MH Daily Bulletin: July 5

News relevant to the plastics industry:

At M. Holland

- We are numb with grief over yesterday’s mass shooting in Highland Park, Illinois, a neighboring community to M. Holland’s headquarters and home to many Mployees. Fortunately, all Mployees are safe and accounted for, but our hearts and thoughts are with the community after this tragic attack.

Supply

- Oil prices rose last Friday on concerns over supply shocks from Libya and Norway.

- Citigroup predicted oil prices could fall to $65/bbl in the event of recession, sinking crude futures in mid-morning trading today, with WTI down 8.5% at $99.27/bbl and Brent down 9.5% at $102.70/bbl. U.S. natural gas was down 4.1% at $5.50/MMBtu.

- Active U.S. oil and gas rigs fell by three last week to 750, according to Baker Hughes.

- The U.S. administration will take public comments for 90 days before finalizing its five-year offshore oil and gas development plan, which could include up to 11 auctions for drilling rights in the Gulf of Mexico and Alaska.

- Exxon Mobil indicated its quarterly profits could double from Q1 to a record $16 billion.

- OPEC production dropped by 120,000 bpd in June, the second month of declines despite pledges to boost output by over 275,000 bpd.

- Norway’s petroleum output could fall 8% starting today if workers move ahead with a planned strike.

- Political protests forced Libya to declare force majeure at a number of new ports and oil fields, cutting its export capacity to one-third of last year’s levels.

- Ecuador is working to restore half its oil output that was shut down by two weeks of protests that ended last Thursday.

- A 645,000-bpd refinery in Venezuela halted production Monday after an electrical fault took out power.

- Many of the world’s largest economies are increasing short-term coal purchases to ensure sufficient supplies of electricity, despite pledges to reduce consumption in the battle against climate change.

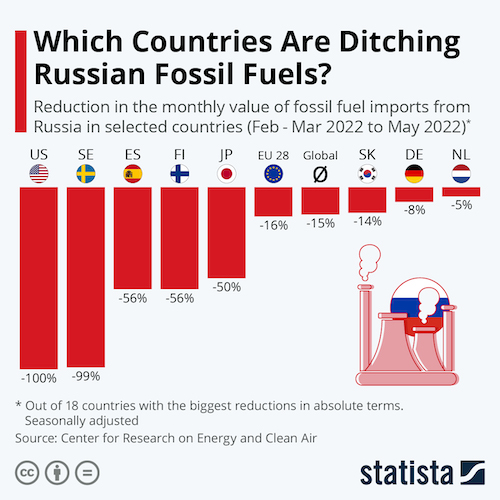

- More oil news related to the war in Europe:

- Gazprom is demanding gas payments in rubles in a scheme similar to that which disrupted oil trade in March and April. Meanwhile, Russian lawmakers may impose a temporary windfall tax on the firm as the price of natural gas continues to surge.

- Shell and Japan’s Mitsui and Mitsubishi could be forced to exit their latest joint venture as Moscow pushes to nationalize the Sakhalin-2 oil and gas project on Russia’s Pacific coast, north of Japan.

- Natural gas prices in Europe have surged around 700% within the past year, pushing the continent closer toward recession.

- More European governments are overturning three decades of separation from private energy markets to help manage fallout from Russia’s invasion of Ukraine. In Germany, negotiations continue over a plan to bail out gas giant Uniper SE with pandemic rescue funds.

- Germany is considering a new levy on gas consumers in a bid to help suppliers manage rising import prices.

- Germany’s top union official says the nation’s biggest industries could face collapse due to cuts in supplies of Russian natural gas.

- At least one German city is preparing to ration hot water and limit maximum heating temperatures in the event of a sudden drop-off in gas supplies.

- Latvia, Lithuania and Estonia say they are prepared to fully remove themselves from Russia’s power grid three years ahead of schedule.

- New fuel-export duties in India are meant to discourage refineries from buying cheap Russian crude and selling it abroad, leaving shortages in the local market.

- Algeria, Europe’s biggest gas supplier after Russia and Norway, is raising prices on exports to the continent.

- Russia’s seaborne crude exports to the crucial Asian market fell 15% last week, retreating further from late-May highs.

- Canada’s government said it will not provide funding support for two proposed LNG export projects.

- Sri Lanka’s fuel crisis is deepening over difficulties raising $587 million for new deliveries.

- California’s fuel taxes rose a pre-planned 5.6% last week despite the state having the highest gasoline prices in the nation.

- British gasoline and diesel prices continue to set new daily records.

Supply Chain

- The cost of shipping a 40-foot container from China to the U.S. West Coast fell 15% last week, according to Freightos.

- Large container lines are losing some of their market share to smaller competitors that have cropped up on eastbound trans-Pacific trade lanes.

- More shippers are seeking to renegotiate contract container rates as shipping lines trim capacity to shore up spot pricing.

- Maersk says its container ships are being delayed for up to three weeks at congested U.S. East Coast ports.

- Ship insurers say new vessel types may be needed to transport electric vehicles and their highly flammable lithium-ion batteries.

- Twenty-one seamen are stranded aboard their bulk carrier after it lost power in stormy weather off the coast of Australia.

- The Brotherhood of Locomotive Engineers and Trainmen union, the nation’s oldest rail union, is preparing a strike authorization vote after working without a contract for nearly three years.

- CSX is launching a $25 million expansion of its intermodal rail yard in Chicago.

- Logistics provider Transportation Insight is moving its headquarters from North Carolina to the Atlanta metro area.

- China’s Hudong-Zhonghua Shipbuilding delivered a container ship with capacity for a record 24,004 TEUs to Evergreen.

- Inventory liquidation companies are seeing booming business as retailers cope with stockpiles of merchandise.

- Thousands of small British construction companies have folded in the face of rising material and labor costs.

- British parcel carrier Yodel saw its first profit in 10 years in its latest fiscal quarter.

- The semiconductor market is showing signs of weakness amidst a drop in personal computer demand and the collapse of cybersecurities.

- In the latest auto news:

- Over 46,000 Hyundai workers in South Korea voted for a possible strike over stalled contract negotiations.

- U.S. auto sales could be 20% lower this quarter from a year ago as high prices continue to weigh on demand, analysts say.

- Car sales in the most recent quarter were down sharply year over year for GM (-15%) and Toyota (-22%).

- Tesla’s 254,695 second-quarter deliveries marked the first quarter-over-quarter decline in two years, despite rising 27% from a year ago. The automaker will idle factories in China and Germany for several weeks to install upgrades.

- Taiwan-based GlobalWafers plans to build a $5 billion factory in Texas to manufacture silicon wafers, a key material for computer chips.

- Plummeting steel demand in China is raising alarms among dry-bulk vessel operators.

- Britain’s prime minister is expected to set out more extensive tariffs on steel imports in a move that some say would break international trade law.

- U.S. securities regulators are weighing a rule requiring that businesses disclose emissions data from suppliers and customers when assessing their climate-related financial risk.

Domestic Markets

- The U.S. reported 43,028 new COVID-19 infections and 67 virus fatalities Monday.

- The fast-spreading BA.5 subvariant of Omicron could become the nation’s dominant strain this month, health experts say.

- Florida saw its COVID-19 positivity rate rise to 22.7% in the week ending July 1, averaging 10,640 new virus cases per day and putting 99% of residents in “high-risk” areas for virus transmission.

- Forty California counties now have high levels of COVID-19, according to the CDC, up from 13 counties last month.

- New York City suddenly dismantled its color-coded COVID-19 alert system last week despite rising cases and hospitalizations.

- New York City clinics will be the first in the nation to offer Pfizer’s COVID-19 antiviral pills at the same time a person tests positive for the virus.

- The FDA will not require vaccine makers to submit clinical trial data when modifying their shots to protect against new COVID-19 variants this fall.

- Commodity prices fell 3.9% during the second quarter, suggesting inflation may have peaked.

- U.S. manufacturing activity slowed more than expected in June, while new orders contracted for the first time in two years, the Institute for Supply Management said. A gauge of factory employment also was down for the second straight month.

- U.S. wages declined 3.3% year over year in May after factoring for inflation, the fifth consecutive month of declines.

- Rising interest rates is prompting more U.S. firms to pay down debt rather than raise capital this year, as indicated by data from the first half.

- Big banks including Bank of America, Credit Suisse and Goldman Sachs face billions of dollars in losses on leveraged buyouts they agreed to finance before markets soured, chilling the outlook for mergers and acquisitions activity.

- Kohl’s chief executive said a sale of the retail chain was “unattainable” in the current financing and retail environment.

- The owner of Panera Bread and Einstein Bros. Bagels shelved plans for an initial public offering, citing unfavorable market conditions.

- The White House is weighing a move to trim mortgage costs for first-time and lower-income buyers amid all-time high home prices.

- In the super hot housing markets of Austin, Phoenix and Las Vegas, almost one-third of home listings saw price cuts in June, according to Realtor.com.

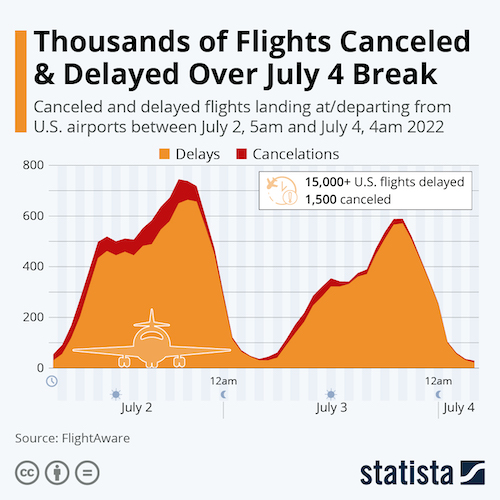

- More than 1,000 flights were canceled and over 10,000 delayed during Fourth of July weekend due to inclement weather and staff shortages.

- Major U.S. carriers canceled 2.9% of domestic flights in June, up from 2% during the same time in 2019.

- The Supreme Court’s latest decision that curbs the power of the EPA is throwing doubt on the SEC’s efforts to force companies to disclose their emissions, legal experts say.

International Markets

- China’s eastern Anhui province recorded over 1,000 COVID-19 infections since late last week, with authorities imposing lockdowns in a scramble to keep cases from neighboring Jiangsu, the nation’s second-biggest GDP contributor.

- COVID-19 infections rose 30% last week in Britain, where hospitalizations also are rising.

- German leaders rejected the idea of new COVID-19 restrictions despite a tripling of the nation’s per capita infection rate the past month.

- France and Australia are considering renewed mask mandates amid a recent rise in COVID-19 cases.

- COVID-19 hospitalizations in Ontario, Canada, rose last week for the first time since May.

- New COVID-19 cases rose by 24% in South Korea last week.

- Australia dropped COVID-19 vaccination requirements for incoming travelers last week.

- China will begin loosening entry restrictions on U.S. travelers.

- Japan lowered its pandemic travel advisories for China, India, Germany and 31 other countries Friday.

- Europe’s medicines regulator said updated COVID-19 shots for Omicron could likely be used as boosters this fall.

- Measures of factory output fell sharply across the globe in June, including in the euro zone, South Korea, Vietnam and Taiwan. China’s manufacturing activity, meanwhile, expanded at its fastest pace in over a year after lockdowns were lifted.

- Germany posted a trade deficit for the first time in more than three decades in May due to fallout from the war in Ukraine.

- Central banks in Norway and Sweden raised interest rates by a larger-than-expected 50 basis points last week.

- Brazil’s trade surplus reached $8.814 billion in June, the second-highest June reading of all time.

- British Airways is trimming its schedule from April to October by 11%, as the carrier struggles with staffing shortages amid surging demand.

- About 10% of flights from Paris Charles de Gaulle were canceled late last week due to worker strikes. Another round of strikes is planned for this weekend.

- Scandinavian airline SAS AB filed for bankruptcy today in the U.S. after close to 1,000 pilots walked out Monday, forcing over half of daily flights to be canceled.

- Ryanair’s Spain-based cabin crew plans to continue striking for at least 12 days this month in a dispute over pay and working conditions.

- China’s largest airlines have recently pledged to buy almost 300 jets made by Airbus, their largest aircraft order of the pandemic.

- Slovakia will cement its place as the world’s biggest car producer per capita after Volvo announced plans to build a $1.25 billion electric vehicle plant in the nation.

- Russia’s invasion of Ukraine is boosting Australian mining and energy exporters, whose revenues are forecast to hit a record $286 billion over the next year.

- India, one of the world’s biggest polluters, imposed a new ban on single-use plastics for a variety of products.

Some sources linked are subscription services.