MH Daily Bulletin: July 20

News relevant to the plastics industry:

At M. Holland

- M. Holland has launched a new Healthcare Packaging line card to help manufacturers solve industry challenges and meet regulatory and supply chain demands.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Libya lifted force majeure and will resume some crude exports today following a weeks-long leadership shakeup at state-owned National Oil Company.

- Saudi officials say the nation is unable to boost production due to a lack of refining capacity rather than crude shortages.

- More oil news related to the war in Europe:

- The EU announced a new plan to conserve energy, calling for member nations to cut natural gas use by 15% starting in August to save supplies for winter.

- Moscow says Russia will fulfill its commitments to supply natural gas to Europe but warned that flows via the Nord Stream pipeline could be curbed to just 20% next week if sanctions prevent additional maintenance on its components. Before maintenance, gas was flowing at about 40% of the pipeline’s capacity.

- Leaders of Germany’s massive chemicals industry say dwindling supplies of gas could force some firms to shut down in the coming months.

- An abrupt cutoff in Russian gas shipments could shrink Europe’s economy by 2.65% this year, economists say. Hungary, Slovakia, the Czech Republic and Italy would see the deepest recessions, the IMF warned.

- Russia is expanding its ties to Iran with a $40 billion pledge to develop more oil and gas fields in the nation. Russia is also set to build a new pipeline to China by 2024.

- Gazprom’s Singapore unit failed to deliver some LNG cargoes to Indian refiners and warned that it may not be able to meet long-term supply deals.

- Saudi Arabia’s crude exports are set to rise over 1 million bpd from June to July on a boost of shipments to China.

- Western U.S. states have significantly more public land available for oil and gas leasing than for renewables development, new analysis shows.

Supply Chain

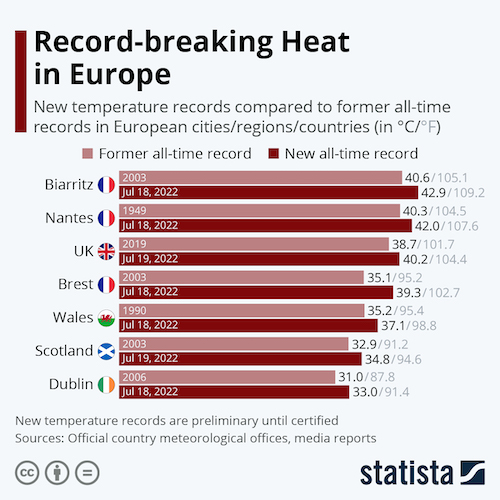

- Britain recorded its hottest day ever Tuesday as 34 locations shattered all-time temperature records. Extreme temperatures are forecast to last into next week in Spain, France and Portugal.

- Container operations at the Port of Oakland ground to a near halt Tuesday as truckers protested a new California law that toughens rules for non-employee drivers.

- Labor activism is roiling British industries, with over 115,000 postal workers at the Royal Mail service voting to strike Tuesday and hundreds of dockworkers at a large port in Liverpool also threatening to strike.

- South Korea’s government signaled it could intervene to break up a worker strike that halted operations at Daewoo Shipbuilding & Marine Engineering since last month.

- Throughput at the 10 largest U.S. container ports reached 2.16 million TEUs last month, a 5.9% increase from 2021 and a 26.9% increase from 2019.

- U.S. online retail sales are projected to grow 11.7% this year to nearly $1.1 trillion, according to FTI Consulting.

- New commercial ship orders plunged by over one-third in the first half of 2022 as costs rose, according to maritime analyst VesselsValue.

- A favorable legal agreement for Frontline and Euronav could make it easier to clear antitrust scrutiny in a rumored merger of the tanker giants.

- After acquiring two supply-chain startups last year, retailer American Eagle says its logistics operations could one day be bigger than its clothing business.

- Hasbro overcame high costs and freight expenses to post an 18% rise in second-quarter operating margins, while inventories surged 73% as the toy-maker built up holiday supplies early.

- Halliburton warned that new supply of fracking equipment won’t be available for the rest of the year due to parts shortages and supply snarls.

- Parts shortages could leave more Lockheed Martin fighter jets grounded for lengthy repairs, the U.S. government warned.

- Boeing is receiving orders for its new 787 Dreamliner jets after inspection and production issues halted deliveries since May 2021.

- Parts shortages will delay normal shipments of Pratt & Whitney engines to Airbus until early next year, the engine-maker said.

- GlobalFoundries’ plan to build a computer chip factory in upstate New York could fall through if lawmakers fail to pass a $52 billion bill spurring domestic production. In a sign of progress, the Senate agreed to debate the bill on Tuesday.

- Japanese farming and construction-equipment-maker Kubota plans to spend $2 billion to build new factories in the U.S. and India as it works to shift production overseas.

- In the latest news from the auto industry:

- Thousands of Hyundai workers in South Korea approved a new wage deal Tuesday, avoiding potential strike action.

- Volvo’s share of pure electric and hybrid vehicle sales rose sharply to 31% of total sales in the second quarter, even as overall unit sales fell by more than a quarter due to production and supply chain issues.

- Profit growth at U.S. car dealers likely lost momentum in the second quarter as the auto industry struggled to ramp up production due to parts shortages.

- PepsiCo committed to spend $400 million annually on diverse supplier contracts.

- The mining sector’s drive toward automation could be worsening a skilled labor shortage that has already prevented large companies from running their most technologically advanced mines.

- Harvests in Romania, Europe’s biggest corn exporter, could slump substantially this year due to drought conditions, officials say.

Domestic Markets

- The U.S. reported 123,639 new COVID-19 infections and 352 virus fatalities Tuesday.

- The fast-spreading BA.5 subvariant of Omicron now accounts for nearly 80% of all COVID-19 variants in the U.S., the CDC says.

- COVID-19 deaths in Los Angeles County are nearing their highest levels since the end of the first Omicron wave last winter. Across California, rising infections are prompting more schools to return to mask mandates.

- Hospitals in Washington state are verging on 130% overcapacity as staff shortages combine with a resurgence in COVID-19 infections.

- After gaining CDC approval Tuesday, Novavax’s COVID-19 vaccine will soon be the fourth shot available for U.S. adults.

- Protection from COVID-19 vaccines may be short-lived and require frequent booster shots, a new study from Yale indicates.

- A buildup of immunity and changing virus strains could play a part in fewer cases of serious health complications in children with COVID-19.

- New U.S. home construction fell 2% last month to a 1.56 million annualized rate, the lowest since September.

- Home sales in California fell 21% in June from a year ago as higher mortgage rates hit demand.

- U.S. cities that saw the largest influx of new residents over the course of the pandemic now have the highest inflation rates of over 10%, online seller Redfin says.

- Miami-based private equity firm 777 Partners agreed to buy 30 more Boeing 737 MAX jets as it expands its low-cost airline plans.

- Volkswagen is reviving its Scout brand for a new line of electric sport trucks and SUVs, the firm announced.

- Johnson & Johnson reported a profit decline in the latest quarter and lowered its full-year guidance, citing rising costs.

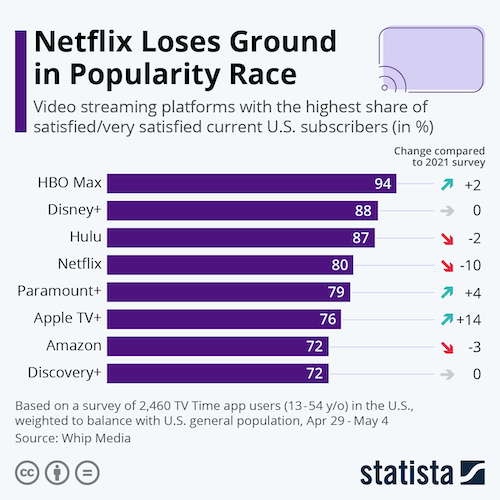

- Netflix reported its second straight quarter of subscriber losses for the first time in company history Tuesday. The firm has lost about two-thirds of its market value year-to-date.

International Markets

- China posted 906 new COVID-19 cases Tuesday, a two-month high, with more than half the tally coming from the nation’s least developed regions. The northern port city of Tianjin shut some businesses and schools after 11 COVID-19 cases were reported.

- The World Health Organization said European nations should boost vaccination drives and bring back mask-wearing to tackle quickly rising COVID-19 cases spurred by BA.5.

- Europe is adding dozens more firms and people to its list of sanctions on Moscow, including Russia’s top lender Sberbank. Officials will also amend some sanctions in a bid to free up food and fertilizer shipments.

- The U.K.’s annual rate of inflation rose to a four-decade high of 9.4% in June, the fastest rise in prices for a G7 economy of the pandemic.

- The European Central Bank is expected to unveil its first interest-rate increase in more than a decade today, which economists say will be more modest than recent hikes in the U.S., Canada and Britain.

- Some Canadian businesses are reconsidering expansion plans following the central bank’s surprise full-percentage-point interest-rate hike last week.

- Mexican inflation likely remained at 20-year highs above 8% in the first half of July, economists say.

- Mexican lender Credito Real requested to enter U.S. Chapter 15 bankruptcy as it struggles to meet its financial obligations.

- EasyJet’s chief executive says sweltering heat has melted runways and added to the carrier’s travel disruptions this summer.

- Saudi Arabia said it will cut airport charges by as much as 35% to compete in a region that already hosts some of the world’s biggest passenger hubs.

- Rolls-Royce liquid-hydrogen combustion engines could make their way into small business jets in the near future, the company said.

- Brazilian plane-maker Embraer is getting more plane orders from airlines in the U.S. and Canada.

- A meeting between EU and Chinese trade officials Tuesday led to a broad new agreement to work together on addressing global food insecurity.

Some sources linked are subscription services.