MH Daily Bulletin: June 23

News relevant to the plastics industry:

At M. Holland

- M. Holland will be charging a fee to recover the reinstated Superfund Excise Tax for applicable U.S. orders starting July 1, 2022. Clients will be notified of details next week. Learn more about the tax in this Plastics News article.

- M. Holland is sponsoring AMI’s Polymers in Cables on June 28-29 in Philadelphia, Pennsylvania. This conference covers the latest technical developments, manufacturing solutions and trends in the wire and cable industry. M. Holland is also hosting the event’s networking reception on June 28 at 5:30 pm ET!

- If you’re attending AMI’s Polymers in Cables in Philadelphia, mark your schedule for M. Holland’s technical session:

- Paul Lorigan, Manager of Technology & Laboratory Services for M. Holland, will be giving a presentation on new cable applications for fluoropolymers, graphene and sustainability solutions. Don’t miss his talk on June 29 at 11:50 am ET.

Supply

- Oil prices fell about 3% Wednesday to their lowest level in weeks, reflecting rising concern about a U.S. recession.

- In mid-morning trading today, WTI futures were down 1.2% at $105.00/bbl, Brent was down 0.8% at $110.80/bbl, and U.S. natural gas was down 2.7% at $6.67/MMBtu.

- The American Petroleum Institute reported a crude build of over 5.6 million barrels this week, the largest build since mid-February.

- Congressional support is lackluster for the White House’s request to pause the 18.4-cent federal tax on gasoline until September.

- U.S. refiners will try to convince the White House not to ban fuel exports during a high-level meeting today.

- The U.S. is expected to become the world’s largest LNG exporter this year, leapfrogging Australia and Qatar.

- Chevron is moving into the booming U.S. LNG market after striking two long-term purchase agreements with top U.S. producers Cheniere Energy and Venture Global LNG.

- Top oilfield firm Schlumberger expects a 50% increase in offshore investment over the next four years.

- The U.S. administration released an environmental impact statement for what could become New Jersey’s first offshore windfarm capable of powering 500,000 homes.

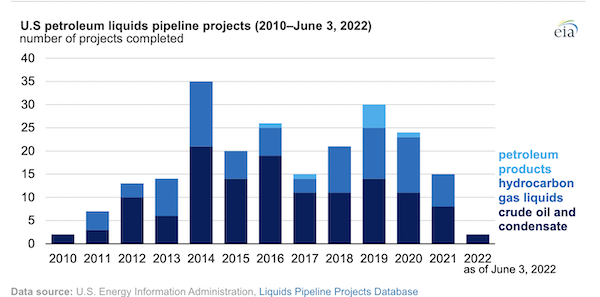

- Two U.S. oil pipeline projects have been completed so far this year, with at least two more set to come online later in 2022:

- More oil news related to the war in Europe:

- Germany today moved a step closer to rationing natural gas.

- EU support is rising for a U.S. proposal that would pare back the bloc’s hardline ban on insuring Russian oil shipments, a move that could bring more oil to markets and reduce prices.

- Europe will temporarily pursue coal to cope with dwindling Russian gas flows that could soon completely stop, according to the International Energy Agency.

- Planned maintenance will completely halt gas deliveries on Russia’s Nordstream 1 pipeline to Germany for two weeks in July, hampering Europe’s efforts to stockpile fuel for winter.

- A Ukrainian drone strike took out production at a refinery in southern Russia Wednesday.

- Iranian oil exports nearly doubled to 961,000 bpd from May to early June as the nation prepares to rejoin the global oil market, primarily with shipments to China.

- Japan’s biggest power generator is preparing to restart another aged power generation unit near Tokyo to help avoid shortages this winter.

- Italy approved a $3.5 billion package to help families and firms cope with surging energy costs and boost gas storage.

- The European Parliament backed reforms to cut emissions faster under the EU’s new carbon market, aiming for a reduction to 55% of 1990 levels by 2030.

- BP is taking the lead to build a 2,500 square-mile, $36 billion renewable energy hub in Australia to produce hydrogen from solar and wind.

Supply Chain

- China’s manufacturing hub of Guangdong raised its flood warning to the highest level amid the worst rain in decades, spurring more evacuations and supply chain disruptions.

- Several thousand German port workers could strike today over union contract disputes.

- Maersk said the cost of shipping cargo is up 25%-30% since the start of the pandemic due to an array of inflationary pressures that are “unlikely to abate in the short-term.”

- The average price to ship a 40-foot container from Asia to the U.S. West Coast fell to $9,574 in early June, according to Freightos, down 41.6% from the first week of March.

- Spot rates in the dry-bulk shipping sector tumbled 19% in early June.

- The first two years of the pandemic saw 3,113 containers lost at sea, almost quadruple the amount of the previous two years.

- Over $450 million was approved to expand the Port of Houston’s main ship channel to accommodate bigger ships.

- British trucking company Pall-Ex Group wants to extend its less-than-truckload franchise operation to the U.S.

- The U.S. administration is open to discussions with Canada to remove some duties on Canadian softwood lumber, a potential boon for homebuilders.

- Tesla’s chief executive reports the firm is losing billions of dollars at new plants in Texas and Berlin due to battery shortages and congestion at Chinese ports. The automaker plans to suspend production at its Shanghai plant for two weeks in July for upgrades.

- Stellantis will halt production at its plant in Brittany, France, until July 3 due to a chip shortage, while a separate plant in eastern France extended stoppages for another week.

- Major automakers and industry suppliers urged Congress on Wednesday to move quickly to pass $52 billion in subsidies for U.S. computer chip production.

- Electric vehicle sales could reach 33% globally by 2028 and 54% by 2035 as demand picks up in most markets, according to consultant AlixPartners.

- The average cost of the most expensive grade of polysilicon in China rose to its highest level in more than a decade, raising the cost of building new solar projects.

- Production at big Japanese aerospace suppliers including Toray Industries and Teijin has returned to pre-pandemic levels.

Domestic Markets

- The U.S. reported 184,074 new COVID-19 infections and 860 virus fatalities Tuesday.

- Almost one-fifth of U.S. adults who have COVID-19 are experiencing symptoms lasting longer than three months, new data shows.

- Moderna’s updated COVID-19 vaccine produced strong immune responses against the fast-spreading BA.4 and BA.5 subvariants of Omicron in a recent study, with the firm planning to seek authorization for the shot in August.

- About 18% of parents surveyed said they would get their children under age 5 vaccinated right after COVID-19 shots were authorized for the age group, compared to roughly 25% who said they never would.

- First-time jobless claims were essentially flat last week at 229,000.

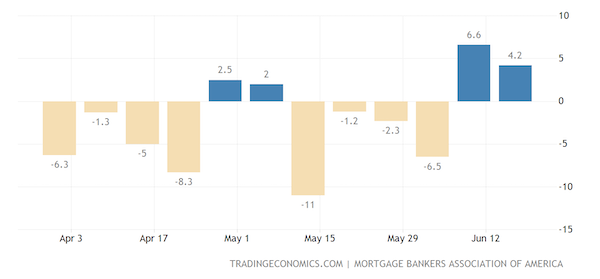

- The 30-year mortgage rate rose to 5.81%, the highest in 13 years.

- The Federal Reserve chairman gave the strongest indication yet that the central bank’s path of raising interest rates will cause a recession. A new paper from Federal Reserve economists, meanwhile, pegs the likelihood of recession at 50% within a year.

- Drastic and unforeseen changes in market conditions are causing firms in various industries to pull job offers, a sign the tightest labor market in decades may be weakening.

- Over 21,500 U.S. tech workers have lost their jobs so far this year, with the total number of layoffs skyrocketing 780% in May over the first four months of the year combined.

- JPMorgan Chase will start laying off hundreds of employees in its mortgage unit this week in response to the spike in interest rates rocking the housing market.

- U.S. mortgage applications rose 4.2% last week but were down over 10% from the same time last year:

- Manhattan’s median monthly rent soared to $4,000 for new leases in May, a 25% year-over-year increase.

- The IRS’s backlog of unprocessed paper tax returns was 21.3 million at the end of May, up 1.3 million from a year earlier as hopes dim for clearing the backlog this year.

International Markets

- COVID-19 infections are rising in multiple European countries including Germany, Italy and Spain, driven by the fast-spreading BA.4 and BA.5 subvariants of Omicron. Daily infections hit a two-month peak in France, while Portugal has the world’s second highest infection rate.

- Macau shut down most businesses except gambling casinos in its battle with a COVID-19 outbreak.

- South Africa, which reported the most COVID-19 infections and deaths on the continent, lifted remaining restrictions as its fifth virus wave fades.

- Denmark will offer fourth COVID-19 vaccine doses this fall to people over age 50.

- COVAX officials are urging vaccine manufacturers to cut or slow deliveries of about half a billion shots so doses are not wasted amid weak demand in low-income nations.

- More news related to the war in Europe:

- More Russian companies are imitating or trying to swipe the brands of Western companies that have left the country since the invasion of Ukraine.

- Russian forces targeted at least two large North American-owned grain terminals in the Ukrainian port of Mykolaiv Wednesday, bolstering allegations of Moscow’s use of food as a weapon.

- British inflation rose to 9.1% in May, a fresh four-decade high and the fastest rate of the pandemic for any G7 nation.

- Canadian inflation neared 8% in May, a four-decade high, with growing expectations that the nation’s central bank will hike interest rates by 75 basis points in July.

- Sri Lanka is on the brink of collapse due to inflation and acute shortages of power, food and medicine, officials said.

- Stellantis workers in Serbia blocked the capital’s main highway Wednesday to protest layoffs as part of the firm’s switch to making electric vehicles.

- Ford said it will make “significant” job cuts in Spain later this decade as it shifts factories to producing electric vehicles.

- Bidders for Toshiba Corp. are offering up to $22 billion to take the beleaguered Japanese conglomerate private.

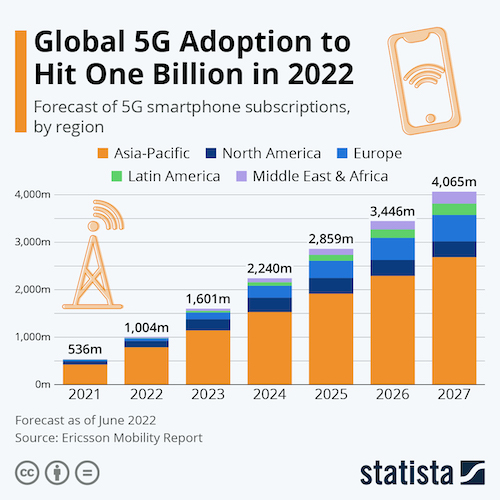

- The number of 5G smartphone subscriptions worldwide will blow past one billion this year, almost doubling from 2021, according to Ericsson:

- The EU proposed new rules Wednesday that would halve the use of chemical pesticides across the continent by 2030.

Some sources linked are subscription services.