MH Daily Bulletin: June 16

News relevant to the plastics industry:

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices fell over 2% Wednesday on demand worries caused by higher U.S. interest rates.

- U.S. natural gas prices jumped over 4% Wednesday on forecasts of extremely high temperatures into next week.

- In mid-morning trading today, WTI futures were up 0.2% at $115.50/bbl, Brent was down 0.4% at $118.00/bbl, and U.S. natural gas was up 3.2% at $7.66/MMBtu.

- U.S. crude stocks rose unexpectedly last week, while production rose by 100,000 bpd to the highest level since April 2020. Gasoline inventories saw a smaller-than-expected drop on weakened demand.

- The White House is raising pressure on oil companies to boost production, saying it may invoke emergency powers used for the baby-formula crisis to increase supplies of gasoline. Refiners, however, are already running well above historical averages.

- A rapid rise in U.S. fuel exports is a major cause of high domestic prices, with seaborne shipments of gasoline, diesel and jet fuel departing the Gulf Coast about 32% higher the past three months than a year ago.

- Fourteen U.S. states are asking a court to restore the largest ever oil and gas lease sale in the Gulf of Mexico that was canceled by the federal government.

- Global refining capacity expansions will not be able to keep pace with diesel and jet fuel demand, the International Energy Agency said, even as prospects for demand growth slow.

- Chinese refinery production dropped 10.9% year over year in May, the steepest decline in a decade.

- British gasoline and diesel prices jumped to a record high this week.

- More oil news related to the war in Europe:

- European gas prices spiked as much as 25% Wednesday on news that Gazprom is halting more shipments to Germany and Italy. Russia’s gas exports to key foreign clients are already down 29% this month to the lowest level in eight years, a move that German officials say is intentional.

- The EU inked multi-year gas deals with Israel and Egypt to replace Russian supplies.

- Italian energy firm Enel is looking to sell its remaining assets in Russia.

- One of Austria’s biggest refineries is down to 20% capacity following a unit explosion earlier this month.

- The world’s largest mining company, Australia’s BHP Group, abandoned the sale of its last thermal coal mine until at least 2030.

- Saudi Aramco plans to merge two energy trading units ahead of an initial public offering of the business.

- BP is beefing up its hydrogen management team as the oil major accelerates investments in low-carbon fuel.

- European lawmakers are attempting to stop the EU from labeling gas and nuclear energy as climate-friendly investments ahead of a bloc-wide vote next month.

Supply Chain

- Dangerous heat enveloped over 120 million people across the U.S. yesterday, with multiple cities, including St. Louis, Nashville and Charlotte, breaking temperature records.

- Water deliveries from the Colorado River may have to be reduced up to 4 million acre-feet next year due to unrelenting drought. By comparison, California is entitled to 4.4 million acre-feet of the river’s water per year.

- Hundreds of protesting truckers began blocking a key route to South Africa’s biggest port Wednesday.

- The East Coast’s second-busiest Port of Savannah moved an all-time high 519,390 TEU in May, up 8.5% from last year.

- Rising interest rates could pinch freight carriers and put industrial real-estate transactions on pause, executives say.

- Over 90% of manufacturers pointed to increases in raw material costs as their top business challenge, according to a new survey.

- About nine in 10 U.S. homebuilders report shortages of appliances, framing lumber and oriented strand board, according to the National Association of Home Builders.

- U.S. business inventories rose 1.2% in April as sales moderated. Inventory costs, meanwhile, were 33% higher in May than the same time in 2020, according to a survey of supply chain managers.

- In the five years through 2021, Florida, Texas and Arizona increased their manufacturing employment the most, while New York, Washington and Illinois lost the most workers.

- Contract manufacturer Foxconn began building its first plant to produce electric vehicle batteries.

- Beauty products company Revlon filed for bankruptcy as it confronts a heavy debt load, inflation, supply chain pressures and greater competition.

- H&M, the world’s second-biggest fashion retailer, posted a larger-than-expected 17% jump in March-May sales.

- Northern countries are racing to build undersea communications cables through the waters of the Arctic as shrinking ice coverage opens the region to new business opportunities.

- The White House’s seventh mission for “Operation Fly Formula” will bring over 44,000 pounds of baby formula into the U.S., although some shipments are being held up by delays at the FDA.

Domestic Markets

- The U.S. reported 183,097 new COVID-19 infections and 682 virus fatalities Wednesday.

- U.S. COVID-19 hospitalizations rose 2% last week for the seventh consecutive weekly rise.

- About 86% of Floridians are living in high-risk COVID-19 counties compared to a national average of 22%.

- Two shots of a COVID-19 vaccine without a booster offer essentially no protection against infection with Omicron, new research suggests.

- The FDA recommended Moderna and Pfizer’s COVID-19 vaccine for children between six months and 5 years old, paving the way for full approval by the CDC. Every state but Florida has pre-ordered vaccines for the age group.

- Moderna is planning to test its COVID-19 vaccine in babies between three and six months old, the youngest group studied to date.

- Two major cruise lines are bringing back mask mandates amid an increase in COVID-19 cases across Alaska.

- The Federal Reserve hiked its benchmark interest rate by 75 basis points Wednesday to a range between 1.5% and 1.75%, the largest increase since 1994. Officials signaled an identical rise could come next month, while investors bet rising borrowing costs will dampen consumer spending and raise business expenses.

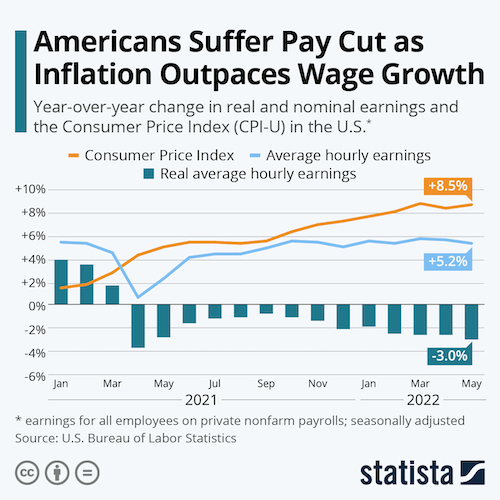

- Inflation has been running hotter than wage growth for 14 months straight, translating to smaller-than-expected gains in real wages:

- The Atlanta Federal Reserve’s real-time GDP tracker estimates growth in the U.S. economy has slowed to zero this quarter.

- More than half of Americans are dipping into savings, borrowing money or going into debt to cover normal expenses, according to the National Retail Federation.

- A total of 1.3 million people are currently on unemployment, near a 50-year low, as first-time claims last week fell slightly to 229,000.

- U.S. import prices rose 0.6% in May, led primarily by a 7.5% gain in fuel prices.

- The 0.3% decline in U.S. retail sales last month was the first decline in five months, led by a 3.5% plunge in auto purchases.

- A top Citigroup executive expects a decline of up to 55% in the bank’s investment business this quarter.

- U.S. homebuilder sentiment dropped to a two-year low so far this month, while purchase applications are down 15% from the same time last year.

- Denmark-based Lego will build a $1 billion manufacturing plant in Virginia.

- Top executives of GM and Ford say U.S. consumer demand for cars and trucks remains strong, despite rising interest rates and record-high gas prices. In May, the average monthly car payment hit a record $712.

- The auto industry’s top safety regulator reported nearly 400 recent crashes in which autonomous driving was involved. More than two-thirds of those crashes happened in a Tesla vehicle.

- GM will invest $81 million to build its future Cadillac Celestiq electric flagship sedan at a plant near Detroit.

- The FAA is urging U.S. airlines to move quickly to address risks from a broadened 5G network rollout starting next month, a potential source of disruption.

- Delta became the first U.S. airline to clamp down on airport lounge use by limiting access to three hours before departure.

- Boeing declined to offer a clear timeline on when it expects regulatory approval for its 737 MAX 10 aircraft as a December deadline for new cockpit requirements approaches.

- The EPA lowered its threshold at which “forever chemicals” pose health risks, indicating the common materials are a greater danger than previously thought.

International Markets

- COVID-19 cases in the Americas jumped 11% last week, with the largest rise in South America.

- Shanghai will conduct mass testing on the entire city every weekend through the end of July as it maintains its rigorous zero-COVID regimen.

- Hong Kong saw over 1,000 daily COVID-19 infections for the first time in two months.

- Canadians traveling within the country’s borders will no longer need to show proof of COVID-19 vaccination.

- More news related to the war in Europe:

- The White House will send an additional $1 billion in military aid and $225 million in humanitarian aid to Ukraine.

- IKEA will permanently exit its Russian business after halting retail operations there in March.

- Russia will be forced to produce vehicles without basic safety features like airbags and anti-lock brakes in order to restart local production amid massive supply shortages.

- The EU’s central bank promised fresh support and a new instrument Wednesday to temper a recent market rout that has officials fearing a debt crisis.

- The Bank of England is expected to raise its main interest rate by 25 basis points to 1.25% this month, what would be the highest rate in 13 years.

- Most Persian Gulf central banks followed the U.S. Federal Reserve Wednesday by lifting their key interest rates by 75 basis points, while Saudi Arabia made a smaller hike.

- Brazil’s central bank raised its benchmark interest rate by 50 basis points to 13.25% Wednesday.

- Canadian home prices declined for the second straight month in May, signaling a slowdown in one of the world’s hottest housing markets.

- German steel workers won their highest pay raise in three decades.

- The majority of U.S. businesses in Shanghai have resumed operations following the city’s lockdown, although only 31% are back to full operations.

- Chinese retail sales fell 6.7% in May from a year ago, the third straight month of declines.

- Home sales in China rose 26% from April to May, the first month-over-month gain this year in a tentative sign of an improving property market.

- Foreign investors cut their holdings of Chinese bonds by another $16 billion in May, as the yuan hit its lowest level in 20 months and institutions continued shifting money into better-performing assets.

- China Southern Airlines began testing Boeing 737 MAX jets for the first time since March, signaling an impending return of the jet in China.

- More Ryanair employees are joining a planned 24-hour strike June 25 to protest pay and working conditions.

- Australia’s Fortescue Metals Group announced a new partnership for the development of zero-emission mining trucks.

- A United Nations campaign to drive faster climate action is toughening the minimum standards for companies to join, including a requirement that they curb new fossil fuel projects.

Some sources linked are subscription services.