MH Daily Bulletin: July 1

News relevant to the plastics industry:

At M. Holland

- M. Holland will be charging a fee to recover the reinstated Superfund Excise Tax for applicable U.S. orders starting July 1, 2022. Clients will be notified of details this week. Learn more about the tax in this Plastics News article.

- M. Holland will be closed Monday in observance of the July Fourth holiday. We wish all subscribers a safe and happy holiday weekend.

Supply

- Oil prices fell 3% Thursday after OPEC+ decided to boost output by 648,000 bpd in July and August. Prices were down for the month of June, the first monthly decline since November.

- In mid-morning trading today, WTI futures were up 1.9% at $107.80/bbl and Brent was up 1.7% at $110.90/bbl.

- U.S. natural gas futures plunged 17% Thursday as the shutdown of a major export facility in Texas keeps more supplies at home. In mid-morning trading today, gas futures were up 5.8% at $5.75/MMBtu.

- Roughly 4% of Norway’s oil production could go offline when a group of Equinor workers strike next week.

- OPEC+ will have returned to pre-pandemic output after the next two months of production increases. The group declined to discuss oil policy from September onward.

- Saudi Arabia may raise the price of crude it sells to Asia by $2.40/bbl, what would be the second month of increases backed by strong premiums for Middle Eastern oil grades. Meanwhile the UAE, an outlier among regional producers, raised crude prices for the fifth time this year.

- Deutsche Bank says Germany faces imminent recession if reduced gas flows from Russia do not improve.

- Reports suggest the U.S. administration may have delayed releasing its five-year oil and gas plan this month in order to include more offshore regions for drilling rights.

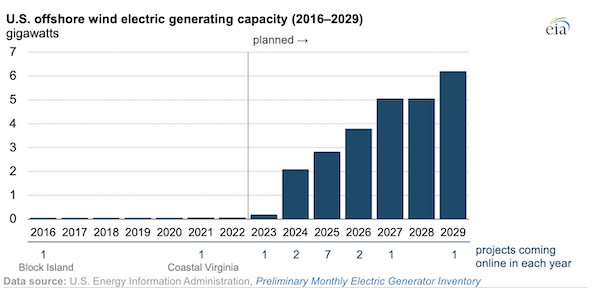

- Developers have announced over 6 GW of new offshore wind capacity for the U.S. over the next seven years, with the bulk of projects coming online in 2025.

- Shell suspended plans to sell its Nigerian assets pending the outcome of a lawsuit over a 2019 oil spill.

- The International Energy Agency is calling on expanded development of nuclear energy to help hit global net-zero goals.

- British officials are considering a $25.5 billion plan to boost capacity of regional power grids over the next five years.

- Australia is looking at revamping its biggest power grid after plant failures led to a novel suspension of the nation’s spot power market last week.

Supply Chain

- West Coast dockworkers say they have no plan to strike or disrupt cargo flows as contract talks continue past today’s July 1 deadline.

- French officials are calling on the nation’s biggest energy and shipping firms to use sky-high profits to lower consumer costs.

- Blank sailings are on the rise as ocean carriers look to divert ships to more profitable routes amid a dip in demand.

- In the latest news from the auto industry:

- GM said chip shortages and supply chain disruptions impacted production by 100,000 vehicles in the second quarter and that 96,000 vehicles in inventory are awaiting missing components. Trading of the company’s shares were briefly halted prior to the announcement made in an SEC filing.

- GM will avoid shutting down its Michigan plants after a contract deal was reached with union workers.

- Nissan will exit the full-size pickup market after years of lackluster performance against Detroit automakers.

- Ford will periodically idle production at eight North American plants in July and August due to computer chip shortages.

- Tesla is expected to break its two-year run of record quarterly deliveries due to supply chain fallout from Chinese lockdowns.

- GM is only making about 12 electric Hummers per day after six months of building out production, creating long wait times for its 77,000 pre-ordering customers.

- Workers at Volkswagen’s main Brazil plant accepted cuts to pay and working hours last week as supply shortages hamper production.

- Audi will spend almost $20 million to restart production in Brazil after component shortages forced shutdowns since last November.

- European commercial vehicle makers believe they can safely raise prices to offset higher costs as demand remains strong.

- New U.S. vehicle sales fell an estimated 17% in the first half of this year compared to 2021, according to Cox Automotive.

- Trucking company Schneider National plans to expand its role in chemical distribution with new investments in an online marketplace for industrial raw materials.

- U.S. chipmaker Micron gave a downbeat forecast for its next fiscal quarter, citing lower demand.

- Procter & Gamble is struggling to find factory workers for a women’s health product plant in Maine even after raising wages to over $25/hour.

- Key grain and other farm exports from Argentina will start flowing again after thousands of truckers ended a week-long strike.

- Over 40,000 workers at one of Britain’s largest telecom providers voted to strike for the first time in three decades this month.

- IKEA says easing transport bottlenecks in Europe have brought its warehouses back to pre-pandemic levels of stock.

- CMA CGM and French energy firm Engie will produce biomethane from wood waste to be used as ship fuel by 2026.

- Benchmark wheat prices are down more than a quarter from recent peaks as good weather improves crops across the globe.

Domestic Markets

- The U.S. reported 135,966 new COVID-19 infections and no virus fatalities Thursday. The seven-day average infection rate hit a 4.5 month high yesterday, while the daily average hospitalization rate has climbed every day since mid-April.

- Over 10% of people are testing positive for COVID-19 in New York City amid growing indications of a new virus wave.

- COVID-19 cases are back on the rise in Los Angeles, with the city reporting a 20% jump in small outbreaks tied to worksites last week.

- Vaccine makers should aim to target the newest and fastest-spreading BA.4 and BA.5 COVID-19 variants with updated shots this fall, the FDA says.

- Pfizer is seeking full FDA approval that would allow it to begin marketing its Paxlovid antiviral pill for COVID-19.

- New York’s COVID-19 vaccine requirement will remain in place after the U.S. Supreme Court declined to hear a challenge from objectors.

- The U.S. government is buying 150,000 more COVID-19 treatments from Eli Lilly for roughly $275 million, nearly exhausting existing funding to buy new treatments.

- A key government inflation gauge tracked by the Federal Reserve jumped 6.3% in May from a year earlier but was unchanged from April.

- The S&P 500 officially recorded its worst half-year since 1970.

- The Atlanta Federal Reserve’s closely watched GDPNow tracker estimated the U.S. economy contracted 1% in the second quarter, marking the second quarterly contraction in a row.

- U.S. jobless claims fell by 2,000 to a total of 231,000 last week, roughly unchanged over the last four weeks.

- State and local government job openings are hovering near record-highs, with payrolls having shrunk by over 630,000 jobs since February 2020.

- The average U.S. mortgage rate fell to 5.70% last week, the first decline in three weeks as more home sellers begin dropping prices.

- Transport disruptions will be widespread this Fourth of July weekend as travel activity surges to an all-time high.

- Delta Air Lines’ CEO apologized to consumers for flight disruptions as the carrier deployed office workers to airports in New York and Atlanta to help support holiday travel.

- Despite beating quarterly estimates, Walgreens kept its modest full-year forecasts on expectations that demand for COVID-19 vaccinations and products will fall.

- Inspectors with the U.S. Transportation Department will audit the FAA’s oversight of Boeing production, the latest in a string of protective measures after the FAA called for a systemic fix to Boeing’s operations earlier this year.

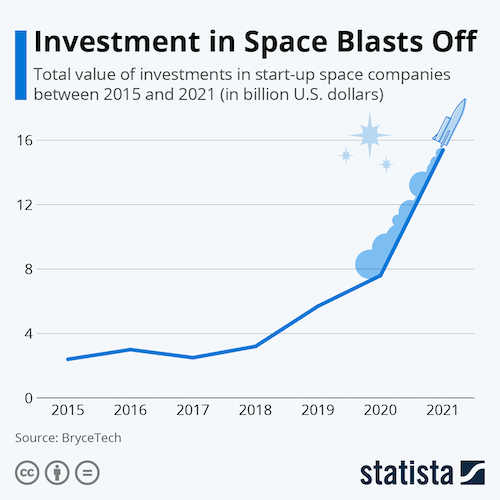

- U.S. regulators gave SpaceX permission to link a range of vehicles to its satellite-internet service, a boost for the technology’s growth ambitions.

- Hyundai plans to invest over $10 billion in the U.S. by 2025 to bolster collaboration with U.S. firms in advanced technology.

- Apple’s new vehicle software will let drivers purchase gas directly from their dashboards at filling stations.

- California’s new tax on lithium could stunt development of the key electric vehicle material just as it gets off the ground, industry executives say.

- California passed one of the nation’s strictest extended responsibility laws on producers of printed paper and packaging. The law also mandates a 25% reduction of single-use packaging by 2032.

International Markets

- Canadian health officials warn that the BA.4 and BA.5 subvariants of Omicron will likely cause COVID-19 cases to surge again this fall and winter.

- British researchers are investigating the growing link between blood clots and long-term symptoms of COVID-19.

- More news related to the war in Europe:

- German unemployment rose for the first time in 15 months in June due in part to an influx of Ukrainian refugees looking for work.

- The U.S. administration sent another $1.3 billion in aid to Ukraine this week and promised at least $800 million more.

- Euro-area annual inflation surged to a fresh record of 8.6% in June, topping market expectations as the bloc’s central bank prepares for its first rate hike in 11 years.

- Britain’s central bank says soaring inflation will hit the country harder than any other major global economy due to its growing energy crisis.

- Core consumer prices in Tokyo rose 2.1% in June from a year ago, the fastest pace in seven years. Across Japan, business sentiment fell for a second straight quarter.

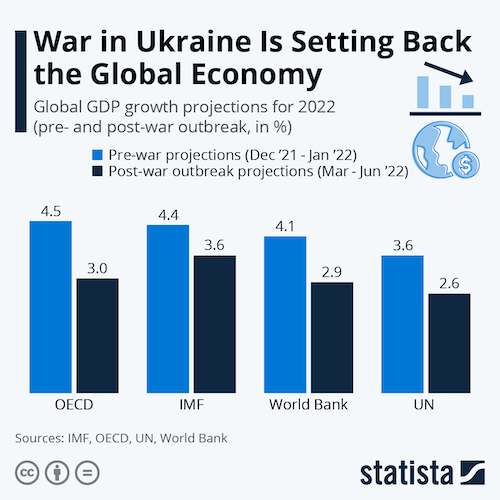

- International financial groups have uniformly lowered their projections for economic growth this year:

- China’s manufacturing output ended a three-month streak of contraction in June, according to Caixin’s private gauge of factory activity.

- French manufacturing activity fell in June to one of its lowest levels of the pandemic.

- Canada’s economy is set for a slight contraction in May due to output slides in oil, manufacturing and construction, economists say.

- Brazil’s unemployment rate is down to the single digits for the first time in six years, new data shows.

- China’s tech giants are moving ahead with more job cuts as growth stalls.

- Europe is advancing legislation that would allow regulators to block businesses from making certain acquisitions or winning public contracts if they benefit from foreign subsidies.

- Air Canada will cut at least 154 of its roughly 1,000 total flights per day this summer to bring passenger volumes down to a manageable level.

- American Airlines paused ticket sales on flights that depart Amsterdam’s Schiphol airport from July 7 to July 31.

- China swapped a $12 billion order for nearly 100 new jets from Boeing to Airbus models.

- Volkswagen’s Chinese sales volumes fell to 3.3 million last year from a peak of 4.2 million in 2018 amid tougher competition from local manufacturers.

- Mercedes is adjusting its network of plants to manufacture a new range of luxury electric vehicles that will comprise most of its fleet by the end of the decade.

- British electric vehicle startup Tevva launched its first electric truck that uses a backup hydrogen “booster” to expand range by over 300 miles per charge.

Some sources linked are subscription services.