in June, a two-year low, reflecting a surge in borrowing rates.

- The median U.S. home price rose 13.4% year over year to a record $416,000, while mortgage demand is down to the lowest level since 2000.

- High prices for personal- and home-care items are finally weighing on demand, with retail sales falling for seven out of nine categories in the latest quarter, according to Bloomberg.

- The number of U.S. workplaces experiencing union organizing efforts rose this year to a six-year high.

- Americans over age 75 are the only age group whose labor-force participation rate is projected to grow over the next decade, potentially by as much as twofold, due in part to inflation pressures.

- Venture capitalists invested around $16 billion in U.S. early-stage deals in the second quarter, a 22% decrease from a year ago.

- Macy’s is quickening plans to open smaller stores that aren’t attached to suburban shopping malls, a shift in strategy spurred by the pandemic, the retailer said.

- Boeing has been cranking out order announcements at this week’s Farnborough Airshow, restoring momentum with at least 100 firm orders for its 737 MAX.

- United Airlines reported a quarterly profit of $329 million and a 6% revenue gain over the comparable quarter in 2019, marking its first quarterly profit without government aid since the beginning of the pandemic.

- Many prominent U.S. tech companies are slowing hiring amid recessionary fears. Microsoft began cutting open positions Wednesday, while Google imposed a two-week hiring freeze.

- Pfizer is investing $470 million to expand a vaccine research facility near New York City.

- Wall Street cut revenue estimates for the U.S. cruise industry by at least 5% in recent months as labor shortages dent the industry’s recovery just when the last restrictions are being lifted.

- The U.S. president stopped short of a rumored climate emergency declaration Wednesday but promised to take executive action to spur renewables development. Officials say climate-induced extreme weather events led to $145 billion in damages last year.

International Markets

- Shanghai is making residents take a COVID-19 test at least once per week until the end of August in a scramble to keep infections at zero.

- Hong Kong’s policy of isolating people infected with new COVID-19 variants has led to underreported cases, leading officials to scrap the measure.

- Tokyo surpassed 30,000 daily COVID-19 cases for the first time yesterday.

- Australia neared record COVID-19 fatalities and hospitalizations Wednesday as authorities urged people to mask up and work from home.

- The CDC elevated five countries, including Colombia and Paraguay, to its Level 3, High Risk rating for COVID-19 infection.

- The European Central Bank will raise interest rates for the first time in 11 years today, with economists now forecasting a larger hike than initially thought.

- Canadian inflation surged 8.1% in June from a year earlier, the fastest rise since 1983 but short of market expectations.

- The Asian Development Bank cut its forecast for GDP growth in developing Asia this year due to uncertainty caused by China’s zero-COVID strategy.

- Japan logged a trade deficit for the 11th consecutive month in June after fuel products led a 46.1% rise in import values from a year ago.

- Early trade data for South Korea shows the nation’s exports remained resilient this month, advancing 14.5% from a year earlier despite lockdowns in China.

- A Chinese city facing mortgage boycotts by homeowners is setting up a bailout fund to help developers complete new projects.

Some sources linked are subscription services.