MH Daily Bulletin: June 7

News relevant to the plastics industry:

At M. Holland

- M. Holland is exhibiting during the WAI Operations Summit & Wire Expo on June 7-8 in Dallas, Texas. This event focused on wire and cable manufacturing offers industry forecasts, technical presentations, networking and more. Join us at Booth #621 to learn more about our supply solutions for wire and cable.

Supply

- Oil prices fell less than half a percent Monday after a day of choppy trading.

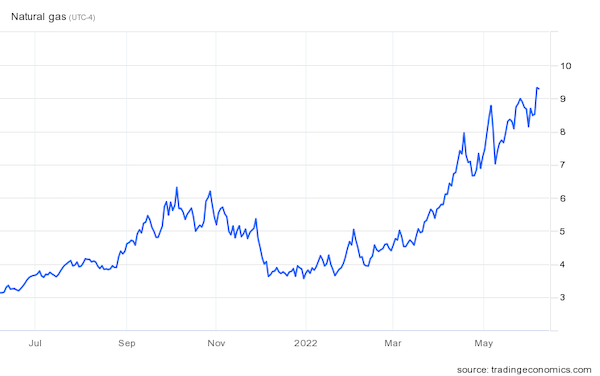

- U.S. natural gas futures rose 10% to a 13-year high Monday on forecasts of hot weather this week and lower production levels.

- In mid-morning trading today, WTI futures were up 0.4% at $119.00/bbl, Brent was up 0.5% at $120.10/bbl, and U.S. natural gas was down 0.2% at $9.30/MMBtu.

- The average U.S. gasoline price hit a record $4.87 a gallon Monday, up 25 cents the past week and 59 cents the past month. The national average could hit $5 a gallon within 10 days, traders say.

- Citibank and Barclays raised their oil price forecasts for 2022 and 2023 by more than $10/bbl.

- Amid high demand for U.S. exports, charter rates for LNG tankers are trading near their highest level in a decade at $120,000 per day, up 50% the past year.

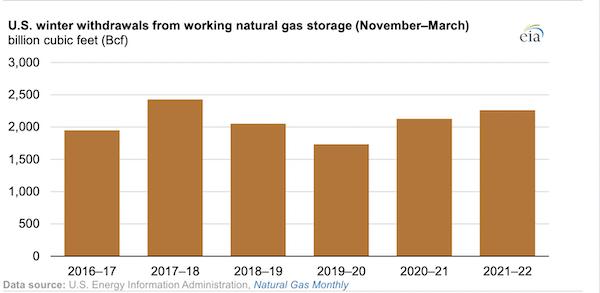

- Withdrawals of natural gas from U.S. storage last winter surged 10% over the five-year average:

- More oil news related to the war in Europe:

- Italy’s Eni and Spain’s Repsol could begin shipping small volumes of Venezuelan oil to Europe as soon as next month.

- Indian refiners are finalizing new six-month supply contracts for discounted Russian crude.

- Moscow’s revenue from oil export duties dropped 5% last week, despite seaborne crude shipments hitting a six-week high on greater shipments to Asia.

- Oil tankers are moving farther out to sea to complete ship-to-ship transfers of sanctioned Russian oil.

- Firms in Greece, Cyprus and Malta have doubled the quantity of Russian oil they transport since late February, despite EU sanctions.

- A mix of environmental groups, local opposition and bureaucracy is stalling European efforts to displace Russian natural gas by installing wind turbines and solar panels on a massive scale.

- Russian coal exports to Europe are at a five-year high ahead of an EU ban on deliveries in August.

- The White House paused import tariffs for two years on solar panels manufactured in Southeast Asia to kickstart the American solar supply chain.

- India’s southern Karnataka state will be home to a $6.7 billion green hydrogen plant to be built within five years.

- Spain’s Iberdrola is building a wind turbine recycling facility in northern Spain.

Supply Chain

- Texas power demand will hit an all-time high this week due to hot weather, grid operators say.

- Nestle is ramping up flights of baby formula from Germany to the U.S.

- Bloomberg’s Commodity Spot Index, which tracks prices for 23 raw materials, rose 1.9% Monday to a record-high, mostly driven by a jump in U.S. natural gas prices.

- The average vessel wait time at the Port of Shanghai is 28 hours, down from a peak of 66 in late April.

- Just 25 container ships were in line for berths at the ports of Los Angeles and Long Beach on May 25, the lowest since August 2021.

- Shipping container spot rates are down 26% from their September 2021 all-time high. Meanwhile, rates out of China are starting to rise since Shanghai’s reopening.

- Average fuel surcharges are up nearly 50% for container ships since Russia invaded Ukraine, according to benchmarking firm Xeneta.

- Losses related to ocean cargo delays are estimated to be as high as $10 billion the past two years, according to Sea-Intelligence.

- Upselling, i.e., encouraging consumers to buy more expensive products, is one strategy companies are employing to protect profits as expenses skyrocket for fuel, labor and raw materials.

- Morgan Stanley economists warn the risk of a U.S. inventory glut is growing, especially in sectors such as consumer discretionary and technology goods.

- Many economists fear restricting trade and direct investment to political allies — a concept dubbed “friend-shoring” — could undo decades of gains from globalization, including higher incomes in developing nations and lower prices in the West.

- Roughly 56% of supply chain executives surveyed say their businesses invested more in supply chains over the past year.

- Retailer AutoZone is opening distribution centers in Virginia, California and Mexico this year as it adjusts its supply chain strategy.

- An Atlanta-based developer is building a 1.1 million-square-foot speculative distribution center in Port St. Lucie, Florida, with close access to northern ports in Jacksonville and Savannah.

- Philadelphia rapid-delivery firm Gopuff is closing or suspending operations at 22 of its U.S. warehouses to cut costs.

- British developers say U.K. warehouse demand remains strong despite Amazon’s pullback in new investments.

- British car sales fell 20% in May from a year ago as the semiconductor shortage continued to bite output.

- Japan’s largest operator of parking lots is opening a base for flying cars in 2025.

- CMA CGM ordered its first batch of 16 dual-fuel container ships capable of running on methanol.

Domestic Markets

- The U.S. reported 120,265 new COVID-19 infections and 272 virus fatalities Monday. More than 29,000 people are currently hospitalized with the virus, up 16% the past two weeks.

- COVID-19 hospitalizations in Florida rose 24% last week. A new report suggests the state’s COVID-19 tracking system may have severely undercounted infections, hampering efforts to contact trace.

- California reported a drop in average daily COVID-19 infections during the Memorial Day week, possibly due to counting delays, as positivity rates continue to rise in San Francisco and Los Angeles County.

- For the first time since March, the CDC added more than a dozen California counties to its high-risk category for COVID-19.

- COVID-19 hospitalizations are declining in the U.S. Northeast, site of the nation’s most recent surge.

- Average daily COVID-19 infections in New Jersey fell 24% the past week.

- The highly transmissible BA.2.12.1 subvariant of Omicron nearly tripled its presence in the U.S. from mid-April to late-May, fueling the most recent surge.

- Three-quarters of U.S. nursing homes say they are in danger of closing due to staffing shortages.

- The U.S. has discarded over 80 million COVID-19 vaccines since December 2020, accounting for 11% of the federal government’s distribution.

- Pfizer is spending $120 million to expand manufacturing of its COVID-19 antiviral pills at a plant in Michigan.

- According to a Wall Street Journal poll, 83% of Americans describe the U.S. economy as “poor or not so good.”

- Commercial real estate sales dropped to $39.4 billion in April, down 16% from a year ago in one of the first signs of a cooling market disrupted by rising interest rates.

- Citigroup will hire over 4,000 new tech workers to help move institutional clients online in the wake of the pandemic.

- Amazon’s stock traded under $1,000 for the first time since October 2017 after the firm’s 20-for-1 stock split took effect Monday.

- Roughly 4.4 million Americans quit their job in April, among the highest quit rates in data going back to 2000.

- Retailers pared 61,000 jobs in May as they battled bloated inventories and cost inflation.

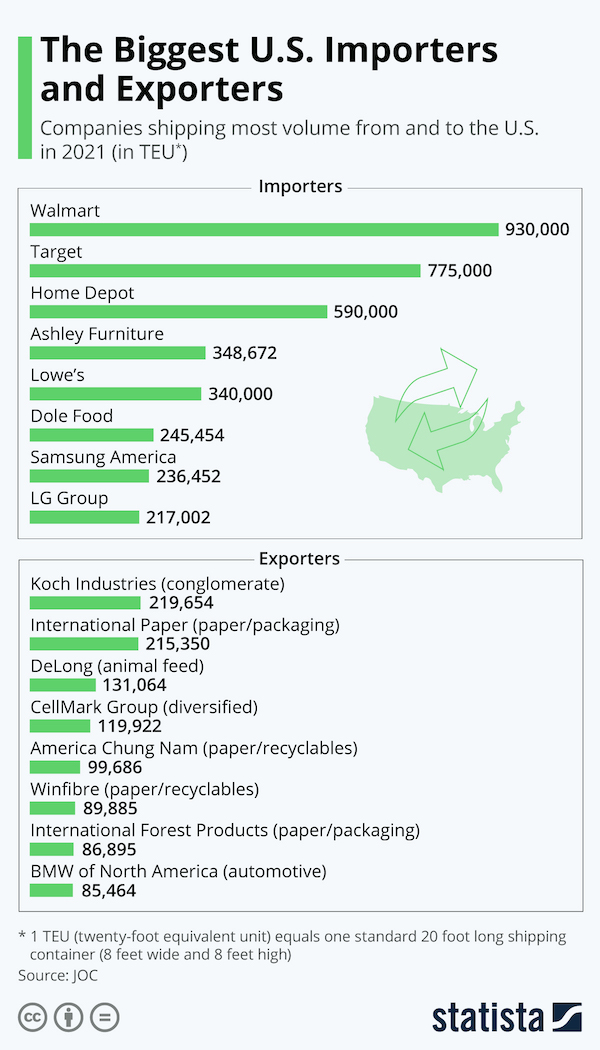

- Target, among the nation’s largest importers, saw its stock tank in pre-market trading after it said it will cancel orders and discount products to adjust bloated inventories, marking its second profit warning in the past month.

- Quarterly sales at big-box chain Big Lots declined at a double-digit pace.

- Kohl’s is in advanced talks to be sold in a deal that could value the department-store chain at roughly $8 billion.

- Air fares may be 30% higher than pre-pandemic levels this summer amid booming travel demand, according to Delta Air Lines.

- With soaring air travel, the five airports with the longest TSA and passport control wait times are Miami International Airport, Fort Lauderdale-Hollywood International Airport, San Francisco International Airport, John F. Kennedy International Airport and O’Hare International Airport. Wait times at these airports range from 39 to 46 minutes.

- Apple is in talks with automakers such as Ford, Nissan and Honda to provide new data-displaying panels in vehicle dashboards.

- Sony’s partnership with Honda will produce a new brand for their jointly developed electric vehicles, executives say. Sony’s involvement will include providing premium in-car entertainment and connectivity services.

- Almost one-quarter of public electric-vehicle chargers in the San Francisco Bay Area were found to be nonfunctioning, a concerning figure ahead of the government’s plan to ramp up spending on U.S. charging networks.

- Arizona will receive $76 million in federal dollars to build electric-vehicle charging stations along major interstates.

International Markets

- Taiwan saw a record 53,000 new COVID-19 cases Monday.

- Beijing has seen no new COVID-19 infections outside quarantine in four days.

- Japan is throwing out 740,000 COVID-19 vaccine doses as demand wanes for booster shots.

- More news related to the war in Europe:

- Allianz, the German insurance heavyweight, will sell a majority stake in its Russian operations as it moves toward fully exiting the country.

- Deutsche Bank will open a new tech center in Berlin to house the hundreds of its 1,500 Russian IT employees who accepted its offer to relocate to Germany. The firm employed heightened security out of fear those relocated could include spies or cyberterrorists.

- Russia is expected to halve its 20% interest rate this Friday to steady its strengthening currency and support its faltering economy.

- Germany’s factory orders fell a disappointing 2.7% in April, the third monthly decline in a row.

- China’s services activity contracted for the third month in a row in May, pointing to a slow recovery ahead despite the easing of lockdowns in Shanghai and neighboring cities.

- Hong Kong’s private sector expanded in May at the fastest pace in more than a decade as the city continues to recover from its COVID-fueled economic slump.

- Argentinian lawmakers proposed a bill that would tax companies that earn extraordinary income from the war in Ukraine, a measure likely to affect the country’s grain industry.

- Home prices in 150 global cities rose 11.5% in the first quarter, the steepest increase in almost 20 years.

- A provisional EU agreement will require all smartphones and tablets to use a common charger by the fall of 2024.

- Britain is running the world’s largest trial of a four-day workweek, which includes 70 firms and over 3,300 employees.

- About 24% of workers are considering quitting their job in the months ahead, according to a new survey of 10 countries.

- A new report finds global plastic waste is set to triple by 2060, exceeding 1 billion tons.

Some sources linked are subscription services.