MH Daily Bulletin: July 11

News relevant to the plastics industry:

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices rose 2% Friday but ended the week down more than 3%, as rising inflation rates stoked fears of lower demand.

- Oil prices continued to fall Monday, suppressed by demand concerns stemming from mass COVID-19 testing in China. WTI futures were down 2.3% at $102.30/bbl, Brent was down 1.8% at $105.10/bbl, and U.S. natural gas was up 7.1% at $6.47/MMBtu.

- The average U.S. gasoline price saw its biggest single-day drop in more than a decade on Friday, falling by 3.1 cents to $4.721 a gallon, according to AAA. Ten states still have prices over $5 a gallon.

- U.S. energy firms added two active oil rigs last week, the fifth weekly gain to a total of 597, the highest since March 2020.

- An explosion and fire at a natural gas facility in Medford, Oklahoma, prompted evacuations over a two-mile radius on Saturday. No injuries were reported.

- Top U.S. LNG producer Cheniere Energy is asking the White House for an exemption from federal pollution limits to avoid extended production shutdowns.

- British LNG prices plummeted over 20% Friday on news that the country’s energy regulator would propose reforms to cut reliance on imports, including a quicker transition to renewables.

- LNG cargoes shipping from a massive offshore facility in Australia will be disrupted for at least the next week due to a workers’ strike, Shell warned.

- More oil news related to the war in Europe:

- The U.S is calling on its counterparts in the Quad group of nations — Australia, India and Japan — to back a price cap of $40-$60/bbl for Russian oil.

- Russia’s Gazprom will further cut gas deliveries to Italy by about one-third to 21 million cubic meters per day, after having already cut supplies in half since June.

- European benchmark natural gas futures are up 20% over the past week and 100% over the past month, as doubts grow over Russia’s promise to deliver more gas once it takes delivery of a key pipeline part from Canada.

- Gulf producers Saudi Arabia and the UAE may have substantially less spare capacity than official figures show, lessening the chance they could make up for Russian crude lost from the global market due to sanctions.

- A “dark” ship-to-ship logistics network is developing for Russian oil shipments off Malta, parts of Africa, Greece and the mid-Atlantic, reports show.

- A newly completed gas pipeline between Bulgaria and Greece could help restore regional supplies after Russian gas deliveries to Bulgaria were shut off in April.

- The U.K. is steadily raising its price caps on energy, threatening millions of low-income households when demand increases heading into winter.

- Rolls Royce is among the winners of over $65 million in U.K. government funding to advance carbon-removal technology.

Supply Chain

- The wildfire in California’s Yosemite National Park doubled in size over the weekend to 2,044 acres with zero containment.

- Rogers Telecommunications, one of Canada’s biggest telecom operators, suffered a 19-hour service outage over the weekend that shut banking, transport and government access for millions of people.

- The shipping market is starting to trend in favor of importers, with some companies renegotiating agreements they struck at the height of the pandemic and dipping into the spot market to take advantage of lower rates.

- A tenth of container ships were non-operational on the container market in May due to delays and bottlenecks in supply chains and ports, according to Sea-Intelligence.

- Long-term rates to ship goods from China to the U.S. West Coast almost tripled between June 2021 and June 2022 to $7,981 per container, according to data firm Xeneta.

- CMA CGM will cut freight contract rates for French customers by 10% on Aug. 1, a response to the government’s calls for price cuts to help inflation-hit consumers.

- J.B. Hunt became the latest logistics firm to expand into ocean shipping with the launch of a new container service between Asia and the Pacific Northwest using chartered vessels.

- Trucking is seeing a softening of demand with spot rates down 22% during the first six months of this year, according to DAT Freight & Analytics.

- Texas will add new cross-border inspection checkpoints for trucks entering from Mexico after dozens of migrants died in connection with a tractor trailer found recently in San Antonio.

- Close to 20% of supply-chain executives surveyed by consulting firm McKinsey & Co. said they had brought some production back to a nearby country in the past year, double the number from a year earlier.

- In the latest news from the auto industry:

- Automakers may be less likely to provide meaningful upgrades to powertrains and styling in gas-powered cars as they turn exclusively to building electric vehicles, a transition that could be complete by the late 2030s, according to company pledges.

- BMW’s second-quarter sales declined nearly 20% even as electric vehicle deliveries surged, a byproduct of continued chip shortages and China’s intermittent lockdowns.

- Chinese auto sales expanded 23.8% year over year in June, boosted by government incentives and a recovery in Shanghai production.

- Indian auto giant Mahindra has set up a separate business unit to build electric vehicles with the goal of having 20% to 30% of its SUV models electric by 2027.

- Maersk made its first direct purchase of three Boeing 767 cargo jets and plans to place the aircraft with a U.S.-based logistics operator.

- Maersk left the International Chamber of Shipping after sitting on its board for over a decade, a move attributed to the group’s weak leadership on climate issues.

- Cargo liquefaction — where moisture causes cargoes to liquify and suddenly shift — continues to be the leading cause of death for crews in the dry bulk sector, despite recent efforts to bring greater safety.

- Abbott Laboratories has reopened its Sturgis, Michigan, baby formula plant, which heavy rains shut down last month just weeks after the facility returned from a bacteria-related closure.

- Kraft Heinz reached a deal to return its products to shelves of British grocery giant Tesco after a disagreement stemming from Tesco’s refusal to charge inflation-adjusted prices to consumers.

Domestic Markets

- The U.S. reported 21,068 new COVID-19 infections and nine virus fatalities Sunday. The average daily fatality toll of 329 has not changed significantly over the past two months.

- New York City health officials are urging a return to mask-wearing due to rising levels of COVID-19. Roughly 25% of people getting tested in Manhattan and Queens are positive.

- Total COVID-19 hospitalizations in Florida hit 4,172 late last week, the most since mid-February. While active COVID-19 cases eased there last week, the state has logged 1,271 virus deaths since June 1, the highest in the nation.

- California’s COVID-19 positivity rate has doubled over the past five weeks to 16.7%.

- New research from Columbia University suggests the BA.4 and BA.5 subvariants of Omicron may be four times as vaccine-resistant as earlier variants of Omicron.

- Concerns over inflation and consumer demand will dominate the corporate-earnings season that kicks off this week, with reports due from big names like JPMorgan Chase, BlackRock, PepsiCo and Delta Air Lines.

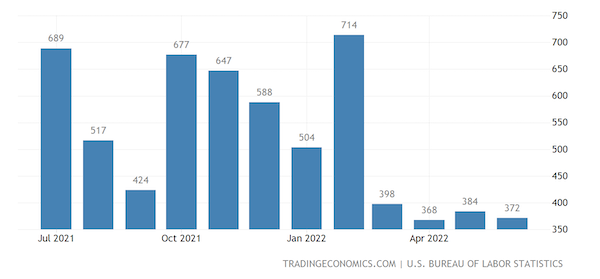

- U.S. non-farm payrolls data showed the economy added more jobs than expected (+372,000) in June, a sign of persistent labor market strength. Overall employment is now just 0.3% off pre-pandemic levels, with most gains in the private sector.

- Education and health services led U.S. job creation in June, followed by professional and business services and leisure and hospitality. Meanwhile, the pace of tech hiring slowed from recent months but remained higher than pre-pandemic levels.

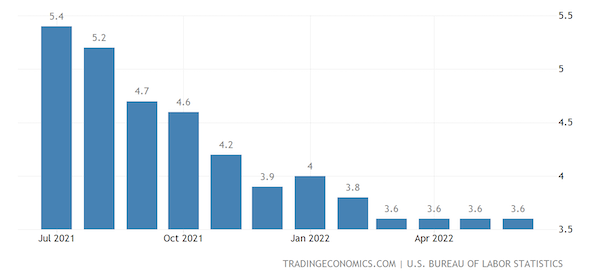

- The U.S. unemployment rate was unchanged at 3.6% in June, the same as the previous three months and the lowest since February 2020:

- Commercial insurance prices in the U.S. rose 12% on average in this year’s first quarter, with many businesses facing double-digit rate increases since at least 2019.

- Over a quarter of new car sales in the nation could be electric by the end of 2025, roughly two years ahead of prior forecasts, according to analysts.

- BofA Global Research says car makers will offer up to 135 electric vehicle models in the U.S. by 2026, about equal the number internal combustion models.

- Argo AI, a U.S. self-driving startup backed by Ford and Volkswagen, laid off more than 150 employees last week as it made “prudent adjustments” to its business plans.

International Markets

- COVID-19 infections in the U.K. rose 18% last week, with about 1 in every 25 people infected.

- The population of the EU, which has suffered more than 2 million COVID-19 fatalities, shrank for the second consecutive year in 2021.

- Starting Friday, Hong Kong will mandate that quarantining COVID-19 patients wear a tracking bracelet so they can’t leave their homes.

- Macau, an autonomous region of China, will enter a citywide lockdown early Monday as authorities seek to contain a spiraling COVID-19 outbreak.

- European regulators are following their U.S. counterparts in paving the way for updated COVID-19 vaccines to be used this fall, specifically to target the Omicron variant.

- The BA.2.75 Omicron variant gaining ground in India and other parts of the world is raising concerns among scientists due to its ability to evade protection offered by COVID-19 vaccines and prior virus infection.

- More news related to the war in Europe:

- Ukrainian consumer prices surged 21.5% in June, the fastest pace in six years, driven by rising prices for fuel and food.

- Irish aircraft lessor SMBC Aviation Capital booked a $1.6 billion impairment charge after losing 34 of its jets to Russian airlines due to sanctions.

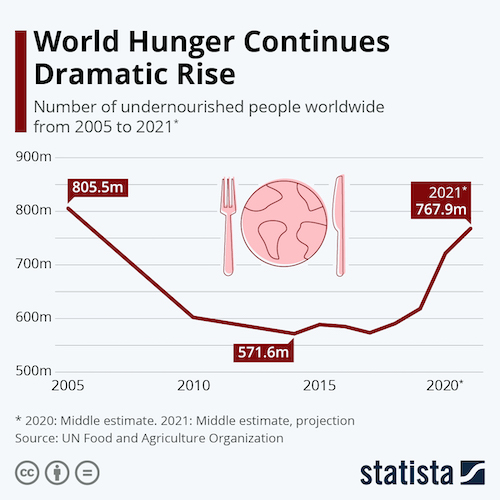

- Increases in the cost of food and fuel since March have pushed an additional 47 million people into acute food insecurity across the globe, according to the World Food Program. Wealthy nations are also facing rising food shortages.

- Ukraine International Airlines, grounded by the war, is reopening in Poland to offer flights for Poles to holiday destinations.

- China’s annual inflation rate hit a larger-than-expected 2.5% in June, the fastest pace in almost two years. Meanwhile, the nation’s producer price index cooled in June to 6.1% year over year, the lowest in 15 months.

- Moody’s cut Mexico’s credit rating by one notch to “Baa2,” citing weak investment prospects.

- Canadian unemployment fell to 4.9% in June, a record-low dating back to 1976.

- Argentinian inflation surged as much as 20% in a single day last week after the nation’s economic minister resigned, worsening the nation’s financial turmoil.

- Sri Lanka’s prime minister resigned Saturday as the island’s worst financial crisis in decades spills into civil and political disruption.

- Dutch Airline KLM will remove up to 20 flights per day to European destinations amid ongoing staff shortages.

Some sources linked are subscription services.