MH Daily Bulletin: July 12

News relevant to the plastics industry:

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices steadied Monday as supply worries balanced out with lower demand prospects.

- Oil prices dove in mid-morning trading today, with WTI futures down 7.5% at $96.31/bbl and Brent down 7.1% at $99.52/bbl. U.S. natural gas was down 1.8% at $6.31/MMBtu.

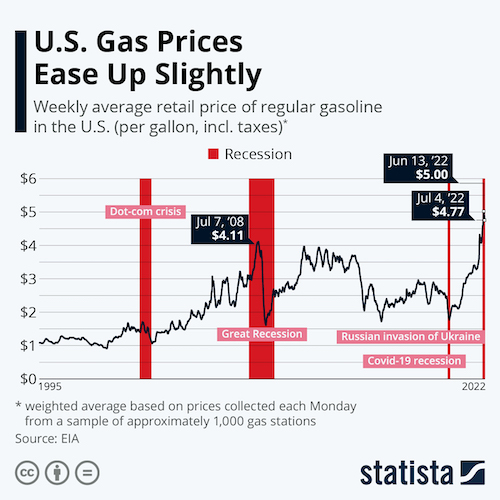

- The average U.S. gasoline price fell to $4.68 a gallon on Sunday, according to AAA, down 6% from a June high of $5.02. Price volatility is causing pain for U.S. gas station owners, who can’t reliably predict costs.

- Some California cities, including Los Angeles, are pushing to ban construction of new gas stations to help boost the switch to renewable fuels.

- Soaring electricity prices will give U.S. power plants their largest summer profits in two decades, with year-over-year gauges of profitability already quadrupling on America’s largest grid and rising 10-fold for some gas plants in Texas.

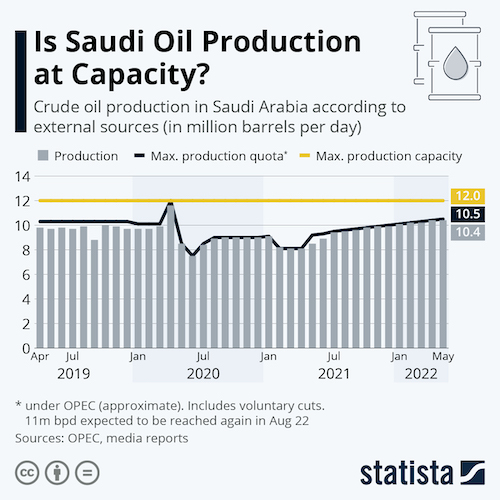

- The U.S. president will make the case for greater oil production from OPEC nations during a rare visit to Saudi Arabia this week, officials said. Historical data suggests Saudi Arabia may already be near peak operating capacity:

- More oil news related to the war in Europe:

- German power prices more than doubled Monday after the largest pipeline carrying Russian gas to Germany began 10 days of annual maintenance.

- The U.S. is backing Canada’s plan to send sanctioned pipeline equipment to Germany, where officials say it could be used to shore up dwindling European gas reserves.

- Germany continues to hold “difficult” talks with Uniper SE over a massive rescue package for the embattled power supplier.

- A Kazakhstan oil pipeline carrying 1% of the world’s supply will continue operating after a Russian court reversed a ruling that ordered flows to be suspended.

- Brazil’s administration says it is nearing a deal with Moscow to buy cheap diesel fuel from Russia.

- India’s Russian oil imports rose 15.5% from May to June to a record 950,000 bpd, while deliveries from the Middle East fell sharply.

- Cargoes of fuel are making unusual trips hundreds of miles up Germany’s Rhine River to inland refineries, as importers scramble to replace lost Russian supplies.

- Germany signed a joint declaration with the Czech Republic to ensure cooperation on replacing Russian fossil fuels and boosting the transition to clean energy.

- Shell invested $40 million into Brazil’s Carbonext, a carbon-credit developer that runs preservation projects across millions of acres of the Amazon forest.

- Brazil’s Petrobras says it signed a five-year, $1.25 billion loan deal linked to its sustainability commitments.

Supply Chain

- Texas households and industry cut power use to help the state’s grid operator avoid rolling blackouts Monday, as triple-digit temperatures across the state pushed demand to new heights.

- A sweltering “heat dome” broke at least 10 temperature records in cities across the Southwest and central U.S. over the weekend, with more all-time highs forecast for this week.

- The French government said the nation’s wheat crop will shrink 7% this year to below the five-year average due to heat and drought, while wildfires raged in southern Europe where temperatures topped 100°F.

- Second-quarter PC shipments likely fell 12.6% from a year ago, marking the steepest demand drop-off in nearly a decade, according to research firm Gartner.

- Tyson Foods’ dominant chicken business is faltering amid staffing shortages, rising supply costs and a growing backlog of unfilled orders.

- In the latest news from the auto industry:

- The global market for auto plastics will rise 4.7% per year and hit $43.4 billion by 2030 due to rising demand for high-performance plastics, analysts say.

- Tesla’s Berlin factory will halt production the next two weeks for planned maintenance.

- Electric vehicle maker Rivian is set to cut hundreds of jobs totaling 5% of its workforce in a bid to shrink areas of the company that grew too fast, reports say.

- Mercedes’ quarterly sales fell 16% from last year on continued supply problems and a steep decline in Chinese demand, the automaker reported.

- Renault’s sales fell almost 30% the first six months of this year after withdrawing from Russia, its second-largest market.

- Hyundai announced plans to build its first fully dedicated electric vehicle factory in South Korea, targeting production by 2025.

- Audi began construction on an electric vehicle plant in northeast China that could produce 150,000 cars per year by 2024.

- China’s auto industry association revised downward its forecast for this year’s sales, citing weak demand.

- GM may offer electric versions of its Chevrolet Express and GMC Savana commercial vans by 2026.

- Airbus raised its 20-year forecast for jet deliveries as soaring fuel bills prompt airlines to buy new, more fuel-efficient planes.

- Nike will start replacing its enterprise resource planning system this year in a bid to tackle high in-transit inventories and extended lead times.

- Joann Fabrics is making contracts with a wider variety of ocean carriers after freight costs dented the firm’s profit in recent quarters.

- Apparel retailer Gap is replacing its chief executive after several years of slumping sales and operational hiccups.

Domestic Markets

- The U.S. reported 160,227 new COVID-19 infections and 444 virus fatalities Monday. Infection levels are considered high in one-fifth of U.S. counties, while total hospitalizations are up 4.5% the past seven days.

- U.S. health experts say COVID-19 infections are being severely undercounted due to inadequate reporting.

- The U.S. government will once again extend the nation’s COVID-19 public health emergency, keeping measures that give millions of Americans access to insurance and telehealth.

- California reported its first case of the new BA.2.75 subvariant of Omicron Monday, a strain raising concerns across the globe for its apparent ability to evade immunity.

- COVID-19 hospitalizations have risen steadily in Alabama the past two months.

- All adult Americans will become eligible for a second COVID-19 booster dose under a new White House plan yet to be released.

- About 300,000 children under age 5 have received COVID-19 shots in their first two weeks of availability, a surprisingly slow pace compared with older groups.

- Moderna is developing two COVID-19 booster shots that could target more recent subvariants of Omicron, including BA.4 and BA.5.

- The FDA granted full approval to Pfizer’s COVID-19 vaccine for teens between 12 and 15 years.

- The U.S. government bought over 3 million of Novavax’s COVID-19 vaccine doses ahead of impending regulatory authorization.

- The National Labor Relations Board received 1,411 union organizing petitions in the first six months of the year, a 69% increase over 2021 and the most in over six years.

- U.S. consumers eased their inflation expectations for the long-term in June, according to the New York Fed’s monthly survey.

- S&P 500 companies paid a record $140.6 billion in dividends in the second quarter.

- Redfin says 15% of U.S. home purchase deals fell through in June, the largest percentage since early pandemic lockdowns froze the housing market in April 2020.

- U.S. passenger vehicle inventories were flat for a sixth consecutive month in June at 1.1 million vehicles, according to Cox Automotive.

- The average monthly payment on a new car loan hit an all-time high of $686 in June, according to Edmunds, up 4% from January and 13% from a year ago. In several cities, car payments are higher than the average rent.

- Frontier says it made its last and final offer to buy Spirit Airlines, potentially marking the end to a months-long bidding war with rival JetBlue Airways for control of the U.S. budget carrier market.

- Cruise tickets are selling at a relative discount to costs of air travel, hotels and gasoline, which are each hitting all-time highs, new data shows.

- Boeing secured a large new order for 737 MAX jets from Japanese airline ANA Holdings, which is looking to replace its aging fleet.

- The U.S. Navy is testing a 3D aluminum printer to build parts for the USS Essex based in Pearl Harbor, Hawaii.

International Markets

- A moving average of COVID-19 cases in Europe rose 28% last week after most countries began dropping preventive measures for the summer. The EU’s medicines regulator is urging more age groups to get a second booster shot.

- COVID-19 cases are rising at the fastest pace since late May in China, where some 30 million citizens are back under movement restrictions as more cities impose partial lockdowns and mass-testing.

- China locked down a city of 300,000 people when just a single COVID-19 infection was detected, while Shanghai saw 59 new infections Monday, spurring bulk buying over fears of another lockdown.

- Hong Kong suspended some non-emergency services in public hospitals amid a recent surge in COVID-19 patients.

- Indonesia will reimpose a COVID-19 testing requirement for travelers who haven’t received a booster dose, a bid to stem rising infections.

- A fourth COVID-19 vaccine dose reduced Israel’s virus death rate among vulnerable populations by 72%, new research shows.

- Over 1 billion COVID-19 vaccine doses worldwide may have been wasted due to weak demand and improper storage.

- More news related to the war in Europe:

- Russia’s current account surplus rose to a record $70.1 billion in the second quarter, fueled by surging revenues from energy and commodity exports.

- Fighting inflation is a higher priority for euro zone finance ministers than the bloc’s dwindling economic growth, officials said Monday. Leaders also announced a potential 25% boost in government funding for companies hurt by sanctions.

- Retail beauty brand Sephora plans to sell its Russian business as it seeks a full exit from the country.

- India is set to surpass China as the world’s most populous country in 2023, with each counting more than 1.4 billion residents this year, the United Nations said.

- Budget European carrier Wizz Air will cut its flight schedule by an additional 5% this summer due to airport staffing shortages.

- Staff-strained Heathrow Airport in London capped the number of departing passengers at 100,000 per day through August and asked airlines to stop selling new tickets.

- Over 50% of flights were delayed out of Toronto Pearson International Airport Sunday after one of the nation’s largest telecom providers suffered a day-long outage. The airport already ranks as the world’s worst for on-time travel.

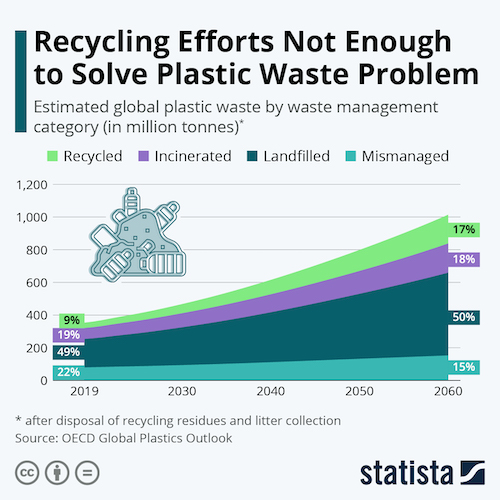

- Global plastic waste is projected to triple by 2060, with two-thirds coming from packaging, consumer products and textiles, according to the Organization for Economic Cooperation and Development:

Some sources linked are subscription services.