MH Daily Bulletin: June 1

News relevant to the plastics industry:

At M. Holland

- M. Holland is exhibiting during the WAI Operations Summit & Wire Expo on June 7-8 in Dallas, Texas. This event focused on wire and cable manufacturing offers industry forecasts, technical presentations, networking and more. Join us at Booth #621 to learn more about our supply solutions for wire and cable.

- Nick Chodorow has joined M. Holland as Chief Innovation Officer. In this role, Nick will lead efforts to enhance the company’s technology platforms and accelerate its digital journey. Click here to read the full press release.

Supply

- Oil prices unexpectedly declined Tuesday on reports that Russia could be removed from OPEC+, potentially allowing other member-nations to boost production. WTI and Brent settled higher for May, the sixth straight month of gains.

- In mid-morning trading today, WTI futures were up 1.3% at $116.20/bbl, Brent was up 1.4% at $117.30/bbl, and U.S. natural gas was up 4.6% at $8.52/MMBtu.

- Active U.S. drilling rigs fell by 1 last week, the first decline in 9 weeks.

- U.S. crude output rose 3% in March to 11.7 million bpd, the latest data shows, well below its record-high 12.3 million bpd in 2019.

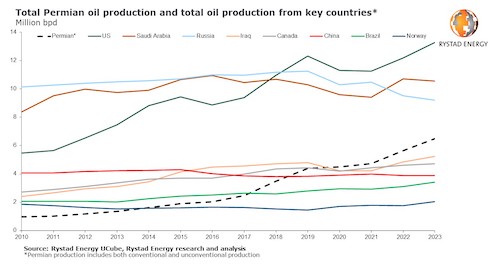

- Output from the U.S. Permian Basin alone is forecast to grow by almost 1 million bpd this year, outpacing the rise in OPEC heavyweight Iraq:

- The average U.S. gasoline price hit another record Tuesday, rising to $4.622 a gallon. In California, gasoline ($6.139 a gallon) and diesel ($6.65 a gallon) hit nationwide highs, while prices are above $5 a gallon in at least seven states.

- New York became the latest state to suspend its gas tax starting today.

- OPEC+ is expected to stick to a planned 430,000-bpd output hike for July when it confers this week.

- The world’s three biggest refiners — the U.S., China and Russia — are below peak processing levels, undermining efforts to lower prices by releasing crude from strategic reserves.

- Japan is testing the world’s first subsea turbine that generates power from deep ocean currents.

- More oil news related to the war in Europe:

- An EU embargo on some 90% of Russian oil imports is expected to pass today. The measure will phase out oil imports over the next six months and refined products over the next eight months, a gap period which Moscow says will allow it to find replacement buyers in Asia.

- The EU’s latest sanctions package will include a blanket insurance ban on Russian crude shipments, undercutting Moscow’s efforts to shift fuel exports to Asia. European companies insure most of the world’s oil trade.

- Some Russian producers have already started re-opening shuttered wells in anticipation of higher demand from Asia, where Russian barrels are selling for about $73.24/bbl.

- Russia cut off natural gas to Shell under a contract that helps supply Germany after Shell refused to pay in rubles.

- The EU is contemplating a price cap on Russian natural gas, according to Italian officials.

- The U.K. could reopen its biggest natural gas storage site as Russia’s invasion threatens to disrupt supplies this winter.

- Russian diesel exports to Europe declined 8% in May to the lowest level since October 2020.

- Ukraine has seized over $67 million of oil depots, gas stations and fuel trucks from Russia-based Tatneft, the nation’s fifth-largest oil company.

Supply Chain

- The remnants of Hurricane Agatha could cross eastward over Mexico and become the Atlantic’s first named storm of the season, forecasters say.

- U.S. regulators extended to Aug. 31 an hours-of-service waiver for vehicles shipping fuel and other scarce goods, the latest in a string of extensions and modifications.

- Foxconn, the world’s largest contract electronics maker, expects supply chain disruptions to ease in the second half of the year.

- Both Tesla and Volkswagen plan to keep workers at their Shanghai factories in a closed-loop system until at least June 10.

- Germany’s Merck, a supplier of materials used in semiconductor manufacturing, plans to build a massive 69-acre semiconductor base in Zhangjiagang, China, to house production plants for specialty materials as well as warehouses and operation centers.

- Supermarkets and distributors are pushing back on higher prices from food makers, in some cases asking brands to justify increases before accepting products.

- Kansas could lose 25% of its winter wheat crop due to severe drought conditions, while North Dakota and Minnesota see similar losses.

- Logistics disruptions are hitting supplies of popcorn, a key source of profit for movie theaters.

- The White House will spend $2.1 billion to shore up weaknesses in the U.S.’s food supply system, officials announced today.

- JetBlue suspended the launch of its Boston-London service due to delivery delays from Airbus.

- CBRE Group projects warehouse leasing volume will be 850 million square feet this year, down from last year’s record 1 billion, partly due to limited supply.

- Liner operator Ocean Network Express will become a shipowner with orders for 10 conventional-fuel neo-panamax boxships.

- Freightos Ltd., a digital platform for global freight-booking services, is set to go public in a roughly $435 million deal.

- Sanctions have limited Russia’s all-cargo Volga-Dnepr airline to using only Russian-built aircraft.

- A Norwegian battery maker plans to build a 200 MWh factory in Washington state to help meet growing demand for hybrid and zero-emission ships.

Domestic Markets

- The U.S. reported 198,400 new COVID-19 infections and 2,272 virus fatalities Tuesday.

- Confirmed COVID-19 cases over the Memorial Day holiday were six times higher than last year.

- COVID-19 cases in New York City are down to a two-week low, signaling an end to the most recent wave.

- Almost as many Americans 65 and older died in four months of the Omicron surge as in six months of the previous Delta wave, despite Delta generally causing more severe illness.

- Researchers are still unsure how long COVID-19 is infectious, with the CDC’s most recent guidelines recommending five days of isolation from first symptoms or diagnosis.

- Exposure to heavily polluted air increases the risk that a person will have severe COVID-19 symptoms, new research suggests.

- Employment openings in the U.S. were at the second-highest level on record in April — 11.4 million — as 4.4 million people quit their jobs.

- U.S. consumer confidence edged down in May, with The Conference Board’s index hitting a three-month low of 106.4.

- Starting today, the Federal Reserve will start shrinking its $8.9 trillion asset portfolio at a pace that’s almost twice as fast as after the last financial crisis.

- Wages for the median worker at the majority of big American companies last year were 10% higher than in 2019.

- Long commutes remain one of the top reasons workers wish to go remote, as new evidence shows that the highest return-to-office rates occur where people live closer to work.

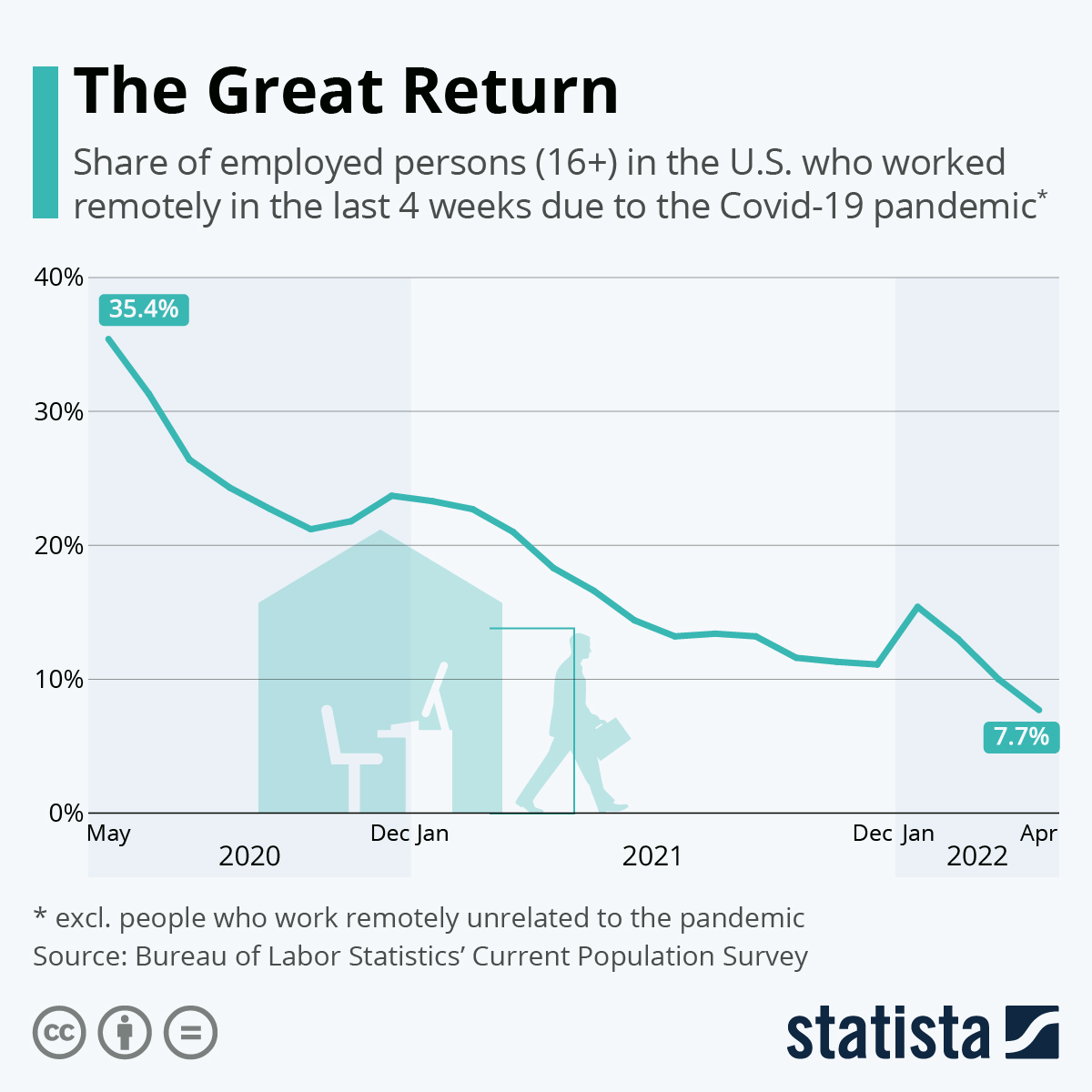

- Roughly 7.7% of Americans were working remotely at some point in the last four weeks, the lowest point of the pandemic:

- The latest Case-Shiller reading shows U.S. home values jumped 20.6% in March from the year before, the largest annual gain in the reading’s 35-year history.

- Although active U.S. home listings rose 5% in recent weeks, buyers still have just two homes to consider for every five homes that were available before the pandemic, according to realtor.com.

- Over 20% of home sellers dropped their price in seven of the 10 most popular destinations last month, according to Redfin.

- HP reported better-than-expected quarterly revenue on strong business demand for desktop computers, although sales continue to be slowed by global supply chain problems and a shortage of chips.

- San Francisco-based Salesforce posted a better-than-expected 24% increase in first-quarter revenue, easing concerns about demand for its business software.

- The FAA rejected Boeing’s requests to self-perform certain regulatory tasks for the standard five-year period, maintaining increased federal oversight of the company.

- Airlines are pressing the U.S. administration to end pre-flight COVID-19 testing requirements for international travelers to the country.

- Michigan-based electric vehicle startup Electric Last Mile Solutions warned it may run out of cash in June, at least one month sooner than previously projected, as it confronts rising costs, an SEC investigation and a possible Nasdaq delisting.

- California predicts 32,000 auto mechanic jobs will be lost by 2040 as the state takes the U.S.’s most aggressive measures to switch to electric vehicles.

- Dollar General is piloting self-checkout as the sole way to make purchases at 200 of its 18,000 U.S. locations this year.

International Markets

- After four straight days with zero COVID-19 fatalities, Shanghai’s long-awaited easing of pandemic lockdowns begins today.

- Hong Kong is reviving one of its toughest COVID-zero measures, forcing mild virus cases and their close contacts into quarantine to tame the spread of new subvariants.

- Italy lifted requirements for incoming travelers to have a COVID-19 vaccine pass.

- COVID-19 restrictions at Canadian airports and land borders will remain in place for at least another month, officials said.

- More news related to the war in Europe:

- The EU’s latest round of sanctions will cut Russia’s largest lender, Sberbank, from the international SWIFT payment system.

- The EU is considering a proposal to send about $535 million to Africa to help tackle food shortages from the fallout of Russia’s invasion.

- France’s economy unexpectedly shrank in the first quarter as consumers struggled to cope with a surging 5.8% rate of inflation.

- India’s economic growth slowed to 4.1% in its fiscal fourth quarter ended March 31, the slowest pace of the fiscal year.

- Sri Lanka’s inflation rate spiked to almost 40% in May amid the island’s worst financial crisis in decades.

- Japan’s factory output fell 1.3% in April, the first decline in three months.

- China will halve taxes on new low-emission vehicles in a bid to boost consumer spending. Analysts say China faces a nearly $1 trillion funding gap from lost tax revenue from recent lockdowns.

- China’s jobless rate among 16- to 24-year-olds climbed to a record 18.2% in April, more than double the 7.9% rate in the U.S.

- Israel and the UAE signed a first-of-its-kind free-trade agreement, boosting business ties less than two years after establishing diplomatic relations.

- A sharp rebound in air travel is triggering long queues at international airports as managers struggle to fill jobs fast enough.

- Brazilian plane-maker Embraer says it already has enough orders to meet its high-end revenue target of $5 billion for the current fiscal year.

Some sources linked are subscription services.